Zoombooks makes bookkeeping and expense management easy for drivers and

self-employed people. Just take photos of the physical receipts and submit, that's

all, Zoombooks will do bookkeeping, expense management and receipt keeping for

you. Save tax, time, and money! Its free as well.

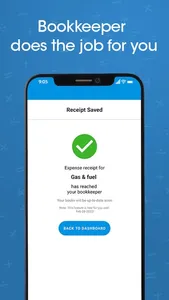

No need to learn accounting basics. Your Zoombooks will take care of bookkeeping

and organize receipts, so you can focus on more important stuff.

FEATURES:

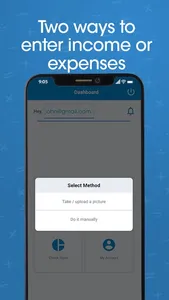

- Income and Expense recording by taking pictures (of receipts or invoices) or

manually

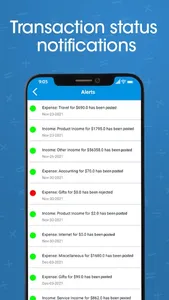

- User notifications for posted transactions

- Receipts and invoices are digitally saved and organized

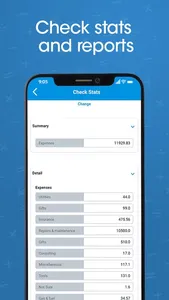

- Run reports to stay on top of your financials

- Download transactions data into Excel and CSV files

- Access transactions and data on web

- Receipt images can be viewed and downloaded

- Proper booking by pro bookkeepers

- Proper Sales tax (GST/ HST/ VAT) handling (calculates the sales tax receivable or

payable)

- Stay tax time ready for CRA or IRS all the time

- Absolutely Zero knowledge of accounting required

No more issues like:

- Shoe box receipts

- Having basic accounting knowledge

- Manual data entry

- Wrong categorization of expenses

- Unsure of expense treatment

- Character recognition errors and wrong entries

USE CASES:

Scenario-1: As a driver (Uber, Lyft, truck, taxi etc.) you handle so many receipts

every day, on the go. Don't have time and place to save and organize those. You

end up losing so many tax saving opportunities and risking tax audits.

Solution: Just taking a snap of your receipts on the go. The receipts will be saved,

organized and recorded properly by Zoombooks. All you did was taking a picture

and hit submit button.

Scenario-2: Losing tax deduction opportunities. Every receipt is important.

Solution: Don't ignore or throw away receipts. Just take their picture. It will be saved

and posted in right category. So, you don't lose any tax deductions.

Scenario-3: At end of the year; you have to organize bags full of receipts and take

those to the accountant for filing tax. That’s a hassle.

Solution: Zoombooks keeps your books-up-to date and tax ready all the time. You

can:

- download properly organized bookkeeping data in excel or spreadsheets

- View or download any receipt you saved

- email the file to the accountant to file your tax returns or do it yourself

Scenario-4: As rideshare driver (Uber, Lyft etc.) you are always confused on how

much is your net profit or loss from driving? or what is your sales tax (like HST/GST

liability)?

Solution: Zoombooks provides real time reports on profitability and sales tax. All for

free.

self-employed people. Just take photos of the physical receipts and submit, that's

all, Zoombooks will do bookkeeping, expense management and receipt keeping for

you. Save tax, time, and money! Its free as well.

No need to learn accounting basics. Your Zoombooks will take care of bookkeeping

and organize receipts, so you can focus on more important stuff.

FEATURES:

- Income and Expense recording by taking pictures (of receipts or invoices) or

manually

- User notifications for posted transactions

- Receipts and invoices are digitally saved and organized

- Run reports to stay on top of your financials

- Download transactions data into Excel and CSV files

- Access transactions and data on web

- Receipt images can be viewed and downloaded

- Proper booking by pro bookkeepers

- Proper Sales tax (GST/ HST/ VAT) handling (calculates the sales tax receivable or

payable)

- Stay tax time ready for CRA or IRS all the time

- Absolutely Zero knowledge of accounting required

No more issues like:

- Shoe box receipts

- Having basic accounting knowledge

- Manual data entry

- Wrong categorization of expenses

- Unsure of expense treatment

- Character recognition errors and wrong entries

USE CASES:

Scenario-1: As a driver (Uber, Lyft, truck, taxi etc.) you handle so many receipts

every day, on the go. Don't have time and place to save and organize those. You

end up losing so many tax saving opportunities and risking tax audits.

Solution: Just taking a snap of your receipts on the go. The receipts will be saved,

organized and recorded properly by Zoombooks. All you did was taking a picture

and hit submit button.

Scenario-2: Losing tax deduction opportunities. Every receipt is important.

Solution: Don't ignore or throw away receipts. Just take their picture. It will be saved

and posted in right category. So, you don't lose any tax deductions.

Scenario-3: At end of the year; you have to organize bags full of receipts and take

those to the accountant for filing tax. That’s a hassle.

Solution: Zoombooks keeps your books-up-to date and tax ready all the time. You

can:

- download properly organized bookkeeping data in excel or spreadsheets

- View or download any receipt you saved

- email the file to the accountant to file your tax returns or do it yourself

Scenario-4: As rideshare driver (Uber, Lyft etc.) you are always confused on how

much is your net profit or loss from driving? or what is your sales tax (like HST/GST

liability)?

Solution: Zoombooks provides real time reports on profitability and sales tax. All for

free.

Show More