In this digital banking app, you can open a savings and wealth account, transfer funds, and manage your finances easily. Includes virtual debit card features, expense controls, cashback rewards, and in-app support options.

About NiyoX - Digital Banking

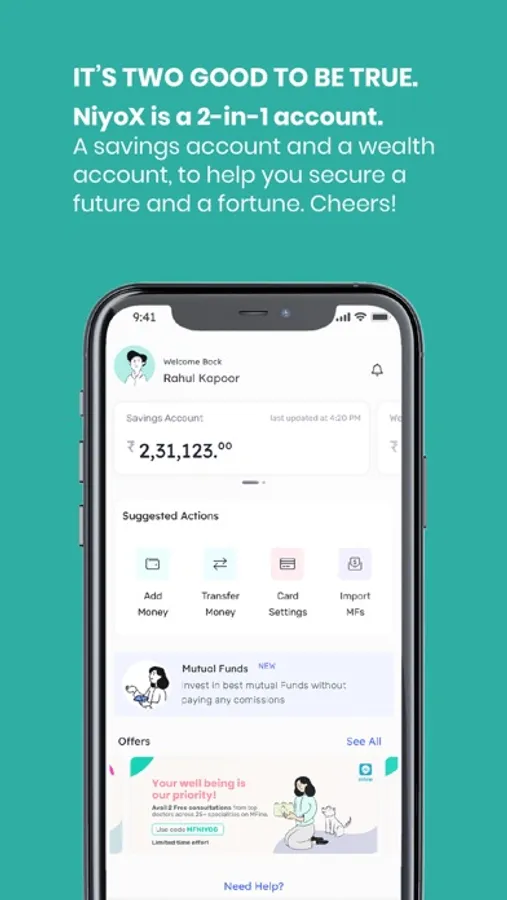

Tired of jumping through multiple loops to get something done at your local bank? Confused by financial lingo? NiyoX is here to decode banking for you with an intuitive, easy-to-use app and a 2-in-1 Savings + Wealth account. Opening your digital savings account with NiyoX is fast, efficient, 100% paperless and can be done from wherever you are. Banking with NiyoX is quick and easy since we’re here to make things simple, safe and smart and put you in charge of your finances.

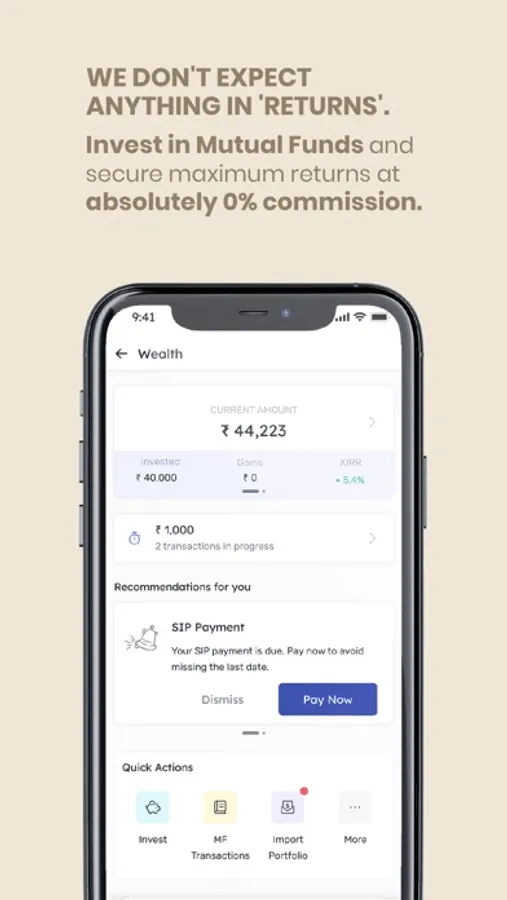

Our 2-in-1 Savings + Wealth account is the perfect place to start if you’re looking to open a zero balance savings account. Why? Because with NiyoX you get the best interest rates on savings and free online fund transfers. We offer you the financial trinity of ₹0 Account Maintenance Charges, 0% commission on Mutual Funds investment, and up to 7% interest p.a.* on your savings to add a touch of 007 to your finances. Our wealth offering, powered by Niyo Money, will help you get started on your investment journey so that your money works for you!

How NiyoX puts the ‘X’ in neobanking:

* 2-in-1 Savings + Wealth Account

* Digital Salary Account that gives cashback with every salary credit*

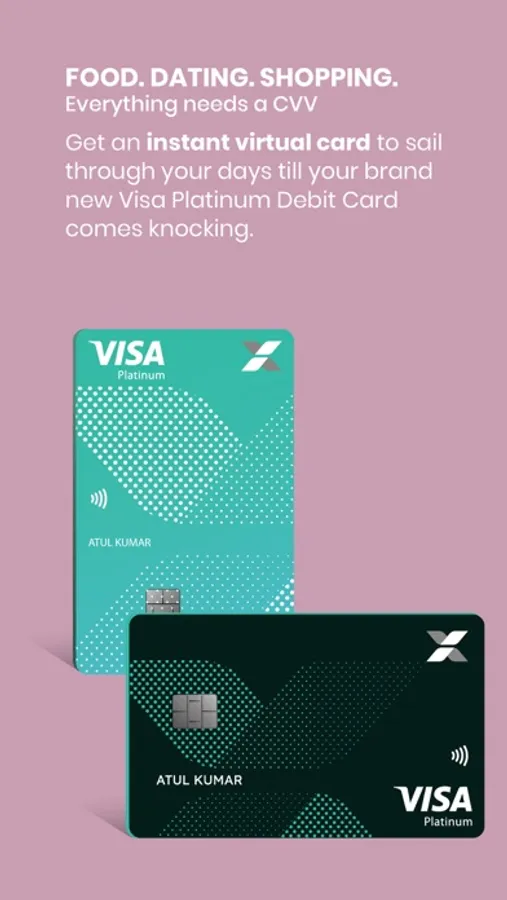

* Virtual Debit Card that helps you start making online transactions as soon as you open your account

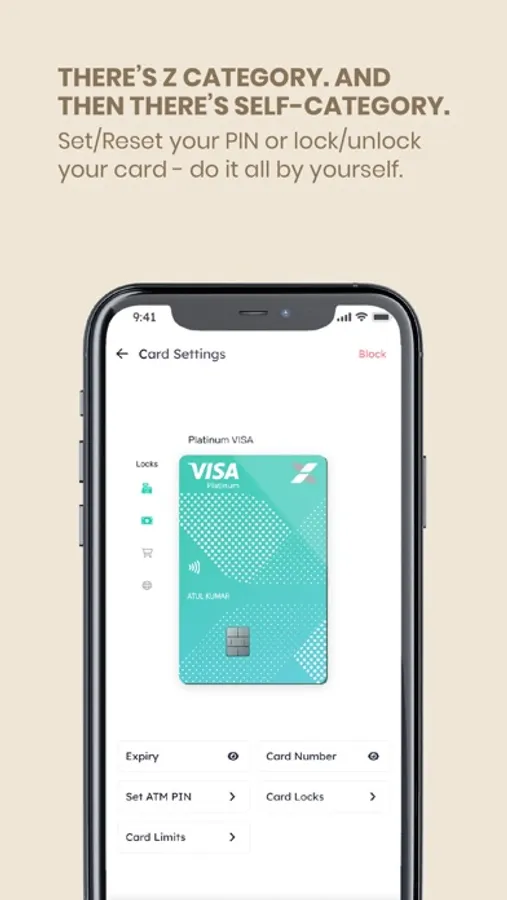

* Card locks and limits that help you control expenses via different payment channels (Online, Card swipe, ATM, International)

* Tap & Pay ZERO forex markup card

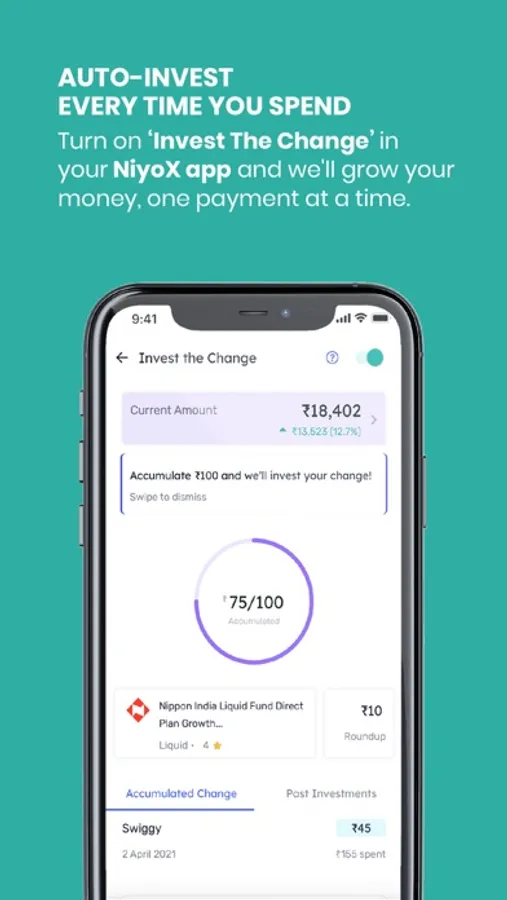

* ‘Invest the Change’ feature to let you save while you spend and invest your spare change

* Exclusive onboarding deals and regular rewards

* Wave feature that hides your account balance when you wave your hand over it to keep it safe from prying eyes

* In-app support and Niyo Community forum to get answers and share feedback

Preparing the Best Financial Dish:

Prep time: Less than 10 minutes

Difficulty: Easier than roasting papad

Serves: As many as you want

Ingredients:

* 1 Gen X User who wants simple digital banking

* PAN

* Aadhaar

Recipe for Online Savings Account Opening:

1. Download the NiyoX App

2. Enter your phone number (should be the one linked to your Aadhaar)

3. Enter your PAN and Aadhaar number

4. Enter basic personal details

5. Easy management of finances is served

Benefits with your NiyoX Savings Account:

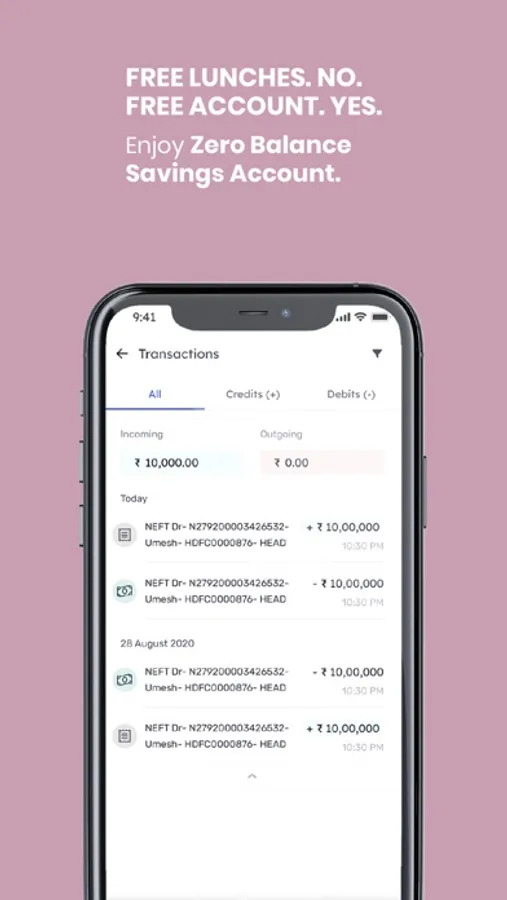

* ₹0 Balance Account

* 0% Commission on Mutual Funds Investments

* Up to 7% interest on your savings

* Digital Salary Account with cashbacks for every salary credit*

* Invest in domestic and international stocks and get useful mutual funds recommendations via Niyo Money

* Auto-invest spare change every time you spend with ‘Invest the Change’

* ₹5 lakhs insurance for your funds by DICGC, a subsidiary of RBI

* Choice of designs for a Platinum VISA Debit Card

* Earn Equinox reward points every time you spend

Digital Banking Services with a human touch

Digitization has brought the entire world to our smartphones, so it’s only logical that your finances follow suit. Why should there be a need to go to a bank and wait in queues, carry a folder full of documents and fill out complicated paperwork when you can manage your finances from the comfort of your home? This is one of the pain points that NiyoX solves for the modern banker who should have everything at their disposal at a moment’s notice. NiyoX also gives you the best salary account that keeps giving back rewards each month--a true companion for all salaried Indians.

Although there is no physical branch, your money is always available for you and is kept secure in your Equitas Small Finance Bank account. If you need help, we are always there to assist you and can be reached at the touch of a button. We use strong encryption protocols to keep your funds safe.

Terms and Conditions:

https://static.goniyo.com/legal/Terms_conditions.pdf

Our 2-in-1 Savings + Wealth account is the perfect place to start if you’re looking to open a zero balance savings account. Why? Because with NiyoX you get the best interest rates on savings and free online fund transfers. We offer you the financial trinity of ₹0 Account Maintenance Charges, 0% commission on Mutual Funds investment, and up to 7% interest p.a.* on your savings to add a touch of 007 to your finances. Our wealth offering, powered by Niyo Money, will help you get started on your investment journey so that your money works for you!

How NiyoX puts the ‘X’ in neobanking:

* 2-in-1 Savings + Wealth Account

* Digital Salary Account that gives cashback with every salary credit*

* Virtual Debit Card that helps you start making online transactions as soon as you open your account

* Card locks and limits that help you control expenses via different payment channels (Online, Card swipe, ATM, International)

* Tap & Pay ZERO forex markup card

* ‘Invest the Change’ feature to let you save while you spend and invest your spare change

* Exclusive onboarding deals and regular rewards

* Wave feature that hides your account balance when you wave your hand over it to keep it safe from prying eyes

* In-app support and Niyo Community forum to get answers and share feedback

Preparing the Best Financial Dish:

Prep time: Less than 10 minutes

Difficulty: Easier than roasting papad

Serves: As many as you want

Ingredients:

* 1 Gen X User who wants simple digital banking

* PAN

* Aadhaar

Recipe for Online Savings Account Opening:

1. Download the NiyoX App

2. Enter your phone number (should be the one linked to your Aadhaar)

3. Enter your PAN and Aadhaar number

4. Enter basic personal details

5. Easy management of finances is served

Benefits with your NiyoX Savings Account:

* ₹0 Balance Account

* 0% Commission on Mutual Funds Investments

* Up to 7% interest on your savings

* Digital Salary Account with cashbacks for every salary credit*

* Invest in domestic and international stocks and get useful mutual funds recommendations via Niyo Money

* Auto-invest spare change every time you spend with ‘Invest the Change’

* ₹5 lakhs insurance for your funds by DICGC, a subsidiary of RBI

* Choice of designs for a Platinum VISA Debit Card

* Earn Equinox reward points every time you spend

Digital Banking Services with a human touch

Digitization has brought the entire world to our smartphones, so it’s only logical that your finances follow suit. Why should there be a need to go to a bank and wait in queues, carry a folder full of documents and fill out complicated paperwork when you can manage your finances from the comfort of your home? This is one of the pain points that NiyoX solves for the modern banker who should have everything at their disposal at a moment’s notice. NiyoX also gives you the best salary account that keeps giving back rewards each month--a true companion for all salaried Indians.

Although there is no physical branch, your money is always available for you and is kept secure in your Equitas Small Finance Bank account. If you need help, we are always there to assist you and can be reached at the touch of a button. We use strong encryption protocols to keep your funds safe.

Terms and Conditions:

https://static.goniyo.com/legal/Terms_conditions.pdf