Welcome to Jordan Ahli Bank's mobile banking app, where you can fully manage your accounts. A wide range of banking services will be available to you, all of which can be completed conveniently, comfortably, and safely from any location.

You can now conduct all your banking operations via the Ahli Mobile app, and the following are some of the features:

• Account-related features:

- Ability to open an account digitally from anywhere and at any time.

- Access detailed information about your accounts, including the current balance, available balance, and transaction history.

- Get your IBAN and Customer ID

- Detailed account statements for various time periods

• Card-related features:

- Activation and deactivation of your various cards

- Pay dues on credit cards

- Know your credit card limit, used and available balances, card transactions and payment date, in addition to the accumulated Reward Points balance.

- Update credit card usage limits such as online shopping limit, ATM withdrawals limit and point of sale limit

- Reload your E-com card without visiting the branch

- Report lost or stolen cards

- Apply for debit and credit cards

- Show your credit card PIN

• Loan-related features:

- View loan details including principal amount, outstanding balance, total number of installments and remaining balance, interest rate and due date.

- Deferment of loan installments directly from the App

- Get your loan repayment schedule

- Apply for different types of loans through app

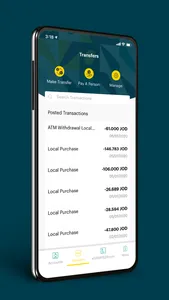

• Transfers-related features:

- Daily transfers of up to JOD 10,000 between your various accounts (you can adjust the daily limit through our contact center 065007777)

- Ability to transfer money between ahli customers via their account numbers

- Local and international transfers of up to JOD 10,000 per day

- CliQ service which allows local money transfers

- Money voucher service

• Checks-related features:

- Request a checkbook for your current account in four major currencies and choose the branch

- Check the status of your checkbook request

- Stop or revoke stopped checks without visiting the branch

- View check service

• Deposits-related features:

- View the accrued amount of interest

- Open a deposit account directly from the app without visiting the branch

- Detailed deposit account transaction statement for various time periods

• Distinctive features:

- Activate Card-less ATM access

- self-registration with or without using your debit card

- Bulk bill payments service

You can now conduct all your banking operations via the Ahli Mobile app, and the following are some of the features:

• Account-related features:

- Ability to open an account digitally from anywhere and at any time.

- Access detailed information about your accounts, including the current balance, available balance, and transaction history.

- Get your IBAN and Customer ID

- Detailed account statements for various time periods

• Card-related features:

- Activation and deactivation of your various cards

- Pay dues on credit cards

- Know your credit card limit, used and available balances, card transactions and payment date, in addition to the accumulated Reward Points balance.

- Update credit card usage limits such as online shopping limit, ATM withdrawals limit and point of sale limit

- Reload your E-com card without visiting the branch

- Report lost or stolen cards

- Apply for debit and credit cards

- Show your credit card PIN

• Loan-related features:

- View loan details including principal amount, outstanding balance, total number of installments and remaining balance, interest rate and due date.

- Deferment of loan installments directly from the App

- Get your loan repayment schedule

- Apply for different types of loans through app

• Transfers-related features:

- Daily transfers of up to JOD 10,000 between your various accounts (you can adjust the daily limit through our contact center 065007777)

- Ability to transfer money between ahli customers via their account numbers

- Local and international transfers of up to JOD 10,000 per day

- CliQ service which allows local money transfers

- Money voucher service

• Checks-related features:

- Request a checkbook for your current account in four major currencies and choose the branch

- Check the status of your checkbook request

- Stop or revoke stopped checks without visiting the branch

- View check service

• Deposits-related features:

- View the accrued amount of interest

- Open a deposit account directly from the app without visiting the branch

- Detailed deposit account transaction statement for various time periods

• Distinctive features:

- Activate Card-less ATM access

- self-registration with or without using your debit card

- Bulk bill payments service

Show More