Bima Tathya

Insurance Development and Regulatory Authority (IDRA)

3.0 ★

store rating

Free

AppRecs review analysis

AppRecs rating 2.5. Trustworthiness 65 out of 100. Review manipulation risk 20 out of 100. Based on a review sample analyzed.

★★☆☆☆

2.5

AppRecs Rating

Ratings breakdown

5 star

0%

4 star

0%

3 star

100%

2 star

0%

1 star

0%

What to know

✓

Low review manipulation risk

20% review manipulation risk

About Bima Tathya

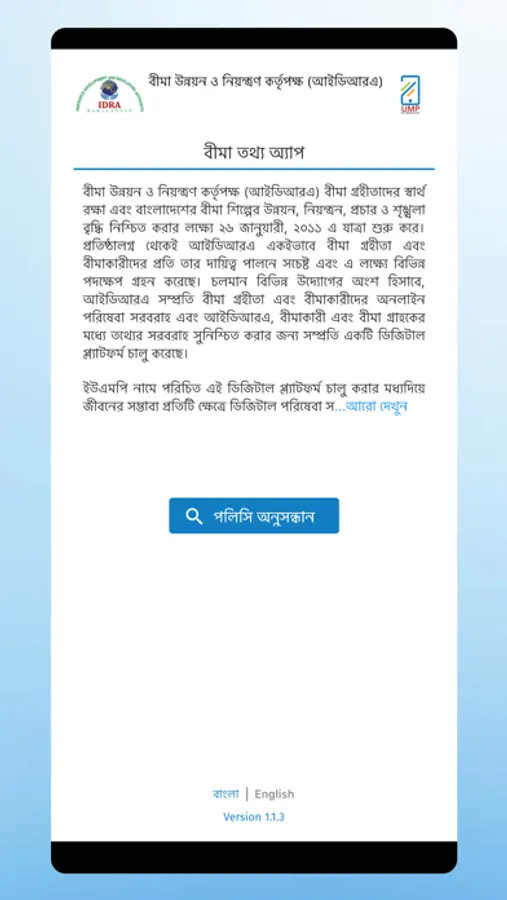

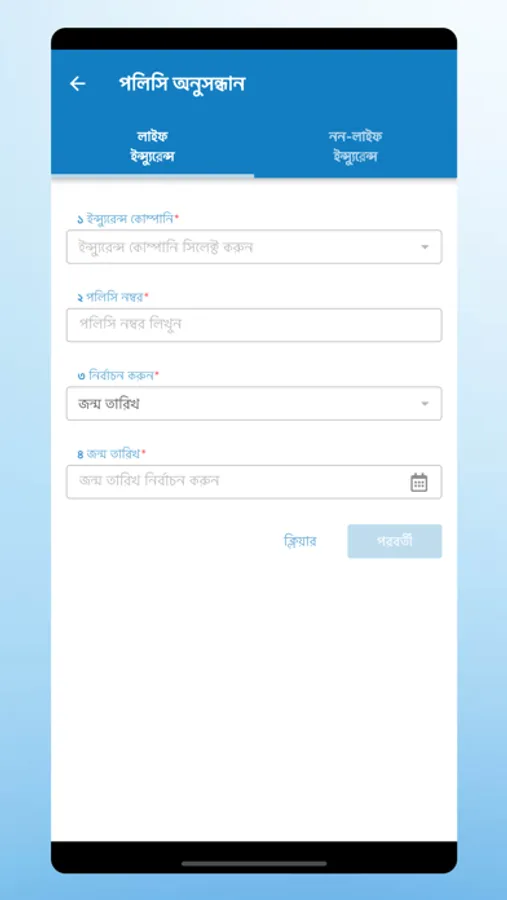

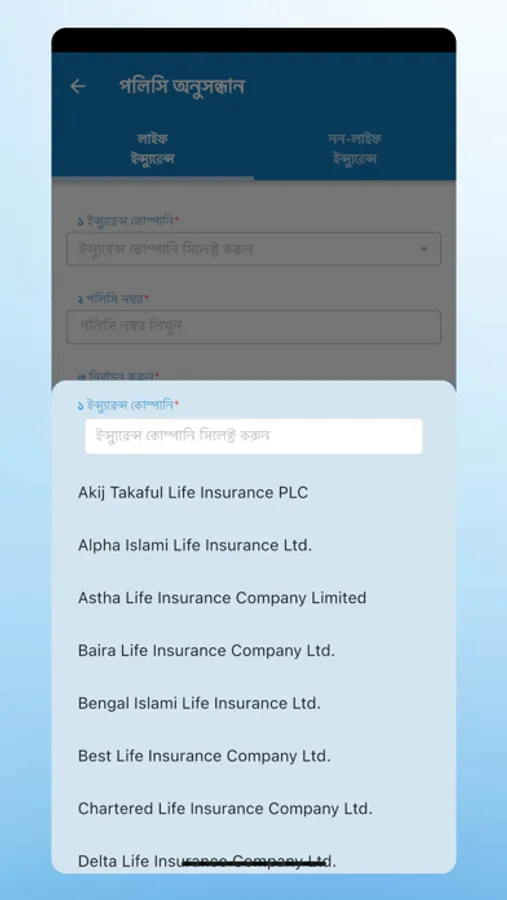

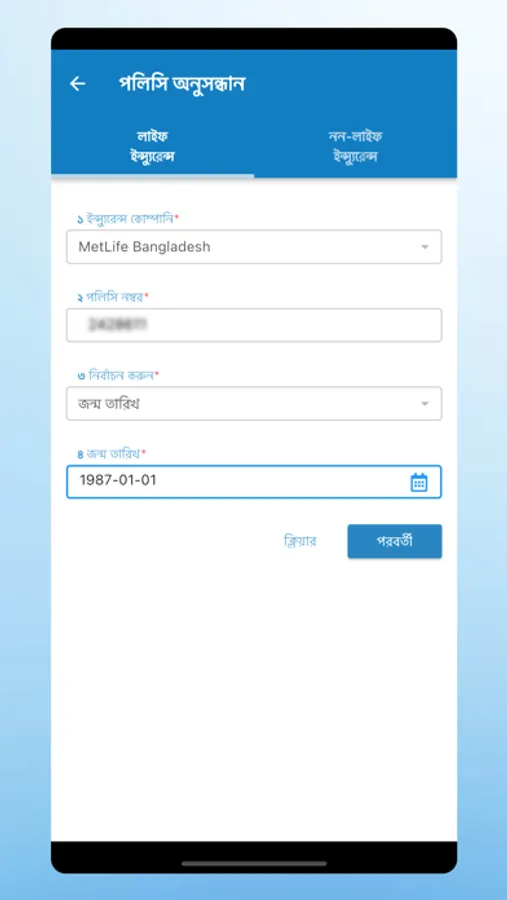

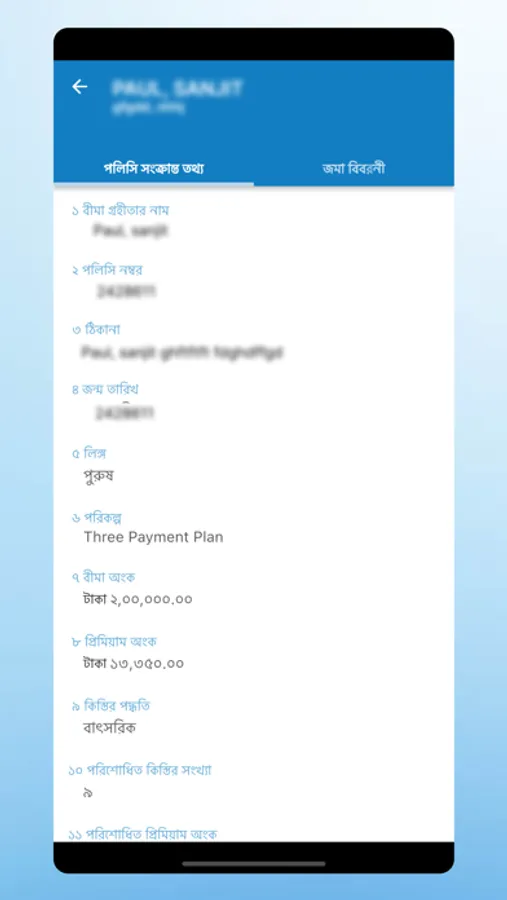

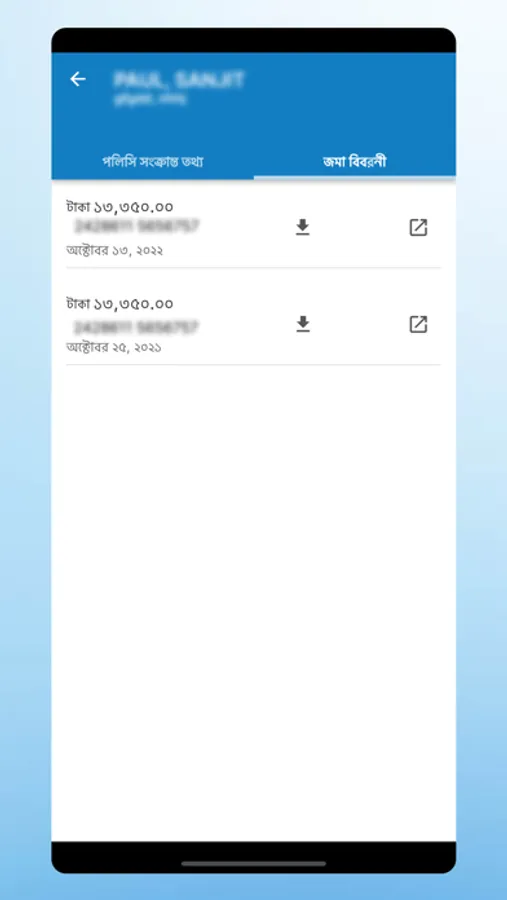

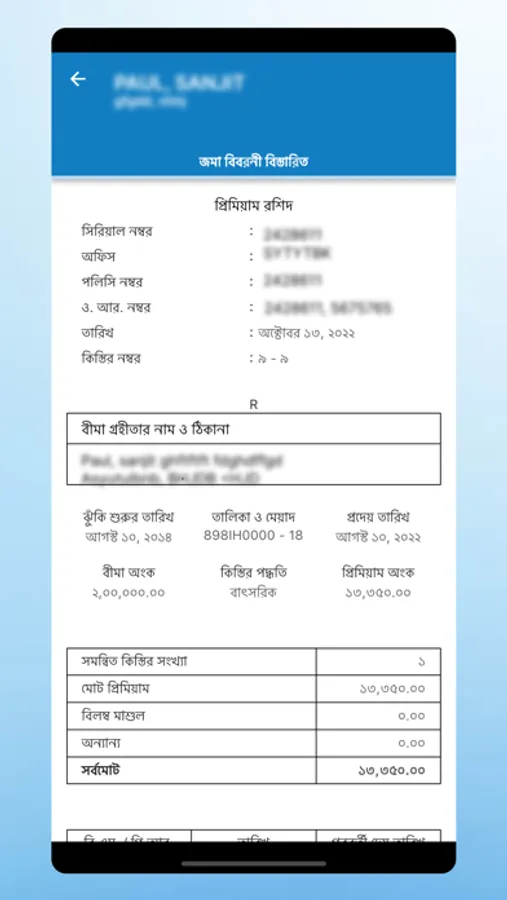

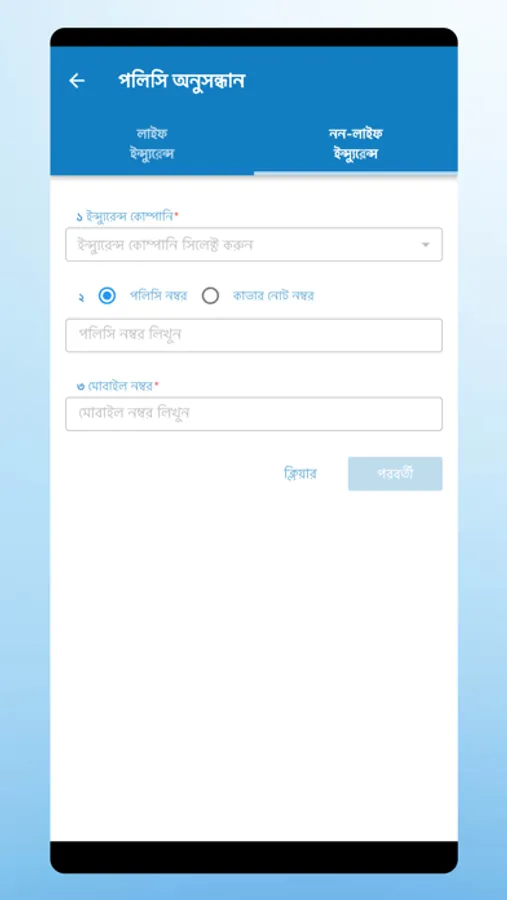

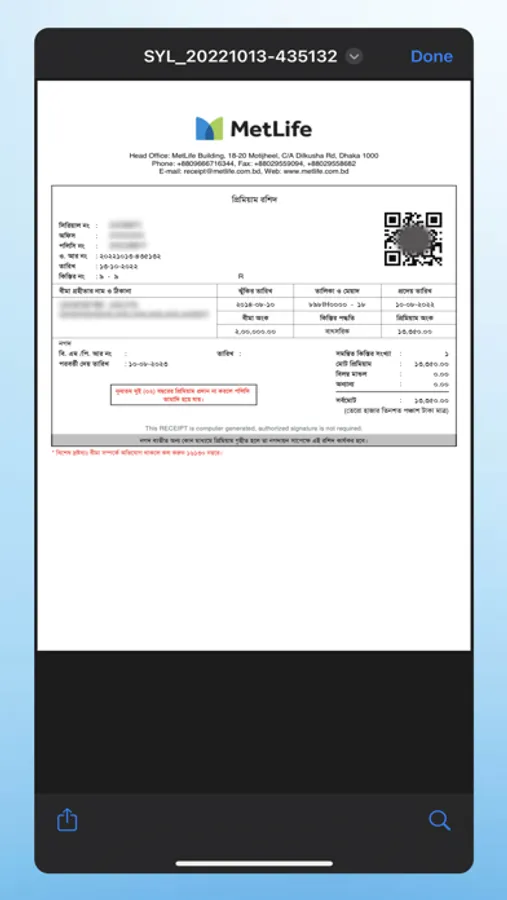

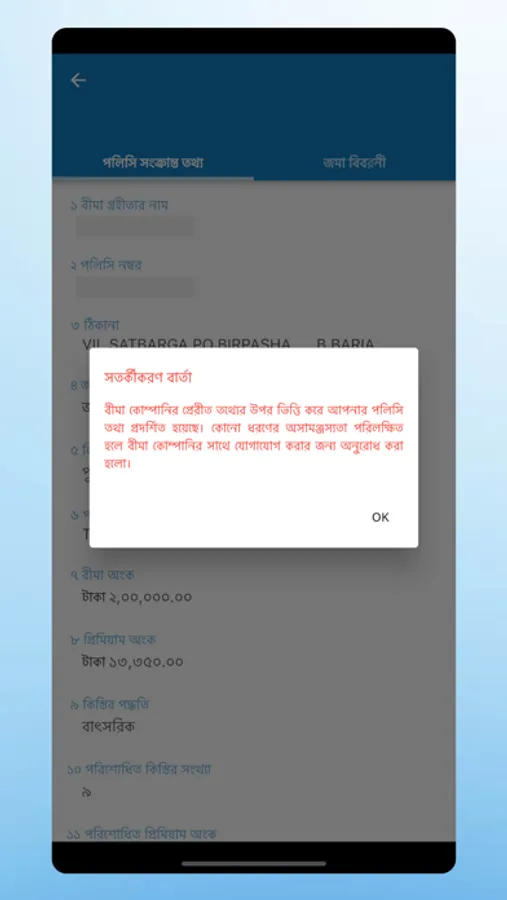

Insurance Development and Regulatory Authority (IDRA) started its journey on January 26, 2011 with a mandate to protect the interests of policyholders, and to regulate, promote and ensure orderly growth of the insurance industry of Bangladesh Over the years IDRA has taken various measures to uphold its responsibility towards policyholders and insurers alike. As part of its ongoing initiatives, IDRA has recently introduced a digital platform to provide policyholders and insurers a multitude of online services, and to bridge any information gap that might exist between IDRA, insurers and policyholders. This digital platform is known as Unified Messaging Platform(UMP).This is not only just a messaging platform but also a building block towards realizing our national goal of providing digital services (Policy-Repository, e-Receipt, e-KYC, e-Agent Approval, BI Tools, actuarial valuation, SMS, Email, Policyholder Web Portal, Policyholder Mobile App etc) for every possible aspect of life. “UMP Policyholder Mobile App” aims at providing vital information and services for policyholders. IDRA is gradually converting crucial information for each policy into a digital format known as e-policy which will be centrally stored by IDRA. An e-policy will contain information such as the policyholder profile, policy terms, premium payment history, policy status etc. A policyholder can view up-to-date information about his/her policy through the “UMP Policyholder Mobile App”.This Platform is expected to help alleviate any information gap that might arise between a policyholder and the policy provider, the insurance company. This direct communication between policyholders and IDRA is touted to increase trust and loyalty between an insurer and its customers.