Step One Finance is a specialist consumer and secured lending business established in 2010. Our company seeks to design and deliver creative consumer loan products based on our core values of responsibility, transparency, fairness and simplicity.

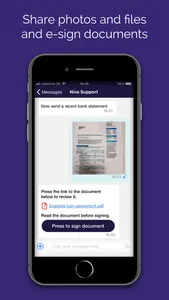

The Step One Finance app allows you to complete a secured loan or mortgage application in a simple and secure way directly from your mobile phone. With the ability to upload files and e-sign documents, together with speedy access to our team of underwriters for questions, updates and guidance along the way, your application journey will be fast and efficient from start to finish.

With industry leading encryption and id verification you can be assured that all communication you have with us through the app is secure and safe from cyber threats.

We are also integrated with all major banks within the UK allowing you to securely send transaction reports from your mobile banking app to speed up your income and expenditure assessment.

Step One Finance has been leading the way since 2010 with innovative products and services that meet the individual requirements of our customers and we are always seeking new and progressive ways to enable our customers to get the right product in a timely manner.

With the use of this app it is our aim to honour our core principals of fairness, transparency and responsibility in our lending, whilst utilising cutting edge technology to meet the demands of our customers and simplify the process.

To learn more about our products please visit www.steponefinance.co.uk.

This app is only intended for use if you are interested in applying for a secured mortgage loan with Step One Finance Ltd.

Step One Finance is authorised and regulated by the Financial Conduct Authority with financial services register number 706087 for our second charge mortgage loans secured on residential property and unsecured personal loans.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

IF YOU ARE THINKING OF CONSOLIDATING EXISTING BORROWING YOU SHOULD BE AWARE THAT IF YOU ARE EXTENDING THE TERM OF THE DEBT YOU MAY BE INCREASING THE TOTAL AMOUNT YOU NEED TO REPAY.

The Step One Finance app allows you to complete a secured loan or mortgage application in a simple and secure way directly from your mobile phone. With the ability to upload files and e-sign documents, together with speedy access to our team of underwriters for questions, updates and guidance along the way, your application journey will be fast and efficient from start to finish.

With industry leading encryption and id verification you can be assured that all communication you have with us through the app is secure and safe from cyber threats.

We are also integrated with all major banks within the UK allowing you to securely send transaction reports from your mobile banking app to speed up your income and expenditure assessment.

Step One Finance has been leading the way since 2010 with innovative products and services that meet the individual requirements of our customers and we are always seeking new and progressive ways to enable our customers to get the right product in a timely manner.

With the use of this app it is our aim to honour our core principals of fairness, transparency and responsibility in our lending, whilst utilising cutting edge technology to meet the demands of our customers and simplify the process.

To learn more about our products please visit www.steponefinance.co.uk.

This app is only intended for use if you are interested in applying for a secured mortgage loan with Step One Finance Ltd.

Step One Finance is authorised and regulated by the Financial Conduct Authority with financial services register number 706087 for our second charge mortgage loans secured on residential property and unsecured personal loans.

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

IF YOU ARE THINKING OF CONSOLIDATING EXISTING BORROWING YOU SHOULD BE AWARE THAT IF YOU ARE EXTENDING THE TERM OF THE DEBT YOU MAY BE INCREASING THE TOTAL AMOUNT YOU NEED TO REPAY.

Show More