About Advataxes

An employee expense report app with a strength on handling recoverable Canadian GST/HST/QST

Advataxes is an expense report app for both expenses and allowances that are reimbursed by an organization to its employees. What is included:

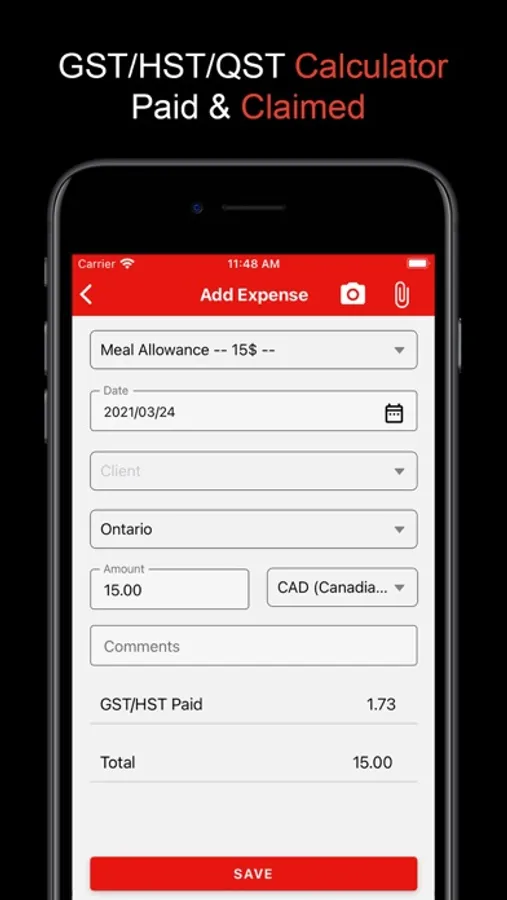

• Advataxes takes into account the Canadian VAT when filling out expense reports. The Canadian Value Added Taxes (VAT) includes: The Goods and Services Tax (GST), the Harmonized Sales Tax (HST) and the Quebec Sales Tax (QST)

• Major GST/HST/QST rules on employee expenses are updated. Whether it’s a hotel expense in Ontario or a meal expense in Quebec, the app precalculates paid GST/HST/QST as well as claimable GST/HST/QST on expenses and on allowances.

• GST/HST/QST rates are updated.

• Precalculated GST/HST/QST paid is either on a tax included or on a tax extra basis as selected by each employee.

• The app uses the exact method for GST/HST & QST purposes.

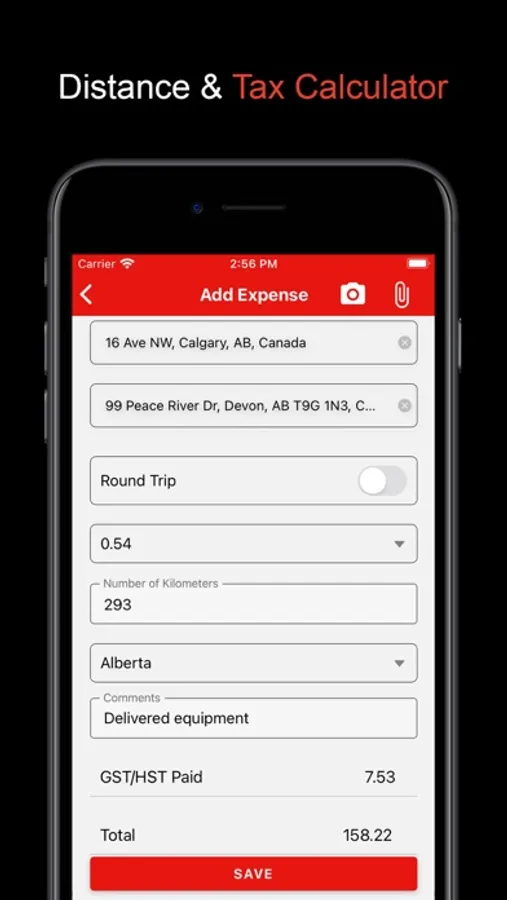

• For any travel expense incurred, a distance calculator provides the distance between two addresses or points of interest in North America, expressed in kilometers.

• For hotel expenses, there is a simple functionality to calculate the average cost per employee per night.

• There are a series of warnings and security features that are included, such as when there is an identical expense that has already been posted, when a tip amount exceeds a certain threshold, when values inserted are not compatible, etc…

• You can select two approval levels, so an employee can send an expense report to their supervisor who can review it and then send that same expense report to the finance department. Should an expense report need to be modified, it can be sent back to the employee so adjustments can be performed.

• The chart of accounts of your organization can have various accounting segments, such as a department or a division code, a project number or a work order number. You can set the desired financial year-end. Once an expense report is posted, it can be exported in a CSV format so it can be integrated into your accounting software.

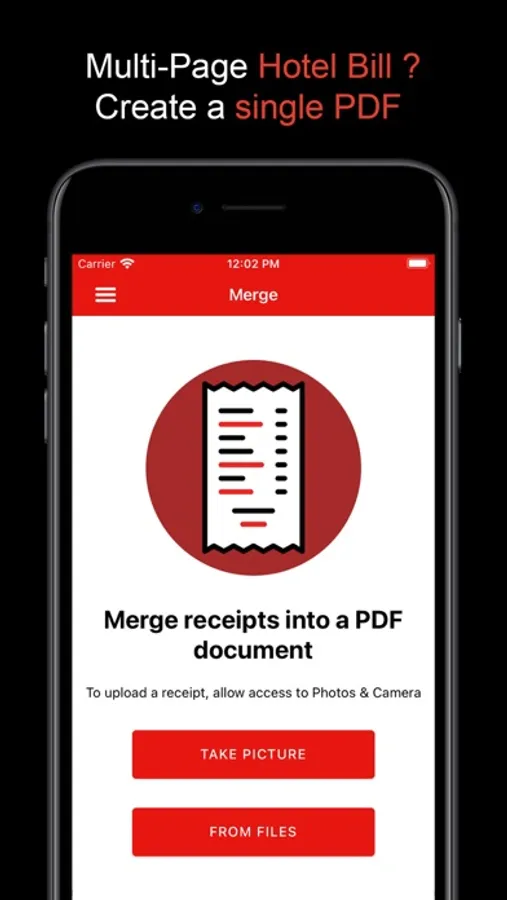

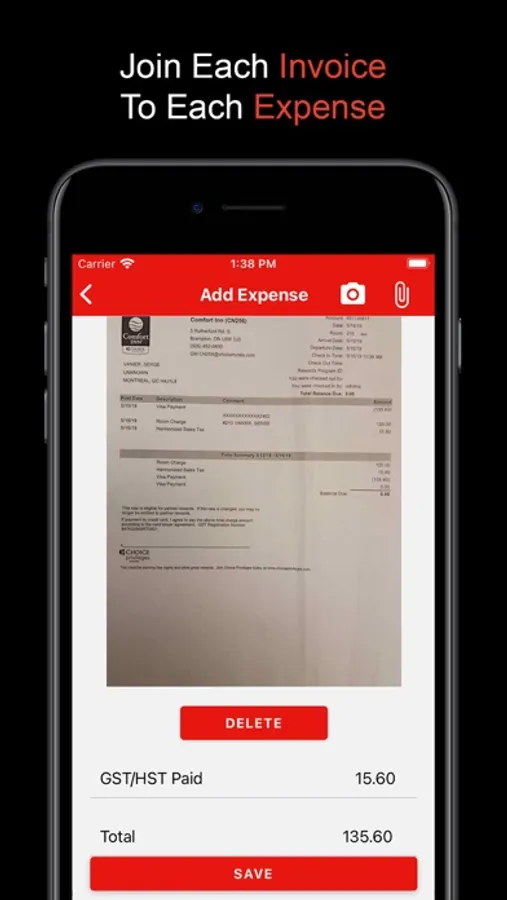

• You can take a picture of your receipts and import them. They will be stored digitally. From our web application you can also import receipts in PDF format and attach them to each expense in your expense report. You can access your historical employee expenses as well as all digitally stored images linked to each expense report.

• The App provides the automatic conversion of the following foreign currency: USD, EUR, GBP, CNY, HKD, INR, JPY, and MXN to CAD.

From our web connection you can upload the list of bank Card transactions in CSV and PDF format.

The App can be displayed in both English or French at the employee level.

Our Mobile App is an extension of our web application https://www.advataxes.ca/

The App has to be used online, and your data is stored in a secure datacenter located in Canada.

We are also an award winning software. We won an award for: Innovative Travel Technology Award – Levvel Research. As the typical approach in the industry has been the use of tax codes, we used matrices to precalculate taxes, based notably on the province an expense was incurred in. We even address the tax rules where optional tips are not subject to Canadian VAT. The strength of this approach is that it is not based on the premise that all employees posting travel expenses are sales tax practitioners which is an unrealistic expectation

Advataxes can also be used by non-Canadian tax registrants for filing travel expenses. The distance calculator also covers US point of interests and it is available in miles rather than kilometers for US entities.

Get started today, and start filling out expense reports with ease. Go to our website and fill out our configuration questionnaire, https://www.advataxes.ca/en/Configuration-questionnaire.aspx, and see how filling out an expense report can become an easy and efficient process. Employee expense reports have never been easier!

Advataxes is an expense report app for both expenses and allowances that are reimbursed by an organization to its employees. What is included:

• Advataxes takes into account the Canadian VAT when filling out expense reports. The Canadian Value Added Taxes (VAT) includes: The Goods and Services Tax (GST), the Harmonized Sales Tax (HST) and the Quebec Sales Tax (QST)

• Major GST/HST/QST rules on employee expenses are updated. Whether it’s a hotel expense in Ontario or a meal expense in Quebec, the app precalculates paid GST/HST/QST as well as claimable GST/HST/QST on expenses and on allowances.

• GST/HST/QST rates are updated.

• Precalculated GST/HST/QST paid is either on a tax included or on a tax extra basis as selected by each employee.

• The app uses the exact method for GST/HST & QST purposes.

• For any travel expense incurred, a distance calculator provides the distance between two addresses or points of interest in North America, expressed in kilometers.

• For hotel expenses, there is a simple functionality to calculate the average cost per employee per night.

• There are a series of warnings and security features that are included, such as when there is an identical expense that has already been posted, when a tip amount exceeds a certain threshold, when values inserted are not compatible, etc…

• You can select two approval levels, so an employee can send an expense report to their supervisor who can review it and then send that same expense report to the finance department. Should an expense report need to be modified, it can be sent back to the employee so adjustments can be performed.

• The chart of accounts of your organization can have various accounting segments, such as a department or a division code, a project number or a work order number. You can set the desired financial year-end. Once an expense report is posted, it can be exported in a CSV format so it can be integrated into your accounting software.

• You can take a picture of your receipts and import them. They will be stored digitally. From our web application you can also import receipts in PDF format and attach them to each expense in your expense report. You can access your historical employee expenses as well as all digitally stored images linked to each expense report.

• The App provides the automatic conversion of the following foreign currency: USD, EUR, GBP, CNY, HKD, INR, JPY, and MXN to CAD.

From our web connection you can upload the list of bank Card transactions in CSV and PDF format.

The App can be displayed in both English or French at the employee level.

Our Mobile App is an extension of our web application https://www.advataxes.ca/

The App has to be used online, and your data is stored in a secure datacenter located in Canada.

We are also an award winning software. We won an award for: Innovative Travel Technology Award – Levvel Research. As the typical approach in the industry has been the use of tax codes, we used matrices to precalculate taxes, based notably on the province an expense was incurred in. We even address the tax rules where optional tips are not subject to Canadian VAT. The strength of this approach is that it is not based on the premise that all employees posting travel expenses are sales tax practitioners which is an unrealistic expectation

Advataxes can also be used by non-Canadian tax registrants for filing travel expenses. The distance calculator also covers US point of interests and it is available in miles rather than kilometers for US entities.

Get started today, and start filling out expense reports with ease. Go to our website and fill out our configuration questionnaire, https://www.advataxes.ca/en/Configuration-questionnaire.aspx, and see how filling out an expense report can become an easy and efficient process. Employee expense reports have never been easier!