EZTax.in Books App give businesses free* accounting, billing, and GST returns.

Easy Invoicing > Easy Accounting > Customizable Printing > Faster GST Returns > Business Analytics > Artificial Intelligence > Great Support

GST Ready Cloud Accounting Solution to make GST-compliant billing, keep books, make GST returns, manage your costs, Profit & Loss, Balance Sheet, and Analytics that allow you know how well your business is performing in real time.

With the EZTax.in GST Accounting App, you can accomplish whatever you could do on a PC browser, but it's easier. With one membership, you can use both on your computer's browser and on your phone.

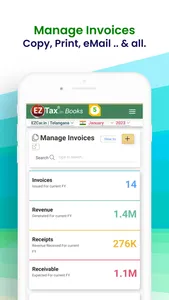

Dashboard Business Insights 1st Page after Login to display you complete business with visual charts of Orders throughout the months and weeks, Real Time P&L for the current month, recent invoices, expenses, and purchases, along with actions and reminders.

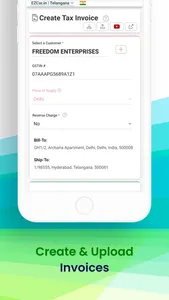

Invoicing is now faster and easier

Estimates, billing, invoicing, delivery challans, credit and debit notes, drafts, templates, and their conversions amongst each other are all taken care of. You can quickly make stunning GST Tax Compliant Invoices with your business logo, references like transport choice, PO references, terms and conditions, bank account details, discount, cess, expanded product descriptions, due dates, reverse charge and location of supply provisions as per Indian GST Act.

more about Billing and Invoicing

More attention was paid to making sure that a single invoice could handle both products and services that were sold separately and those that were sold together. One invoice can have thousands of line items, and having the invoice delivered automatically saves time and money compared to printing and mailing it.

Printing – many choices

There are different formats so that you can print your invoices on the right kind of paper. The POS format is A4, 3.125 inches, and there are both portrait and landscape options.

Expenses, Purchases, Vouchers

It's easy to create and manage expenses, purchases, and vouchers. The system will take care of how a voucher entry should be handled to apply to P&L and the balance sheet automatically. The chart of accounts doesn't need to be explained. (COA). Ledger groupings can be formed at the product or service level that will automatically apply to the P&L, and balance sheet.

GST Returns GSTR-3B, GSTR-1, and GSTR-2 can be looked at on the screen or downloaded as a JSON file to be uploaded at gst.gov.in, which is the government of India's GSTN portal. Upload invoices that were made on paper into the system before you file them using Excel. Using heuristics to find the real difference between purchases and bills from suppliers makes it easy to reconcile GSTR-2A.

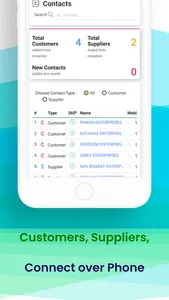

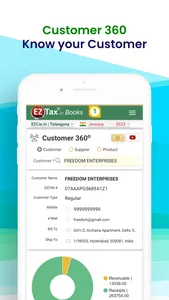

360-degree views of customers, products, and suppliers

Make proper decisions to be paid faster with a single-touch 360-degree view of your customer, supplier, and product to know comprehensive facts, including transactions, receivables, and payables, through graphic charts.

Ageing Reports

Accounting is made easier with the help of artificial intelligence (AI). The solution tells you when and how to respond to your customer or supplier based on how old your receivables and payables are.

A lot of other things

Multiple users can log in and work under a single license, Sales Analytics, Customized Views for Regular, Composition, Month Close Process, Multi-Channel GST Returns, Excellent User Experience, Easy-to-understand Language, AI, and above all, depend on our excellent customer service.

Start now

If you have already registered online at https://eztax.in/gst, just DOWNLOAD & start using the app today. It's free and doesn't take long.

About MYD Labs Private Limited: MYD Labs Private Limited is the company that produced EZTax.in. They offer a complete self-service tax filing solution in India that includes income tax, TDS, virtual accounting services, and registrations.

Easy Invoicing > Easy Accounting > Customizable Printing > Faster GST Returns > Business Analytics > Artificial Intelligence > Great Support

GST Ready Cloud Accounting Solution to make GST-compliant billing, keep books, make GST returns, manage your costs, Profit & Loss, Balance Sheet, and Analytics that allow you know how well your business is performing in real time.

With the EZTax.in GST Accounting App, you can accomplish whatever you could do on a PC browser, but it's easier. With one membership, you can use both on your computer's browser and on your phone.

Dashboard Business Insights 1st Page after Login to display you complete business with visual charts of Orders throughout the months and weeks, Real Time P&L for the current month, recent invoices, expenses, and purchases, along with actions and reminders.

Invoicing is now faster and easier

Estimates, billing, invoicing, delivery challans, credit and debit notes, drafts, templates, and their conversions amongst each other are all taken care of. You can quickly make stunning GST Tax Compliant Invoices with your business logo, references like transport choice, PO references, terms and conditions, bank account details, discount, cess, expanded product descriptions, due dates, reverse charge and location of supply provisions as per Indian GST Act.

more about Billing and Invoicing

More attention was paid to making sure that a single invoice could handle both products and services that were sold separately and those that were sold together. One invoice can have thousands of line items, and having the invoice delivered automatically saves time and money compared to printing and mailing it.

Printing – many choices

There are different formats so that you can print your invoices on the right kind of paper. The POS format is A4, 3.125 inches, and there are both portrait and landscape options.

Expenses, Purchases, Vouchers

It's easy to create and manage expenses, purchases, and vouchers. The system will take care of how a voucher entry should be handled to apply to P&L and the balance sheet automatically. The chart of accounts doesn't need to be explained. (COA). Ledger groupings can be formed at the product or service level that will automatically apply to the P&L, and balance sheet.

GST Returns GSTR-3B, GSTR-1, and GSTR-2 can be looked at on the screen or downloaded as a JSON file to be uploaded at gst.gov.in, which is the government of India's GSTN portal. Upload invoices that were made on paper into the system before you file them using Excel. Using heuristics to find the real difference between purchases and bills from suppliers makes it easy to reconcile GSTR-2A.

360-degree views of customers, products, and suppliers

Make proper decisions to be paid faster with a single-touch 360-degree view of your customer, supplier, and product to know comprehensive facts, including transactions, receivables, and payables, through graphic charts.

Ageing Reports

Accounting is made easier with the help of artificial intelligence (AI). The solution tells you when and how to respond to your customer or supplier based on how old your receivables and payables are.

A lot of other things

Multiple users can log in and work under a single license, Sales Analytics, Customized Views for Regular, Composition, Month Close Process, Multi-Channel GST Returns, Excellent User Experience, Easy-to-understand Language, AI, and above all, depend on our excellent customer service.

Start now

If you have already registered online at https://eztax.in/gst, just DOWNLOAD & start using the app today. It's free and doesn't take long.

About MYD Labs Private Limited: MYD Labs Private Limited is the company that produced EZTax.in. They offer a complete self-service tax filing solution in India that includes income tax, TDS, virtual accounting services, and registrations.

Show More