Debbie is the app that will get you out of debt. For good.

We are the first rewards program for debt payoff. At the core of Debbie is a psychology-based debt payoff program, where we help you understand your money mindset, set goals, track your progress, and earn rewards when you reach milestones! Each part of the Debbie program will help you gain the knowledge and tools to upgrade your habits, stay out of debt forever, and build wealth.

Here are the features you can expect from the Debbie app:

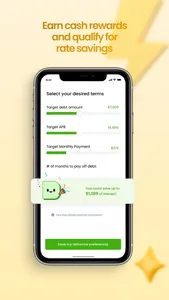

- Personalized monthly debt payoff and savings goals

- Quick Wins: weekly short financial challenges, like checking your balance or credit score

- Learnings: weekly courses that uncover the truth of your money psychology

- Cash rewards for completing your goals, Quick Wins, and Learnings!

Note: Debbie is currently by invite only. We are working actively to get as many users as possible off of our waitlist. Download the app and sign up to be notified about opportunities to skip the waitlist.

HERE’S HOW IT WORKS:

1. Download the Debbie app

Start by downloading the app to get ready on your journey to debt freedom.

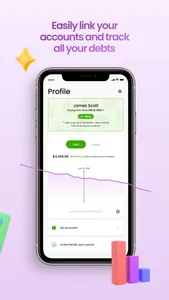

2. Connect your debt and savings accounts

In order to help you track your progress and reward you for hitting your goals, you will need to hook up any relevant accounts.

3. Get started on your Debbie course

We will walk you through your Debbie course which teach your about your money mindset

4. Hit your goals and get paid

Complete your debt payoff and savings goals for the month, as well as your weekly Quick Wins and Learnings to earn rewards.

5. Access lower rates on your debt*

Level up in the Debbie program and gain access to our Rate Crusher, where we negotiate for lower rates on your debt.

FREQUENTLY ASKED QUESTIONS

How much does Debbie cost?

Debbie is 100% free to the user.

How does Debbie get paid?

We work with financial institutions who sponsor our users in order to improve engagement on their loan and savings accounts. In addition, those partners pay us when we’re able to match you with a product that suits your needs.

How does Debbie save me money?

We focus on making sure you stay on your debt freedom journey and don’t rack the debt back up, as well as reducing the interest burden of your current debts.

Does it really work?

Debbie users have pad off 3x more debt than the average debtor, as well as save around $100/month on average. Do you want to be part of this elite crowd?

DISCLOSURES

*Not a guarantee of approval. Debbie does not extend credit directly. Our credit check won’t impact your credit score. Terms and conditions apply.

We are the first rewards program for debt payoff. At the core of Debbie is a psychology-based debt payoff program, where we help you understand your money mindset, set goals, track your progress, and earn rewards when you reach milestones! Each part of the Debbie program will help you gain the knowledge and tools to upgrade your habits, stay out of debt forever, and build wealth.

Here are the features you can expect from the Debbie app:

- Personalized monthly debt payoff and savings goals

- Quick Wins: weekly short financial challenges, like checking your balance or credit score

- Learnings: weekly courses that uncover the truth of your money psychology

- Cash rewards for completing your goals, Quick Wins, and Learnings!

Note: Debbie is currently by invite only. We are working actively to get as many users as possible off of our waitlist. Download the app and sign up to be notified about opportunities to skip the waitlist.

HERE’S HOW IT WORKS:

1. Download the Debbie app

Start by downloading the app to get ready on your journey to debt freedom.

2. Connect your debt and savings accounts

In order to help you track your progress and reward you for hitting your goals, you will need to hook up any relevant accounts.

3. Get started on your Debbie course

We will walk you through your Debbie course which teach your about your money mindset

4. Hit your goals and get paid

Complete your debt payoff and savings goals for the month, as well as your weekly Quick Wins and Learnings to earn rewards.

5. Access lower rates on your debt*

Level up in the Debbie program and gain access to our Rate Crusher, where we negotiate for lower rates on your debt.

FREQUENTLY ASKED QUESTIONS

How much does Debbie cost?

Debbie is 100% free to the user.

How does Debbie get paid?

We work with financial institutions who sponsor our users in order to improve engagement on their loan and savings accounts. In addition, those partners pay us when we’re able to match you with a product that suits your needs.

How does Debbie save me money?

We focus on making sure you stay on your debt freedom journey and don’t rack the debt back up, as well as reducing the interest burden of your current debts.

Does it really work?

Debbie users have pad off 3x more debt than the average debtor, as well as save around $100/month on average. Do you want to be part of this elite crowd?

DISCLOSURES

*Not a guarantee of approval. Debbie does not extend credit directly. Our credit check won’t impact your credit score. Terms and conditions apply.

Show More