Why do we recommend Tax@Home for your employee assessment or tax return 🌠?

💶💶💶 Get more tax back with the tips from the tax book.

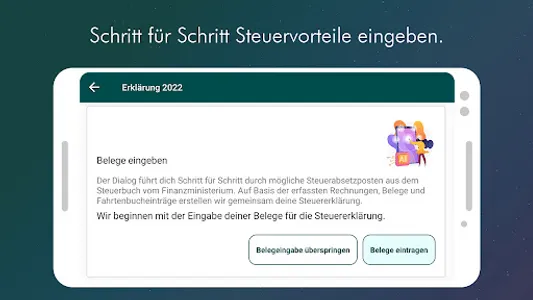

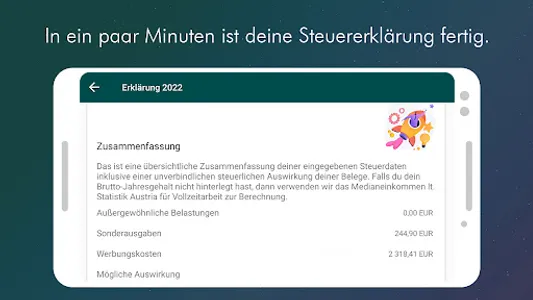

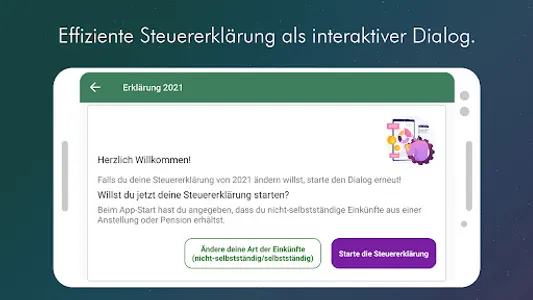

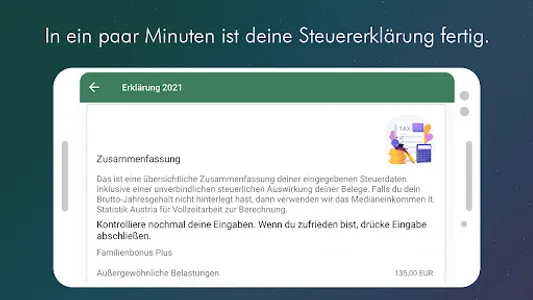

👋 With the Tax return dialog we query your expenses and automatically create your tax return documents. Brilliantly simple!

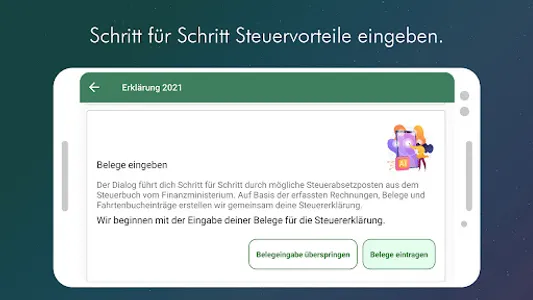

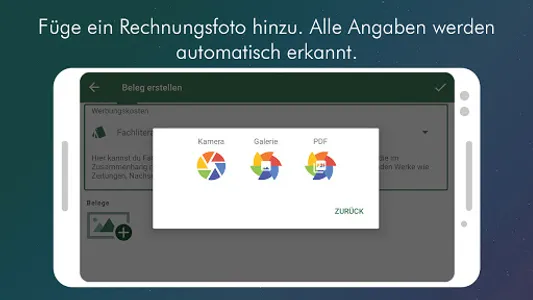

🎉 Store digitally instead of paper chaos, paperwork & forgetting. You conveniently collect the receipts with your smartphone. We assume that receipts are automatically assigned to tax categories & depreciation is taken into account. You have collected everything in the app.

⭐ Your personal data is processed locally on the smartphone.

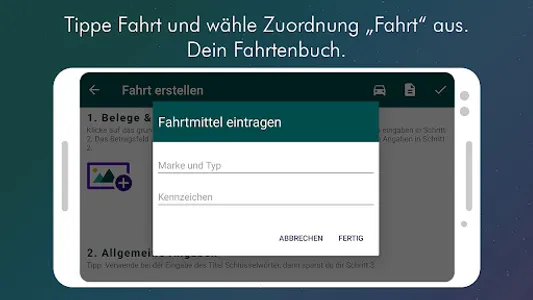

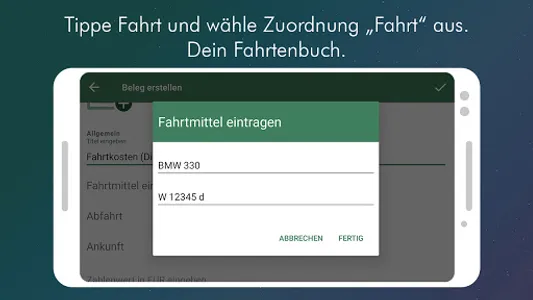

🚗 With the digital logbook you can deduct business trips, car or bike, from the tax. Everything in one app.

😃 Submit directly from your smartphone.

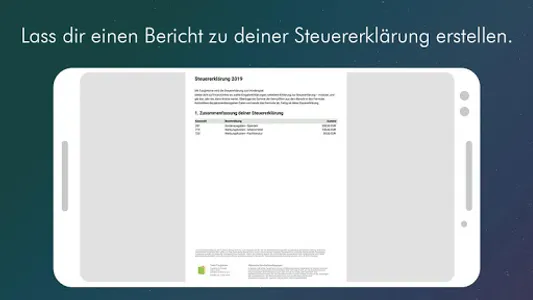

👋 You can answer questions from the tax office with your clear tax report. We're happy to help if you have any questions!

⭐ We offer you understandable info in the tax blog and with our chatbot IDA. IDA answers your tax questions in easy-to-understand language. If the question is too complicated for IDA, our support will help you.

👋 A highlight of tax savings are our weekly push messages. This is how you effectively save taxes.

💕 Enjoy all the benefits now.

If you're wondering if Tax@Home is the right tax app for you?

🧍 We help all professionals save on tax, whether you've been doing your tax return for years or for the first time. Our tips will help you get more money immediately when you start your career. We will help you with commuter allowances, negative tax and many tax situations. Ideal for apprentices, students, newcomers, summer jobs and part-time jobs.

🧍 We help experienced taxpayers, workers, employees, retirees, retirees save on taxes with more than 100 precise tax tips. For example, how can I deduct work equipment in the home office? Can I deduct my car journeys from taxes even though I'm a commuter? Which costs can I deduct from the tax? There are always questions and we will help you so that you do not give money to the state.

👪 We help families save on taxes. You can apply for the Family Bonus Plus, the single-earner tax credit, the single-parent tax credit and much more. There are great benefits whether you have a large or small income.

₿ We help with stocks & cryptocurrencies with great tax tips. You get excellent benefits when you open a Blockpit account through Tax@Home.

Wondering how much the service costs?

We have decided to offer transparent in-app products:

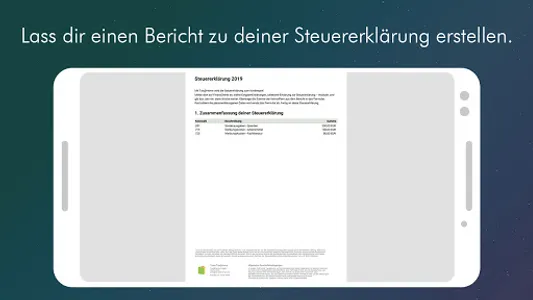

👋 The PDF report for 6.99 euros is an automatically generated report that prepares your information for the tax return. The report explains how to file your tax return. The report contains easy-to-understand instructions for the tax return, a summary of your receipts and what you have to do if the tax office asks.

👋 Submit directly online via the app costs 16.99 euros. We will guide you step by step through the submission process. After successful submission, you will receive the PDF report as documentation.

👋 The tax consultant export or complete export costs 25.99 euros and includes the PDF report, the prepared data as Excel and receipts as an image. You can take the document to a tax consultant if your tax return is too complicated for you. Find a tax advisor? You can search for tax consultants in the app info.

Tax@Home is happy to be your digital tax return.

Disclaimer: Operated by a private organization.

Source: Wage Tax Directive 2002

The app uses Business, Money, Creative, Pencil, Mobile, Abstract, Coffee vector created by vectorjuice available on freepik.

💶💶💶 Get more tax back with the tips from the tax book.

👋 With the Tax return dialog we query your expenses and automatically create your tax return documents. Brilliantly simple!

🎉 Store digitally instead of paper chaos, paperwork & forgetting. You conveniently collect the receipts with your smartphone. We assume that receipts are automatically assigned to tax categories & depreciation is taken into account. You have collected everything in the app.

⭐ Your personal data is processed locally on the smartphone.

🚗 With the digital logbook you can deduct business trips, car or bike, from the tax. Everything in one app.

😃 Submit directly from your smartphone.

👋 You can answer questions from the tax office with your clear tax report. We're happy to help if you have any questions!

⭐ We offer you understandable info in the tax blog and with our chatbot IDA. IDA answers your tax questions in easy-to-understand language. If the question is too complicated for IDA, our support will help you.

👋 A highlight of tax savings are our weekly push messages. This is how you effectively save taxes.

💕 Enjoy all the benefits now.

If you're wondering if Tax@Home is the right tax app for you?

🧍 We help all professionals save on tax, whether you've been doing your tax return for years or for the first time. Our tips will help you get more money immediately when you start your career. We will help you with commuter allowances, negative tax and many tax situations. Ideal for apprentices, students, newcomers, summer jobs and part-time jobs.

🧍 We help experienced taxpayers, workers, employees, retirees, retirees save on taxes with more than 100 precise tax tips. For example, how can I deduct work equipment in the home office? Can I deduct my car journeys from taxes even though I'm a commuter? Which costs can I deduct from the tax? There are always questions and we will help you so that you do not give money to the state.

👪 We help families save on taxes. You can apply for the Family Bonus Plus, the single-earner tax credit, the single-parent tax credit and much more. There are great benefits whether you have a large or small income.

₿ We help with stocks & cryptocurrencies with great tax tips. You get excellent benefits when you open a Blockpit account through Tax@Home.

Wondering how much the service costs?

We have decided to offer transparent in-app products:

👋 The PDF report for 6.99 euros is an automatically generated report that prepares your information for the tax return. The report explains how to file your tax return. The report contains easy-to-understand instructions for the tax return, a summary of your receipts and what you have to do if the tax office asks.

👋 Submit directly online via the app costs 16.99 euros. We will guide you step by step through the submission process. After successful submission, you will receive the PDF report as documentation.

👋 The tax consultant export or complete export costs 25.99 euros and includes the PDF report, the prepared data as Excel and receipts as an image. You can take the document to a tax consultant if your tax return is too complicated for you. Find a tax advisor? You can search for tax consultants in the app info.

Tax@Home is happy to be your digital tax return.

Disclaimer: Operated by a private organization.

Source: Wage Tax Directive 2002

The app uses Business, Money, Creative, Pencil, Mobile, Abstract, Coffee vector created by vectorjuice available on freepik.

Show More