KDV Hesaplama

Teqergy

Free

500+

downloads

About KDV Hesaplama

What is VAT (Value Added Tax)?

VAT is a type of tax that was regulated in 1984 with the Value Added Tax Law No. 3065 and collected on expenditures. It entered into force as of 01.01.1985. It stands for value added tax. It is the tax paid by the end consumer. It is paid if there is no extra condition for every product purchased as the end consumer.

What are the VAT Rates?

VAT rates may differ for each country and product. However, it is applied in 1%, 8% and 18% in our country. These rates are determined according to the needs of the product.

How is VAT Calculated?

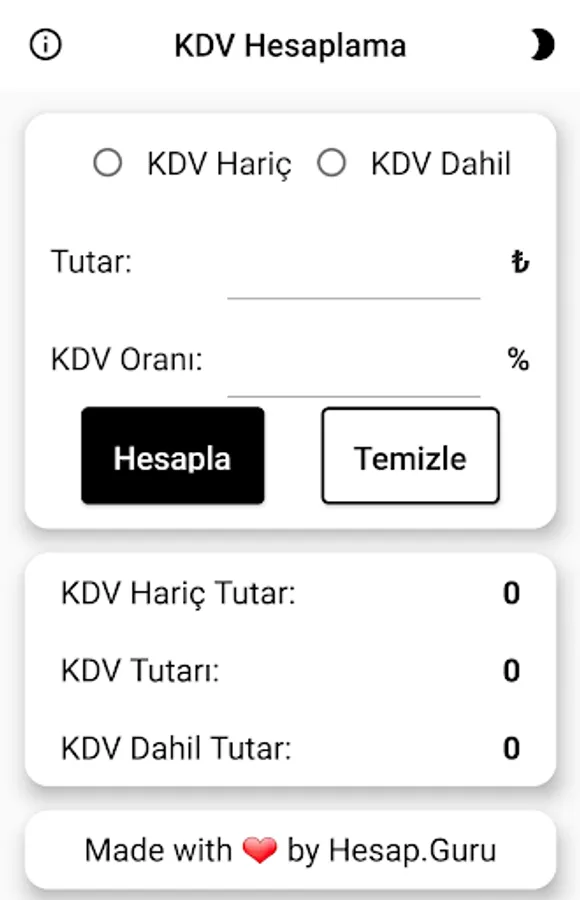

Using our calculation tool for VAT calculation;

1- First, select the calculation method.

2- Enter the amount information.

3- Enter the VAT rate information.

You can get the result by clicking 4- Calculate button.

VAT Rates by Product

1% VAT applied products;

• Wheat flour,

• Types of bread made from wheat,

• They are basic necessities such as dough.

8% VAT is collected from consumer products excluding non-luxury wheat products. For example;

• Consumables such as milk, yoghurt, eggs, cheese, honey,

Foods such as dry beans, chickpeas, lentils,

• Poultry and fish.

18% VAT is generally applied for non-essential luxury products.

• Technological products such as telephones, computers, white goods,

• Furniture products.

For more calculations, we welcome you to our account.guru address !!!

DON'T FORGET #NIGHT MODE! #

VAT is a type of tax that was regulated in 1984 with the Value Added Tax Law No. 3065 and collected on expenditures. It entered into force as of 01.01.1985. It stands for value added tax. It is the tax paid by the end consumer. It is paid if there is no extra condition for every product purchased as the end consumer.

What are the VAT Rates?

VAT rates may differ for each country and product. However, it is applied in 1%, 8% and 18% in our country. These rates are determined according to the needs of the product.

How is VAT Calculated?

Using our calculation tool for VAT calculation;

1- First, select the calculation method.

2- Enter the amount information.

3- Enter the VAT rate information.

You can get the result by clicking 4- Calculate button.

VAT Rates by Product

1% VAT applied products;

• Wheat flour,

• Types of bread made from wheat,

• They are basic necessities such as dough.

8% VAT is collected from consumer products excluding non-luxury wheat products. For example;

• Consumables such as milk, yoghurt, eggs, cheese, honey,

Foods such as dry beans, chickpeas, lentils,

• Poultry and fish.

18% VAT is generally applied for non-essential luxury products.

• Technological products such as telephones, computers, white goods,

• Furniture products.

For more calculations, we welcome you to our account.guru address !!!

DON'T FORGET #NIGHT MODE! #