AppRecs review analysis

AppRecs rating 3.7. Trustworthiness 80 out of 100. Review manipulation risk 23 out of 100. Based on a review sample analyzed.

★★★☆☆

3.7

AppRecs Rating

Ratings breakdown

5 star

57%

4 star

9%

3 star

0%

2 star

9%

1 star

26%

What to know

✓

Low review manipulation risk

23% review manipulation risk

✓

Credible reviews

80% trustworthiness score from analyzed reviews

✓

Good user ratings

65% positive sampled reviews

About When Can I Retire Pro

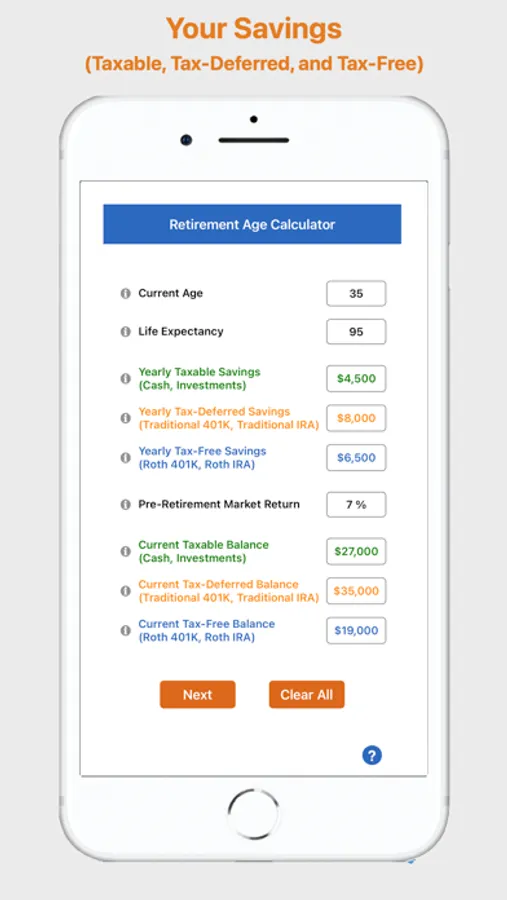

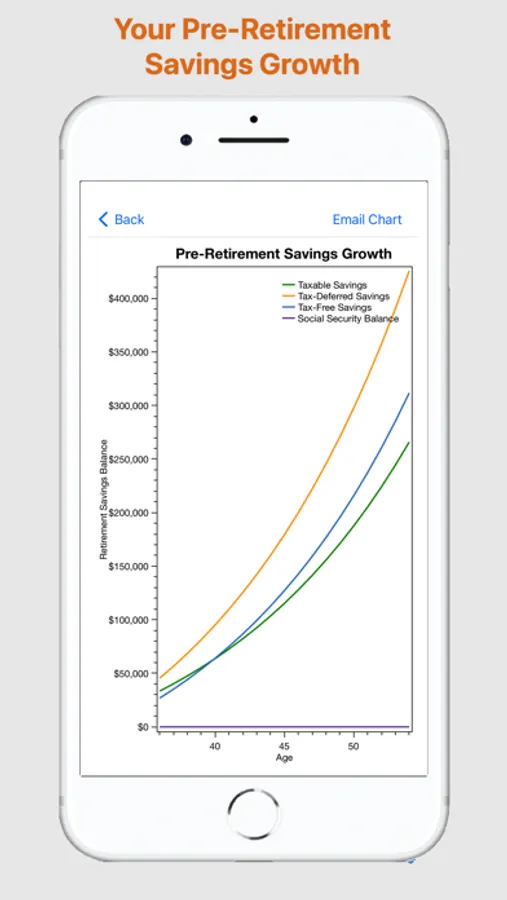

You may have retirement savings in taxable accounts (cash, investments), tax-deferred accounts (Traditional 401k, Traditional IRA), and tax-free accounts (Roth 401k, Roth IRA). Find out when you will be able to retire based on your financial circumstances.

**App Highlights**

* The "When Can I Retire Pro" app calculates your retirement age by separating out your retirement savings in taxable accounts (cash, investments) and tax-advantaged accounts (Traditional, Roth) as certain tax-advantaged retirement savings cannot be withdrawn without a penalty until you reach the age 59 1/2.

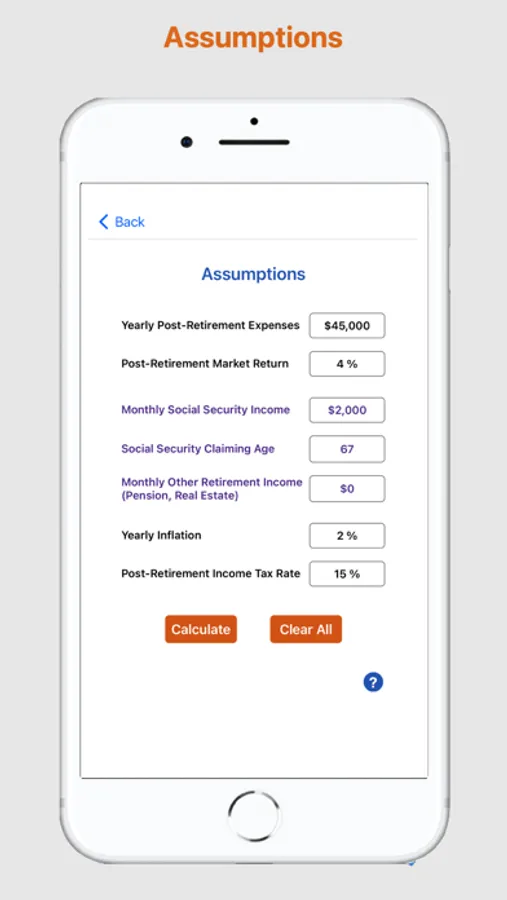

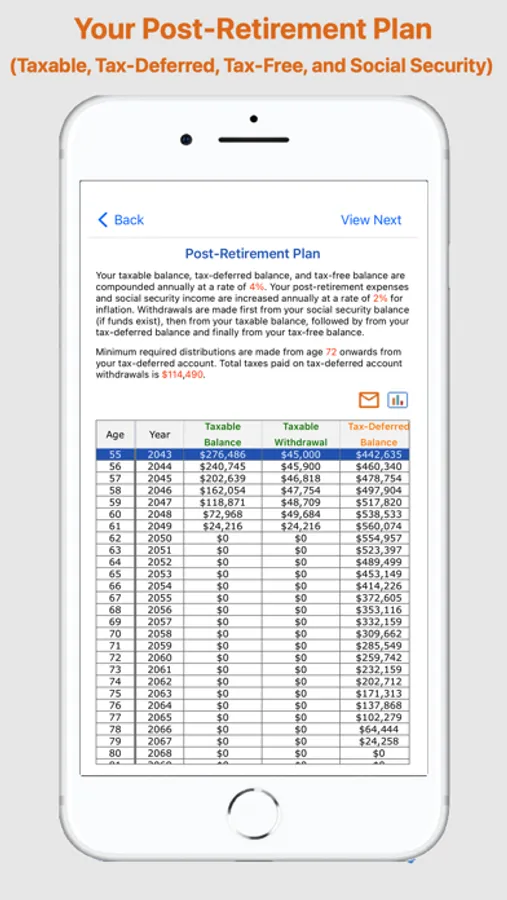

* The app factors in the retirement age calculation the taxes you are required to pay on withdrawals from your tax-deferred accounts (Traditional 401k, Traditional IRA).

* The app takes into account you are required to make minimum withdrawals from your tax-deferred accounts (Traditional 401k, Traditional IRA) from the age of 72 onwards.

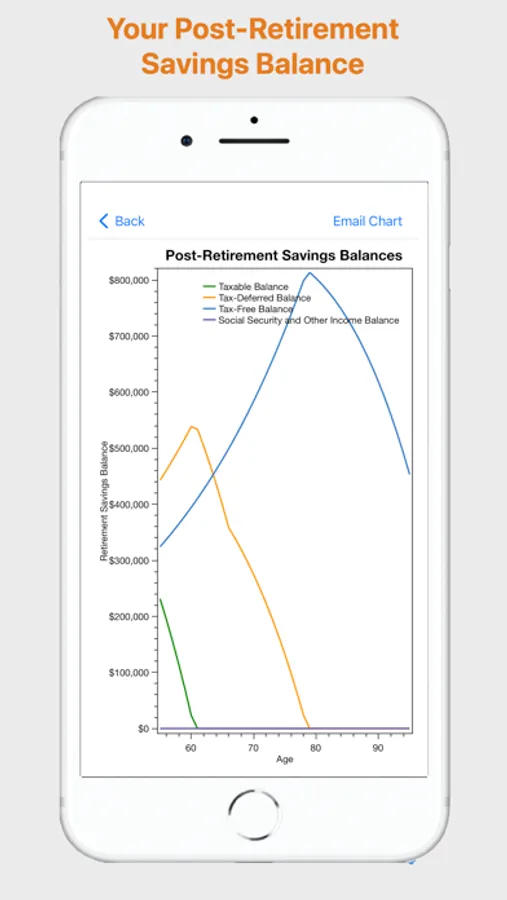

* Additionally, this app helps you with an effective strategy on the order in which you can withdraw your retirement assets during your retirement years when you have savings in taxable, tax-deferred, and tax-free accounts. The retirement withdrawals are made first from your taxable accounts, then from your tax-deferred accounts, and finally from your tax-free accounts.

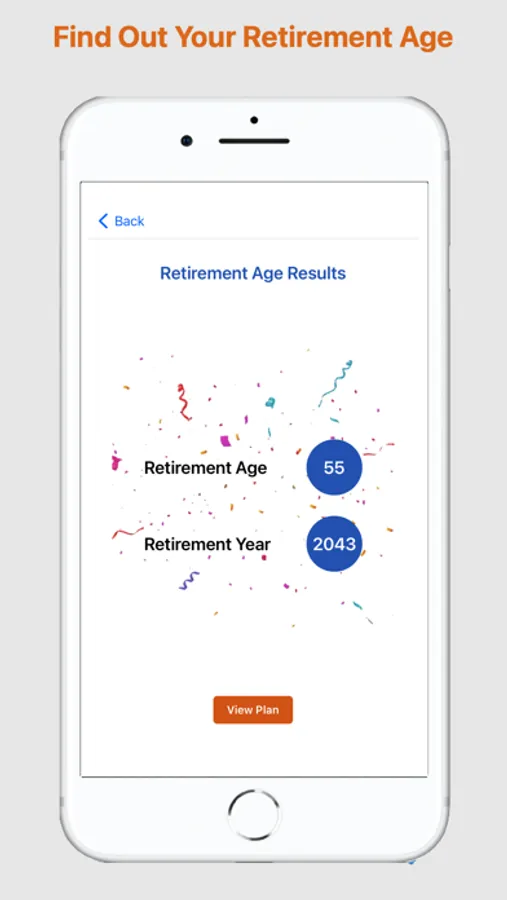

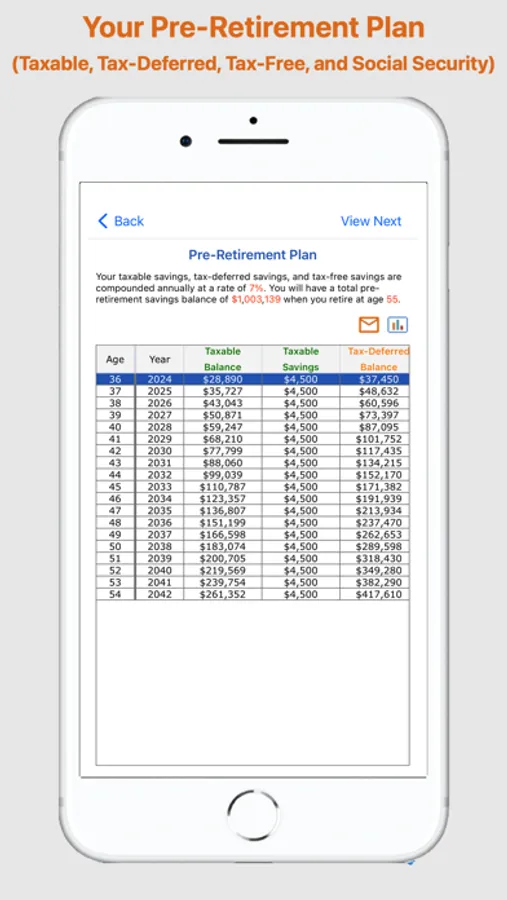

* This app lays out a clear picture of your finances with the pre-retirement plan and post-retirement plan.

* You can email your pre-retirement plan and post-retirement plan in tabular and graphical views to yourself or others from within the app.

* This app saves your inputs across the launches upon successful retirement age calculation.

* You can share the app via email, Facebook, or Twitter from within the app.

Terms of Use: https://www.apple.com/legal/internet-services/itunes/dev/stdeula/

**App Highlights**

* The "When Can I Retire Pro" app calculates your retirement age by separating out your retirement savings in taxable accounts (cash, investments) and tax-advantaged accounts (Traditional, Roth) as certain tax-advantaged retirement savings cannot be withdrawn without a penalty until you reach the age 59 1/2.

* The app factors in the retirement age calculation the taxes you are required to pay on withdrawals from your tax-deferred accounts (Traditional 401k, Traditional IRA).

* The app takes into account you are required to make minimum withdrawals from your tax-deferred accounts (Traditional 401k, Traditional IRA) from the age of 72 onwards.

* Additionally, this app helps you with an effective strategy on the order in which you can withdraw your retirement assets during your retirement years when you have savings in taxable, tax-deferred, and tax-free accounts. The retirement withdrawals are made first from your taxable accounts, then from your tax-deferred accounts, and finally from your tax-free accounts.

* This app lays out a clear picture of your finances with the pre-retirement plan and post-retirement plan.

* You can email your pre-retirement plan and post-retirement plan in tabular and graphical views to yourself or others from within the app.

* This app saves your inputs across the launches upon successful retirement age calculation.

* You can share the app via email, Facebook, or Twitter from within the app.

Terms of Use: https://www.apple.com/legal/internet-services/itunes/dev/stdeula/