This app can help you find emergency debt relief solutions based on your individual needs.

Are you struggling with a high level of debt across credit cards, loans, and other products? It's time to look at your debt relief options!

This app is for:

* Anyone who is wondering how to get out of debt and has yet to find a suitable answer.

* If you are only just able to make the minimum repayments across multiple types of unsecured debt including credit cards, student loans, personal loans, lines of credit, and others.

* You have too many different types of debt that it's hard to keep track of payments.

* You want to lower your overall level of debt or interest rates.

If this sounds like you, debt relief programs could be the right answer!

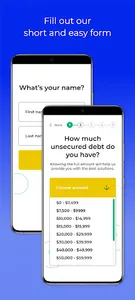

The app can quickly help you find an emergency debt settlement/consolidation program in a matter of minutes. All you have to do is open the app and tap the "Start Now" button and provide:

* Your full legal first and last name

* Your address and zip code

* The total amount of unsecured debt you need help paying off

* A contact phone number

* A contact email address

It's as easy as that, you may then gain access to some of the best debt relief companies!

Note: Debt settlement and consolidation can currently only apply to unsecured debts. These are standard debts such as credit card debt, personal loans, some student loans, some business lines of credit, bank overdrafts, and any other similar product where you have not signed any collateral like a house, car, or other items of value in the case of default (failing to make payments).

Most personal debts outside of home mortgages and large corporate business loans are unsecured, but if you are unsure, check the agreement between you and the lender or contact them directly to ask if it is unsecured.

Legal Requirements:

* Credit must have been obtained lawfully from a certified lender

* The recipient must be at least 18 years of age at the time of obtaining the credit.

* App users must be legal residents of the United States with a fixed address.

So, what are you waiting for? If you need help with loan or credit card debt, the solution is just around the corner!

==============================

Material disclosure, rates, and fees

This app is not a lender, creditor, or debt collector. This is not a loan. Referral arrangements with our partners make it possible for you to apply for a loan. The operator of this app does not make any credit decisions. Independent, participating debt relief companies that you might be connected with may perform credit checks with credit reporting bureaus or obtain consumer reports, typically through alternative providers to determine credit worthiness, credit standing, and/or credit capacity. By submitting your information, you agree to allow participating companies to verify your information and check your credit.

APR Disclosure

The APR is the annual percentage rate charged for loans. It depends on how much you borrow, for how long, and the lender's policies. Some states legally limit APRs. Annual Percentage Rates provided by our partners range from 5.99% to 35.99%. Loan repayment terms vary depending on the loan amount, individual lender policies, and the type of loan. Repayment terms range between 65 days to 3 years. Failure to repay a loan can result in extra fees, interest, collection proceedings, and a hit to your credit score.

Below is a representative example of how APR might be calculated:

A loan of $1,000 taken out over a one-year period with a 20% APR will cost you:

* Total charge for loan: $1,000 * 0.20 (20% APR) = $200

* Total amount you'll repay: $1,000 + $200 = $1,200

* Monthly payment: $1,200 / 12 = $100

Are you struggling with a high level of debt across credit cards, loans, and other products? It's time to look at your debt relief options!

This app is for:

* Anyone who is wondering how to get out of debt and has yet to find a suitable answer.

* If you are only just able to make the minimum repayments across multiple types of unsecured debt including credit cards, student loans, personal loans, lines of credit, and others.

* You have too many different types of debt that it's hard to keep track of payments.

* You want to lower your overall level of debt or interest rates.

If this sounds like you, debt relief programs could be the right answer!

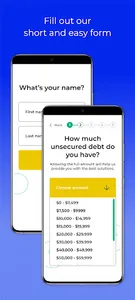

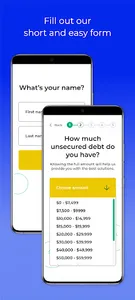

The app can quickly help you find an emergency debt settlement/consolidation program in a matter of minutes. All you have to do is open the app and tap the "Start Now" button and provide:

* Your full legal first and last name

* Your address and zip code

* The total amount of unsecured debt you need help paying off

* A contact phone number

* A contact email address

It's as easy as that, you may then gain access to some of the best debt relief companies!

Note: Debt settlement and consolidation can currently only apply to unsecured debts. These are standard debts such as credit card debt, personal loans, some student loans, some business lines of credit, bank overdrafts, and any other similar product where you have not signed any collateral like a house, car, or other items of value in the case of default (failing to make payments).

Most personal debts outside of home mortgages and large corporate business loans are unsecured, but if you are unsure, check the agreement between you and the lender or contact them directly to ask if it is unsecured.

Legal Requirements:

* Credit must have been obtained lawfully from a certified lender

* The recipient must be at least 18 years of age at the time of obtaining the credit.

* App users must be legal residents of the United States with a fixed address.

So, what are you waiting for? If you need help with loan or credit card debt, the solution is just around the corner!

==============================

Material disclosure, rates, and fees

This app is not a lender, creditor, or debt collector. This is not a loan. Referral arrangements with our partners make it possible for you to apply for a loan. The operator of this app does not make any credit decisions. Independent, participating debt relief companies that you might be connected with may perform credit checks with credit reporting bureaus or obtain consumer reports, typically through alternative providers to determine credit worthiness, credit standing, and/or credit capacity. By submitting your information, you agree to allow participating companies to verify your information and check your credit.

APR Disclosure

The APR is the annual percentage rate charged for loans. It depends on how much you borrow, for how long, and the lender's policies. Some states legally limit APRs. Annual Percentage Rates provided by our partners range from 5.99% to 35.99%. Loan repayment terms vary depending on the loan amount, individual lender policies, and the type of loan. Repayment terms range between 65 days to 3 years. Failure to repay a loan can result in extra fees, interest, collection proceedings, and a hit to your credit score.

Below is a representative example of how APR might be calculated:

A loan of $1,000 taken out over a one-year period with a 20% APR will cost you:

* Total charge for loan: $1,000 * 0.20 (20% APR) = $200

* Total amount you'll repay: $1,000 + $200 = $1,200

* Monthly payment: $1,200 / 12 = $100

Show More