Fincash

Fincash

Free

100+

downloads

About Fincash

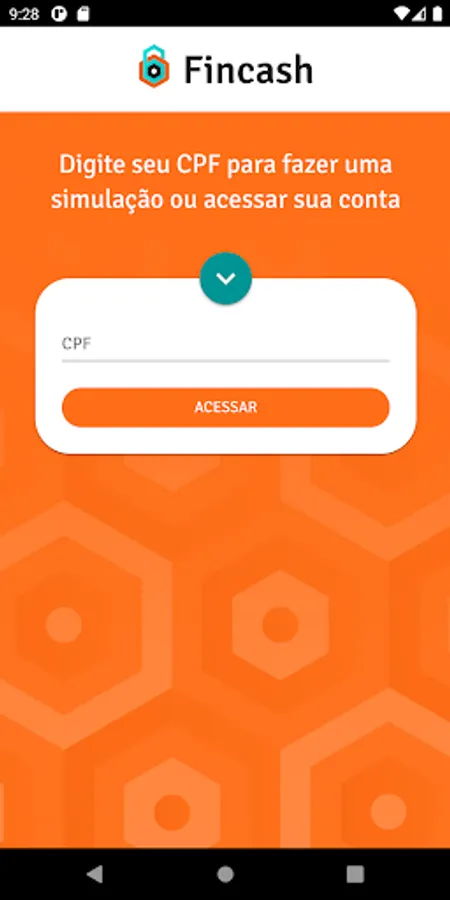

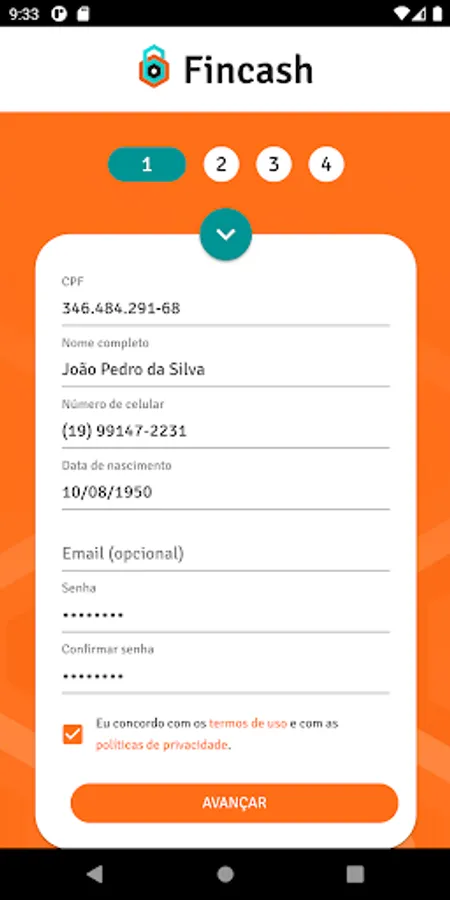

Fincash is an alternative for retirees and pensioners seeking payroll-deductible loans without all the bureaucracy of going to the bank, with total transparency in the process and best of all, 100% online, in the comfort of your home you can request!

With Fincash, you can have an exclusive direct service manager on your cell phone, exclusive credit concierge service, to help you understand your moment better and be able to deliver you an effective alternative, with the lowest interest rate* in the market !

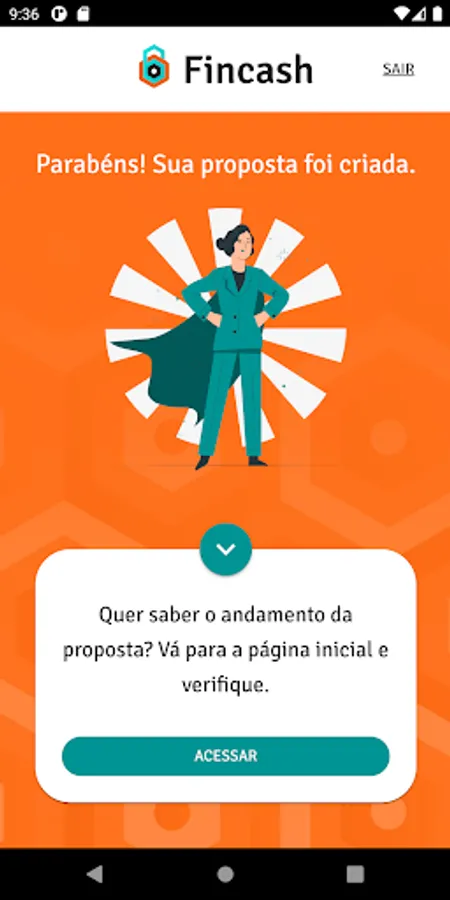

In 5 minutes you can simulate and send your credit request 100% online, 100% in control, in the palm of your hand!

Tired of having to travel to a branch, take 1km of FILA, fill a truckload of paperwork and still expose your life to a manager who only thinks about his goals?

We were born precisely to solve this pain, Fincash is a company that since 2016, seeks solutions to help our client quickly, practically and with total transparency!

Come with us to be Fincash!

*Nominal interest rate of 1.80% per month (23.87% per year). CET 1.91% per month (25.48% per year).

**Like any credit proposal, it is subject to approval by the financial institution, paying agency (INSS) and sufficient margin available to release the credit!

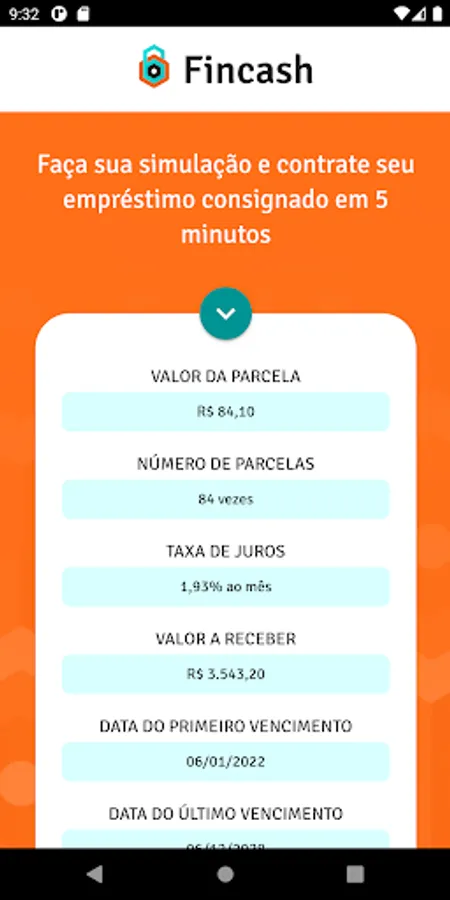

***Fincash makes your credit inquiry at several online banks. Payment terms vary from 12 to 84 months per product and financial institution chosen by the customer. The interest rate offered by the partners varies from 1.09% to 1.80% per month (13.89% to 23.87% per year) according to credit and profile analysis. Example: Value: R$5,000.00; term: 84 months; Interest Rate: 1.80% per month (23.87% per year); CET 25.48% per year; Installments R$119.61; Total value of the IOF: BRL 156.57; Total cost of the loan: R$10,047.24.

With Fincash, you can have an exclusive direct service manager on your cell phone, exclusive credit concierge service, to help you understand your moment better and be able to deliver you an effective alternative, with the lowest interest rate* in the market !

In 5 minutes you can simulate and send your credit request 100% online, 100% in control, in the palm of your hand!

Tired of having to travel to a branch, take 1km of FILA, fill a truckload of paperwork and still expose your life to a manager who only thinks about his goals?

We were born precisely to solve this pain, Fincash is a company that since 2016, seeks solutions to help our client quickly, practically and with total transparency!

Come with us to be Fincash!

*Nominal interest rate of 1.80% per month (23.87% per year). CET 1.91% per month (25.48% per year).

**Like any credit proposal, it is subject to approval by the financial institution, paying agency (INSS) and sufficient margin available to release the credit!

***Fincash makes your credit inquiry at several online banks. Payment terms vary from 12 to 84 months per product and financial institution chosen by the customer. The interest rate offered by the partners varies from 1.09% to 1.80% per month (13.89% to 23.87% per year) according to credit and profile analysis. Example: Value: R$5,000.00; term: 84 months; Interest Rate: 1.80% per month (23.87% per year); CET 25.48% per year; Installments R$119.61; Total value of the IOF: BRL 156.57; Total cost of the loan: R$10,047.24.

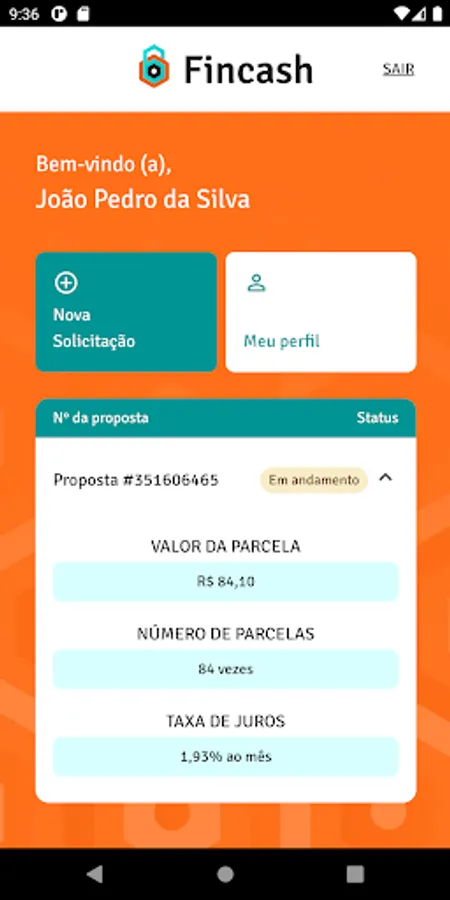

Fincash Screenshots

Tap to Rate: