India's Digital Loan Referral Chain App for Associates & Customers

(A) Who are we?

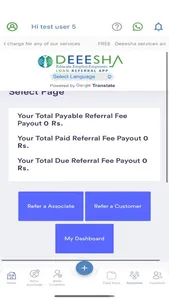

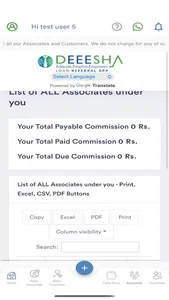

DEEESHA (www.deeesha.com) is a Digital Loan Referral Chain App offering SAME-DAY payouts (income) before 12 mid-night! to our Associates who bring Associates / Customers to us - with 1% to 2.25% payout on Unsecured Loan & 0.2% to 0.7% payout on Secured Loan disbursals. Refer associates & customers and track the status of all your loan disbursements live on our app!

DEEESHA is a free app that helps associates refer loan customers, track their referrals, monitor their payouts, etc.

We have approx. 10,000 Associates working with us PAN INDIA.

(B) What loan products / services do we offer?

· Unsecured Personal Loan

· Unsecured / Secured Business Loan

· Home Loan & Loan Against Property

· CC / OD

· Balance Transfer

· Education Loan

· Gold Loan, etc.

(C) Who are our lending partners and in which city?

We are partner to almost all Banks & NBFCs (50+) in 1300+ cities / towns in India to facilitate lending - which include ICICI, Axis, Kotak, Aditya Birla Capital, Tata Capital, Axis Finance, Fullerton India, Federal, Centrum, Aadhar Housing, Poonawalla Fincorp, Shriram, Godrej, Incred, Moneytap, Moneyview, Paysense, Indiabulls, Ugrow, Unity, Karur, Neogrowth & Lendingkart.

(D) What are our Key features?

* Instant Loan: Apply for a personal, business, Home, LAP, education loan digitally & meet your funding requirement in no time.

* Your data is safe: Your personal details will be safe with highest levels of data security protocols.

• Expert assistance for free till disbursal

• For existing borrowers, wide choice to transfer your home/business/personal loan

(E) Loan Terms for Personal Loan:

1. Get loans ranging from INR 5,000 to INR 20,00,000

2. 100% online loan application process - Only few documents to be uploaded on the application

3. Disbursal within 1-7 days

4. Minimum APR (Annual Percentage Rate) is 10.99% and the Maximum APR is 30%

5. Minimum Tenure is 6 months and Maximum Tenure is 5 years

6. Processing Fee is 2% - 4%

7. Get a higher loan on successful repayment

*The annual interest rates and processing fee will vary as per the risk profile of the customers and the selected tenure.

Example

Loan Amount: ₹20,000

Tenure:180 days (6 months)

Interest Charged: ₹ 1,426 (24% per annum)

Processing Fee: ₹236 (1% of Loan Amount - ₹200 + GST @18% - ₹36)

Amount Disbursed: ₹19,764

EMI Amount: ₹ 3,571

Loan amount is ₹ 20,000. Disbursed amount is ₹ 19,764. Total loan repayment amount is ₹ 21,426.

(F) Loan Terms for Business Loan:

1. Get Loans ranging from ₹ 1,00,000 to ₹ 10,00,000.

2. 100% online loan application process- only few documents to be uploaded on the application

3. Disbursal within 1-7 days

4. Minimum APR (Annual Percentage Rate) is 11% and the Maximum APR (Annual Percentage Rate) is 25%

5. Tenure ranges from 6 months-60 months

6. Get a higher loan on successful repayment

Interest Calculation

If you avail a loan of ₹ 3,00,000 for a tenure of 12 months at 18% p.a. interest rate, the loan EMI will be ₹ 27504 and the total interest paid would be ₹ 30048

(G) Prominent Disclosures:

1 All loans are provided via RBI registered Banks & NBFC with whom we have official agreements

2 We do not provide any pay-day loans or loans with less than 60 day repayment period or having Maximum APR beyond 30% - in accordance with Appstore Policy.

3 We provide full disclosure about our usage of any customer data and permissions at various points (terms here https://deeesha.com/terms_condition.php and privacy policy here https://deeesha.com/privacy.php )

(H) Security & Privacy Policy

DEEESHA app ensures the safety of its customers via standard security. In simple terms, we do not share personal information with third-party apps.

(I) Contact Us:

Helpdesk: - +91-90826 58097

E-mail: support@deeesha.com

Also check out:

Webpage: www.deeesha.com

Terms & Conditions: https://deeesha.com/terms_condition.php

Privacy: https://deeesha.com/privacy.php

[:mav: 1.2.2]

(A) Who are we?

DEEESHA (www.deeesha.com) is a Digital Loan Referral Chain App offering SAME-DAY payouts (income) before 12 mid-night! to our Associates who bring Associates / Customers to us - with 1% to 2.25% payout on Unsecured Loan & 0.2% to 0.7% payout on Secured Loan disbursals. Refer associates & customers and track the status of all your loan disbursements live on our app!

DEEESHA is a free app that helps associates refer loan customers, track their referrals, monitor their payouts, etc.

We have approx. 10,000 Associates working with us PAN INDIA.

(B) What loan products / services do we offer?

· Unsecured Personal Loan

· Unsecured / Secured Business Loan

· Home Loan & Loan Against Property

· CC / OD

· Balance Transfer

· Education Loan

· Gold Loan, etc.

(C) Who are our lending partners and in which city?

We are partner to almost all Banks & NBFCs (50+) in 1300+ cities / towns in India to facilitate lending - which include ICICI, Axis, Kotak, Aditya Birla Capital, Tata Capital, Axis Finance, Fullerton India, Federal, Centrum, Aadhar Housing, Poonawalla Fincorp, Shriram, Godrej, Incred, Moneytap, Moneyview, Paysense, Indiabulls, Ugrow, Unity, Karur, Neogrowth & Lendingkart.

(D) What are our Key features?

* Instant Loan: Apply for a personal, business, Home, LAP, education loan digitally & meet your funding requirement in no time.

* Your data is safe: Your personal details will be safe with highest levels of data security protocols.

• Expert assistance for free till disbursal

• For existing borrowers, wide choice to transfer your home/business/personal loan

(E) Loan Terms for Personal Loan:

1. Get loans ranging from INR 5,000 to INR 20,00,000

2. 100% online loan application process - Only few documents to be uploaded on the application

3. Disbursal within 1-7 days

4. Minimum APR (Annual Percentage Rate) is 10.99% and the Maximum APR is 30%

5. Minimum Tenure is 6 months and Maximum Tenure is 5 years

6. Processing Fee is 2% - 4%

7. Get a higher loan on successful repayment

*The annual interest rates and processing fee will vary as per the risk profile of the customers and the selected tenure.

Example

Loan Amount: ₹20,000

Tenure:180 days (6 months)

Interest Charged: ₹ 1,426 (24% per annum)

Processing Fee: ₹236 (1% of Loan Amount - ₹200 + GST @18% - ₹36)

Amount Disbursed: ₹19,764

EMI Amount: ₹ 3,571

Loan amount is ₹ 20,000. Disbursed amount is ₹ 19,764. Total loan repayment amount is ₹ 21,426.

(F) Loan Terms for Business Loan:

1. Get Loans ranging from ₹ 1,00,000 to ₹ 10,00,000.

2. 100% online loan application process- only few documents to be uploaded on the application

3. Disbursal within 1-7 days

4. Minimum APR (Annual Percentage Rate) is 11% and the Maximum APR (Annual Percentage Rate) is 25%

5. Tenure ranges from 6 months-60 months

6. Get a higher loan on successful repayment

Interest Calculation

If you avail a loan of ₹ 3,00,000 for a tenure of 12 months at 18% p.a. interest rate, the loan EMI will be ₹ 27504 and the total interest paid would be ₹ 30048

(G) Prominent Disclosures:

1 All loans are provided via RBI registered Banks & NBFC with whom we have official agreements

2 We do not provide any pay-day loans or loans with less than 60 day repayment period or having Maximum APR beyond 30% - in accordance with Appstore Policy.

3 We provide full disclosure about our usage of any customer data and permissions at various points (terms here https://deeesha.com/terms_condition.php and privacy policy here https://deeesha.com/privacy.php )

(H) Security & Privacy Policy

DEEESHA app ensures the safety of its customers via standard security. In simple terms, we do not share personal information with third-party apps.

(I) Contact Us:

Helpdesk: - +91-90826 58097

E-mail: support@deeesha.com

Also check out:

Webpage: www.deeesha.com

Terms & Conditions: https://deeesha.com/terms_condition.php

Privacy: https://deeesha.com/privacy.php

[:mav: 1.2.2]

Show More