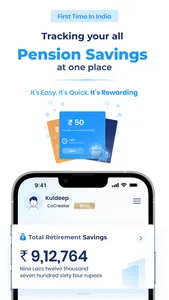

Easily plan your retirement for free, Save more tax, track your EPF (Employee Provident Fund), PPF and National Pension Scheme Savings for FREE & Get better insights. Create your dream retirement plan within minutes & start saving for free.

Track savings & plan better | Win rewards & more

Our rewards are not coins but real pension savings. Every time you reach a milestone, refer a friend & family or just save better than everyone else, we add real pension savings to help you save better for retirement.

PensionBox App Features:

Free EPF Balance Check & Insights

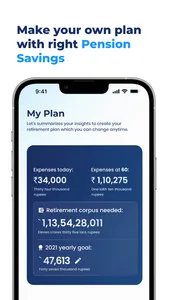

Real-Time Retirement Planning with AI model

Saving Manager: Stay tuned with your savings

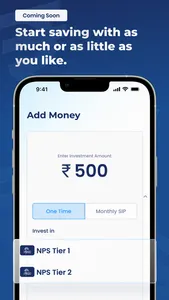

Start saving with as much or as little as you like.

Save Tax on every savings in PensionBox

Insights & How much to save, where to save & when to save

Savings Analysis with better insights

Every action you take is rewards with more pension savings

Why PensionBox App?

Plan & save right for your dream retirement

Track pension savings like never before

Interactive charts allow easy visualisation of how your money grows

Safe & secure pension app

Exciting rewards & Tax savings every year

How to open a PensionBox account?

PensionBox is built for a billion Indian's dream retirement. To open a pensionbox account, you need to be a good saver.

The process is simple

Download PensionBox or simply get started

Fill name, mobile number & email ID

Create your dream retirement in minutes

Track your EPF or provident fund savings with UAN & OTP in seconds

Learn the gap & save more in National Pension Scheme (NPS)

Why do you need PensionBox?

To ensure your retirement savings are enough.

To save more tax, simple!

To stay independent financially now & in the

A higher credit score is an indicator of good financial behaviour

How to Plan and Track Pension Savings using PensionBox?

Signup PensionBox with your full name & mobile number, email to get your first free pension savings

Learn how much to save, where to save & your retirement goal

Track every month PF & more retirement savings with in seconds

Invest monthly to boost your retirement goal

Where do my savings get invested with PensionBox?

National Pension Scheme is where users invest with PensionBox to save more tax & build bigger savings.

Is my savings safe with PensionBox?

PensionBox never touches your savings, your savings always stay with NPS Trust or EPFO or respective AMCs with bank level security.

Can I withdraw my pension savings anytime with PensionBox?

We recommend not withdrawing your savings before the right time. It also depends on individual investment product limits such as NPS, EPF etc. We will surely help you with the right processes and optimise withdrawals at PensionBox.

Can PensionBox help me save more tax?

Absolutely, Every pension savings will help you save more tax. You get additional tax savings on INR 50,000 invested with NPS via PensionBox.

Is PensionBox approved by PFRDA (Regulator)?

Yes, We are registered & authorised with PFRDA & ICICI Pension Fund POP as POP-SE POPSE53062022. We follow all regulations & make sure to do the right thing.

Track savings & plan better | Win rewards & more

Our rewards are not coins but real pension savings. Every time you reach a milestone, refer a friend & family or just save better than everyone else, we add real pension savings to help you save better for retirement.

PensionBox App Features:

Free EPF Balance Check & Insights

Real-Time Retirement Planning with AI model

Saving Manager: Stay tuned with your savings

Start saving with as much or as little as you like.

Save Tax on every savings in PensionBox

Insights & How much to save, where to save & when to save

Savings Analysis with better insights

Every action you take is rewards with more pension savings

Why PensionBox App?

Plan & save right for your dream retirement

Track pension savings like never before

Interactive charts allow easy visualisation of how your money grows

Safe & secure pension app

Exciting rewards & Tax savings every year

How to open a PensionBox account?

PensionBox is built for a billion Indian's dream retirement. To open a pensionbox account, you need to be a good saver.

The process is simple

Download PensionBox or simply get started

Fill name, mobile number & email ID

Create your dream retirement in minutes

Track your EPF or provident fund savings with UAN & OTP in seconds

Learn the gap & save more in National Pension Scheme (NPS)

Why do you need PensionBox?

To ensure your retirement savings are enough.

To save more tax, simple!

To stay independent financially now & in the

A higher credit score is an indicator of good financial behaviour

How to Plan and Track Pension Savings using PensionBox?

Signup PensionBox with your full name & mobile number, email to get your first free pension savings

Learn how much to save, where to save & your retirement goal

Track every month PF & more retirement savings with in seconds

Invest monthly to boost your retirement goal

Where do my savings get invested with PensionBox?

National Pension Scheme is where users invest with PensionBox to save more tax & build bigger savings.

Is my savings safe with PensionBox?

PensionBox never touches your savings, your savings always stay with NPS Trust or EPFO or respective AMCs with bank level security.

Can I withdraw my pension savings anytime with PensionBox?

We recommend not withdrawing your savings before the right time. It also depends on individual investment product limits such as NPS, EPF etc. We will surely help you with the right processes and optimise withdrawals at PensionBox.

Can PensionBox help me save more tax?

Absolutely, Every pension savings will help you save more tax. You get additional tax savings on INR 50,000 invested with NPS via PensionBox.

Is PensionBox approved by PFRDA (Regulator)?

Yes, We are registered & authorised with PFRDA & ICICI Pension Fund POP as POP-SE POPSE53062022. We follow all regulations & make sure to do the right thing.

Show More