AppRecs review analysis

AppRecs rating 2.3. Trustworthiness 65 out of 100. Review manipulation risk 29 out of 100. Based on a review sample analyzed.

★★☆☆☆

2.3

AppRecs Rating

Ratings breakdown

5 star

0%

4 star

0%

3 star

0%

2 star

0%

1 star

100%

What to know

✓

Low review manipulation risk

29% review manipulation risk

⚠

Mixed user feedback

Average 2.3★ rating suggests room for improvement

About Refyne

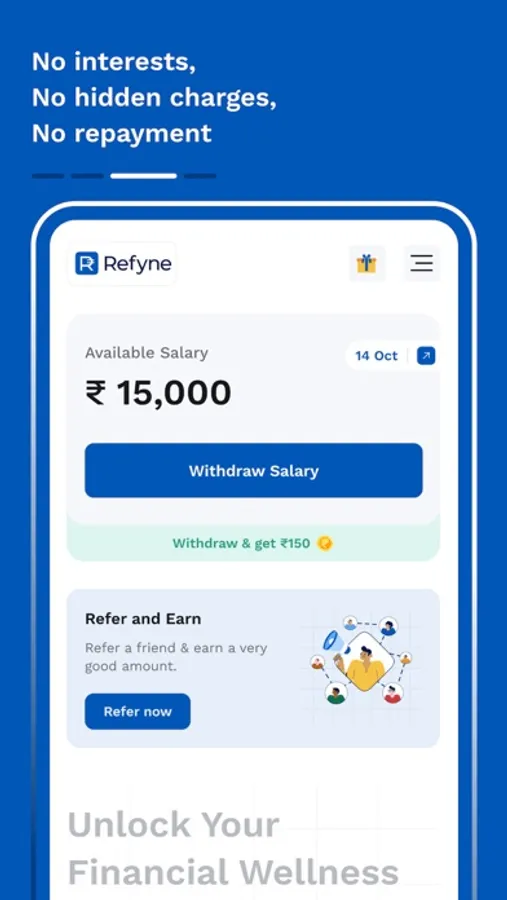

Refyne is one of India’s most trusted Financial Wellness platforms. Refyne has a wide range of products including UPI Scan and Pay, Salary On-Demand, Digital Gold and Insurance and is a One-Stop Shop for all your financial needs.

Refyne Offers:

* Refyne Pay - Scan Merchant QR Code and make UPI payments directly from your Salary On-Demand or Bank Account

* Salary On-Demand - Access funds up to 1.5x of salary

* Refyne PRO - Subscription model which allows unlimited free transactions

* Money Guru - Access expert financial tips and tools like Tax & Home Loan Calculator, PF tracker, Credit score check and more

* Gold Savings - Save in 24K Digital Gold starting from ₹10, 99.5% Pure Gold with doorstep delivery of physical gold

Refyne takes the SMS Read, Write and Receive Permission from the user to complete the SIM Binding (Device Binding) as a security measure for creating UPI Accounts for Scan and Pay. These permissions are mandatory as per the guidelines laid down by the National Payments Corporation of India (NPCI) related to UPI Account creation and payments.

Refyne has partnered with RBI-authorised NBFCs -

* Sunita Finlease Ltd. (https://www.sunitafinance.com/loan-service-provider-digital-lending-apps)

* Refyne Finance Private Limited (https://www.refynefinance.com/our-digital-partners)

Important Things to Note About Refyne Salary On-Demand -

* Loan Amount: Rs 1,000 to Rs 10,00,000

* Minimum Annual Percentage Rate (APR): 8%,

* Maximum Annual Percentage Rate: 36% (reducing balance)

* Minimum repayment period: 90 days, Maximum repayment period: 24 months

* Processing Fees: Max (₹350 + GST, Up to 1%-7% of loan amount plus GST)

* Prepayment Fees: Zero

* Late fee: Zero

Below is an example of the fee breakup for a Salary On-Demand transaction:

* Loan Amount: ₹10,000

* Minimum repayment period: 3 months

* Maximum repayment period: 12 months

* Interest rate: 0% (for the first 3 months), 4th month onward, 16% p.a. reducing

* Processing fee: ₹99

* GST on processing fee: ₹18

* Total interest: ₹678 (calculated from 4th to 12th month, in total 9 months)

* APR: 16%

* Disbursed amount: ₹9,883

* Total loan repayment amount: ₹10,678

Our policies & services are fully regulated & 100% compliant with NPCI and RBI guidelines.

Eligibility Criteria:

* Indian nationality

* Applicant's age should be 21 & above

* Only for employees of partnered companies. This is a closed marketplace and is not intended for public use.

* The user must be an active employee of the partner company for at least three months and have signed employment agreement forms with their employer.

Documents Required:

* PAN

* Aadhaar

* Employment details

How to use Refyne App:

* Sign up with your number or work email

* Complete the KYC process

* Create UPI Account to enable UPI Scan and Pay to make translations using Salary On-Demand or from Bank Account

* Enter the Amount to be withdrawn

* Automatic deduction takes place as per the agreed repayment schedule

Privacy Policy: https://www.refyne.co.in/privacy

Terms & Conditions: https://www.refyne.co.in/terms

In case of any query, reach us at :

support@refyne.co.in OR 080-64899999

Address: Prestige Pegasus, Sarjapur - Marathahalli Rd, Ambalipura, Haralur, Bengaluru, Karnataka 560103

Disclaimer: The application is SSL-certified, and all transactions are 100% safe and secure.

Refyne Offers:

* Refyne Pay - Scan Merchant QR Code and make UPI payments directly from your Salary On-Demand or Bank Account

* Salary On-Demand - Access funds up to 1.5x of salary

* Refyne PRO - Subscription model which allows unlimited free transactions

* Money Guru - Access expert financial tips and tools like Tax & Home Loan Calculator, PF tracker, Credit score check and more

* Gold Savings - Save in 24K Digital Gold starting from ₹10, 99.5% Pure Gold with doorstep delivery of physical gold

Refyne takes the SMS Read, Write and Receive Permission from the user to complete the SIM Binding (Device Binding) as a security measure for creating UPI Accounts for Scan and Pay. These permissions are mandatory as per the guidelines laid down by the National Payments Corporation of India (NPCI) related to UPI Account creation and payments.

Refyne has partnered with RBI-authorised NBFCs -

* Sunita Finlease Ltd. (https://www.sunitafinance.com/loan-service-provider-digital-lending-apps)

* Refyne Finance Private Limited (https://www.refynefinance.com/our-digital-partners)

Important Things to Note About Refyne Salary On-Demand -

* Loan Amount: Rs 1,000 to Rs 10,00,000

* Minimum Annual Percentage Rate (APR): 8%,

* Maximum Annual Percentage Rate: 36% (reducing balance)

* Minimum repayment period: 90 days, Maximum repayment period: 24 months

* Processing Fees: Max (₹350 + GST, Up to 1%-7% of loan amount plus GST)

* Prepayment Fees: Zero

* Late fee: Zero

Below is an example of the fee breakup for a Salary On-Demand transaction:

* Loan Amount: ₹10,000

* Minimum repayment period: 3 months

* Maximum repayment period: 12 months

* Interest rate: 0% (for the first 3 months), 4th month onward, 16% p.a. reducing

* Processing fee: ₹99

* GST on processing fee: ₹18

* Total interest: ₹678 (calculated from 4th to 12th month, in total 9 months)

* APR: 16%

* Disbursed amount: ₹9,883

* Total loan repayment amount: ₹10,678

Our policies & services are fully regulated & 100% compliant with NPCI and RBI guidelines.

Eligibility Criteria:

* Indian nationality

* Applicant's age should be 21 & above

* Only for employees of partnered companies. This is a closed marketplace and is not intended for public use.

* The user must be an active employee of the partner company for at least three months and have signed employment agreement forms with their employer.

Documents Required:

* PAN

* Aadhaar

* Employment details

How to use Refyne App:

* Sign up with your number or work email

* Complete the KYC process

* Create UPI Account to enable UPI Scan and Pay to make translations using Salary On-Demand or from Bank Account

* Enter the Amount to be withdrawn

* Automatic deduction takes place as per the agreed repayment schedule

Privacy Policy: https://www.refyne.co.in/privacy

Terms & Conditions: https://www.refyne.co.in/terms

In case of any query, reach us at :

support@refyne.co.in OR 080-64899999

Address: Prestige Pegasus, Sarjapur - Marathahalli Rd, Ambalipura, Haralur, Bengaluru, Karnataka 560103

Disclaimer: The application is SSL-certified, and all transactions are 100% safe and secure.