TAX CLARITY FOR MULTI-EARNERS

* Save more income from freelancing, jobs, and investments

* Get federal, state and local tax estimates and account for tax payments you've already made, including any paycheck withholdings

TRACK YOUR TAXED INCOME

* Get accurate tax estimates by including all types of income

* Add income from self-employment, jobs, and investment income including interest, dividends, and capital gains/losses (including crypto)

MAXIMIZE YOUR TAX DEDUCTIONS

* Uncover write offs and save with a deductible retirement account

* Apply special tax breaks for freelancers including Home Office and SEP IRA contributions

* Upward automatically calculates the Self-Employment Tax and Qualified Business Income deductions, which are based on your self-employment income

KNOW YOUR TAXES OWED

* Understand when and how much to pay in federal and state (including local) taxes

* We help you pay on time to avoid costly late payment penalties and ensure you don't give the government an interest-free loan

CONNECT BANKS AND CREDIT CARDS

* Ensure no transactions are missed and let us do the work

* We'll import and categorize your transactions and predict which ones are tax-related (income, deductions, or tax payments you've made)

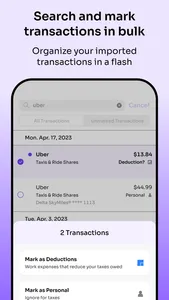

SEARCH AND MARK TRANSACTIONS IN BULK

* Organize your imported transactions in a flash

* Mark transactions as income, deductions, tax payments or personal and see your tax estimates update in real-time

FILTER TRANSACTIONS WITH EASE

* Create custom list views that give every perspective possible

* Filter by category, marked/unmarked status, and predicted tax relevance

SET RULES AND GO ON AUTO-PILOT

* We'll automatically mark incoming transactions for you

* See your income, deductions and tax estimates updated when you return

SET A SEP IRA GOAL AND SAVE MONEY

* Decrease your tax bill while investing tax-free for retirement

* See exactly how much you can save by deducting up to $66,000 in 2023 through a SEP IRA contribution

BE MORE ACCURATE WITH TAX PLANNING

* Know exactly how much to pay in as your results are updated

* See if you've underpaid or overpaid at any point throughout the year

We're a small, rapidly moving team and are always looking to improve our product for you. We're here to help and would love to receive your feedback, questions, or problems:

support@upwardearner.com

* Save more income from freelancing, jobs, and investments

* Get federal, state and local tax estimates and account for tax payments you've already made, including any paycheck withholdings

TRACK YOUR TAXED INCOME

* Get accurate tax estimates by including all types of income

* Add income from self-employment, jobs, and investment income including interest, dividends, and capital gains/losses (including crypto)

MAXIMIZE YOUR TAX DEDUCTIONS

* Uncover write offs and save with a deductible retirement account

* Apply special tax breaks for freelancers including Home Office and SEP IRA contributions

* Upward automatically calculates the Self-Employment Tax and Qualified Business Income deductions, which are based on your self-employment income

KNOW YOUR TAXES OWED

* Understand when and how much to pay in federal and state (including local) taxes

* We help you pay on time to avoid costly late payment penalties and ensure you don't give the government an interest-free loan

CONNECT BANKS AND CREDIT CARDS

* Ensure no transactions are missed and let us do the work

* We'll import and categorize your transactions and predict which ones are tax-related (income, deductions, or tax payments you've made)

SEARCH AND MARK TRANSACTIONS IN BULK

* Organize your imported transactions in a flash

* Mark transactions as income, deductions, tax payments or personal and see your tax estimates update in real-time

FILTER TRANSACTIONS WITH EASE

* Create custom list views that give every perspective possible

* Filter by category, marked/unmarked status, and predicted tax relevance

SET RULES AND GO ON AUTO-PILOT

* We'll automatically mark incoming transactions for you

* See your income, deductions and tax estimates updated when you return

SET A SEP IRA GOAL AND SAVE MONEY

* Decrease your tax bill while investing tax-free for retirement

* See exactly how much you can save by deducting up to $66,000 in 2023 through a SEP IRA contribution

BE MORE ACCURATE WITH TAX PLANNING

* Know exactly how much to pay in as your results are updated

* See if you've underpaid or overpaid at any point throughout the year

We're a small, rapidly moving team and are always looking to improve our product for you. We're here to help and would love to receive your feedback, questions, or problems:

support@upwardearner.com

Show More