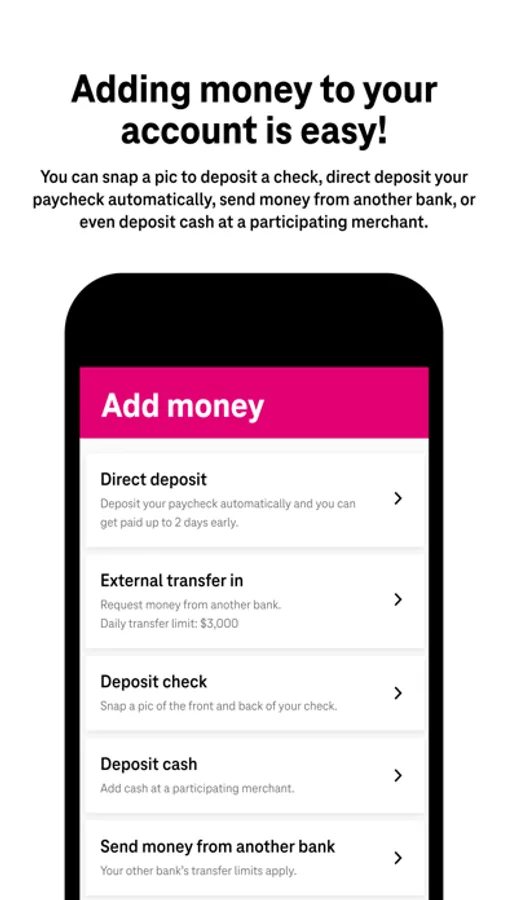

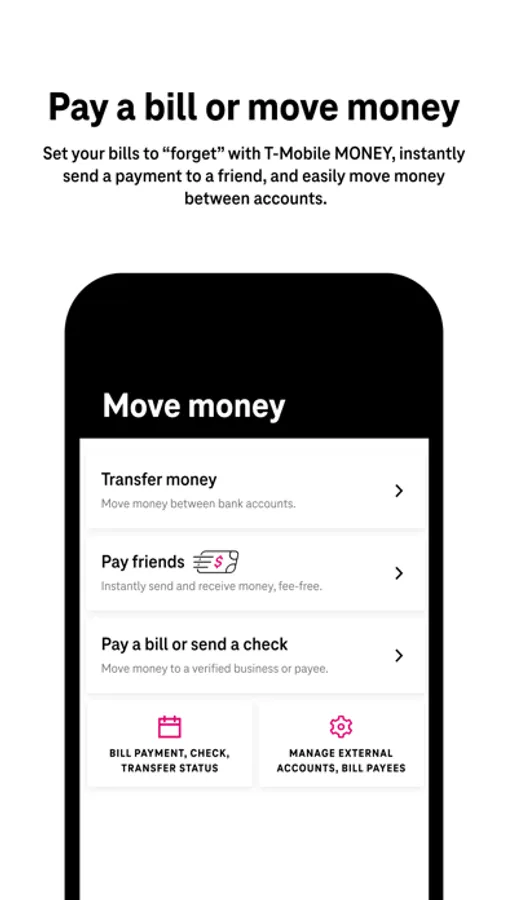

With this banking app, you can view account balances, transfer funds, and manage payments. Includes account access on the web and mobile, mobile deposit, and transaction alerts.

AppRecs review analysis

AppRecs rating 4.3. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.3

AppRecs Rating

Ratings breakdown

5 star

90%

4 star

7%

3 star

2%

2 star

0%

1 star

1%

What to know

✓

High user satisfaction

90% of sampled ratings are 5 stars

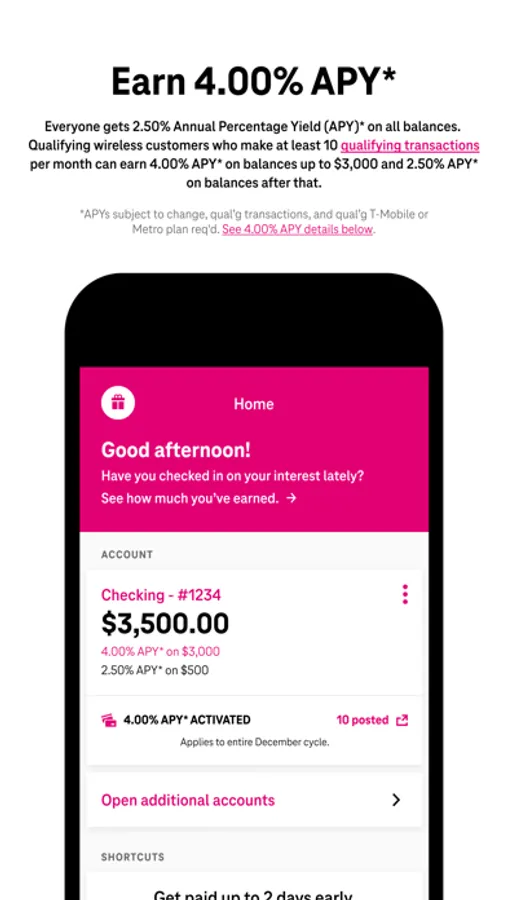

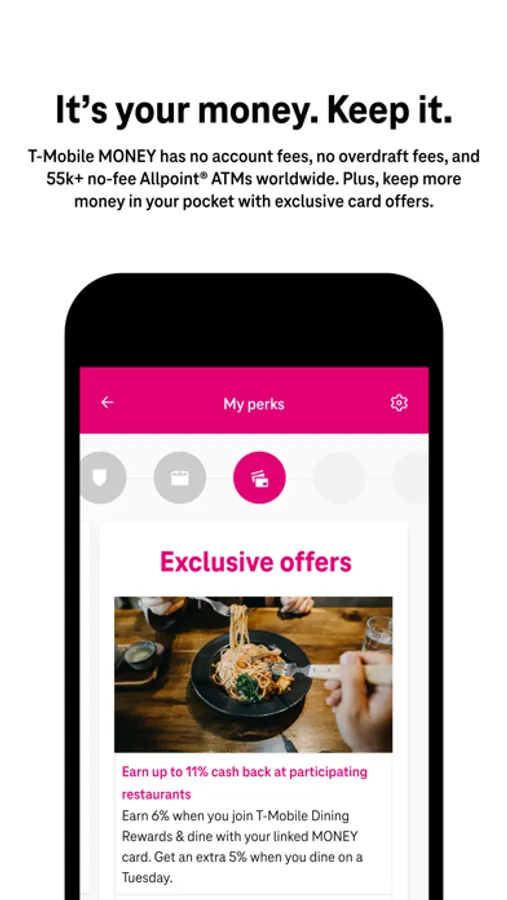

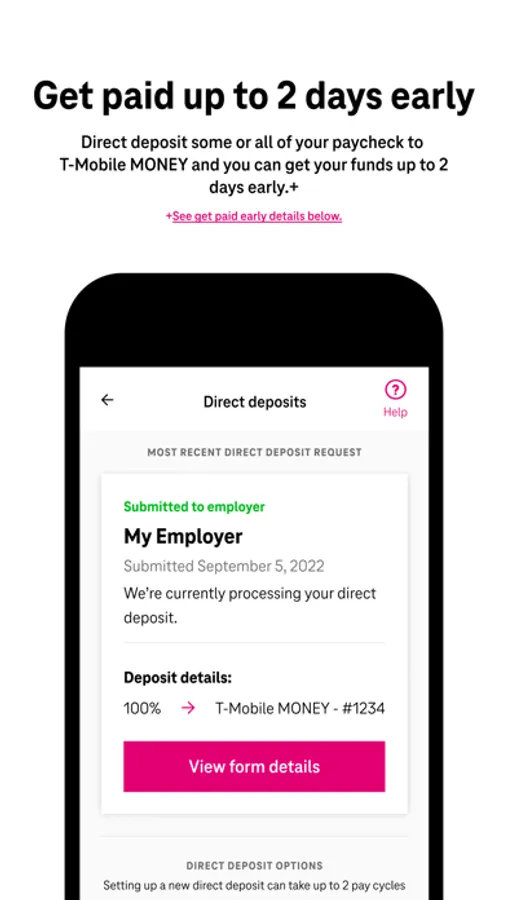

About T-Mobile MONEY: Better Banking

T-Mobile Money has moved to T-Life - your all-in-one spot for everything T-Mobile. This new, connected experience brings your money and your mobile life together in one place.

Additionally, you can continue to access your account on the web.

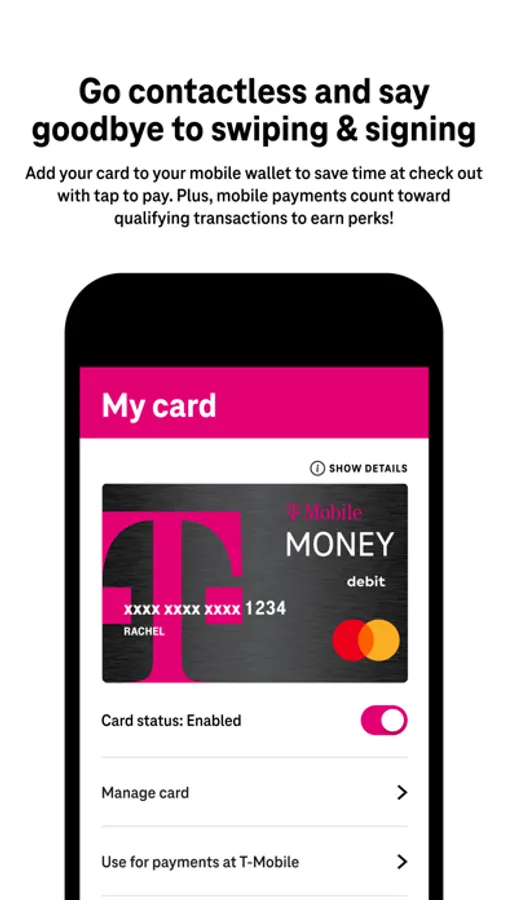

T-Mobile Money accounts are provided by Coastal Community Bank, Member FDIC. T-Mobile is not a bank. FDIC Insurance only covers the failure of an FDIC-insured bank. FDIC insurance is available through pass-through insurance at Coastal Community Bank, Member FDIC, if certain conditions have bene met. The T-Mobile Money Debit Mastercard® is issued by Coastal Community Bank pursuant to a license by Mastercard International Incorporated and may be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design and true name are trademarks of Mastercard International Incorporated.

Additionally, you can continue to access your account on the web.

T-Mobile Money accounts are provided by Coastal Community Bank, Member FDIC. T-Mobile is not a bank. FDIC Insurance only covers the failure of an FDIC-insured bank. FDIC insurance is available through pass-through insurance at Coastal Community Bank, Member FDIC, if certain conditions have bene met. The T-Mobile Money Debit Mastercard® is issued by Coastal Community Bank pursuant to a license by Mastercard International Incorporated and may be used everywhere Mastercard is accepted. Mastercard is a registered trademark, and the circles design and true name are trademarks of Mastercard International Incorporated.