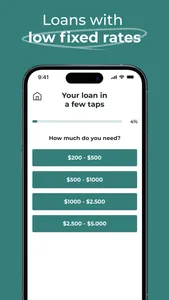

Everyone should have easy access to loan solutions. Hence, our instant cash advance app has been created with a single goal, to provide loans for people's financial purposes. We made the process easy, fast, and straightforward, taking a few single steps to fly a loan application and receive credit immediately. Our instant cash advance no credit check app is designed to provide a user-friendly interface tailored for you.

Our cash advance app benefits:

- Easy to Use Online Loans

You can use our cash advance no credit check app easily from your home. This way, you'll avoid the hassle with all other financial institution procedures. You need your mobile phone and internet and click on your mobile screen a few times. Using our no credit check cash advance app, you can easily explore all loan terms and make an informed decision. Furthermore, you can track your credit application progress in real time while receiving notifications immediately.

- Personalized features

Everyone has their financial situation or goals, and people's needs differ. With that in mind, we present many flexible terms for all loan options in our cash advance no credit check app. You can choose a suitable one from various loan repayment terms, amounts, or interest rates, allowing you to pick an ideal credit solution for your case.

- Speedy approval

Speed is everything regarding loans and financial goals; many people need cash for debt consolidation or emergency requests. That is why we've made our lending procedures as fast as possible. In our instant cash advance app, you can track everything and see whether you are approved. Moreover, once you are, you will receive the funds shortly after.

- Flexible Repayment Terms

Flexibility is something we provide to our users. The repayment terms are often limiting when it comes to credits. However, with our cash advance app, that is not the case. As you can see, repayment periods range from 65 days to two years. You can easily explore options and pick terms that suit your financial situation.

Competitive Interest Rates

Regarding APRs, our cash advance no credit check app has some of the most competitive ones, ranging from 5.99% — 35.99%. That allows all users to pick a loan based on their needs.

Material Disclosure

Our instant cash advance app is available to qualified borrowers and is subject to loan approval. We should note that the loan amount, repayment period, interest rates, and other conditions may vary based on your financial situation.

Any loans provided by our cash advance no credit check app may accompany the request for additional documentation. These will determine all terms on your credit application, like exact APRs and monthly installments. A loan interest rate can range from 5.99% — 35.99%; the repayment period is 65 days to two years.

There are no hidden or additional loan costs and fees besides the ones provided in the lending terms. Any charges and interest will be presented to you upfront so that you can make an informed financial decision.

Representative Loan Example

We will provide an excellent example of a loan and its lending conditions. They will be based on previous data simulating a loan request and terms of earlier clients.

Example: Let's say you decide to take a credit that amounts to $3000. Its average lending terms will be 9.99% for its APR. You'll repay this loan over seven months. You'll pay $3,100.72, or $442.96, each month, meaning an overall interest of $100.72 will be charged.

Our cash advance app benefits:

- Easy to Use Online Loans

You can use our cash advance no credit check app easily from your home. This way, you'll avoid the hassle with all other financial institution procedures. You need your mobile phone and internet and click on your mobile screen a few times. Using our no credit check cash advance app, you can easily explore all loan terms and make an informed decision. Furthermore, you can track your credit application progress in real time while receiving notifications immediately.

- Personalized features

Everyone has their financial situation or goals, and people's needs differ. With that in mind, we present many flexible terms for all loan options in our cash advance no credit check app. You can choose a suitable one from various loan repayment terms, amounts, or interest rates, allowing you to pick an ideal credit solution for your case.

- Speedy approval

Speed is everything regarding loans and financial goals; many people need cash for debt consolidation or emergency requests. That is why we've made our lending procedures as fast as possible. In our instant cash advance app, you can track everything and see whether you are approved. Moreover, once you are, you will receive the funds shortly after.

- Flexible Repayment Terms

Flexibility is something we provide to our users. The repayment terms are often limiting when it comes to credits. However, with our cash advance app, that is not the case. As you can see, repayment periods range from 65 days to two years. You can easily explore options and pick terms that suit your financial situation.

Competitive Interest Rates

Regarding APRs, our cash advance no credit check app has some of the most competitive ones, ranging from 5.99% — 35.99%. That allows all users to pick a loan based on their needs.

Material Disclosure

Our instant cash advance app is available to qualified borrowers and is subject to loan approval. We should note that the loan amount, repayment period, interest rates, and other conditions may vary based on your financial situation.

Any loans provided by our cash advance no credit check app may accompany the request for additional documentation. These will determine all terms on your credit application, like exact APRs and monthly installments. A loan interest rate can range from 5.99% — 35.99%; the repayment period is 65 days to two years.

There are no hidden or additional loan costs and fees besides the ones provided in the lending terms. Any charges and interest will be presented to you upfront so that you can make an informed financial decision.

Representative Loan Example

We will provide an excellent example of a loan and its lending conditions. They will be based on previous data simulating a loan request and terms of earlier clients.

Example: Let's say you decide to take a credit that amounts to $3000. Its average lending terms will be 9.99% for its APR. You'll repay this loan over seven months. You'll pay $3,100.72, or $442.96, each month, meaning an overall interest of $100.72 will be charged.

Show More