With this income tax calculator app, you can estimate your tax liabilities for specific financial years and regimes. Includes options for different income sources, deductions, and TDS entries.

AppRecs review analysis

AppRecs rating 1.8. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★☆☆☆☆

1.8

AppRecs Rating

Ratings breakdown

5 star

7%

4 star

7%

3 star

7%

2 star

16%

1 star

62%

What to know

✓

Authentic reviews

Natural distribution, no red flags

⚠

Mixed user feedback

Average 1.8★ rating suggests room for improvement

⚠

High negative review ratio

78% of sampled ratings are 1–2 stars

About Income Tax Calculator

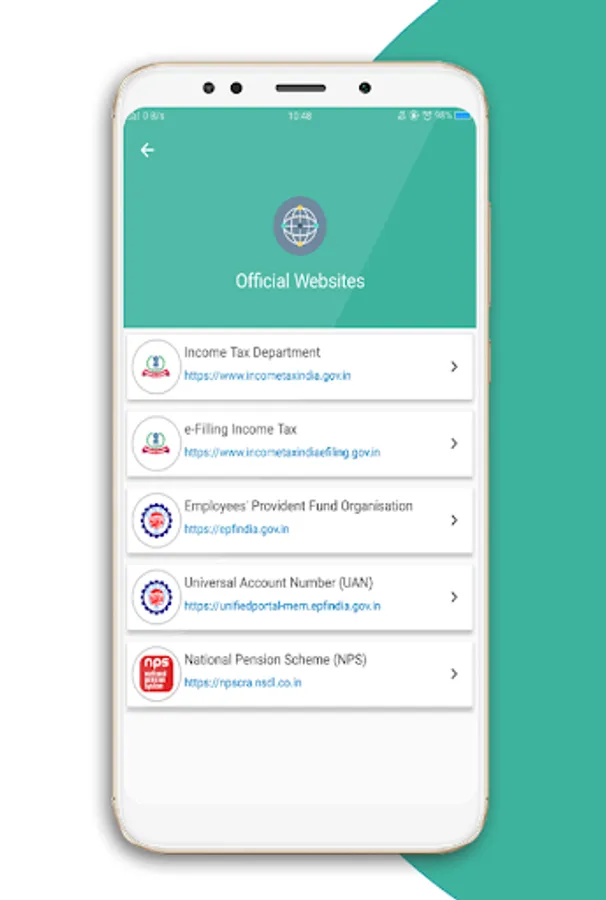

DISCLAIMER: This app is not an official government app neither it is affiliated with any government entity. It just provides a collection of government websites that are easily available over the internet.

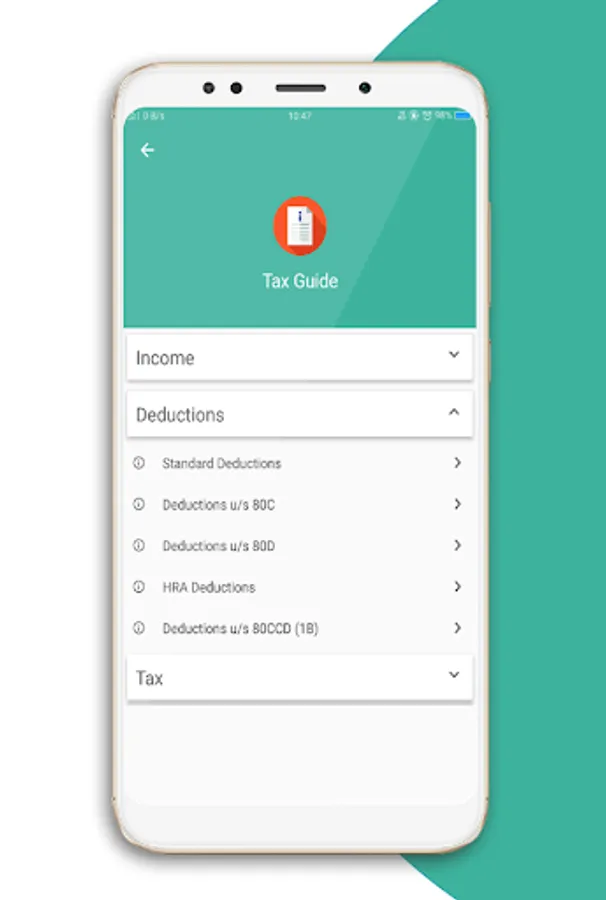

Income Tax Calculator is an easy-to-use Android application that helps you estimate your taxes based on your income. One can easily check his/her tax liabilities for FY 2022-23 and FY 2023-24 for both the New and Old Tax Regimes.

Income Tax Calculator will help you make decisions about the New or Old Regime.

How to use the Income-tax calculator app?

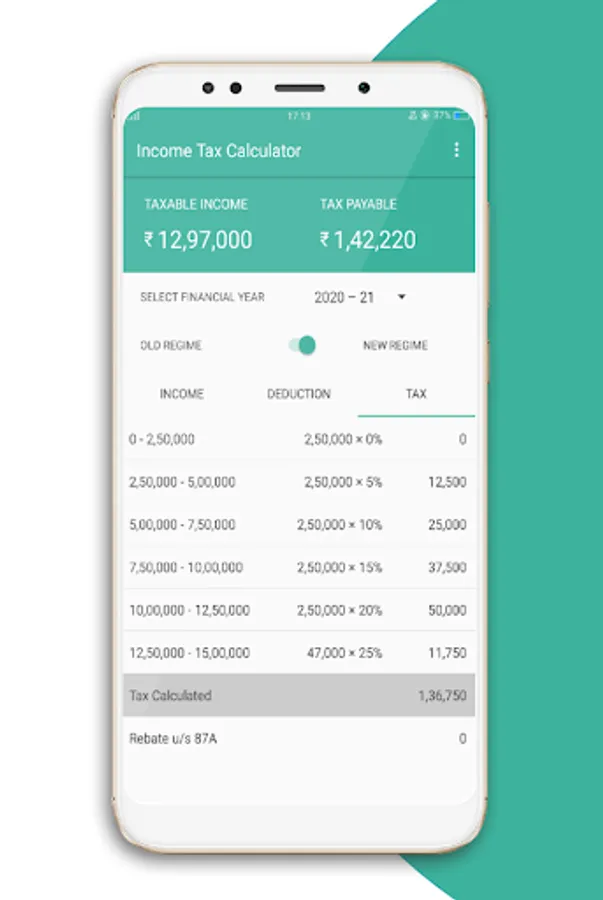

1. Choose the financial year for which you want your taxes to be calculated.

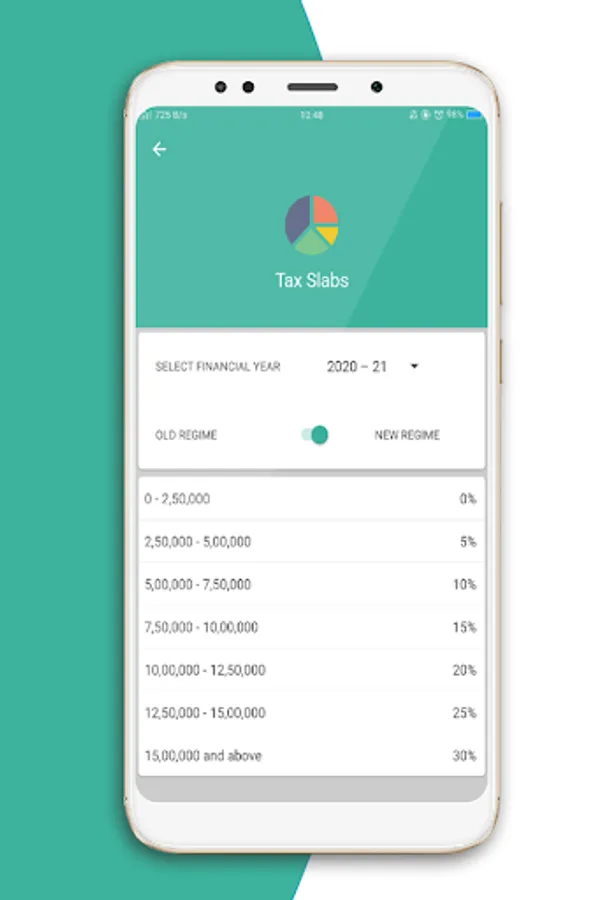

2. For FY 2022-23 and FY 2023-24, you can opt for Old Regime or New Regime.

3. Select your age accordingly. Tax liability in India differs based on age groups (not applicable for FY 2020-21 New Regime).

4. Click the Income Tab. Enter your Income from Salary, Income from House, and Other sources of income.

5. Click the Deduction Tab. Enter investments you are planning to do in that year.

6. Click the Tax Tab. See your Tax calculations. Enter TDS if already some amount of tax was deducted at the source.

Easy to use income tax calculator for checking Income Tax for FY 2022-23 and FY 2023-24 New and Old Regimes.

Developer: Smart Up

Email: smartlogic08@gmail.com

Website: https://smartupapps.in

Follow us at: https://www.facebook.com/smartup8

Income Tax Calculator is an easy-to-use Android application that helps you estimate your taxes based on your income. One can easily check his/her tax liabilities for FY 2022-23 and FY 2023-24 for both the New and Old Tax Regimes.

Income Tax Calculator will help you make decisions about the New or Old Regime.

How to use the Income-tax calculator app?

1. Choose the financial year for which you want your taxes to be calculated.

2. For FY 2022-23 and FY 2023-24, you can opt for Old Regime or New Regime.

3. Select your age accordingly. Tax liability in India differs based on age groups (not applicable for FY 2020-21 New Regime).

4. Click the Income Tab. Enter your Income from Salary, Income from House, and Other sources of income.

5. Click the Deduction Tab. Enter investments you are planning to do in that year.

6. Click the Tax Tab. See your Tax calculations. Enter TDS if already some amount of tax was deducted at the source.

Easy to use income tax calculator for checking Income Tax for FY 2022-23 and FY 2023-24 New and Old Regimes.

Developer: Smart Up

Email: smartlogic08@gmail.com

Website: https://smartupapps.in

Follow us at: https://www.facebook.com/smartup8