El seguro de vida una forma de

Victor M. Martinez Becerril

100+

downloads

Free

About El seguro de vida una forma de

Life insurance

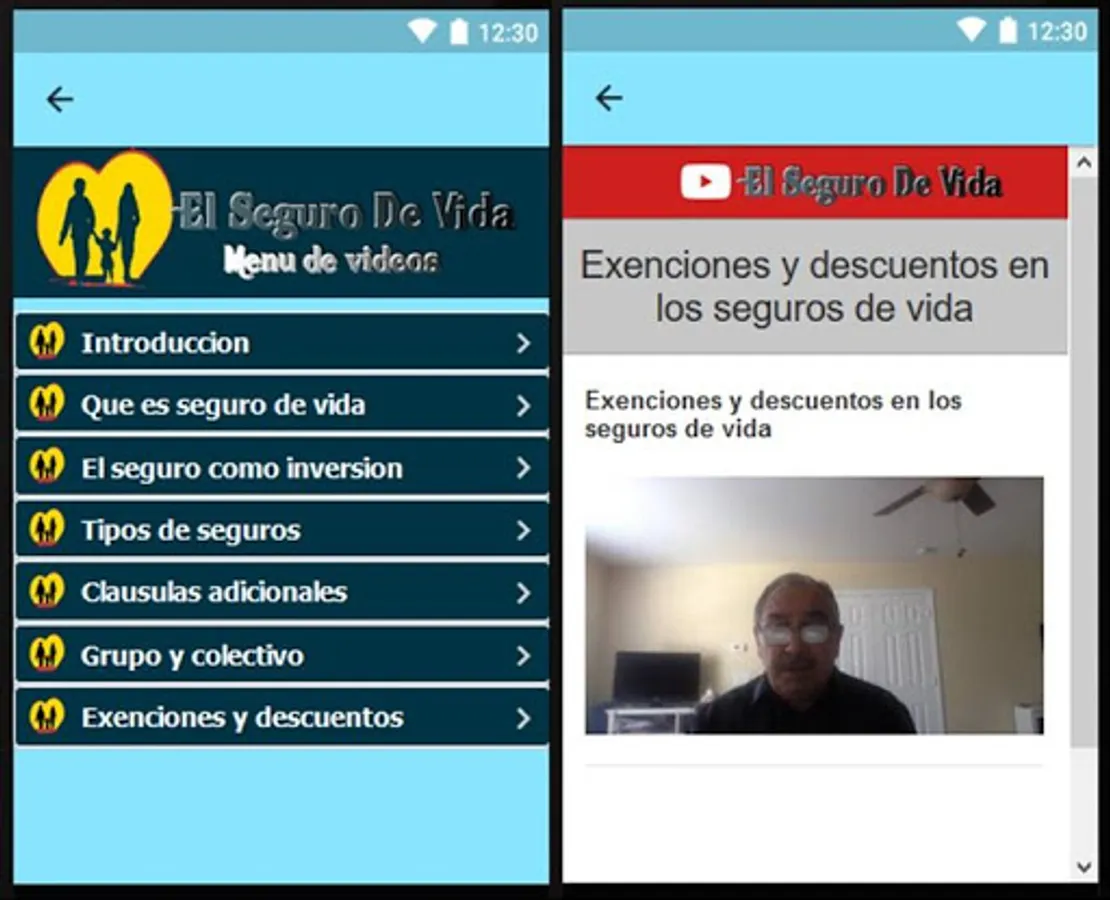

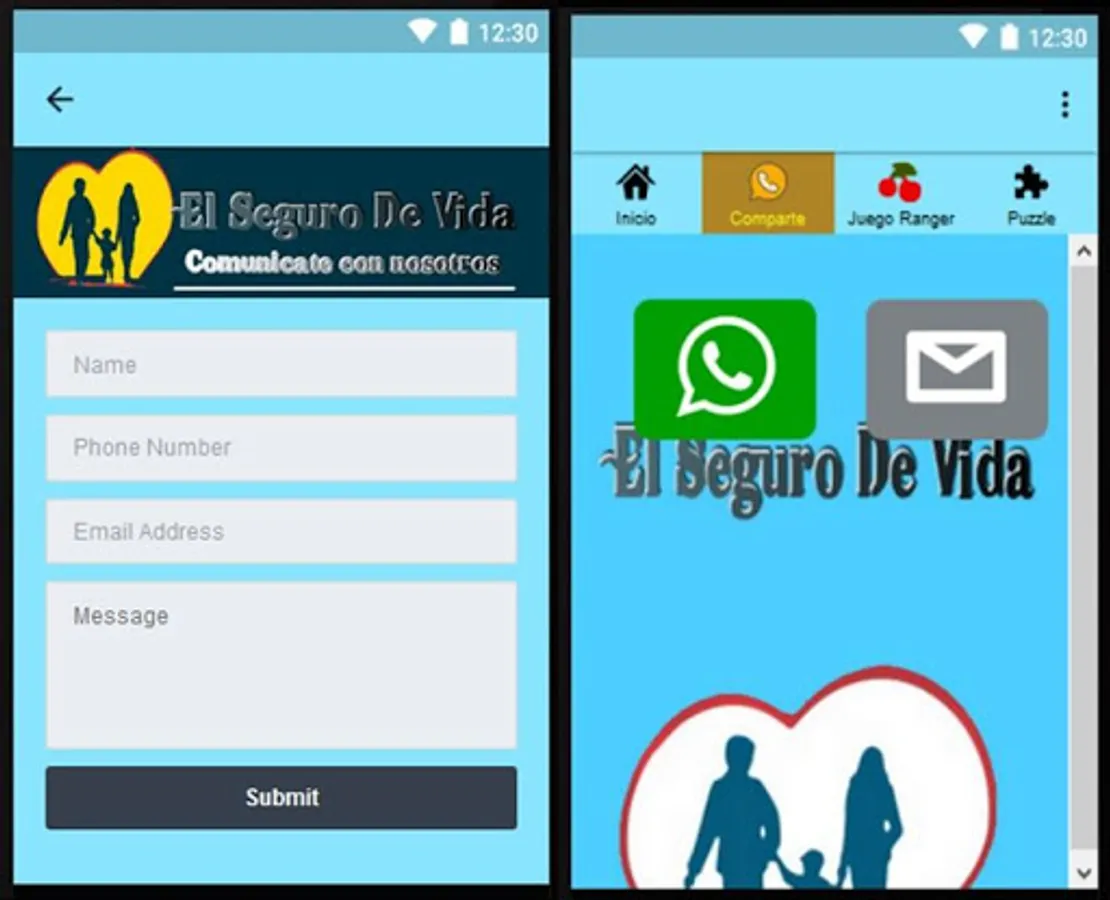

The purpose of this application is to give you an information tool that will guide you on the general aspects of life insurance, with the hope that it will be useful when the time comes to discuss with your insurance agent the terms, coverages and conditions of your policy.

Among all financial instruments, it is perhaps life insurance that provides the most humanitarian service to families. After all, the loss of a human life is the greatest loss.

In a comparative analysis between the different investment options in order to avoid the consequences caused by the death of the main provider in family finances, it is life insurance that is not only the most economic, profitable and provides the best liquidity in the as little time as possible.

Over the years, life insurance has been adapted and developed by insurance companies in different countries of the world to offer its population a range of types of coverage and the variety of validity and risks, including flexibility in the sum insured to adapt it to the economic conditions of the country. Thus we find in addition to the individual life policy, the group and collective policies. Also policies of short, medium term and unlimited validity.

Companies can include group insurance as their benefit, making it even more accessible with a monthly premium discount on the payroll. Also the associations or social service clubs find a great benefit and attraction for their membership the possibility of subscribing to a collective life insurance with the discount in the cost of the annual or monthly premium that brings with it the massive hiring.

They have not been without their life insurance plan for minors, although in most countries this is considered more an investment plan and are promoted as savings and investment plans in order to secure a fund for studies when the young person reaches the age of going to university.

The life insurance contract popularly known as "The Policy" is extremely flexible in its capabilities, being able to receive the additional clauses necessary to grant coverage that the client requires, either double payment of insured sum for accidental death or even triple payment for death accidental if this happens in public places. Death due to street riots or murder, Death due to dangerous sports, and even suicide (although this is paid only after two years of validity of the policy).

To conclude with this description we only need to inform you that life insurance unlike movable and immovable property insurance, does not indicate a limit as to the amount that you are allowed to contract, being also possible to accumulate policies of different insurance companies if it is something that is within your needs whether they are family or personal.

Hoping that this application Life Insurance will be useful.

Your friend

Víctor Martínez Becerril

The purpose of this application is to give you an information tool that will guide you on the general aspects of life insurance, with the hope that it will be useful when the time comes to discuss with your insurance agent the terms, coverages and conditions of your policy.

Among all financial instruments, it is perhaps life insurance that provides the most humanitarian service to families. After all, the loss of a human life is the greatest loss.

In a comparative analysis between the different investment options in order to avoid the consequences caused by the death of the main provider in family finances, it is life insurance that is not only the most economic, profitable and provides the best liquidity in the as little time as possible.

Over the years, life insurance has been adapted and developed by insurance companies in different countries of the world to offer its population a range of types of coverage and the variety of validity and risks, including flexibility in the sum insured to adapt it to the economic conditions of the country. Thus we find in addition to the individual life policy, the group and collective policies. Also policies of short, medium term and unlimited validity.

Companies can include group insurance as their benefit, making it even more accessible with a monthly premium discount on the payroll. Also the associations or social service clubs find a great benefit and attraction for their membership the possibility of subscribing to a collective life insurance with the discount in the cost of the annual or monthly premium that brings with it the massive hiring.

They have not been without their life insurance plan for minors, although in most countries this is considered more an investment plan and are promoted as savings and investment plans in order to secure a fund for studies when the young person reaches the age of going to university.

The life insurance contract popularly known as "The Policy" is extremely flexible in its capabilities, being able to receive the additional clauses necessary to grant coverage that the client requires, either double payment of insured sum for accidental death or even triple payment for death accidental if this happens in public places. Death due to street riots or murder, Death due to dangerous sports, and even suicide (although this is paid only after two years of validity of the policy).

To conclude with this description we only need to inform you that life insurance unlike movable and immovable property insurance, does not indicate a limit as to the amount that you are allowed to contract, being also possible to accumulate policies of different insurance companies if it is something that is within your needs whether they are family or personal.

Hoping that this application Life Insurance will be useful.

Your friend

Víctor Martínez Becerril