About Financial Forecast 2

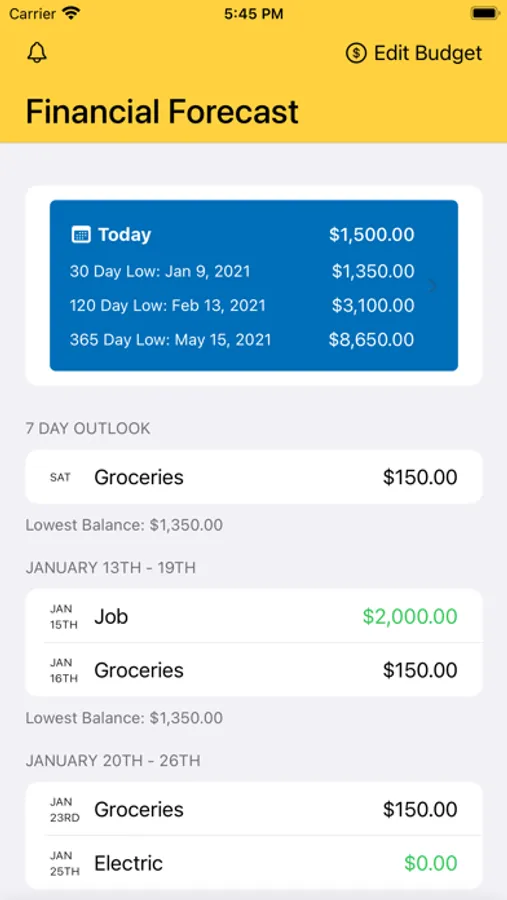

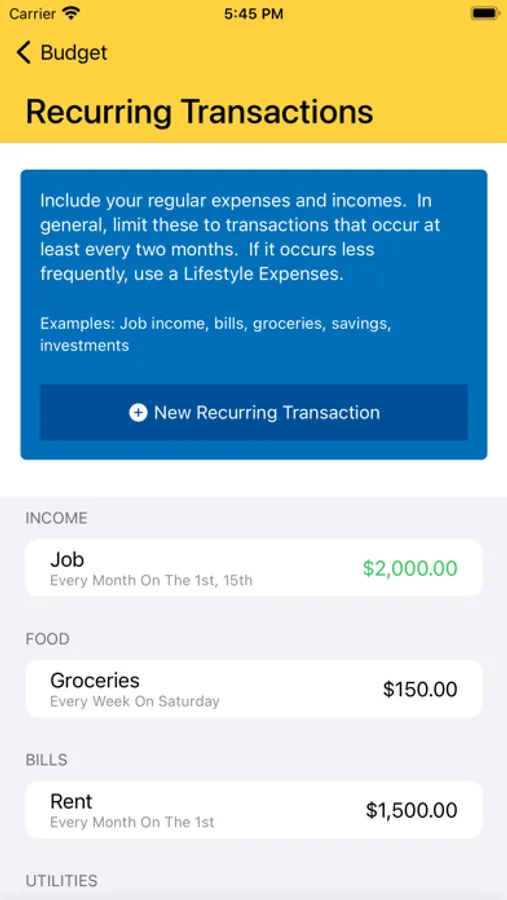

Financial Forecast is a simple app: Enter your repeating expenses and income sources and Financial Forecast will create a "calendar" for your money.

- See your lowest balance in the next 30 days

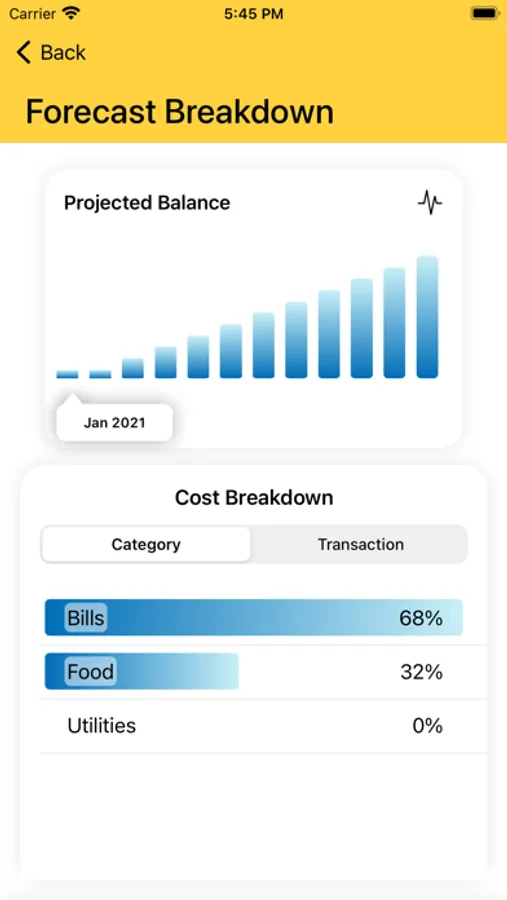

- Graph your balance over the next year

Financial Forecast also helps you evaluate one-time expenses. Enter concert tickets to see how that impacts your balance.

Why use Financial Forecast?

- Break the "rich-poor" cycle: After getting a paycheck many people feel rich and make a large purchase. At the end of the month those same people feel poor. Financial Forecast lets you focus on your lowest balance. That's the number that really matters.

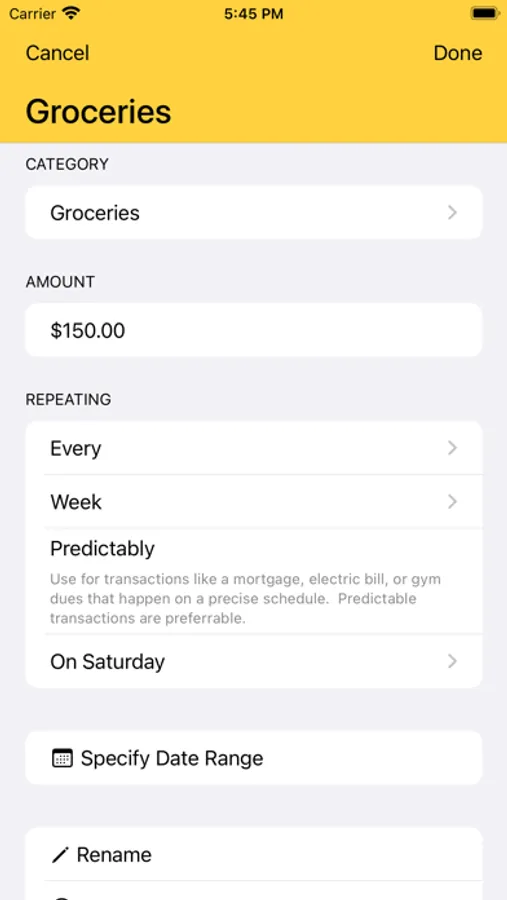

- Many budgeting apps expect you to enter a monthly amount for expenses like groceries. For many, groceries is a weekly cost, not a monthly cost. How can you possibly enter an accurate budget if the number of weeks differs month to month?

Have irregular occurrences?

- Get paid bi-weekly? No problem

- Water bill is paid every other month? You're covered.

- See your lowest balance in the next 30 days

- Graph your balance over the next year

Financial Forecast also helps you evaluate one-time expenses. Enter concert tickets to see how that impacts your balance.

Why use Financial Forecast?

- Break the "rich-poor" cycle: After getting a paycheck many people feel rich and make a large purchase. At the end of the month those same people feel poor. Financial Forecast lets you focus on your lowest balance. That's the number that really matters.

- Many budgeting apps expect you to enter a monthly amount for expenses like groceries. For many, groceries is a weekly cost, not a monthly cost. How can you possibly enter an accurate budget if the number of weeks differs month to month?

Have irregular occurrences?

- Get paid bi-weekly? No problem

- Water bill is paid every other month? You're covered.