With this fintech app, you can apply for online loans, make payments, and manage investments using AI-based credit evaluations. Includes secure transaction processing, savings targeting, and interbank transfer features.

AppRecs review analysis

AppRecs rating 4.3. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.3

AppRecs Rating

Ratings breakdown

5 star

80%

4 star

0%

3 star

0%

2 star

0%

1 star

20%

What to know

✓

High user satisfaction

80% of sampled ratings are 4+ stars (4.2★ average)

✓

Authentic reviews

No red flags detected

About BiD

BiD application is an AI and fintech based product of "Business Invest Development NBFI" LLC and it offers online loan and payment service. "Business Invest Development NBFI" LLC is established in 2004 and received the non-banking financial service under the Decree No 340 of Central Bank of Mongolia on May, 2005

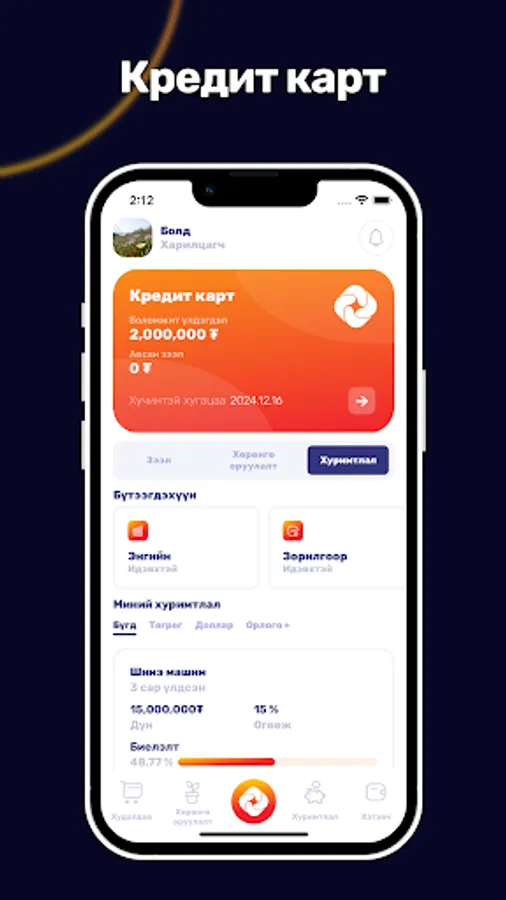

BiD application provides following services under Mongolian Laws and regulations.

- Online loan

- Online payment and shoppoing

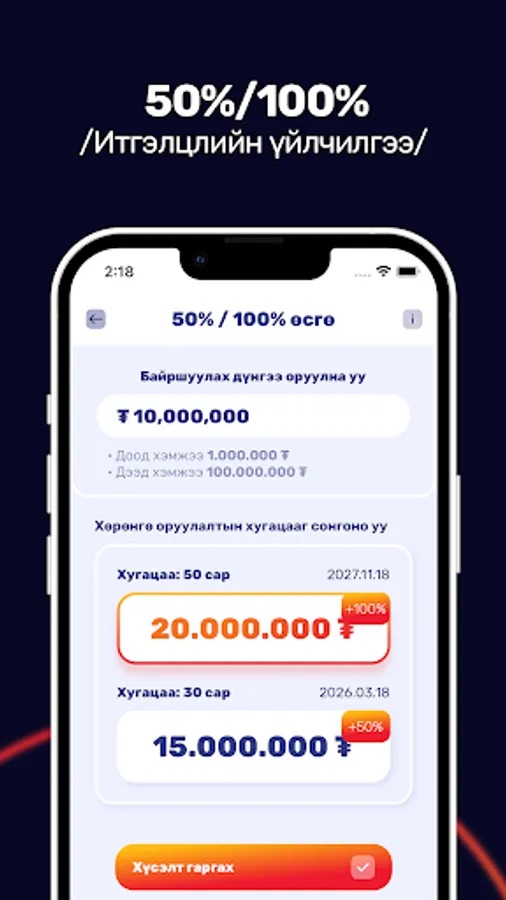

- Long and short term Investments

- Target and potential savings

- Interbank transaction

Privacy Policy

We sctricly adhers with the local regulations and laws of Mongolia. in addition, we keep the confidentiality of private information at high secured place. We are compliant with the Anti-Money laundering Comissions as well as National Data Privacy Comission

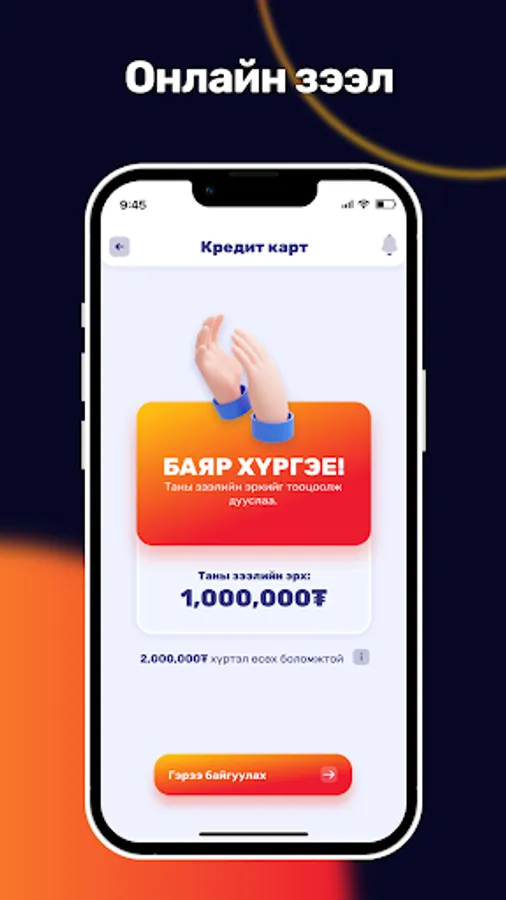

How to get loan?

Once the customer download the application from App store and register by using valid information, his/her credit scoring is evaluated based on our AI system and centralized loan database of Bank of Mongolia. This prevents the customers from receiving multiple loans, which may result in the failure of repayment. Once the customer`s credit scoring is completed and the Loan Agreement is signed be the parties, the customer will be able to receive loan anytime to his/her bank account or BiD wallet without any additional criteria.

Loan term: from 6 months to 12 months

Fee: 1%

Loan ammount: MNT50,000 - MNT100,000,000

BiD application provides following services under Mongolian Laws and regulations.

- Online loan

- Online payment and shoppoing

- Long and short term Investments

- Target and potential savings

- Interbank transaction

Privacy Policy

We sctricly adhers with the local regulations and laws of Mongolia. in addition, we keep the confidentiality of private information at high secured place. We are compliant with the Anti-Money laundering Comissions as well as National Data Privacy Comission

How to get loan?

Once the customer download the application from App store and register by using valid information, his/her credit scoring is evaluated based on our AI system and centralized loan database of Bank of Mongolia. This prevents the customers from receiving multiple loans, which may result in the failure of repayment. Once the customer`s credit scoring is completed and the Loan Agreement is signed be the parties, the customer will be able to receive loan anytime to his/her bank account or BiD wallet without any additional criteria.

Loan term: from 6 months to 12 months

Fee: 1%

Loan ammount: MNT50,000 - MNT100,000,000