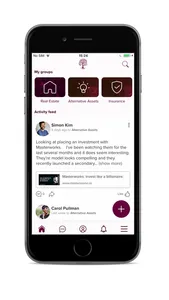

Long Angle is a community for those who seek perspectives on wealth management from exceptionally successful peers. Members discuss all major areas of high-net-worth personal finance:

Trust | Legacy | Estate - Defining objectives, setting strategy, and executing tactics for multi-generational wealth preservation and utilization.

Tax & Retirement - Optimizing asset classes, corporate structures, personal account structures, and responses to political and market developments.

Philanthropy - Rooting philanthropy in the context of a personal financial plan, setting goals, selecting recipients, and evaluating results.

Asset Allocation - Crafting the blend of asset classes and leverage across an entire portfolio to align with personal goals and risk tolerance.

Stocks & Bonds - Evaluating the expected returns, volatility, and correlation of individual securities, funds, and classes of securities.

Real Estate - Acquiring, managing, and selling primary residences, vacation homes, rental properties, commercial properties, and land.

Alternative Assets - Finding and evaluating opportunities in private equity, VC, angel, crypto, commodities, collectibles, and other assets.

Insurance - Understanding and purchasing life, disability, umbrella, auto, real estate, D&O, health, Lloyd’s and other types of insurance.

Private Businesses - Starting, growing, operating, and selling private businesses; key issues include cash management and HR.

Career & Boards - Exploring and negotiating opportunities for executive advancement, post-liquidity careers, and board service.

Budget Planning - Measuring and analyzing expenses and income streams; aligning spending with priorities; scenario-planning major changes.

Lifestyle - Harnessing wealth as a tool; realize personal goals, instill values, create meaning, and make a lasting social impact.

Trust | Legacy | Estate - Defining objectives, setting strategy, and executing tactics for multi-generational wealth preservation and utilization.

Tax & Retirement - Optimizing asset classes, corporate structures, personal account structures, and responses to political and market developments.

Philanthropy - Rooting philanthropy in the context of a personal financial plan, setting goals, selecting recipients, and evaluating results.

Asset Allocation - Crafting the blend of asset classes and leverage across an entire portfolio to align with personal goals and risk tolerance.

Stocks & Bonds - Evaluating the expected returns, volatility, and correlation of individual securities, funds, and classes of securities.

Real Estate - Acquiring, managing, and selling primary residences, vacation homes, rental properties, commercial properties, and land.

Alternative Assets - Finding and evaluating opportunities in private equity, VC, angel, crypto, commodities, collectibles, and other assets.

Insurance - Understanding and purchasing life, disability, umbrella, auto, real estate, D&O, health, Lloyd’s and other types of insurance.

Private Businesses - Starting, growing, operating, and selling private businesses; key issues include cash management and HR.

Career & Boards - Exploring and negotiating opportunities for executive advancement, post-liquidity careers, and board service.

Budget Planning - Measuring and analyzing expenses and income streams; aligning spending with priorities; scenario-planning major changes.

Lifestyle - Harnessing wealth as a tool; realize personal goals, instill values, create meaning, and make a lasting social impact.

Show More