Basic edition of easyFigures. It is designed for all people who want or need to calculate key figures based on balance sheets or/and income statements.

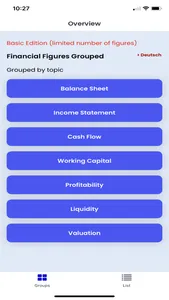

Grouped by topic from balance sheet to working capital or as a complete keyword list. A brief explanation and the calculation for each figure is included. Each input value is clearly labeled and therefore self-explanatory even for non-professionals in finance.

Disclaimer: Due to the nature of the offer, individual errors in the calculations cannot be completely ruled out. We always try to eliminate them, but cannot give a 100% guarantee for the correctness.

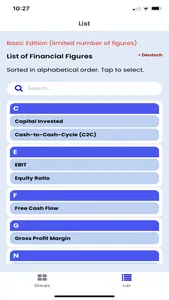

This edition covers following figures:

- Capital Invested

- Cash-to-cash-Cycle (C2C)

- EBIT

- Equity Ratio

- Free Cash Flow

- Gross Profit Margin

- Net Asset Value

- Net Present Value (NPV)

- Operating Cash Flow

- Quick Ratio

- Return on Investment (ROI)

- Turnover per Employee

- Weighted Average Costs of Capital (WACC)

- Working Capital

Complete list of covered key figures in the standard version (easyFigures):

- Average Inventory

- Beta

- Book Value per Share

- CAPEX

- CAPEX to Depreciation

- CAPEX to Turnover

- Capital Expenditure Coverage

- Capital Invested

- Cash Flow

- Cash Flow from Financial Activities

- Cash Flow from Investing Activities

- Cash Flow Indirect

- Cash Flow Margin

- Cash Flow per Share

- Cash Ratio

- Cash-to-Cash-Cycle (C2C)

- Compound Annual Growth Rate (CAGR)

- Cost of Debt (w/ Rating)

- Cost of Debt (w/o Rating)

- Cost of Equity

- Cost of Sales to Inventories

- Current Liabilities to Sales Ratio

- Current Ratio

- Days Inventory Held (DIH)

- Days Payable Outstanding (DPO)

- Days Sales Outstanding (DSO)

- Debt Ratio

- Debt Structure

- Debt-Service Coverage Ratio (DSCR)

- Debt-to-Equity Ratio

- Depreciation Intensity

- Depreciation Rate (II)

- Depreciation Ratio (I)

- Depreciation Structure

- Diluted Earnings per Share (diluted EPS)

- Discounted Cash Flow (DCF)

- Dividend Per Share

- Dividend Yield

- Dynamic Leverage

- Earnings per Share (EPS)

- EBIT

- EBIT Margin

- EBIT to Short-Term Liabilities

- EBIT(DA) per Share

- EBITDA

- EBITDA Margin

- EBT

- Economic Value Added (EVA)

- Enterprise Value (EV)

- Enterprise Value / EBIT

- Enterprise Value / EBITDA

- Equity Ratio

- Equity Structure

- Equity-to-Asset Ratio I

- Equity-to-Asset Ratio II

- Financial Result

- Financial Strength

- Free Cash Flow

- Golden Rule (of Financing)

- Golden Rule of Balance Sheet

- Goodwill

- Gross Profit Margin

- Hidden Reserves

- Intensity of Current Assets

- Intensity of Fixed Assets

- Internal Rate of Return (IRR)

- Inventory Intensity

- Inventory Turnover Ratio

- Market Capitalization

- Net Asset Value

- Net Debt

- Net Present Value (NPV)

- NOPAT

- Operating Cash Flow

- Payout Ratio

- Price-Earnings Ratio (P/E Ratio)

- Price-Earnings-to-Growth Ratio (PEG Ratio)

- Price-to-Book-Value Ratio (P/BV)

- Price-to-Cash Flow Ratio

- Price-to-Sales Ratio (PSR)

- Profit

- Provisions Ratio

- Quick Ratio

- R&D Intensity

- Ratio turnover-costs to total-costs

- Reinvestment Rate

- Reserve Fund Intensity

- Return on Average Assets (ROAA)

- Return on Capital Employed (ROCE)

- Return on Equity (ROE)

- Return on Invested Capital (ROIC)

- Return on Investment (ROI)

- Return on Sales (ROS)

- Return on Total Capital

- Sales to Tangible Assets Ratio

- Staffing Intensity

- System Wear and Tear

- Tax Ratio

- Terminal Value (TV)

- Times Interest Earned Ratio

- Turnover per Employee

- Turnover Rate Accounts Payable

- Turnover Rate Accounts Receivable

- Turnover Rate of Current Assets

- Turnover Rate of Fixed Assets

- Turnover Rate of Total Assets

- Turnover Total Capital

- Weighted Average Costs of Capital (WACC)

- Work Intensity

- Working Capital

- Working Capital to Turnover/Sales

Grouped by topic from balance sheet to working capital or as a complete keyword list. A brief explanation and the calculation for each figure is included. Each input value is clearly labeled and therefore self-explanatory even for non-professionals in finance.

Disclaimer: Due to the nature of the offer, individual errors in the calculations cannot be completely ruled out. We always try to eliminate them, but cannot give a 100% guarantee for the correctness.

This edition covers following figures:

- Capital Invested

- Cash-to-cash-Cycle (C2C)

- EBIT

- Equity Ratio

- Free Cash Flow

- Gross Profit Margin

- Net Asset Value

- Net Present Value (NPV)

- Operating Cash Flow

- Quick Ratio

- Return on Investment (ROI)

- Turnover per Employee

- Weighted Average Costs of Capital (WACC)

- Working Capital

Complete list of covered key figures in the standard version (easyFigures):

- Average Inventory

- Beta

- Book Value per Share

- CAPEX

- CAPEX to Depreciation

- CAPEX to Turnover

- Capital Expenditure Coverage

- Capital Invested

- Cash Flow

- Cash Flow from Financial Activities

- Cash Flow from Investing Activities

- Cash Flow Indirect

- Cash Flow Margin

- Cash Flow per Share

- Cash Ratio

- Cash-to-Cash-Cycle (C2C)

- Compound Annual Growth Rate (CAGR)

- Cost of Debt (w/ Rating)

- Cost of Debt (w/o Rating)

- Cost of Equity

- Cost of Sales to Inventories

- Current Liabilities to Sales Ratio

- Current Ratio

- Days Inventory Held (DIH)

- Days Payable Outstanding (DPO)

- Days Sales Outstanding (DSO)

- Debt Ratio

- Debt Structure

- Debt-Service Coverage Ratio (DSCR)

- Debt-to-Equity Ratio

- Depreciation Intensity

- Depreciation Rate (II)

- Depreciation Ratio (I)

- Depreciation Structure

- Diluted Earnings per Share (diluted EPS)

- Discounted Cash Flow (DCF)

- Dividend Per Share

- Dividend Yield

- Dynamic Leverage

- Earnings per Share (EPS)

- EBIT

- EBIT Margin

- EBIT to Short-Term Liabilities

- EBIT(DA) per Share

- EBITDA

- EBITDA Margin

- EBT

- Economic Value Added (EVA)

- Enterprise Value (EV)

- Enterprise Value / EBIT

- Enterprise Value / EBITDA

- Equity Ratio

- Equity Structure

- Equity-to-Asset Ratio I

- Equity-to-Asset Ratio II

- Financial Result

- Financial Strength

- Free Cash Flow

- Golden Rule (of Financing)

- Golden Rule of Balance Sheet

- Goodwill

- Gross Profit Margin

- Hidden Reserves

- Intensity of Current Assets

- Intensity of Fixed Assets

- Internal Rate of Return (IRR)

- Inventory Intensity

- Inventory Turnover Ratio

- Market Capitalization

- Net Asset Value

- Net Debt

- Net Present Value (NPV)

- NOPAT

- Operating Cash Flow

- Payout Ratio

- Price-Earnings Ratio (P/E Ratio)

- Price-Earnings-to-Growth Ratio (PEG Ratio)

- Price-to-Book-Value Ratio (P/BV)

- Price-to-Cash Flow Ratio

- Price-to-Sales Ratio (PSR)

- Profit

- Provisions Ratio

- Quick Ratio

- R&D Intensity

- Ratio turnover-costs to total-costs

- Reinvestment Rate

- Reserve Fund Intensity

- Return on Average Assets (ROAA)

- Return on Capital Employed (ROCE)

- Return on Equity (ROE)

- Return on Invested Capital (ROIC)

- Return on Investment (ROI)

- Return on Sales (ROS)

- Return on Total Capital

- Sales to Tangible Assets Ratio

- Staffing Intensity

- System Wear and Tear

- Tax Ratio

- Terminal Value (TV)

- Times Interest Earned Ratio

- Turnover per Employee

- Turnover Rate Accounts Payable

- Turnover Rate Accounts Receivable

- Turnover Rate of Current Assets

- Turnover Rate of Fixed Assets

- Turnover Rate of Total Assets

- Turnover Total Capital

- Weighted Average Costs of Capital (WACC)

- Work Intensity

- Working Capital

- Working Capital to Turnover/Sales

Show More