About Compounder

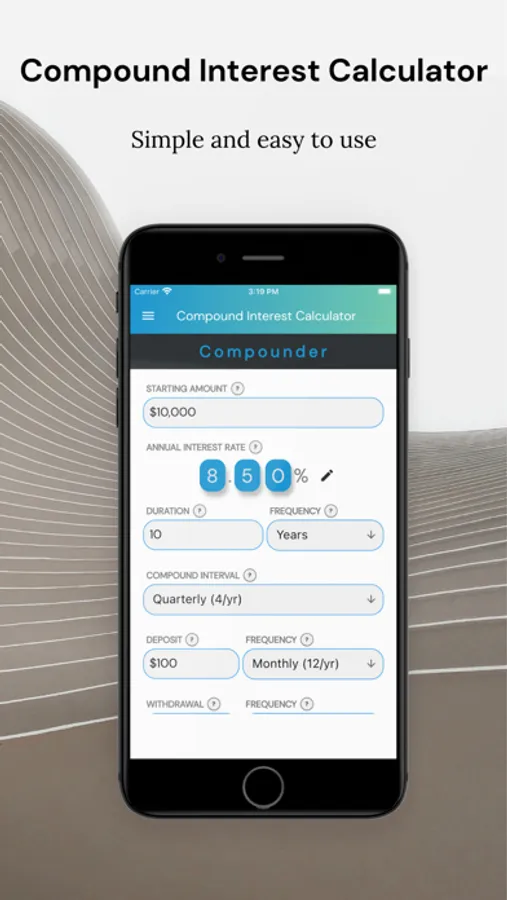

Calculate compound interest with ease using the Compounder Tool. This is a smooth and intuitive compound interest calculator (aka FIRE Calculator) that helps you calculate and plan out your future earnings so you can achieve Financial Independence and Retire Early. Start planning to stop working today.

Without a doubt, compounding interest is the most important concept to know to help you achieve financial independence earlier. At its most basic, compounding interest is a money multiplier. It is the money you earn for free from your money and is a key cornerstone in being financially independent.

Everyone can take advantage of compounding interest, and you can start immediately. For example, let’s say you invest $100 each month with a 10% overall return each year (compounding quarterly). After 30 years, you’ll have saved $36,000. How much money do you think you would have earned from compounding interest? $60,000? $80,000? You earned over $180,000; making your total savings of $36,000 worth over $220,000 at the end of the 30 years (more than 6 times the amount you had saved).

The Compounder calculator allows you to not only plan and calculate long and short-term savings potential, but also theory craft the impact of a flat taxation rate and inflation on your retirement goals.

Features included:

- Calculate the amount of money you could accumulate with your compound interest based investment

- Yearly interest rate up to 100%

- Multiple options for compounding frequency (daily, two-weekly, monthly, quarterly, 6-monthly, yearly)

- Multiple options for duration of your investment (daily, weekly, monthly, yearly) to account for a broader range of investment avenues, including crypto

- Unlike most other compound interest calculators, the Compounder includes both deposit and withdrawals in the one calculation to give a more complete picture of your finances

- Display graph and detailed table view

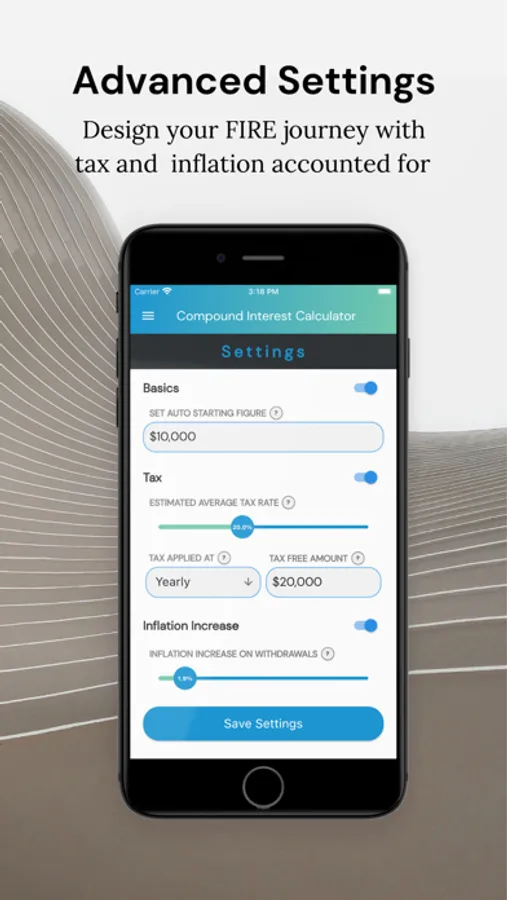

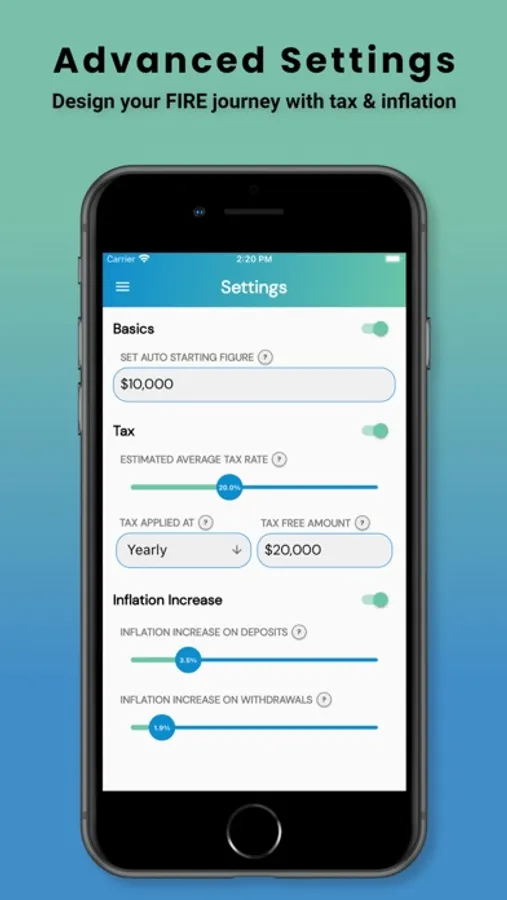

- Advanced settings include:

• the ability to pre-set a starting figure.

• enter a basic (flat) tax rate, with an option for a tax-free threshold.

• set inflation to apply to your withdrawals.

- Basic formula explanations included

Without a doubt, compounding interest is the most important concept to know to help you achieve financial independence earlier. At its most basic, compounding interest is a money multiplier. It is the money you earn for free from your money and is a key cornerstone in being financially independent.

Everyone can take advantage of compounding interest, and you can start immediately. For example, let’s say you invest $100 each month with a 10% overall return each year (compounding quarterly). After 30 years, you’ll have saved $36,000. How much money do you think you would have earned from compounding interest? $60,000? $80,000? You earned over $180,000; making your total savings of $36,000 worth over $220,000 at the end of the 30 years (more than 6 times the amount you had saved).

The Compounder calculator allows you to not only plan and calculate long and short-term savings potential, but also theory craft the impact of a flat taxation rate and inflation on your retirement goals.

Features included:

- Calculate the amount of money you could accumulate with your compound interest based investment

- Yearly interest rate up to 100%

- Multiple options for compounding frequency (daily, two-weekly, monthly, quarterly, 6-monthly, yearly)

- Multiple options for duration of your investment (daily, weekly, monthly, yearly) to account for a broader range of investment avenues, including crypto

- Unlike most other compound interest calculators, the Compounder includes both deposit and withdrawals in the one calculation to give a more complete picture of your finances

- Display graph and detailed table view

- Advanced settings include:

• the ability to pre-set a starting figure.

• enter a basic (flat) tax rate, with an option for a tax-free threshold.

• set inflation to apply to your withdrawals.

- Basic formula explanations included