With myRaiffeisen mobile application you can keep your bank in your pocket. It is simple, user friendly and secure, indeed. Use it for transfers, credit card pay off, standing order or direct debit, or just simply track your finances with it. Access to your data and transactions are protected via PIN code or biometric authentication.

-----------

YOU UNDERSTAND WHERE YOUR MONEY GOES.

We know people need to get a more meaningful view on their money than a simple transactions list.

We created a space in the app called Analytics to let you see how you spend your money. By automated categorisation and grouping spending in different ways you can easily see where you might have spent a lot. Is it about bills & utilities, shopping or maybe healthcare and beauty? You can see how all little things add-up to something big or how much cash you have taken out.

-----------

ANALYTICS KEEP TRACK OF YOUR:

-Monthly overview, to help you keep track of your money,

-Little Things, because small things can add up fast;

-Big Spends, to ensure you never miss one;

-Money In, to celebrate every time you earn;

-Money Out, to see on what you have spend;

-Cash Out, to show you how much cash you have taken out.

-----------

YOU FIND EVERYTHING IN ONE PLACE IN THE MY PRODUCTS PAGE.

We put all Raiffeisen bank accounts, debit cards, credit cards and term deposits in one place so that you can manage them with ease.

You can:

-share your account details with others

-easily change your card limits whenever you want

-view your overdraft

-create term deposit, terminate or withdraw it

-activate, block or unlock your cards.

-----------

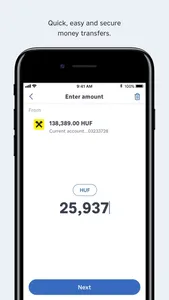

YOU GET THINGS DONE WITH LESS EFFORT WITH THESE FUNCTIONS.

-Login and authorize easily using TouchID or FaceID (Mobile token)

-Make transfer even to email, mobile number, tax number or ID are liked to bank accounts.

-Manage card limits

-Pay-off your credit card

-Apply for personal loan

-You can view, create and delete existing Standing Orders.

-You can view, create and withdraw Term Deposits.

-You can view, create and delete Direct debits.

-The items waiting for collection above the limit you set can be approved or rejected.

-Get special offer to exchange currencies between own accounts.

-Generate QR codes to request payment and send payment by scanning QR code.

-Manage, send and receive payment requests.

-Allow the internetbank – DirektNet – login and authorize the transactions.

-Online purchases can be authorized in the mobile application.

-We send you a push notification about the task of the authorization.

-----------

TO ACTIVATE OUR NEW MOBILE APP YOU NEED:

-maintaining the account in Raiffeisen Bank Hungary

-bank account or credit card in Raiffeisen Bank Hungary

-internet banking service - valid DirektNet credentials

-a smartphone operating on iOS 11.0 or later

-----------

Following app functions are also available with joint signature: HUF, SEPA payments, transfer between own accounts payments request.

Registration: download the app, log in with your internet banking credentials. Activate Mobile Token by choose a PIN code. The Mobile token PIN code can be substituted with Touch ID or FaceID.

-----------

We use technology creatively to bring new things to life and make your daily banking experience even better. Stay tuned, we have more coming soon. If you like us, give us a rating! If we can improve it, let us know via email to info@raiffeisen.hu.

-----------

YOU UNDERSTAND WHERE YOUR MONEY GOES.

We know people need to get a more meaningful view on their money than a simple transactions list.

We created a space in the app called Analytics to let you see how you spend your money. By automated categorisation and grouping spending in different ways you can easily see where you might have spent a lot. Is it about bills & utilities, shopping or maybe healthcare and beauty? You can see how all little things add-up to something big or how much cash you have taken out.

-----------

ANALYTICS KEEP TRACK OF YOUR:

-Monthly overview, to help you keep track of your money,

-Little Things, because small things can add up fast;

-Big Spends, to ensure you never miss one;

-Money In, to celebrate every time you earn;

-Money Out, to see on what you have spend;

-Cash Out, to show you how much cash you have taken out.

-----------

YOU FIND EVERYTHING IN ONE PLACE IN THE MY PRODUCTS PAGE.

We put all Raiffeisen bank accounts, debit cards, credit cards and term deposits in one place so that you can manage them with ease.

You can:

-share your account details with others

-easily change your card limits whenever you want

-view your overdraft

-create term deposit, terminate or withdraw it

-activate, block or unlock your cards.

-----------

YOU GET THINGS DONE WITH LESS EFFORT WITH THESE FUNCTIONS.

-Login and authorize easily using TouchID or FaceID (Mobile token)

-Make transfer even to email, mobile number, tax number or ID are liked to bank accounts.

-Manage card limits

-Pay-off your credit card

-Apply for personal loan

-You can view, create and delete existing Standing Orders.

-You can view, create and withdraw Term Deposits.

-You can view, create and delete Direct debits.

-The items waiting for collection above the limit you set can be approved or rejected.

-Get special offer to exchange currencies between own accounts.

-Generate QR codes to request payment and send payment by scanning QR code.

-Manage, send and receive payment requests.

-Allow the internetbank – DirektNet – login and authorize the transactions.

-Online purchases can be authorized in the mobile application.

-We send you a push notification about the task of the authorization.

-----------

TO ACTIVATE OUR NEW MOBILE APP YOU NEED:

-maintaining the account in Raiffeisen Bank Hungary

-bank account or credit card in Raiffeisen Bank Hungary

-internet banking service - valid DirektNet credentials

-a smartphone operating on iOS 11.0 or later

-----------

Following app functions are also available with joint signature: HUF, SEPA payments, transfer between own accounts payments request.

Registration: download the app, log in with your internet banking credentials. Activate Mobile Token by choose a PIN code. The Mobile token PIN code can be substituted with Touch ID or FaceID.

-----------

We use technology creatively to bring new things to life and make your daily banking experience even better. Stay tuned, we have more coming soon. If you like us, give us a rating! If we can improve it, let us know via email to info@raiffeisen.hu.

Show More