WalletHub is the first app to offer 100% free credit scores, WalletScores, and full credit reports updated daily. Plus, get personalized tips for how to save money and improve both your credit score and your WalletScore. Download this award-winning app and reach top WalletFitness®.

Sign up for a free WalletHub account to get:

• 100% free credit scores, updated daily

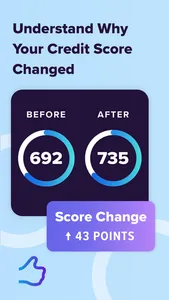

• A clear plan for improving your credit score

• The all-new WalletScore to give you a holistic picture of your financial health

• Free credit reports, updated daily

• 24/7 credit monitoring to warn you of identity theft and fraud

• Savings alerts so you can repay your debt faster and avoid overpaying on your credit cards and loans

• Your custom-built debt payoff roadmap

2,000+ News Mentions, Including:

• The Wall Street Journal

• The New York Times

• The Washington Post

• CNBC

• Yahoo Finance

• MSN Money

• Forbes

Frequently Asked Questions:

Q: Is WalletHub Really Free?

A: Yes, it’s 100% free, and we’ll never even ask you for a credit card number.

Q: Will Using WalletHub Hurt My Credit?

A: Not at all. It’s only a “soft” inquiry when you check your latest credit report and score through WalletHub. So WalletHub can only help your credit as a result.

Q: Why WalletHub?

A: While there are a number of places to get a free credit score and free credit report, WalletHub is the first free credit score app to offer daily updates, a clear action plan for credit improvement, and your WalletScore. Your WalletScore gives you insight into your overall financial performance, which you won’t find on other apps that just look at your credit. We’ll also give you a personalized debt payoff plan to help you maximize your savings and get out of debt faster.

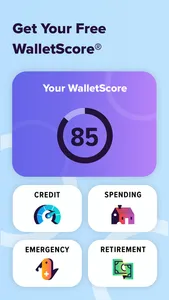

Q: What Is A WalletScore?

A: WalletScore is an innovative tool that tells you how financially healthy you are, based on your:

Credit: This category measures your creditworthiness, which impacts your ability to borrow at a good price when you need to.

Spending: This category measures your ability to comfortably pay off your expenses and debt, to ensure you are living within your means.

Emergency Preparedness: This category measures your ability to handle a financial emergency, considering your savings, insurance policies, etc.

Retirement: This category measures your ability to retire at a reasonable age with sufficient funds from your income sources, investment accounts and other assets.

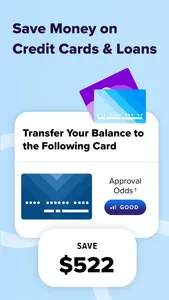

Q: How Will WalletHub Save Me Money?

A: Whether you have excellent credit or bad credit, WalletHub will automatically hunt for better deals so you’ll never get taken advantage of. And if your credit isn’t perfect, we’ll help you improve it, enabling you to save thousands each year on your credit cards, mortgage, auto loan, student loan, car insurance and more. A strong credit rating will help indirectly with potential employers and landlords, too.

Beyond your credit score, WalletHub’s WalletScore will help you save money in the long run by giving you the tools to improve your emergency preparedness, spending habits and retirement planning.

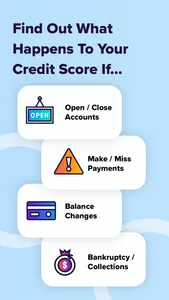

Q: Can WalletHub Help Me Improve My Credit?

A: WalletHub analyzes your latest credit score and report to identify your financial strengths and weaknesses. We then run a number of simulations to determine how different actions will impact your credit standing. Finally, we present you with a customized credit-improvement plan, along with a comprehensive credit scorecard.

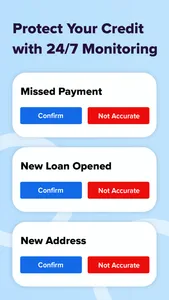

Q: How Does 24/7 Credit Monitoring Work?

A: WalletHub’s free credit monitoring keeps a round-the-clock watch on your TransUnion credit report and will notify you whenever there is an important change. In addition to email alerts, you can also customize your WalletHub account to receive SMS alerts, which most credit monitoring services don’t provide. This will give you the chance to quickly confirm the accuracy of credit-report changes and, if necessary, start sorting out any problems before they really get out of hand.

Sign up for a free WalletHub account to get:

• 100% free credit scores, updated daily

• A clear plan for improving your credit score

• The all-new WalletScore to give you a holistic picture of your financial health

• Free credit reports, updated daily

• 24/7 credit monitoring to warn you of identity theft and fraud

• Savings alerts so you can repay your debt faster and avoid overpaying on your credit cards and loans

• Your custom-built debt payoff roadmap

2,000+ News Mentions, Including:

• The Wall Street Journal

• The New York Times

• The Washington Post

• CNBC

• Yahoo Finance

• MSN Money

• Forbes

Frequently Asked Questions:

Q: Is WalletHub Really Free?

A: Yes, it’s 100% free, and we’ll never even ask you for a credit card number.

Q: Will Using WalletHub Hurt My Credit?

A: Not at all. It’s only a “soft” inquiry when you check your latest credit report and score through WalletHub. So WalletHub can only help your credit as a result.

Q: Why WalletHub?

A: While there are a number of places to get a free credit score and free credit report, WalletHub is the first free credit score app to offer daily updates, a clear action plan for credit improvement, and your WalletScore. Your WalletScore gives you insight into your overall financial performance, which you won’t find on other apps that just look at your credit. We’ll also give you a personalized debt payoff plan to help you maximize your savings and get out of debt faster.

Q: What Is A WalletScore?

A: WalletScore is an innovative tool that tells you how financially healthy you are, based on your:

Credit: This category measures your creditworthiness, which impacts your ability to borrow at a good price when you need to.

Spending: This category measures your ability to comfortably pay off your expenses and debt, to ensure you are living within your means.

Emergency Preparedness: This category measures your ability to handle a financial emergency, considering your savings, insurance policies, etc.

Retirement: This category measures your ability to retire at a reasonable age with sufficient funds from your income sources, investment accounts and other assets.

Q: How Will WalletHub Save Me Money?

A: Whether you have excellent credit or bad credit, WalletHub will automatically hunt for better deals so you’ll never get taken advantage of. And if your credit isn’t perfect, we’ll help you improve it, enabling you to save thousands each year on your credit cards, mortgage, auto loan, student loan, car insurance and more. A strong credit rating will help indirectly with potential employers and landlords, too.

Beyond your credit score, WalletHub’s WalletScore will help you save money in the long run by giving you the tools to improve your emergency preparedness, spending habits and retirement planning.

Q: Can WalletHub Help Me Improve My Credit?

A: WalletHub analyzes your latest credit score and report to identify your financial strengths and weaknesses. We then run a number of simulations to determine how different actions will impact your credit standing. Finally, we present you with a customized credit-improvement plan, along with a comprehensive credit scorecard.

Q: How Does 24/7 Credit Monitoring Work?

A: WalletHub’s free credit monitoring keeps a round-the-clock watch on your TransUnion credit report and will notify you whenever there is an important change. In addition to email alerts, you can also customize your WalletHub account to receive SMS alerts, which most credit monitoring services don’t provide. This will give you the chance to quickly confirm the accuracy of credit-report changes and, if necessary, start sorting out any problems before they really get out of hand.

Show More