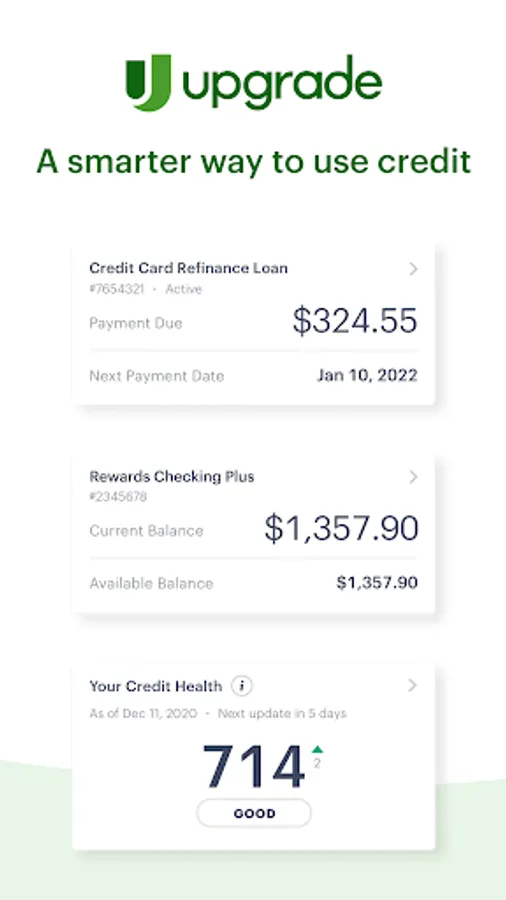

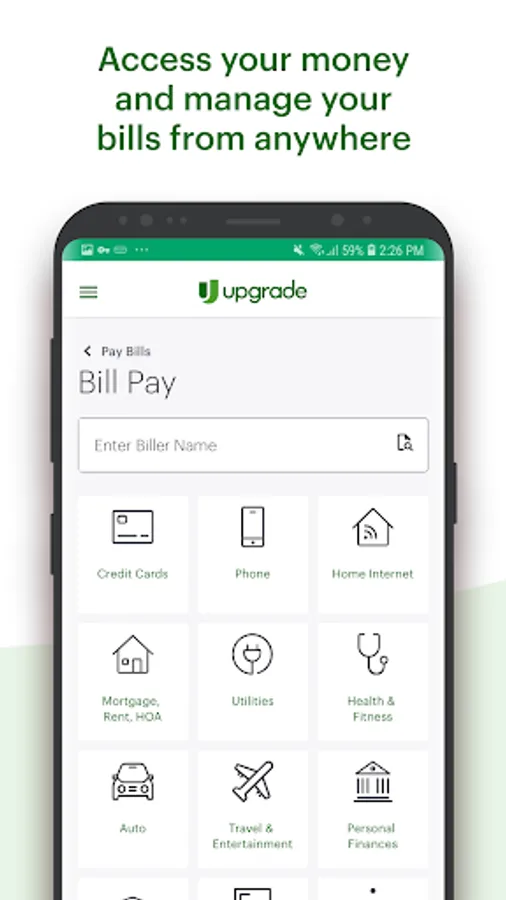

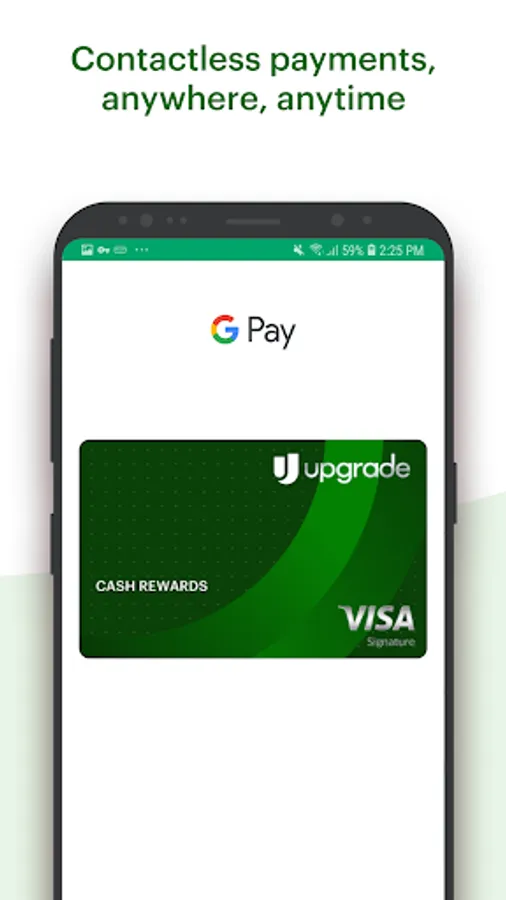

In this mobile banking app, you can manage accounts, request cash advances, and pay bills easily. Includes features for monitoring credit scores, earning rewards, and viewing balances.

AppRecs review analysis

AppRecs rating 4.4. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.4

AppRecs Rating

Ratings breakdown

5 star

78%

4 star

11%

3 star

2%

2 star

1%

1 star

8%

What to know

✓

High user satisfaction

88% of sampled ratings are 4+ stars (4.5★ average)

About Upgrade

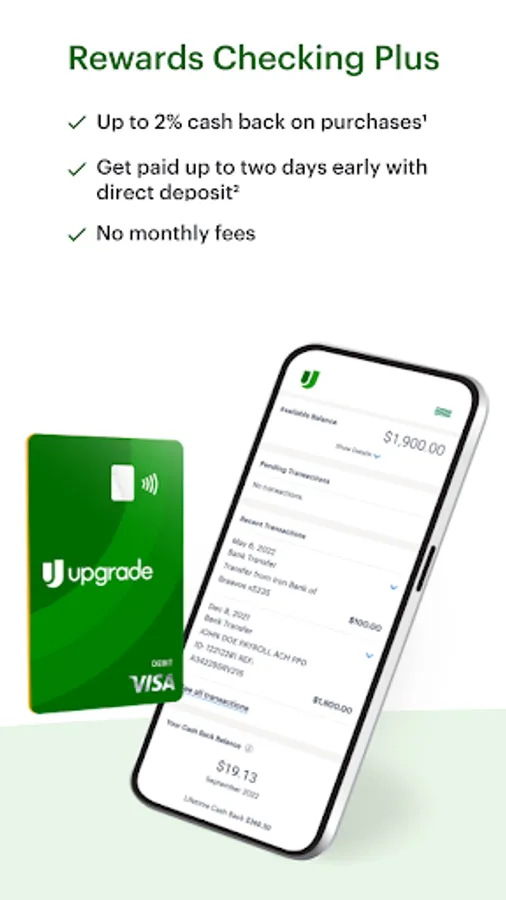

Get safe and easy mobile banking all in one place! Request cash advances and open a high-yield savings account, check balances, view available credit, pay bills, track cash back and more.

Upgrade is a financial technology company, not a bank.

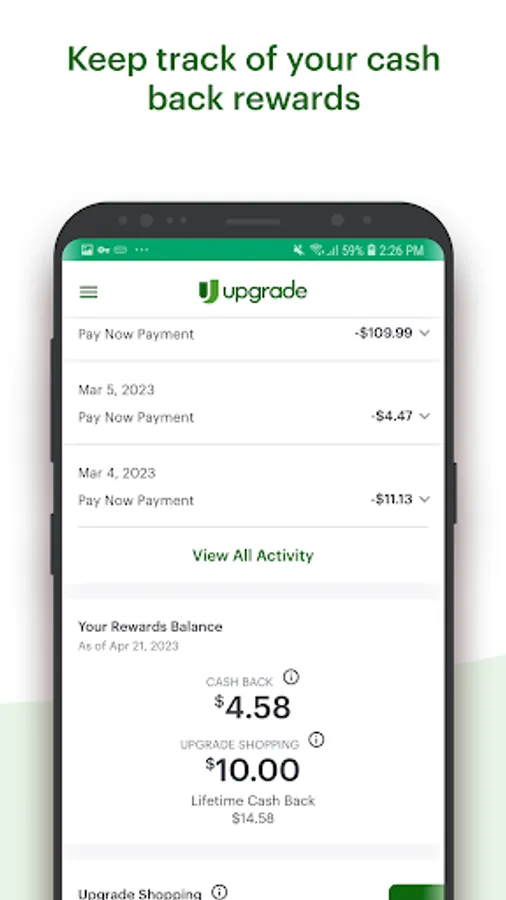

● Track Rewards – Earn cash back rewards on Upgrade Card purchases⁴

● Manage Upgrade Card or Personal Loan, Flex Pay buy now pay later, Upgrade Card, Auto Finance, Auto Refinance and Home Improvement through Upgrade accounts. Make payments and check your balance.

● Monitor credit score, get notified of changes, and use our credit score simulator to see how different actions may impact your score.

Share feedback at mobile_app_feedback@upgrade.com

Personal Loan offers shown assume an APR of 12% and a term of 36 months for Faster Payoff and 48 months for Lower Payment.Subject to approval. For more information visit https://www.upgrade.com/personal-loans/.

¹ Subject to eligibility. BoostCash™ amounts range from initial $25 to $500 over time. 10.00% APY and express delivery requires a $9.99/month Premium subscription. 1-month free trial for select customers. Cancel anytime. Learn more about eligibility and terms at http://www.upgrade.com/boost-money/eligibility.

² Add funds to your Boost Money™ Spend account, and spend up to the available balance with Boost Money™ Card. We'll report on-time payments to the three major credit bureaus (Transunion®, Experian®, and Equifax®) to help you build credit over time. Late payments, delinquencies or other derogatory activity on this account or your other credit card accounts and loans may adversely impact your ability to build credit.

³ For Boost Money™ Save accounts, the 10.00% Annual Percentage Yield (APY) up to a $1,000 balance requires a Premium subscription ($9.99/mo). Balances over $1,000 with Premium earn 3.05% APY. Without a Premium subscription, the APY for the Boost Money™ Save account is 1.50% on all balances. The APY is effective as of 10/31/2025, is variable and may change at any time. Certain fees, such as outbound wire transfers or RTP, may impact earnings. Please refer to the applicable Cross River Bank Savings Deposit Account Agreement and Truth in Savings Disclosure.

⁴ Purchases accrue cash back when you pay them back. Certain limitations apply. See Upgrade.com for full Upgrade Cash Back Rewards Program details.

Personal loans made through Upgrade feature Annual Percentage Rates (APRs) of 7.74%-35.99% and a 1.85%-9.99% origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of existing debt directly. For certain discounts, collateral may be required. Repayment terms from 24 to 84 months. For example, if you receive a $10,000 unsecured loan with a 36-month term and a 17.59% APR (which includes a 13.94% yearly interest rate and a 5% one-time origination fee), you would receive $9,500 and would have a required monthly payment of $341.48. Over the life of the loan, your payments would total $12,293.46. The APR and other terms of your loan may vary and you may not be presented with multiple offers. If offered, your loan terms, including your rate, will depend on credit score, credit usage history, loan amount, and other factors. Late payments or other fees, as noted in your Borrower Agreement, may increase the cost of your fixed rate loan. Certain loan offers may not be available in all states.

All loans, Personal Credit Lines, and checking and savings accounts are provided by Upgrade's bank partners (www.upgrade.com/bank-partners/). Upgrade Visa® Cards and Upgrade Visa® Debit Cards are issued by Upgrade's bank partners, pursuant to a license from Visa USA Inc. Upgrade, Inc. (NMLS #1548935) holds the following state licenses (upgrade.com/State-Licenses) and does business under the following DBAs (https://www.upgrade.com/dba). Upgrade is a financial technology company, not a bank (https://upgrade.zendesk.com/hc/en-us/articles/115005202407--Is-Upgrade-a-bank-).

Upgrade is a financial technology company, not a bank.

● Track Rewards – Earn cash back rewards on Upgrade Card purchases⁴

● Manage Upgrade Card or Personal Loan, Flex Pay buy now pay later, Upgrade Card, Auto Finance, Auto Refinance and Home Improvement through Upgrade accounts. Make payments and check your balance.

● Monitor credit score, get notified of changes, and use our credit score simulator to see how different actions may impact your score.

Share feedback at mobile_app_feedback@upgrade.com

Personal Loan offers shown assume an APR of 12% and a term of 36 months for Faster Payoff and 48 months for Lower Payment.Subject to approval. For more information visit https://www.upgrade.com/personal-loans/.

¹ Subject to eligibility. BoostCash™ amounts range from initial $25 to $500 over time. 10.00% APY and express delivery requires a $9.99/month Premium subscription. 1-month free trial for select customers. Cancel anytime. Learn more about eligibility and terms at http://www.upgrade.com/boost-money/eligibility.

² Add funds to your Boost Money™ Spend account, and spend up to the available balance with Boost Money™ Card. We'll report on-time payments to the three major credit bureaus (Transunion®, Experian®, and Equifax®) to help you build credit over time. Late payments, delinquencies or other derogatory activity on this account or your other credit card accounts and loans may adversely impact your ability to build credit.

³ For Boost Money™ Save accounts, the 10.00% Annual Percentage Yield (APY) up to a $1,000 balance requires a Premium subscription ($9.99/mo). Balances over $1,000 with Premium earn 3.05% APY. Without a Premium subscription, the APY for the Boost Money™ Save account is 1.50% on all balances. The APY is effective as of 10/31/2025, is variable and may change at any time. Certain fees, such as outbound wire transfers or RTP, may impact earnings. Please refer to the applicable Cross River Bank Savings Deposit Account Agreement and Truth in Savings Disclosure.

⁴ Purchases accrue cash back when you pay them back. Certain limitations apply. See Upgrade.com for full Upgrade Cash Back Rewards Program details.

Personal loans made through Upgrade feature Annual Percentage Rates (APRs) of 7.74%-35.99% and a 1.85%-9.99% origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of existing debt directly. For certain discounts, collateral may be required. Repayment terms from 24 to 84 months. For example, if you receive a $10,000 unsecured loan with a 36-month term and a 17.59% APR (which includes a 13.94% yearly interest rate and a 5% one-time origination fee), you would receive $9,500 and would have a required monthly payment of $341.48. Over the life of the loan, your payments would total $12,293.46. The APR and other terms of your loan may vary and you may not be presented with multiple offers. If offered, your loan terms, including your rate, will depend on credit score, credit usage history, loan amount, and other factors. Late payments or other fees, as noted in your Borrower Agreement, may increase the cost of your fixed rate loan. Certain loan offers may not be available in all states.

All loans, Personal Credit Lines, and checking and savings accounts are provided by Upgrade's bank partners (www.upgrade.com/bank-partners/). Upgrade Visa® Cards and Upgrade Visa® Debit Cards are issued by Upgrade's bank partners, pursuant to a license from Visa USA Inc. Upgrade, Inc. (NMLS #1548935) holds the following state licenses (upgrade.com/State-Licenses) and does business under the following DBAs (https://www.upgrade.com/dba). Upgrade is a financial technology company, not a bank (https://upgrade.zendesk.com/hc/en-us/articles/115005202407--Is-Upgrade-a-bank-).