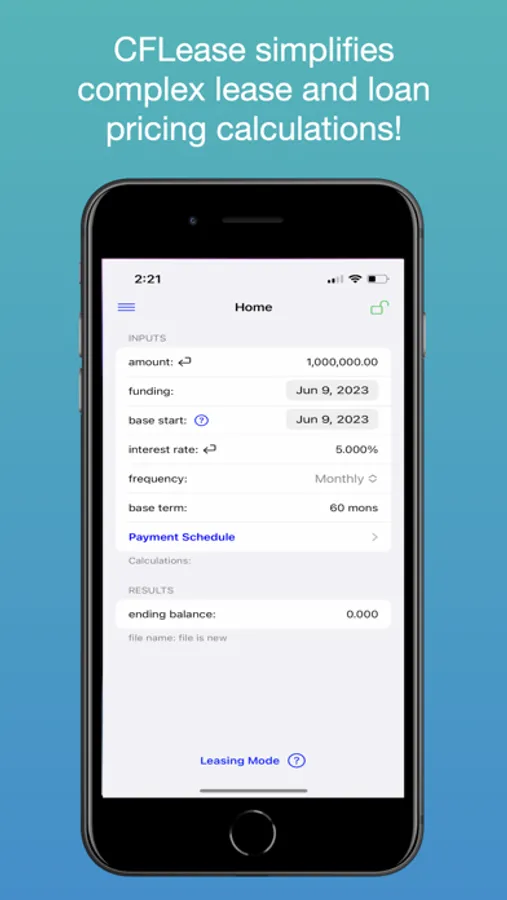

About CFLease

Lease / Loan Pricing Software for Finance Professionals

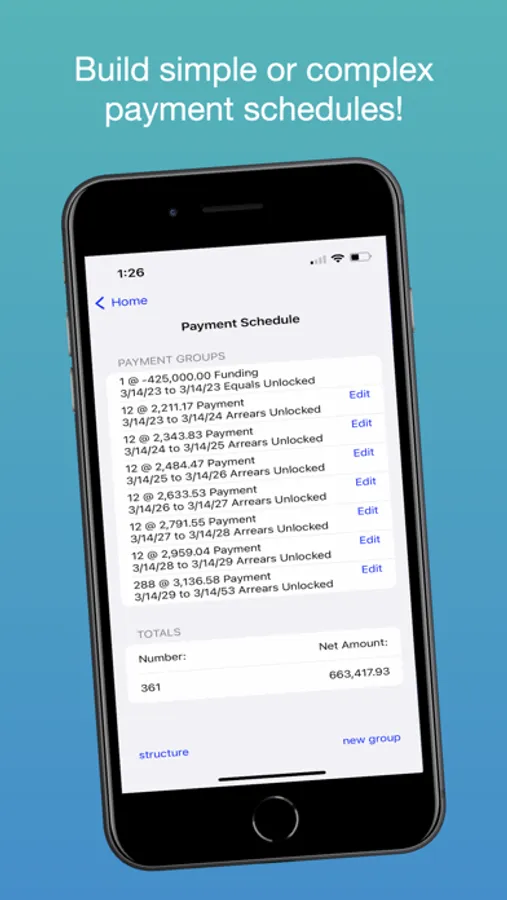

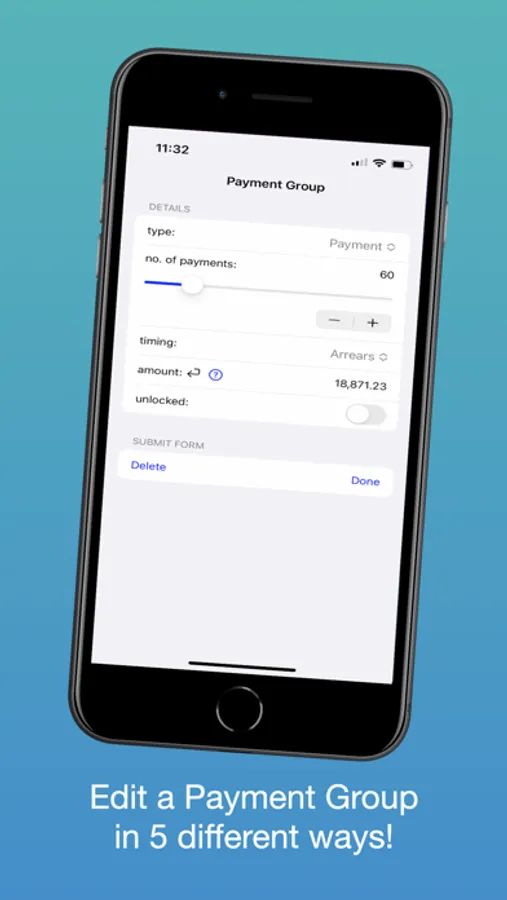

Repayment Plans: Structure simple to highly complex repayment plans using six (6) different payment types - including payment, principal, residual, balloon, interest only, daily equivalent next and daily equivalent all. Payment frequencies include monthly, quarterly, semiannual and annual. Timing of payments can be set to advance or arrears. Seven (7) different preset repayment structures are available including (1) first and last in advance, (2) first and last two in advance, (3) high-low, (4) low-high, (5) term amortization, (6) annual escalator, and (7) graduated payments.

Targeting: Solve for any one of four (4) variables - principal, unlocked payments, interest rate, or term.

Yields: Calculate the lease/loan interest rate, yield after purchase fee, the EBO rate, the EBO rate after purchase fee and the implicit rate.

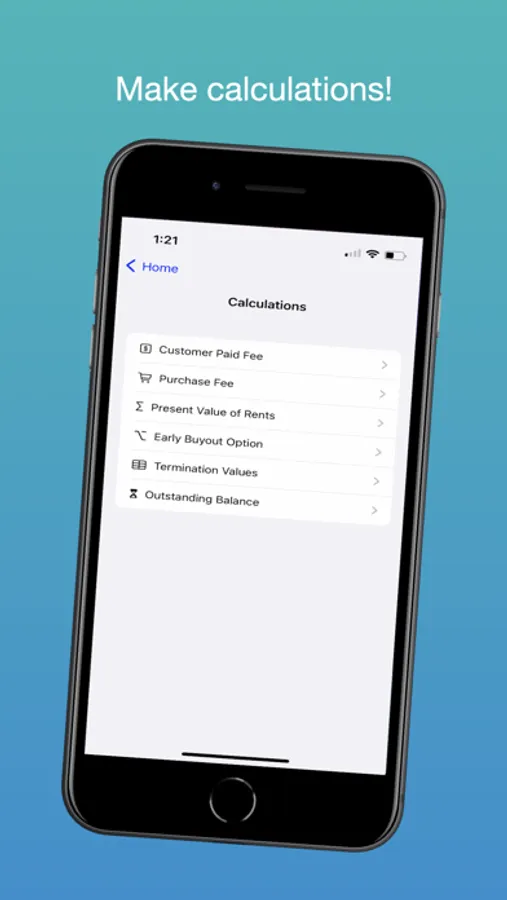

Calculations: Perform numerous calculations including (1) lessee paid fee given specified implicit rate or the implicit rate given a specified lessee paid fee, (2) buy rate given a specified purchase fee or the purchase fee given a specified buy rate, (3) early buyout option (EBO) payment including or excluding any rent payment due, (4) termination values at par or at specified premiums to par values, and (5) the outstanding lease/loan balance as of any date including the applicable per diem interest.

Interest Calculation: Includes four (4) different day count methods for calculation of interest, including 30/360, actual/365, actual/actual, and actual/360. End of month rule allows payment due dates to occur on last day of the month for all applicable months.

Accounting: Calculate the implicit rate, the present value of minimum rents, including any lessee paid fees and lessee residual guaranty amounts. Calculate maximum residual guaranty to pass 90% present value test.

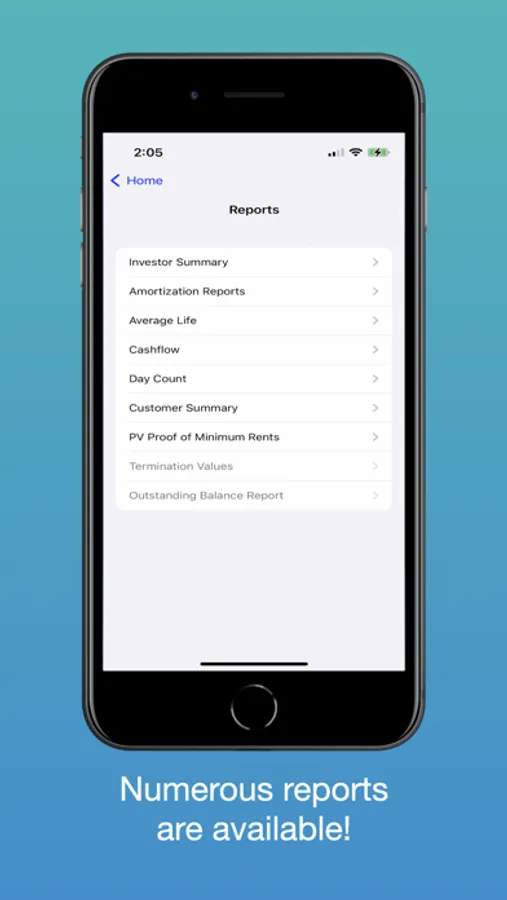

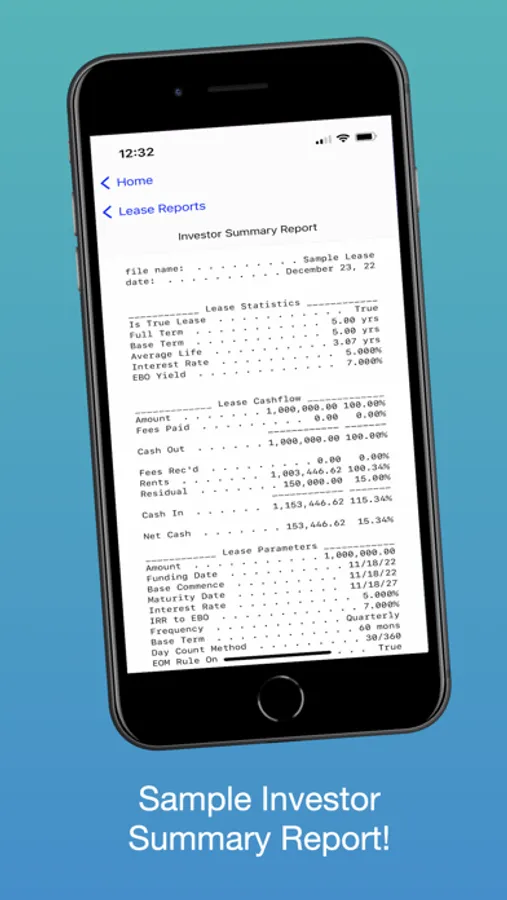

Reporting: Twelve (12) different reports are provided, including (1) Investment Summary, (2) Day Count, (3) Cashflow, (4) Customer Summary, (5) Average Life Proof, (6) PV Proof of Minimum Rents, (7) Lease Balance, (8) Termination Values and four (4) different amortization reports. All reports can be easily shared via text or emailed with a long press.

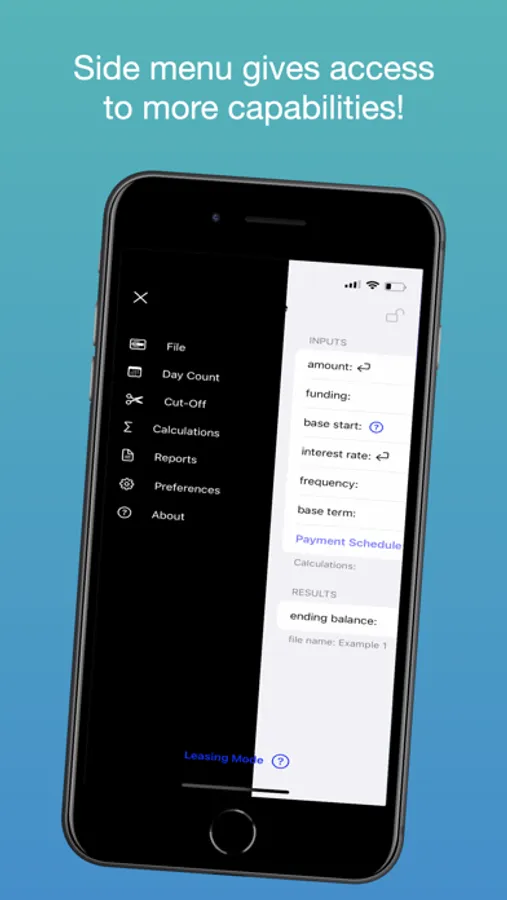

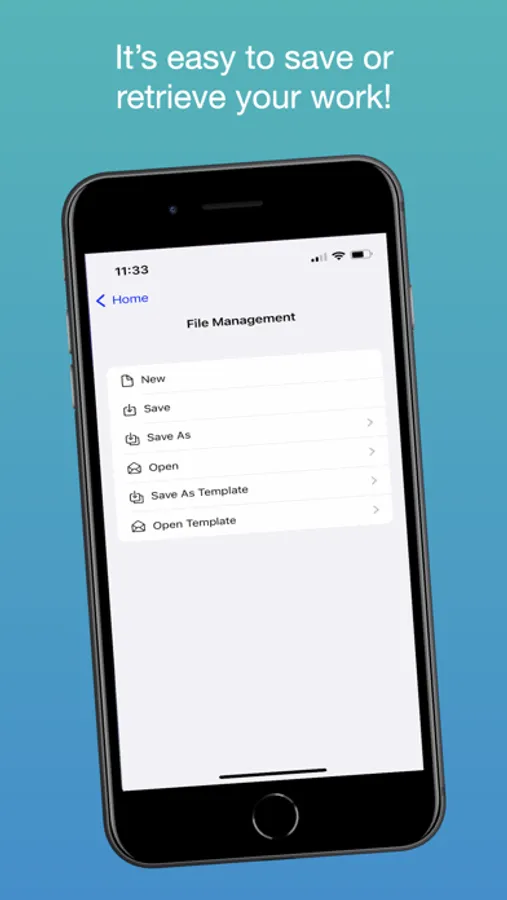

File Management: Extensive capabilities including the ability to save, save as, rename, delete, export or import CFLease data files. Easily share CFLease data files with other CF Lease users via iCloud. Also included is the ability to create templates which simplify the pricing of similar structured deals.

Preferences - Light and dark modes. Ability to set custom default lease parameters at startup.

Repayment Plans: Structure simple to highly complex repayment plans using six (6) different payment types - including payment, principal, residual, balloon, interest only, daily equivalent next and daily equivalent all. Payment frequencies include monthly, quarterly, semiannual and annual. Timing of payments can be set to advance or arrears. Seven (7) different preset repayment structures are available including (1) first and last in advance, (2) first and last two in advance, (3) high-low, (4) low-high, (5) term amortization, (6) annual escalator, and (7) graduated payments.

Targeting: Solve for any one of four (4) variables - principal, unlocked payments, interest rate, or term.

Yields: Calculate the lease/loan interest rate, yield after purchase fee, the EBO rate, the EBO rate after purchase fee and the implicit rate.

Calculations: Perform numerous calculations including (1) lessee paid fee given specified implicit rate or the implicit rate given a specified lessee paid fee, (2) buy rate given a specified purchase fee or the purchase fee given a specified buy rate, (3) early buyout option (EBO) payment including or excluding any rent payment due, (4) termination values at par or at specified premiums to par values, and (5) the outstanding lease/loan balance as of any date including the applicable per diem interest.

Interest Calculation: Includes four (4) different day count methods for calculation of interest, including 30/360, actual/365, actual/actual, and actual/360. End of month rule allows payment due dates to occur on last day of the month for all applicable months.

Accounting: Calculate the implicit rate, the present value of minimum rents, including any lessee paid fees and lessee residual guaranty amounts. Calculate maximum residual guaranty to pass 90% present value test.

Reporting: Twelve (12) different reports are provided, including (1) Investment Summary, (2) Day Count, (3) Cashflow, (4) Customer Summary, (5) Average Life Proof, (6) PV Proof of Minimum Rents, (7) Lease Balance, (8) Termination Values and four (4) different amortization reports. All reports can be easily shared via text or emailed with a long press.

File Management: Extensive capabilities including the ability to save, save as, rename, delete, export or import CFLease data files. Easily share CFLease data files with other CF Lease users via iCloud. Also included is the ability to create templates which simplify the pricing of similar structured deals.

Preferences - Light and dark modes. Ability to set custom default lease parameters at startup.