General Information about KDBUz Mobile application;

• Only KDB Bank’s Individual Clients could register into and use MultiPay application.

• KDB Mobile Banking application supports three languages; Uzbek, Russian and English.

Functions

Individual clients will be able to:

• register into mobile banking application through UzCard, Visa Card or Demand Deposit Account opened in KDB Bank;

• to review Bank branches on the map (addresses, contact phone numbers, branch opening hours);

• set up push notifications:

• choose language setting;

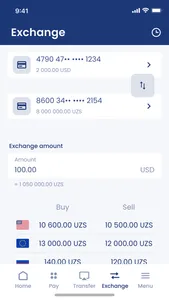

• view currency exchange rates;

• change user setting, such as changing passport, entry options, secret questions;

• view their balances on all card, demand deposit, and wallet accounts;

• view payment, exchange, conversion history;

• generate up to 3 month statement of card, wallet and demand deposit accounts;

• make external UZS transfers from UzCard KDB to UzCard of any other bank;

• make internal UZS transfers from UzCard to demand deposit, demand deposit to UzCard, demand deposit to demand deposit within KDB clients;

• blocking of UzCard and Visa Card;

• make payment to varies service providers (phone companies, internet providers, utility companies, etc.);

• replenish Visa Card, FCY demand deposit and FCY wallet account using online conversion function from a UZS accounts;

• make reverse conversion from FCY accounts; VISA, FCY demand deposit, and FCY wallet to UzCard, UZS demand deposit or wallet accounts;

• make transfers between own accounts from any UZS account to any UZS account and vice versa;

• make transfers between own account from any FCY account to any FCY account and vice versa;

• create favorite list of payments to be used for future payments;

• create and safe history of payments, history of transfers and statement of accounts;

• view mobile banking tariffs and terms and conditions.

• Only KDB Bank’s Individual Clients could register into and use MultiPay application.

• KDB Mobile Banking application supports three languages; Uzbek, Russian and English.

Functions

Individual clients will be able to:

• register into mobile banking application through UzCard, Visa Card or Demand Deposit Account opened in KDB Bank;

• to review Bank branches on the map (addresses, contact phone numbers, branch opening hours);

• set up push notifications:

• choose language setting;

• view currency exchange rates;

• change user setting, such as changing passport, entry options, secret questions;

• view their balances on all card, demand deposit, and wallet accounts;

• view payment, exchange, conversion history;

• generate up to 3 month statement of card, wallet and demand deposit accounts;

• make external UZS transfers from UzCard KDB to UzCard of any other bank;

• make internal UZS transfers from UzCard to demand deposit, demand deposit to UzCard, demand deposit to demand deposit within KDB clients;

• blocking of UzCard and Visa Card;

• make payment to varies service providers (phone companies, internet providers, utility companies, etc.);

• replenish Visa Card, FCY demand deposit and FCY wallet account using online conversion function from a UZS accounts;

• make reverse conversion from FCY accounts; VISA, FCY demand deposit, and FCY wallet to UzCard, UZS demand deposit or wallet accounts;

• make transfers between own accounts from any UZS account to any UZS account and vice versa;

• make transfers between own account from any FCY account to any FCY account and vice versa;

• create favorite list of payments to be used for future payments;

• create and safe history of payments, history of transfers and statement of accounts;

• view mobile banking tariffs and terms and conditions.

Show More