About Save Plan It

The Vision:

This app created to revolutionize the collective consciousness of financial conduct. While adopting two basic habits:

1. Setting Goals

2. Perseverance and self-discipline

These are the main ingredients for making dreams come true as well as for a good, balanced life.

The Motivation:

At work and in business we create and manage projects. Every job and every business uses business management system to manage their projects and budgets.

The Save Plan It venture created from a belief that successful business habits will work equally well for a private person or for a family, making human and family life prosperous as they become a thriving business.

How does it works:

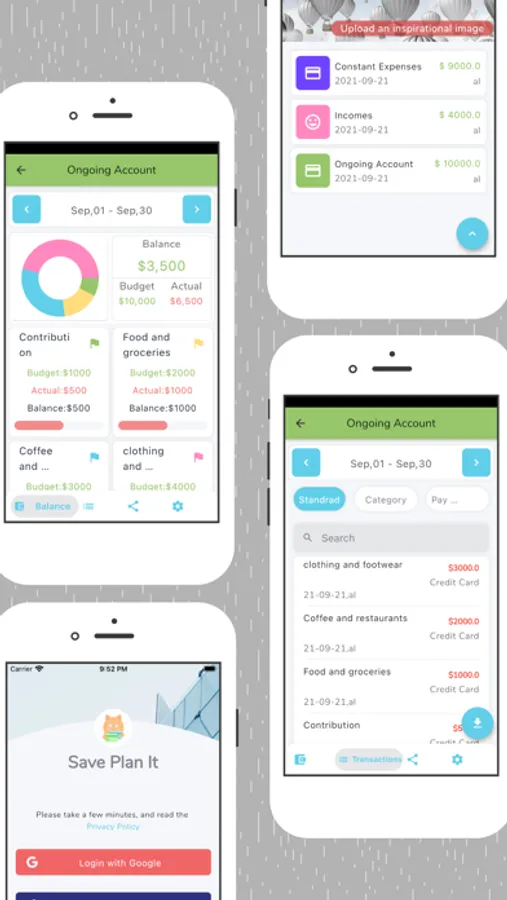

With a sleek, fast and easy-to-operate app interface, anyone can control their budget:

1. First, create a new project on one of the following topics: construction, trip or home/family account.

2. The system will generate budget sections according to the template you select in section (1).

3. Next, a budgetary framework will be set for each section of the project.

4. Inviting budget partners such as spouse and children (in the case of a construction project, the supervisor will also be summoned).

5. It is the responsibility of each participant to document each expense in the appropriate budget section.

When talking about a periodic family budget, the idea is to learn and get better from month to month. Therefore, items like rent, mortgage or insurance are not items that should be included in the budget because they are fixed and known in advance.

On the other hand, we would like to include in the project items such as fuel, food, restaurants, electricity and more.

Save Plan It for Professionals:

Sometimes, the common man does not have the knowledge and ability to create a reliable and professional budget to suit his needs.

In these cases a person will contact a professional to help and lead him.

In the case of construction, it will be a construction inspector. In case of setting up family budget - it would be, a Family Economics Consultant.

This professional, after setting up the budget in the app, will invite the client who contacted him to the app, by clicking share button.

This will allow him to see, track and comment on the client's behavior during the project.

For example, a family economics consultant could identify behavioral patterns. Such as, cases where a large part of the budget is wasted at the end of the month. Or that the amount of outdoor food is more than a quarter of the budget, and more.

Exposing the contractor's payments to the building inspector will help him manage them more accurately, ensuring that the amount paid matches the actual performance status.

At the end of the project, the supervisor's work can be estimated against the budgetary target set at the beginning of the project.

Please read the terms here:

https://api.zivvidas.com/Home/GeneralContent?name=terms&language=en

This app created to revolutionize the collective consciousness of financial conduct. While adopting two basic habits:

1. Setting Goals

2. Perseverance and self-discipline

These are the main ingredients for making dreams come true as well as for a good, balanced life.

The Motivation:

At work and in business we create and manage projects. Every job and every business uses business management system to manage their projects and budgets.

The Save Plan It venture created from a belief that successful business habits will work equally well for a private person or for a family, making human and family life prosperous as they become a thriving business.

How does it works:

With a sleek, fast and easy-to-operate app interface, anyone can control their budget:

1. First, create a new project on one of the following topics: construction, trip or home/family account.

2. The system will generate budget sections according to the template you select in section (1).

3. Next, a budgetary framework will be set for each section of the project.

4. Inviting budget partners such as spouse and children (in the case of a construction project, the supervisor will also be summoned).

5. It is the responsibility of each participant to document each expense in the appropriate budget section.

When talking about a periodic family budget, the idea is to learn and get better from month to month. Therefore, items like rent, mortgage or insurance are not items that should be included in the budget because they are fixed and known in advance.

On the other hand, we would like to include in the project items such as fuel, food, restaurants, electricity and more.

Save Plan It for Professionals:

Sometimes, the common man does not have the knowledge and ability to create a reliable and professional budget to suit his needs.

In these cases a person will contact a professional to help and lead him.

In the case of construction, it will be a construction inspector. In case of setting up family budget - it would be, a Family Economics Consultant.

This professional, after setting up the budget in the app, will invite the client who contacted him to the app, by clicking share button.

This will allow him to see, track and comment on the client's behavior during the project.

For example, a family economics consultant could identify behavioral patterns. Such as, cases where a large part of the budget is wasted at the end of the month. Or that the amount of outdoor food is more than a quarter of the budget, and more.

Exposing the contractor's payments to the building inspector will help him manage them more accurately, ensuring that the amount paid matches the actual performance status.

At the end of the project, the supervisor's work can be estimated against the budgetary target set at the beginning of the project.

Please read the terms here:

https://api.zivvidas.com/Home/GeneralContent?name=terms&language=en