About Calculadora Décimo Terceiro

Thirteenth Salary (13th Salary)

Also known as a Christmas bonus; the payment of the Thirteenth Salary (Salary) is now mandatory for every employee who works with a formal contract. Law No. 4,090 of the CLT. source: plateau.gov.

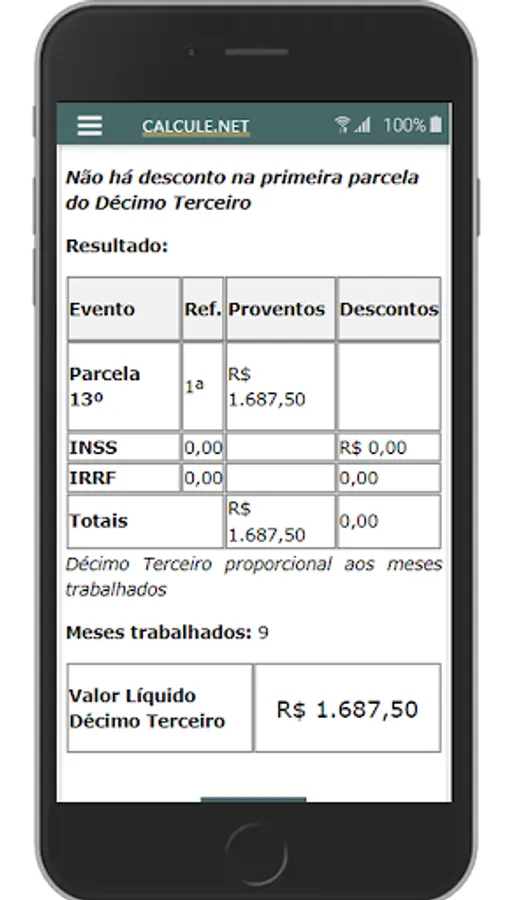

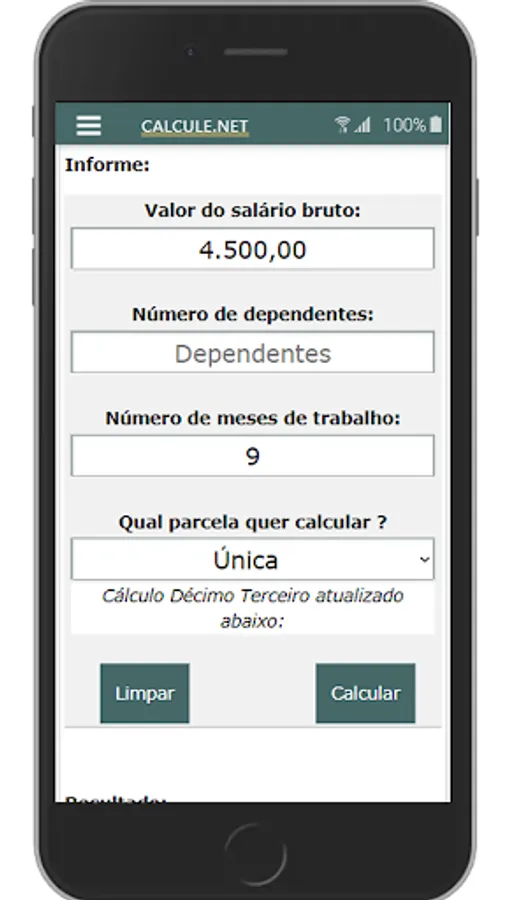

Calculating the 13th Salary proportional is easy and fast, fill in the information in the Calculator and click on Calculate

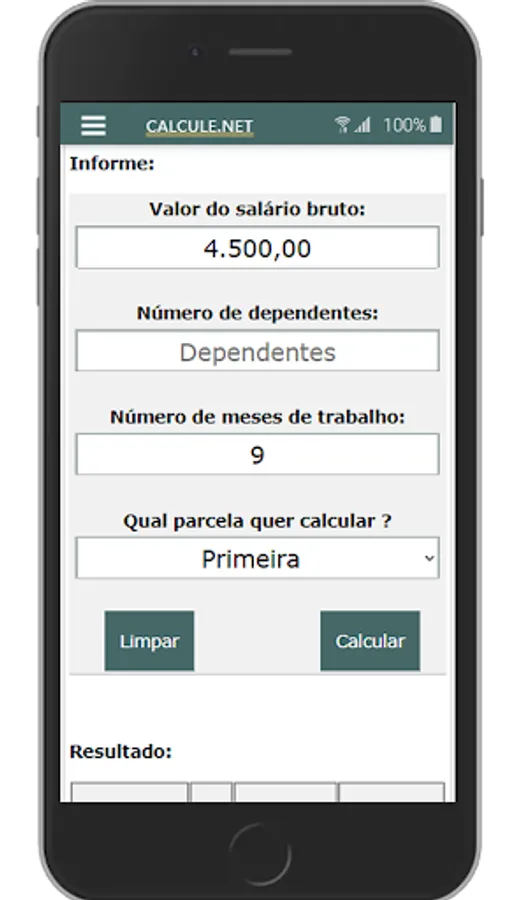

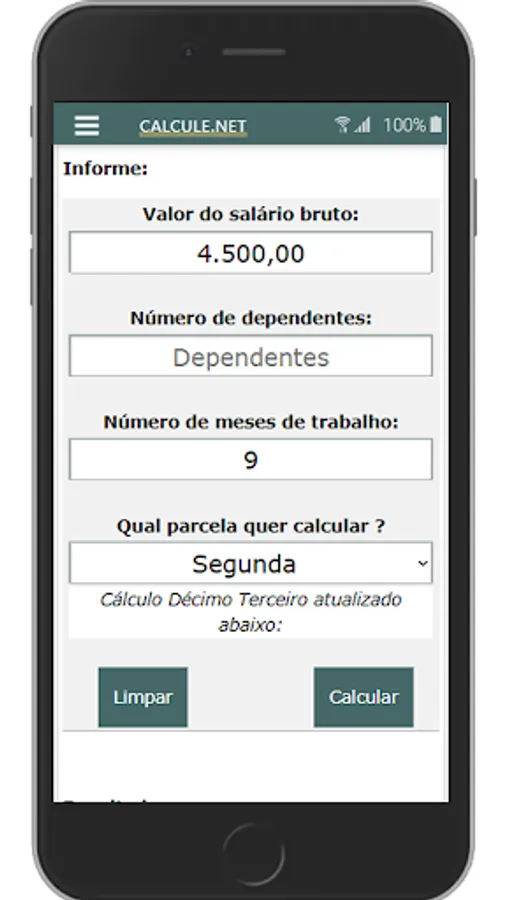

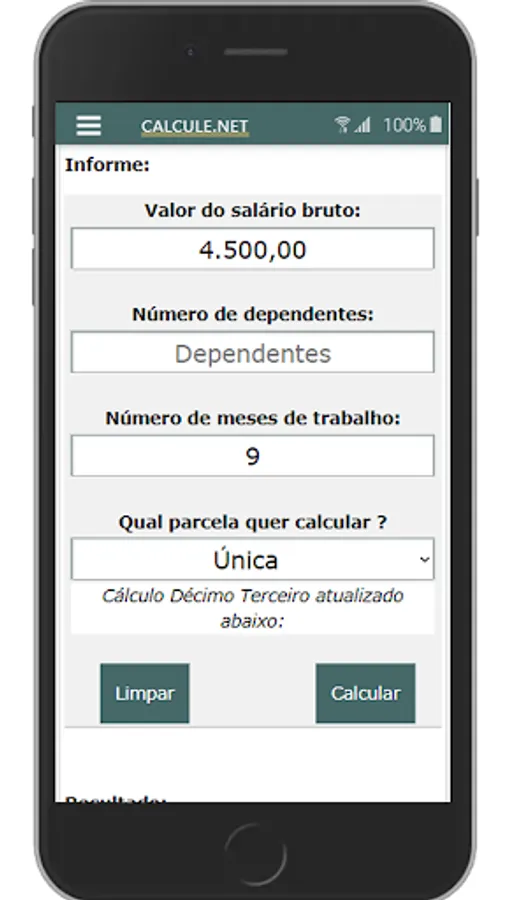

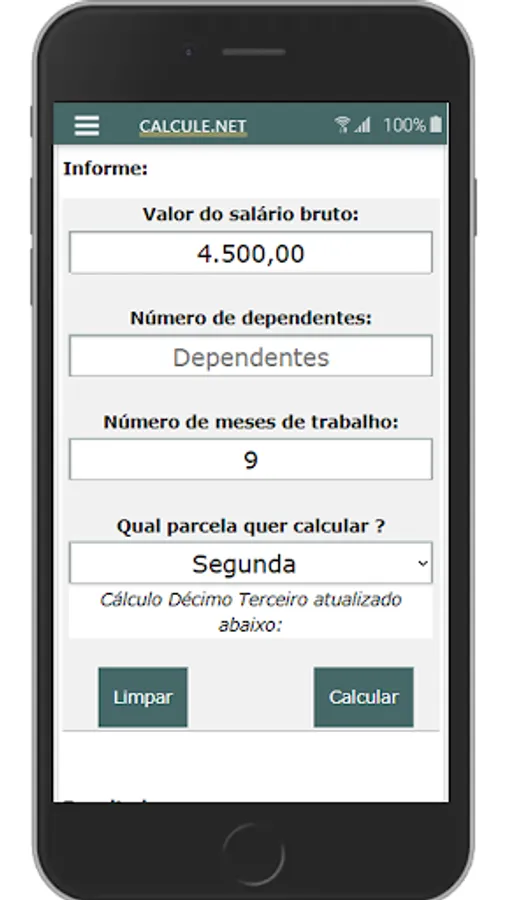

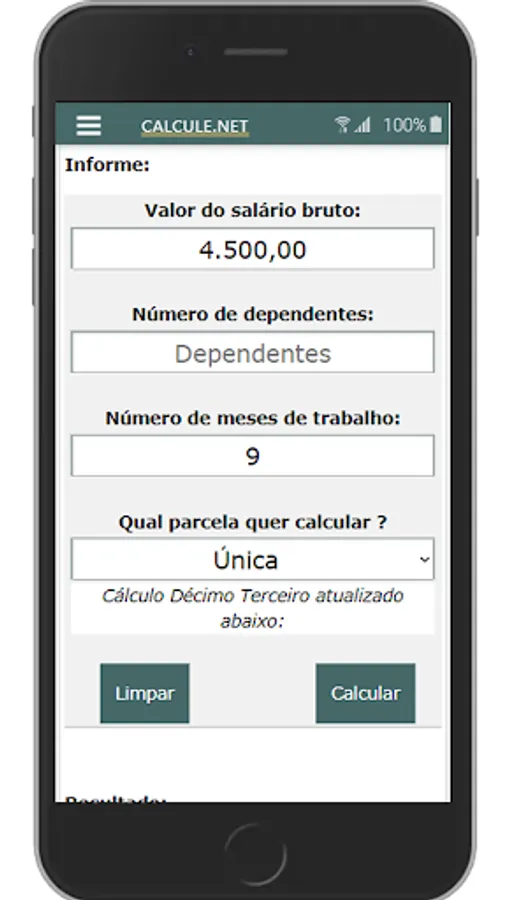

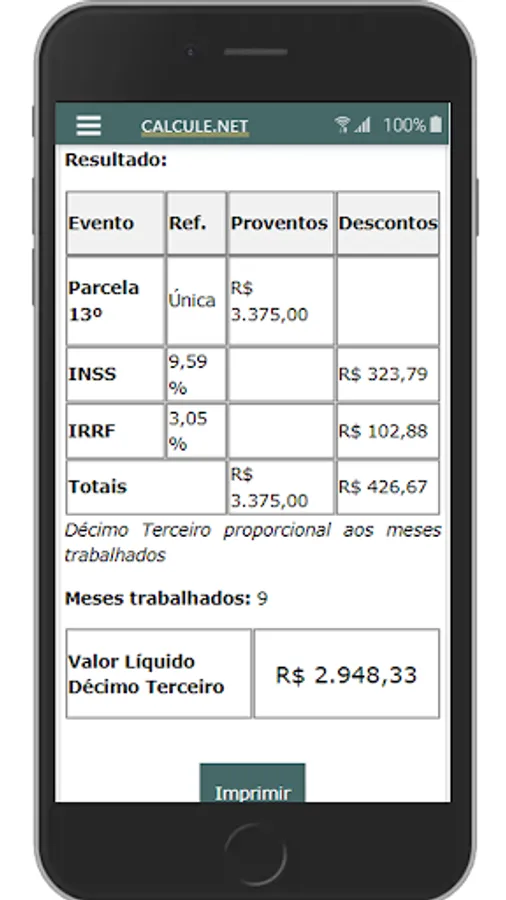

Instructions for calculating the Thirteenth on this Calculator:

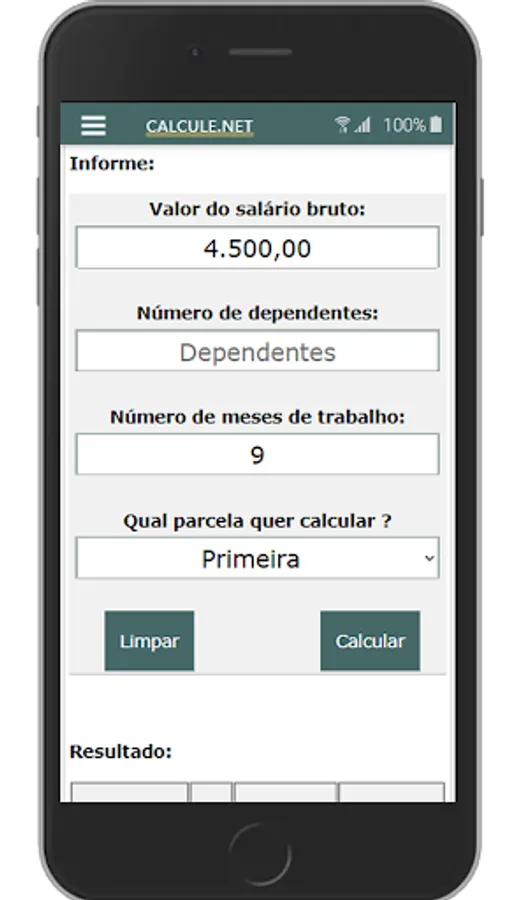

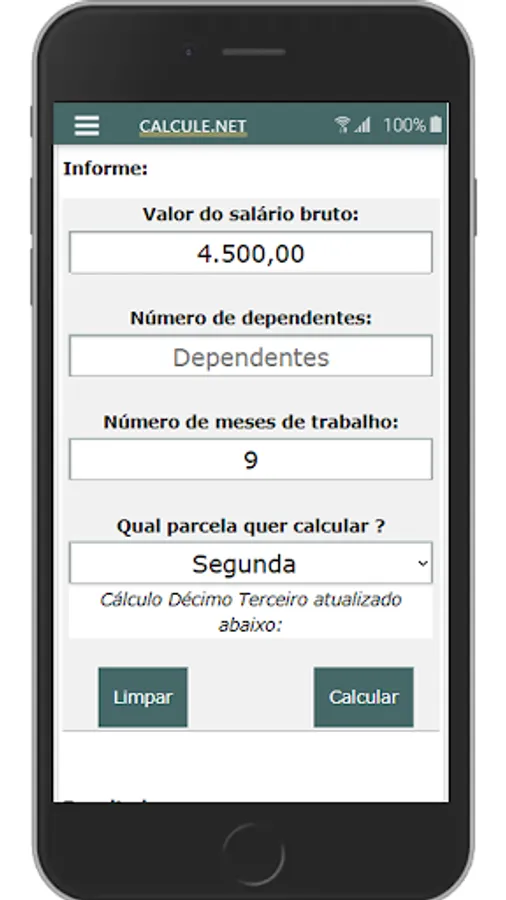

- Gross salary amount is the salary without discounts;

- Number of dependents is the amount of people you declared in the IR that depend on you, we use this information to Calculate IRRF;

- Number of months of work is the number of months you have worked or worked at the company;

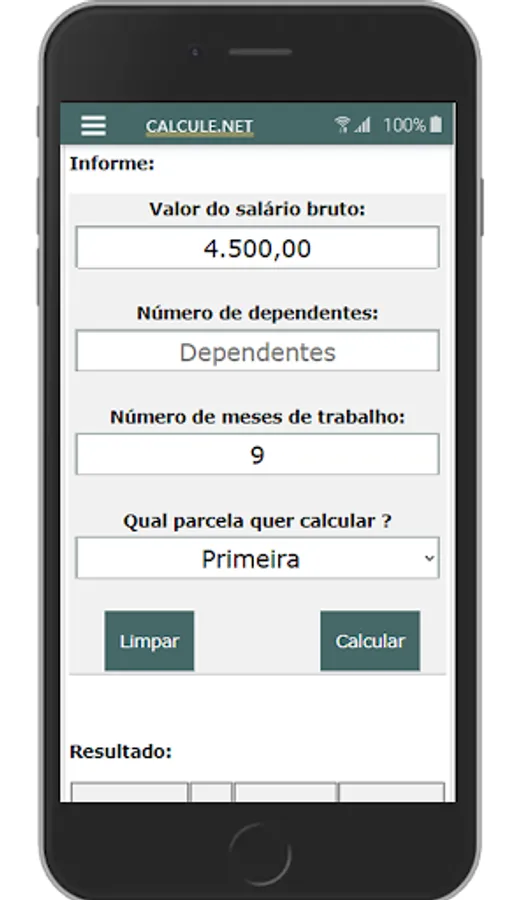

- Which portion do you want to calculate? you need to select; First; Second or Single;

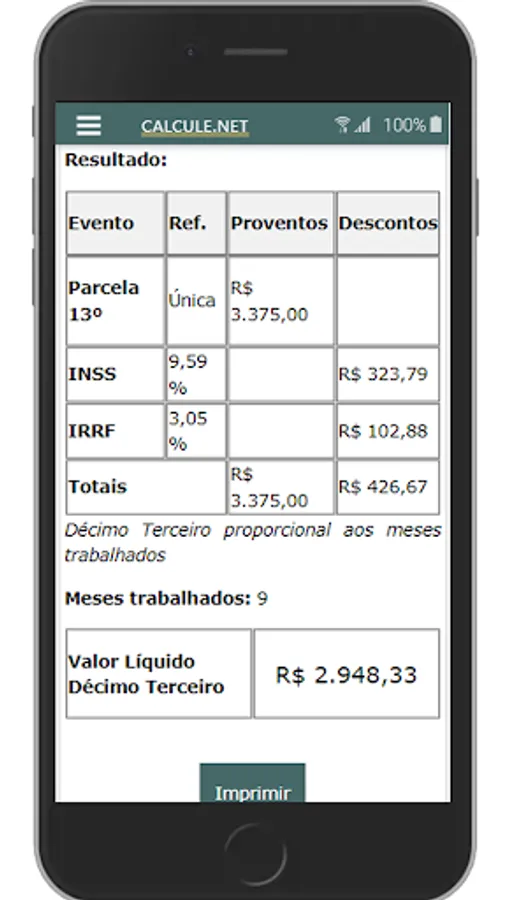

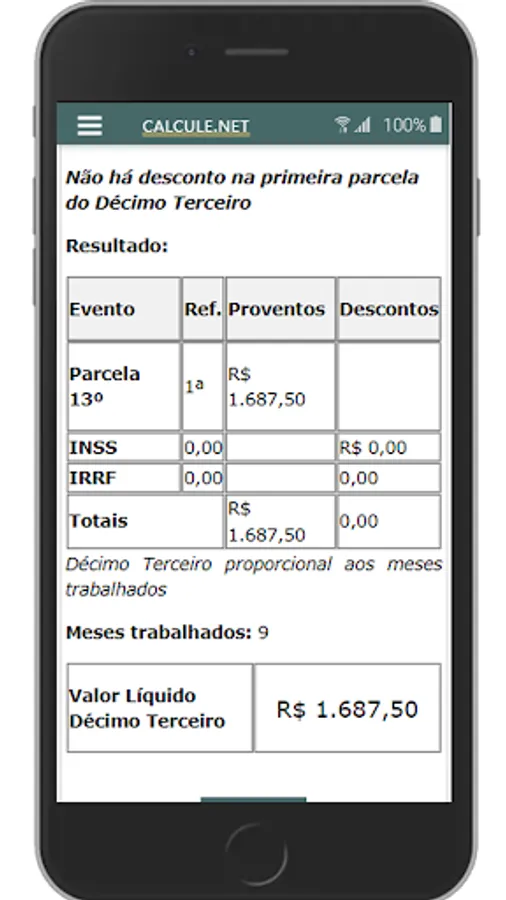

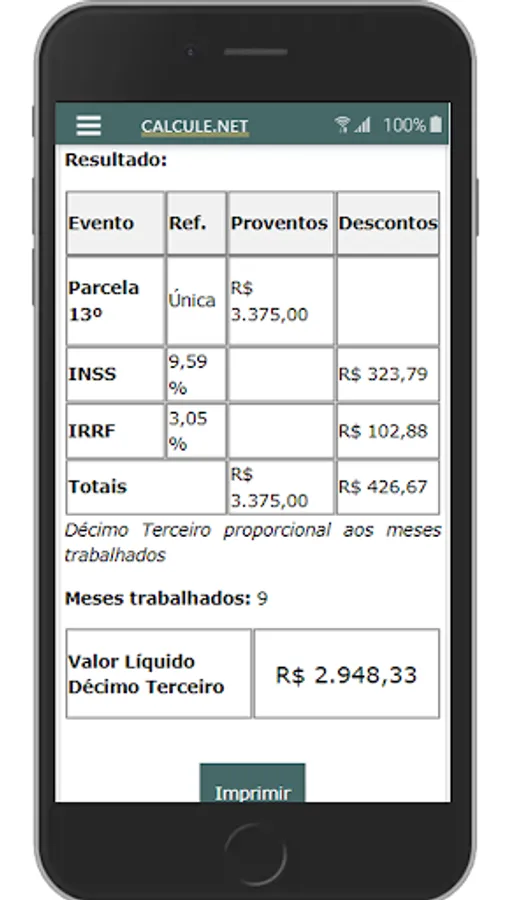

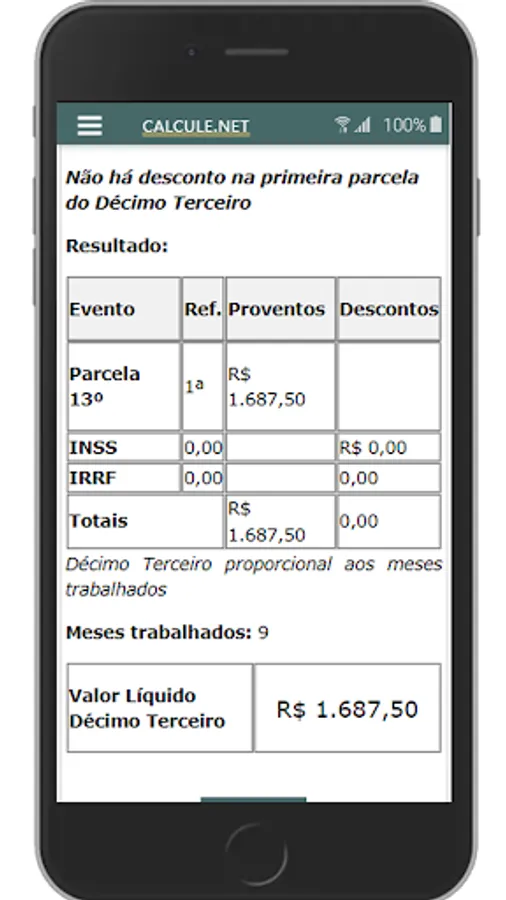

- Official INSS and IRRF discounts (if any); are made from the second installment, or in the single installment.

Fill in the information carefully to obtain the exact calculation of your Thirteenth (13th salary).

Also known as a Christmas bonus; the payment of the Thirteenth Salary (Salary) is now mandatory for every employee who works with a formal contract. Law No. 4,090 of the CLT. source: plateau.gov.

Calculating the 13th Salary proportional is easy and fast, fill in the information in the Calculator and click on Calculate

Instructions for calculating the Thirteenth on this Calculator:

- Gross salary amount is the salary without discounts;

- Number of dependents is the amount of people you declared in the IR that depend on you, we use this information to Calculate IRRF;

- Number of months of work is the number of months you have worked or worked at the company;

- Which portion do you want to calculate? you need to select; First; Second or Single;

- Official INSS and IRRF discounts (if any); are made from the second installment, or in the single installment.

Fill in the information carefully to obtain the exact calculation of your Thirteenth (13th salary).