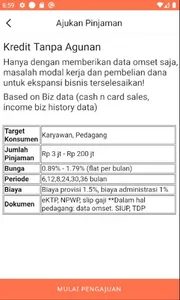

OK! Bank KTA is a fast funding solution for your various needs.

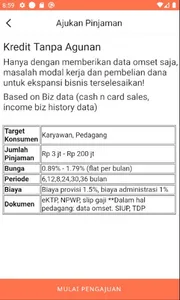

- Interest : 0.89% - 3.49% Flat Per Month

- Limit: Minimum IDR 3 million, - up to a maximum of IDR 200 million

- Loan Tenor: Minimum 6 Months to Maximum 5 Years

- Administration Fee: 4%

- Loan Purpose: Working Capital, Investment, and Consumptive

Simulation Example:

Loan Limit IDR 3,000,000

12 months tenor

3.49% Interest

Administration Fee 4%

Funds received:

IDR 3,000,000 - (IDR 3,000,000 x 4% administration fee) = IDR 2,880,000

Installment : IDR 354,700 / month

What's OK! KTA bank?

OK! Bank KTA is an unsecured credit product owned by OK BANK Indonesia. We provide unsecured loan services that can be submitted via a mobile application.

The safety?

OK! Bank KTA is an official product of OK BANK Indonesia which is registered and supervised by the Financial Services Authority (OJK) with a decree S-104/PB.322/2019. We ensure your security and privacy.

Advantage OK! KTA Bank

• Easy & Flexible Terms

• Easy registration via app

• Competitive Interest Rates

• Official product from OK BANK

• Free to Use For Anything

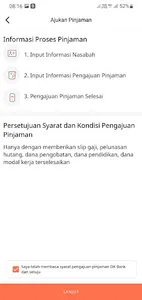

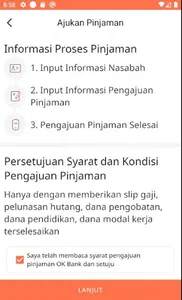

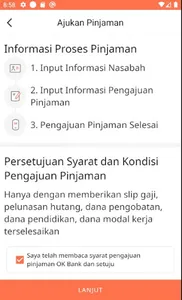

Loan Process OK! KTA Bank

1. Input Customer Information

2. Input Loan Application Information

3. Loan Application Complete

“OK! KTA Bank”

- Indonesian citizen

- 21 - 54 Years

- Domiciled in the JABODETABEK area

- E-KTP

- NPWP (Loans above 50 million)

- Salary Slip & Employee Certificate (Employee)

- Current Account for the Last 3 Months (Entrepreneur)

- Certificate of Business Domicile / Siup / Tdp (Entrepreneur)

Contact OK! Retail Loans:

For more information, you can contact us at:

Phone: 150-119

Email: kta@okbank.co.id

Facebook: OK BANK Indonesia

Instagram: @okbankindonesia

Our address: Bank Oke Indonesia Building, Jl. H. Ir. H. Juanda No 12, Rw 4, Gambir District, Central Jakarta, Special Capital Region of Jakarta 10120

- Interest : 0.89% - 3.49% Flat Per Month

- Limit: Minimum IDR 3 million, - up to a maximum of IDR 200 million

- Loan Tenor: Minimum 6 Months to Maximum 5 Years

- Administration Fee: 4%

- Loan Purpose: Working Capital, Investment, and Consumptive

Simulation Example:

Loan Limit IDR 3,000,000

12 months tenor

3.49% Interest

Administration Fee 4%

Funds received:

IDR 3,000,000 - (IDR 3,000,000 x 4% administration fee) = IDR 2,880,000

Installment : IDR 354,700 / month

What's OK! KTA bank?

OK! Bank KTA is an unsecured credit product owned by OK BANK Indonesia. We provide unsecured loan services that can be submitted via a mobile application.

The safety?

OK! Bank KTA is an official product of OK BANK Indonesia which is registered and supervised by the Financial Services Authority (OJK) with a decree S-104/PB.322/2019. We ensure your security and privacy.

Advantage OK! KTA Bank

• Easy & Flexible Terms

• Easy registration via app

• Competitive Interest Rates

• Official product from OK BANK

• Free to Use For Anything

Loan Process OK! KTA Bank

1. Input Customer Information

2. Input Loan Application Information

3. Loan Application Complete

“OK! KTA Bank”

- Indonesian citizen

- 21 - 54 Years

- Domiciled in the JABODETABEK area

- E-KTP

- NPWP (Loans above 50 million)

- Salary Slip & Employee Certificate (Employee)

- Current Account for the Last 3 Months (Entrepreneur)

- Certificate of Business Domicile / Siup / Tdp (Entrepreneur)

Contact OK! Retail Loans:

For more information, you can contact us at:

Phone: 150-119

Email: kta@okbank.co.id

Facebook: OK BANK Indonesia

Instagram: @okbankindonesia

Our address: Bank Oke Indonesia Building, Jl. H. Ir. H. Juanda No 12, Rw 4, Gambir District, Central Jakarta, Special Capital Region of Jakarta 10120

Show More