With this real estate investing app, you can build a diversified property portfolio and track your investments. Includes auto-investment options, rewards, and flexible withdrawal scheduling.

AppRecs review analysis

AppRecs rating 4.2. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.2

AppRecs Rating

Ratings breakdown

5 star

71%

4 star

6%

3 star

6%

2 star

4%

1 star

14%

What to know

✓

High user satisfaction

77% of sampled ratings are 4+ stars (4.2★ average)

✓

Authentic reviews

Natural distribution, no red flags

About Concreit Real Estate Investing

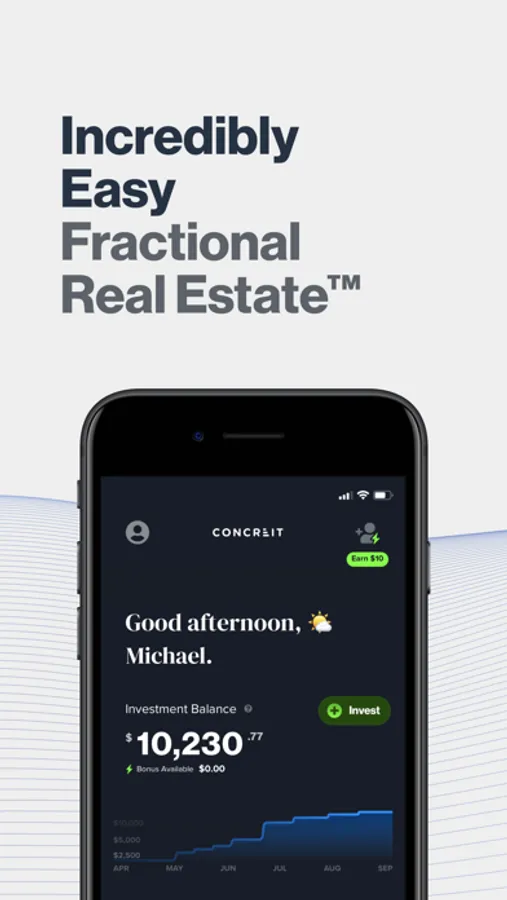

-=- Build Wealth in Real Estate, Fractionally. -=-

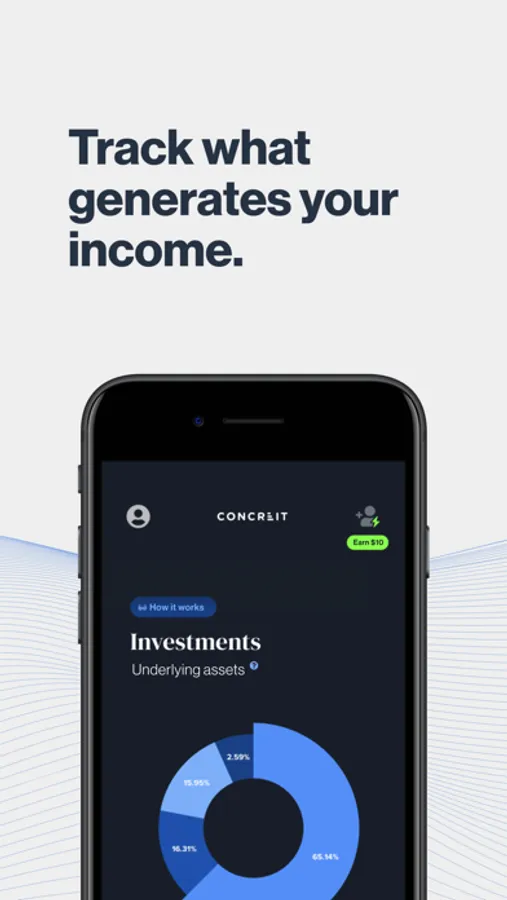

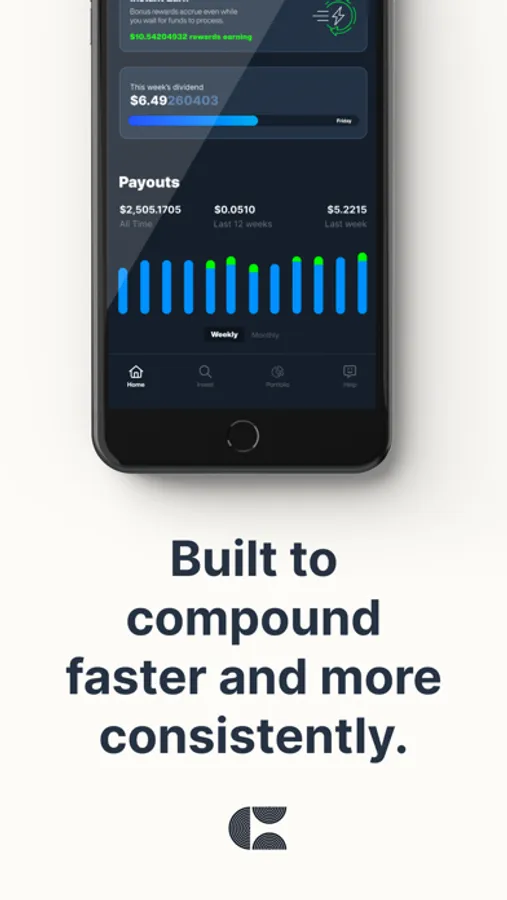

Concreit makes real estate investing available to everyone. Sit back and let your money produce a passive income stream for you with our flagship Cash Flow strategy and craft your own portfolio by buying shares on individual rental properties. Build your own diversified portfolio of real estate assets managed by a professional investment team. Invest any amount to get started and grow your account by setting up auto-investments or a financial goal.

-=- Not crypto. Not stocks. Just Real Estate -=-

Reduce your volatility and hedge inflation with real estate. This asset class has been used as a strategy to counter inflation for wealthy investors and now you can do it too. Concreit is an easy-to-use app that gives investors the ability to find passive income outside of publicly traded markets.

-=- Boost your payout with rewards -=-

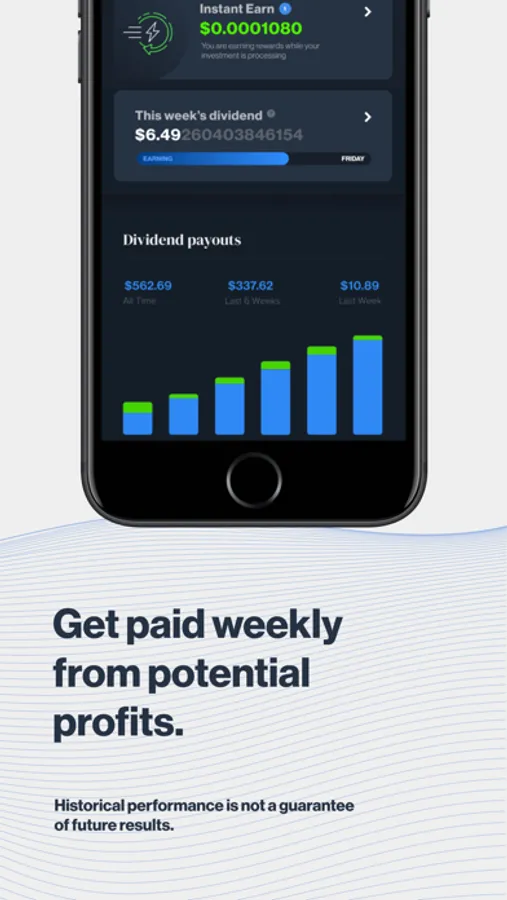

Earn rewards to accelerate your long-term investment plan through enhanced payouts. Rewards are automatically added to your dividends and can potentially boost your payout rate by up to 1% annualized until they are fully paid out.

* Rewards cannot be directly withdrawn or redeemed for cash.

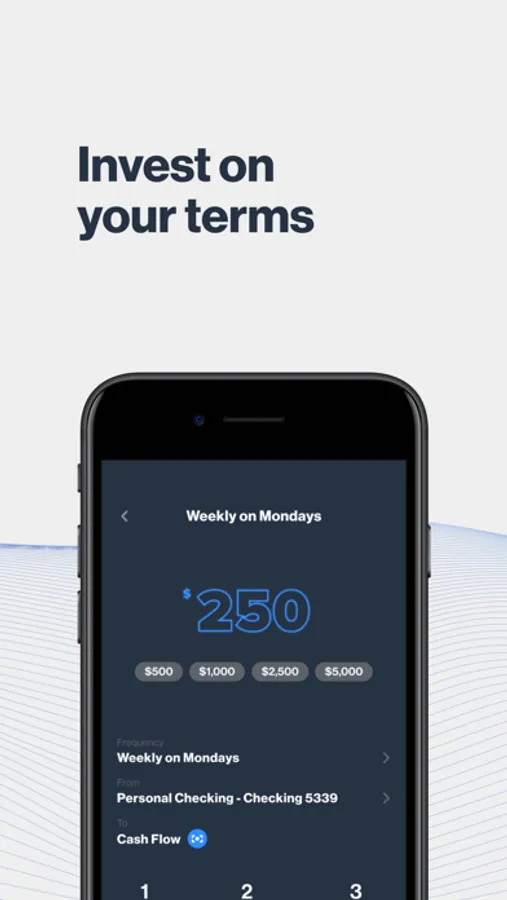

-=- Flexible for the type of investor you are -=-

We get that life has unique demands and stuff happens. Pull together a mix between more liquid investments and longer-term investments that are right for you.

We’ve made private real estate investing more flexible with our Cash Flow debt strategy. You can schedule & request withdrawals from our Cash Flow strategy anytime through our app, which is based on approval & fund availability. Easy as that.

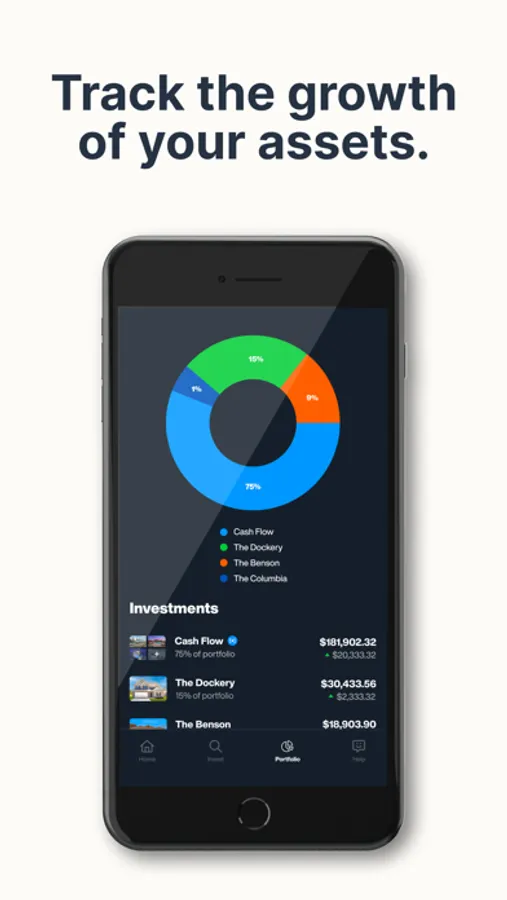

For your long-term investment dollars, you can purchase shares of individual rental homes and build your own unique diversified portfolio.

-=- Put your money on a mission -=-

We’re building easy solutions so you can invest towards retirement, take that trip of a lifetime, buy a home, save for a kid’s education, or anything else!

-=- Professional management with over $30b of experience -=-

Access to a private market real estate investment team shouldn't be limited to the wealthy. We’re leveraging a proprietary full-stack real estate technology platform to make data-driven decisions combined with proprietary connections and experience for you.

-=- Bank-level Security -=-

Concreit uses AES256-bit encryption for your personal data, the same security level as banks. Your investor information is encrypted.

-=- Disclosures -=-

Investing in real estate involves risks including the potential loss of principal. A real estate portfolio is subject to risks similar to those associated with the direct ownership of real estate and real estate debt, as the investments are sensitive to factors such as changes to real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand, and the management skill and credit worthiness of the issuer & borrowers. Portfolios concentrated in real estate assets may experience price volatility and other risks associated with non-diversification. There is no guarantee that investment objectives will be achieved, and past performance does not indicate future results. For a more complete list of risks, please refer to our website.

Incredibly Easy Real Estate® in the app screenshots refers to the ease of use of the mobile application and the platform and does not infer that private real estate investing is easy or simple. Your investments with Concreit are actively managed by a team of industry professionals.

Liquidity Not Guaranteed: Investments offered are illiquid and there is never any guarantee that you will be able to exit your investments through our redemption program.

Visit concreit.com for additional documents, such as legal terms.

Concreit makes real estate investing available to everyone. Sit back and let your money produce a passive income stream for you with our flagship Cash Flow strategy and craft your own portfolio by buying shares on individual rental properties. Build your own diversified portfolio of real estate assets managed by a professional investment team. Invest any amount to get started and grow your account by setting up auto-investments or a financial goal.

-=- Not crypto. Not stocks. Just Real Estate -=-

Reduce your volatility and hedge inflation with real estate. This asset class has been used as a strategy to counter inflation for wealthy investors and now you can do it too. Concreit is an easy-to-use app that gives investors the ability to find passive income outside of publicly traded markets.

-=- Boost your payout with rewards -=-

Earn rewards to accelerate your long-term investment plan through enhanced payouts. Rewards are automatically added to your dividends and can potentially boost your payout rate by up to 1% annualized until they are fully paid out.

* Rewards cannot be directly withdrawn or redeemed for cash.

-=- Flexible for the type of investor you are -=-

We get that life has unique demands and stuff happens. Pull together a mix between more liquid investments and longer-term investments that are right for you.

We’ve made private real estate investing more flexible with our Cash Flow debt strategy. You can schedule & request withdrawals from our Cash Flow strategy anytime through our app, which is based on approval & fund availability. Easy as that.

For your long-term investment dollars, you can purchase shares of individual rental homes and build your own unique diversified portfolio.

-=- Put your money on a mission -=-

We’re building easy solutions so you can invest towards retirement, take that trip of a lifetime, buy a home, save for a kid’s education, or anything else!

-=- Professional management with over $30b of experience -=-

Access to a private market real estate investment team shouldn't be limited to the wealthy. We’re leveraging a proprietary full-stack real estate technology platform to make data-driven decisions combined with proprietary connections and experience for you.

-=- Bank-level Security -=-

Concreit uses AES256-bit encryption for your personal data, the same security level as banks. Your investor information is encrypted.

-=- Disclosures -=-

Investing in real estate involves risks including the potential loss of principal. A real estate portfolio is subject to risks similar to those associated with the direct ownership of real estate and real estate debt, as the investments are sensitive to factors such as changes to real estate values and property taxes, interest rates, cash flow of underlying real estate assets, supply and demand, and the management skill and credit worthiness of the issuer & borrowers. Portfolios concentrated in real estate assets may experience price volatility and other risks associated with non-diversification. There is no guarantee that investment objectives will be achieved, and past performance does not indicate future results. For a more complete list of risks, please refer to our website.

Incredibly Easy Real Estate® in the app screenshots refers to the ease of use of the mobile application and the platform and does not infer that private real estate investing is easy or simple. Your investments with Concreit are actively managed by a team of industry professionals.

Liquidity Not Guaranteed: Investments offered are illiquid and there is never any guarantee that you will be able to exit your investments through our redemption program.

Visit concreit.com for additional documents, such as legal terms.