CALCULATOR:

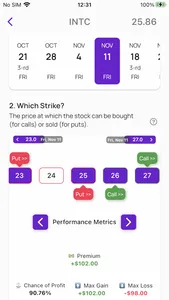

Analyze the likely outcomes of options strategies using a real-time calculator and strategy-builder:

a) Performance metrics: Probability of Profit, Max Gain &Min/Max Loss

b) Risk metrics. The so-called “Greeks”: delta, gamma, theta, etc.

c) Strategy builder. Generate options strategy based on expectations about the price move.

CALENDAR OF KEY EVENTS:

Keeping track of upcoming important events that are likely to have a significant impact on prices:

a) Earnings calls. Affect virtually all listed companies. Stock prices tend to significantly fluctuate depending on whether the results were better/worse than expected. Options prices almost always tumble post-announcement due to the decrease in uncertainty.

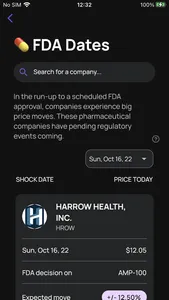

b) FDA decision announcements. Potential make-or-break event for pharmaceutical companies. The effect is more pronounced for smaller firms that have higher dependency on that particular drug/treatment that’s being reviewed by the FDA.

c) SPAC-related events. SPACs (Special Purpose Acquisition Companies) have a set of scheduled events that could drastically affect the future of the company.

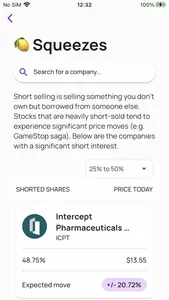

MARKET VIBES/SENTIMENT:

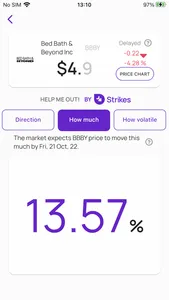

By analyzing the options prices, we can cut out the noise and uncover what the market actually feels, not what the analysts say:

a) Stock/ETF price direction. By measuring the so-called implied volatility skew we can identify whether market is valuing more calls or puts, and as such determine which move is likelier: up or down.

b) Move magnitude. By analyzing options prices we can judge the expectations about the move: the higher the options prices the larger is the expected move.

c) Future volatility. By analyzing options prices of different maturities (expiration dates) we can determine whether the market expects volatility to subside or increase in the future.

DISCLAIMER:

Options trading involves a high degree of risk and is not suitable for all investors. Strikes is not a registered investment advisor. The calculations, information, and sentiment in this app are for educational purposes only and do not constitute investment advice. Calculations are estimates and do not account for all market conditions and events.

You can check our Terms of Use here:

https://firebasestorage.googleapis.com/v0/b/strikes-fb13d.appspot.com/o/strikes_terms_of_service.pdf?alt=media&token=2c26b7b1-c795-4b15-ac37-f8fe29eb6b04

And our Privacy Policy here:

https://firebasestorage.googleapis.com/v0/b/strikes-fb13d.appspot.com/o/Privacy%20Policy.pdf?alt=media&token=21f99967-a270-482f-af8e-d12a882ce9e9

Analyze the likely outcomes of options strategies using a real-time calculator and strategy-builder:

a) Performance metrics: Probability of Profit, Max Gain &Min/Max Loss

b) Risk metrics. The so-called “Greeks”: delta, gamma, theta, etc.

c) Strategy builder. Generate options strategy based on expectations about the price move.

CALENDAR OF KEY EVENTS:

Keeping track of upcoming important events that are likely to have a significant impact on prices:

a) Earnings calls. Affect virtually all listed companies. Stock prices tend to significantly fluctuate depending on whether the results were better/worse than expected. Options prices almost always tumble post-announcement due to the decrease in uncertainty.

b) FDA decision announcements. Potential make-or-break event for pharmaceutical companies. The effect is more pronounced for smaller firms that have higher dependency on that particular drug/treatment that’s being reviewed by the FDA.

c) SPAC-related events. SPACs (Special Purpose Acquisition Companies) have a set of scheduled events that could drastically affect the future of the company.

MARKET VIBES/SENTIMENT:

By analyzing the options prices, we can cut out the noise and uncover what the market actually feels, not what the analysts say:

a) Stock/ETF price direction. By measuring the so-called implied volatility skew we can identify whether market is valuing more calls or puts, and as such determine which move is likelier: up or down.

b) Move magnitude. By analyzing options prices we can judge the expectations about the move: the higher the options prices the larger is the expected move.

c) Future volatility. By analyzing options prices of different maturities (expiration dates) we can determine whether the market expects volatility to subside or increase in the future.

DISCLAIMER:

Options trading involves a high degree of risk and is not suitable for all investors. Strikes is not a registered investment advisor. The calculations, information, and sentiment in this app are for educational purposes only and do not constitute investment advice. Calculations are estimates and do not account for all market conditions and events.

You can check our Terms of Use here:

https://firebasestorage.googleapis.com/v0/b/strikes-fb13d.appspot.com/o/strikes_terms_of_service.pdf?alt=media&token=2c26b7b1-c795-4b15-ac37-f8fe29eb6b04

And our Privacy Policy here:

https://firebasestorage.googleapis.com/v0/b/strikes-fb13d.appspot.com/o/Privacy%20Policy.pdf?alt=media&token=21f99967-a270-482f-af8e-d12a882ce9e9

Show More