Welcome to LendingTree, the comprehensive financial planning app that puts everything you need right at your fingertips. With powerful tools to track your credit score, manage your budget, shop for loans, and more, you'll always be in control of your finances.

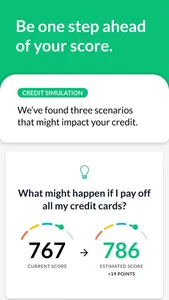

IMPROVE YOUR CREDIT SCORE

• Track your credit score as often as you want – it won’t hurt your credit!

• Understand what's impacting your score in the Credit Factor pages

• See how potential actions could change your score with the credit simulator

• Get recommendations on how to improve your credit

TRACK ALL YOUR ACCOUNTS

• View all your loans, credit cards and accounts in one place

• Monitor your expenses and build a budget

• Know how much money you’ll have next month

GET RID OF DEBT

• Work towards financial freedom

• Compare refinance and debt consolidation options

• Find your best debt payoff strategy, including avalanche and snowball methods

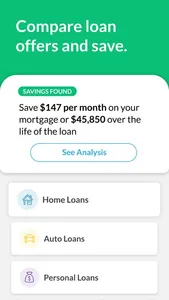

FIND THE BEST LOAN RATES

• Get access to LendingTree's trusted network of lenders

• Find personalized loan offers that fit your budget and goals

• Compare rates and terms for personal loans, auto loans, home loans, credit cards, insurance, and more

• Read lender reviews to find the best fit for you

FIND WAYS TO SAVE

• Take advantage of personalized savings recommendations

• Get pre-approved loan offers that fit your budget and goals

• Compare loans and interest rates to get your best deal

Personal Loan Disclosure

A Personal Loan can offer funds relatively quickly once you qualify you could have your funds within a few days to a week. Lenders may charge an origination fee generally around 1% of the amount sought. Be sure to ask about all fees, costs and terms associated with each loan product. Loan amounts of $1,000 up to $50,000 are available through participating lenders; however, your state, credit history, credit score, personal financial situation, and lender underwriting criteria can impact the amount, fees, terms and rates offered.

As of 27-Apr-23, LendingTree Personal Loan consumers were seeing match rates as low as 6.37% (on a $1000 loan amount for a term of three (3) years. Offers provided to customers feature rate quotes on LendingTree of no greater than 35.99% APR with repayment terms from 61 days to 180 months. Rates and APRs were based on a self-identified credit score of 700 or higher, zero down payment, origination fees of $0 to $100 (depending on loan amount and term selected). Here are some examples of matches consumers were receiving during this time period:

Here are is an examples of a match consumers have received during this time period:

Loan amount: $10,000

Loan Term (Years): 3

Rate: 6.99%

APR: 6.99%

Origination Fee: $200.00 (2% of loan)

Estimated Fixed Monthly Loan Payment: $308.73

Total Cost of Loan with 36 Payments: 11,114.28

Total Interest Paid: $1,114.28

IMPROVE YOUR CREDIT SCORE

• Track your credit score as often as you want – it won’t hurt your credit!

• Understand what's impacting your score in the Credit Factor pages

• See how potential actions could change your score with the credit simulator

• Get recommendations on how to improve your credit

TRACK ALL YOUR ACCOUNTS

• View all your loans, credit cards and accounts in one place

• Monitor your expenses and build a budget

• Know how much money you’ll have next month

GET RID OF DEBT

• Work towards financial freedom

• Compare refinance and debt consolidation options

• Find your best debt payoff strategy, including avalanche and snowball methods

FIND THE BEST LOAN RATES

• Get access to LendingTree's trusted network of lenders

• Find personalized loan offers that fit your budget and goals

• Compare rates and terms for personal loans, auto loans, home loans, credit cards, insurance, and more

• Read lender reviews to find the best fit for you

FIND WAYS TO SAVE

• Take advantage of personalized savings recommendations

• Get pre-approved loan offers that fit your budget and goals

• Compare loans and interest rates to get your best deal

Personal Loan Disclosure

A Personal Loan can offer funds relatively quickly once you qualify you could have your funds within a few days to a week. Lenders may charge an origination fee generally around 1% of the amount sought. Be sure to ask about all fees, costs and terms associated with each loan product. Loan amounts of $1,000 up to $50,000 are available through participating lenders; however, your state, credit history, credit score, personal financial situation, and lender underwriting criteria can impact the amount, fees, terms and rates offered.

As of 27-Apr-23, LendingTree Personal Loan consumers were seeing match rates as low as 6.37% (on a $1000 loan amount for a term of three (3) years. Offers provided to customers feature rate quotes on LendingTree of no greater than 35.99% APR with repayment terms from 61 days to 180 months. Rates and APRs were based on a self-identified credit score of 700 or higher, zero down payment, origination fees of $0 to $100 (depending on loan amount and term selected). Here are some examples of matches consumers were receiving during this time period:

Here are is an examples of a match consumers have received during this time period:

Loan amount: $10,000

Loan Term (Years): 3

Rate: 6.99%

APR: 6.99%

Origination Fee: $200.00 (2% of loan)

Estimated Fixed Monthly Loan Payment: $308.73

Total Cost of Loan with 36 Payments: 11,114.28

Total Interest Paid: $1,114.28

Show More