MILEAGEWISE - IRS-Proof Mileage Log

2023 IRS rates are automatically updated in the software.

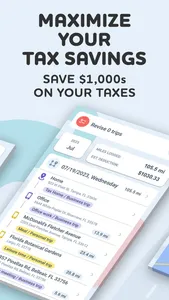

Save time and get the most accurate digital mileage logbook with the IRS-Proof automatic mileage tracker by MileageWise.

No additional hardware is needed.

Maximize your tax deductions to $12,000/year in tax savings.

Say goodbye to tedious paper mileage logs with the most accurate but cheapest automatic mileage tracker app.

Accurately track business & personal mileage to create 100% IRS-Proof mileage logs at the touch of a button.

With MileageWise, you get all the mileage reimbursement or tax deductions you're entitled to.

WITH MILEAGEWISE, YOU’LL GET TO:

- CLAIM YOUR TIME BACK

Our miles tracker saves you hours of manually logging journeys. The app records all the information you need in real-time.

- STAY UP-TO-DATE WITH YOUR TAXES

EffortlessIy gets IRS-Proof mileage logs of your work-related driving for reporting to the IRS.

- BE THE NEATEST EMPLOYEE

Create & send your trip logs to your employer in a matter of seconds.

- IRS MILEAGE AUDIT COMING UP?

Access your previous & current mileage logs anytime, anywhere.

- WORLD-CLASS SUPPORT

Call or email our brilliant customer service with any questions, there is no such thing as a bad question!

MileageWise is the only automatic mileage tracker you need as a small business owner, independent contractor, employee, employer, or just about anyone who drives!

HOW DOES IT WORK?

Simplify mile tracking to just 3 steps:

Track, Check & Report!

1. TRACK

- Track trips with 3+1 automatic trip recording modes - the car mile tracker will start tracking once you reach a certain speed.

- Want to track an individual trip manually? Just tap START-STOP, and leave the rest to our wise mileage app.

- Effortless odometer tracking.

- Forgot to track your journeys during the day? Enter the start & end addresses of your drives and the app will do the rest for you.

2. CHECK

- Set your working hours and MileageWise will auto-classify each trip on the go as Business or Personal for a compliant driving log

- Use MileageWise’s Web Dashboard platform to review your trips at a glance and easily edit details in just 7 minutes/month

3. REPORT

- IRS-Proof reports for your employee mileage reimbursement or car expenses tax claim

- Claiming deductions by the actual expenses method? Use our Vehicle Expense Tracker function to add any car-related expenses and MileageWise will split the costs by percentage

- Create separate logs for separate vehicles and workplaces

- Choose if you want to show odometer readings

- Have your reports include the total miles, start & end dates, distance, reimbursement amount, or % split between business and personal driving

- Get your vehicle log books in PDF, CSV, or Excel, or send them directly through the app

MILEAGEWISE FOR WEB: Bring All the Functionality to Your Desktop

- Review your logs and edit details easily

- Import trips from many different sources, like Google Maps Timeline

- Add trips you forgot to record manually or automatically with AdWise Wizard

- Generate your mileage reports

MILEAGEWISE FOR TEAMS: Perfect for Business

- Invite, manage, and remove users

- Employees create & share consistent logbooks with their managers

- Managers review and approve mileage reimbursement expense claims in a straightforward overview

PRIVACY BY DESIGN

- We never sell data

- We will never provide your information to other parties for marketing purposes

LEARN MORE:

- Privacy Policy: https://mileagewise.com/privacy-policy

- Terms of Service: https://mileagewise.com/terms-of-service/

SUPPORT

-Don’t have time to create your own mileage log retrospectively? Our Concierge Service will make your mileage log for entire years!

- Looking for a quick answer to your question? Visit our comprehensive Help Center straight from the app or watch videos!

- Our professional Support team is ready to assist you at any time at team@mileagewise.com

BE WISE, CHOOSE MILEAGEWISE.

2023 IRS rates are automatically updated in the software.

Save time and get the most accurate digital mileage logbook with the IRS-Proof automatic mileage tracker by MileageWise.

No additional hardware is needed.

Maximize your tax deductions to $12,000/year in tax savings.

Say goodbye to tedious paper mileage logs with the most accurate but cheapest automatic mileage tracker app.

Accurately track business & personal mileage to create 100% IRS-Proof mileage logs at the touch of a button.

With MileageWise, you get all the mileage reimbursement or tax deductions you're entitled to.

WITH MILEAGEWISE, YOU’LL GET TO:

- CLAIM YOUR TIME BACK

Our miles tracker saves you hours of manually logging journeys. The app records all the information you need in real-time.

- STAY UP-TO-DATE WITH YOUR TAXES

EffortlessIy gets IRS-Proof mileage logs of your work-related driving for reporting to the IRS.

- BE THE NEATEST EMPLOYEE

Create & send your trip logs to your employer in a matter of seconds.

- IRS MILEAGE AUDIT COMING UP?

Access your previous & current mileage logs anytime, anywhere.

- WORLD-CLASS SUPPORT

Call or email our brilliant customer service with any questions, there is no such thing as a bad question!

MileageWise is the only automatic mileage tracker you need as a small business owner, independent contractor, employee, employer, or just about anyone who drives!

HOW DOES IT WORK?

Simplify mile tracking to just 3 steps:

Track, Check & Report!

1. TRACK

- Track trips with 3+1 automatic trip recording modes - the car mile tracker will start tracking once you reach a certain speed.

- Want to track an individual trip manually? Just tap START-STOP, and leave the rest to our wise mileage app.

- Effortless odometer tracking.

- Forgot to track your journeys during the day? Enter the start & end addresses of your drives and the app will do the rest for you.

2. CHECK

- Set your working hours and MileageWise will auto-classify each trip on the go as Business or Personal for a compliant driving log

- Use MileageWise’s Web Dashboard platform to review your trips at a glance and easily edit details in just 7 minutes/month

3. REPORT

- IRS-Proof reports for your employee mileage reimbursement or car expenses tax claim

- Claiming deductions by the actual expenses method? Use our Vehicle Expense Tracker function to add any car-related expenses and MileageWise will split the costs by percentage

- Create separate logs for separate vehicles and workplaces

- Choose if you want to show odometer readings

- Have your reports include the total miles, start & end dates, distance, reimbursement amount, or % split between business and personal driving

- Get your vehicle log books in PDF, CSV, or Excel, or send them directly through the app

MILEAGEWISE FOR WEB: Bring All the Functionality to Your Desktop

- Review your logs and edit details easily

- Import trips from many different sources, like Google Maps Timeline

- Add trips you forgot to record manually or automatically with AdWise Wizard

- Generate your mileage reports

MILEAGEWISE FOR TEAMS: Perfect for Business

- Invite, manage, and remove users

- Employees create & share consistent logbooks with their managers

- Managers review and approve mileage reimbursement expense claims in a straightforward overview

PRIVACY BY DESIGN

- We never sell data

- We will never provide your information to other parties for marketing purposes

LEARN MORE:

- Privacy Policy: https://mileagewise.com/privacy-policy

- Terms of Service: https://mileagewise.com/terms-of-service/

SUPPORT

-Don’t have time to create your own mileage log retrospectively? Our Concierge Service will make your mileage log for entire years!

- Looking for a quick answer to your question? Visit our comprehensive Help Center straight from the app or watch videos!

- Our professional Support team is ready to assist you at any time at team@mileagewise.com

BE WISE, CHOOSE MILEAGEWISE.

Show More