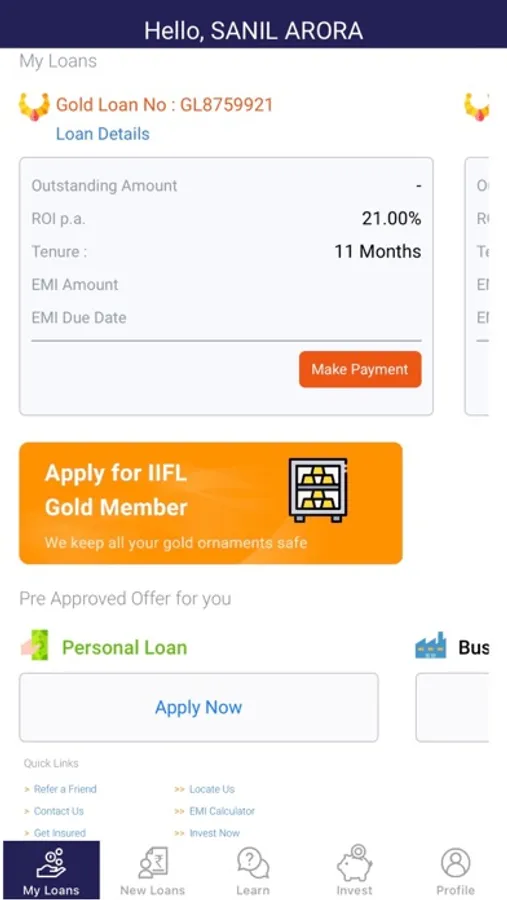

In this finance app, you can apply for various loans such as gold, personal, business, and home loans through a digital platform and track your application status. Includes features like minimal documentation and quick disbursal.

About IIFL Loans

IIFL Finance is the one-stop solution for all your financial needs. Whether you seek Gold Loan, Personal Loan, Business Loan, or Home Loan, the hassle-free process from application to the amount transfer makes it one of the most preferred choices. Plus, we also cater to your insurance and investment needs.

Why choose IIFL Finance?

- Trusted and reputed brand name

- Simple paperless application process

- Affordable interest rates

- Caters to multiple requirements

- Flexible repayment options

- Quicker approval and disbursal

- Minimal documentation required

Products offered by IIFL Loans app:

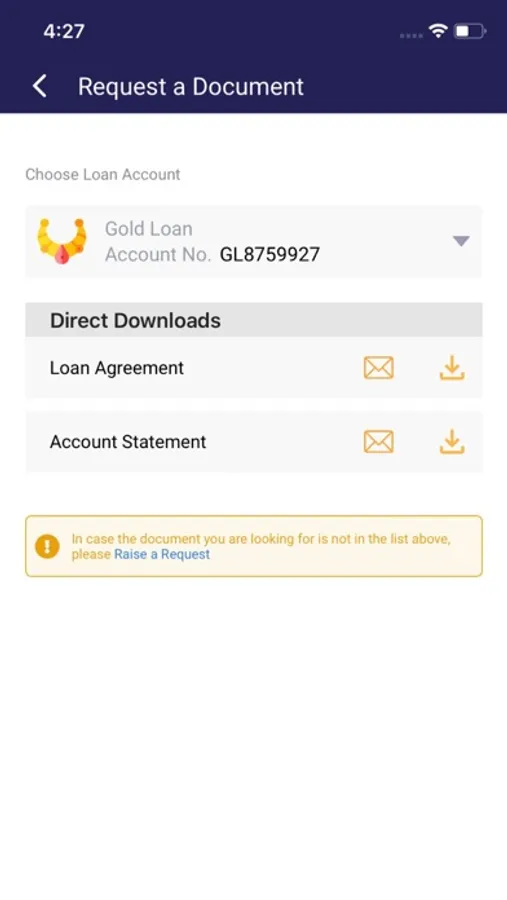

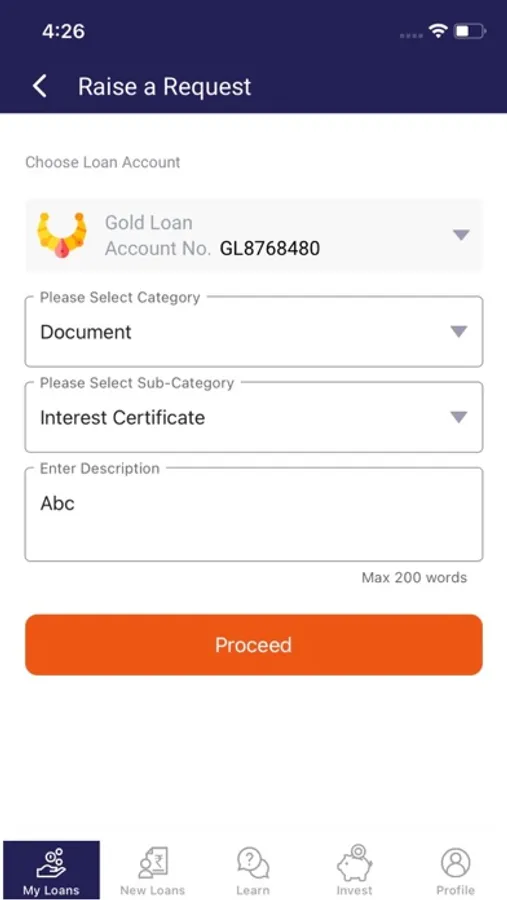

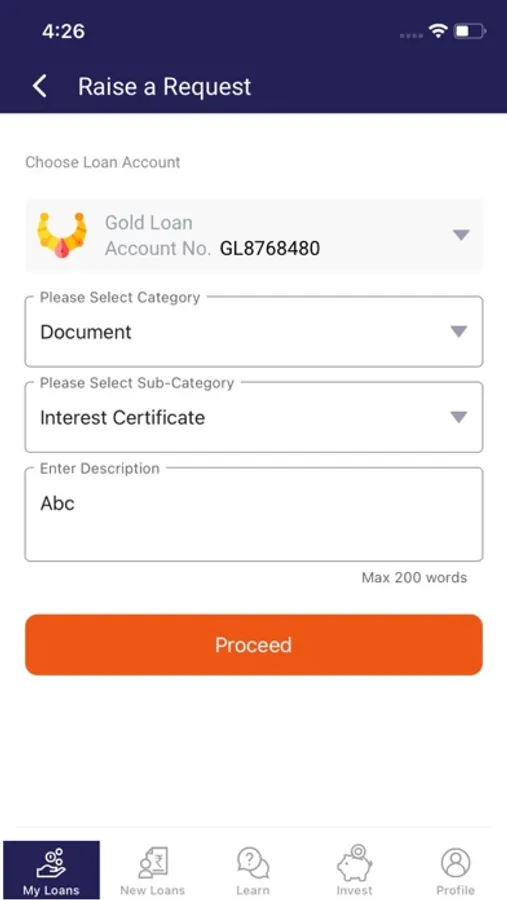

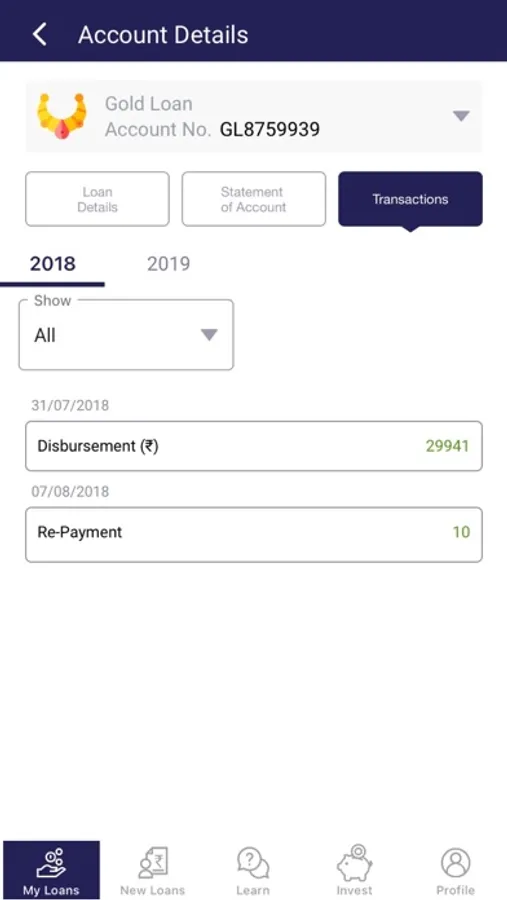

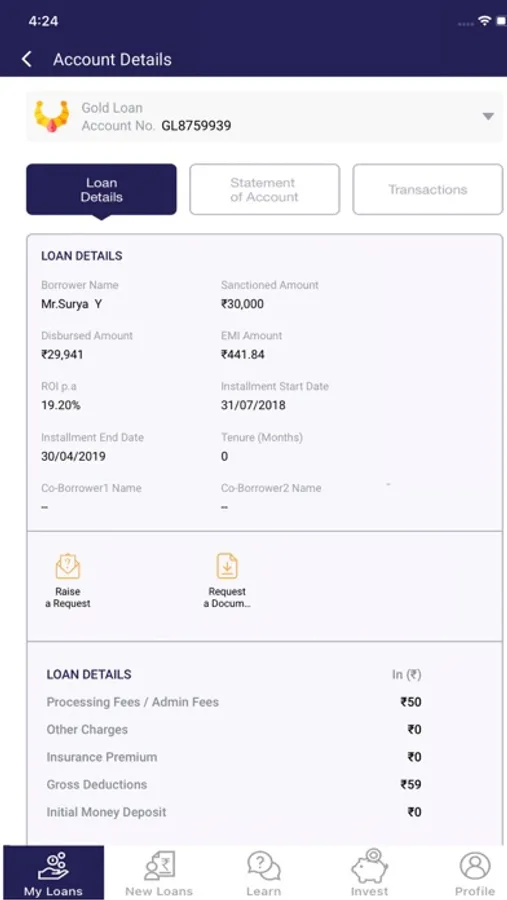

Gold Loan:

IIFL's loan app offers instant loans against the value of your gold with minimal effort. Through this app, you can easily make appointments from the comfort of your own home or you can visit your nearest branch to pledge your gold.

Why choose IIFL Gold Loan?

- Easy application process

- Zero hidden costs

- Low interest rates

- Quick disbursal

- Offers unique and comprehensive gold loans

Business Loan:

Whether you are an entrepreneur or an established businessperson, applying for a business loan has never been this easy. IIFL loans app ensures the entire process is digital, lightning-fast, and with minimum paperwork.

Why choose IIFL Business Loan?

- Loans for businesses of any size

- Entirely digital and paperless process

- No collateral needed

- Offers affordable and attractive interest rates

- MSME business loans can help you invest in vital infrastructure, machinery, plants, operations, advertising, marketing, etc.

Personal Loan:

Wedding, vacation, home renovation, car makeover – you may have multiple items on your bucket list. With minimal documentation, the app can let you avail loans up to 5 lakhs.

Why choose IIFL Personal Loan?

- Attractive and affordable interest rates

- Offers better liquidity

- Achieve your personal financial goals easily

- Application is processed within minutes

- Zero extensive documentation

- Quick approval

Product Features for Personal Loan:

1. Get loans ranging from INR 5,000 to INR 5,00,000.

2. 100% online loan application process - Only a few documents need to be uploaded on the application.

3. Disbursal within 24 hours.

4. Attractive APR ranging from 21% - 30% makes repayment easy.

5. Minimum tenure is 3 months and maximum tenure is 42 months.

6. Processing fee is 2% - 6% (Minimum ₹500 to be charged). An additional convenience fee of ₹500 will be charged.

7. Get a higher loan on successful repayment.

*The annual interest rates and processing fee will vary as per the risk profile of the customers and the selected tenure.

Example:

Loan Amount: ₹20,000 - ₹3,00,000

Tenure: 180 days (6 months) - 10 months (300 days)

Interest Charged: ₹1,426 (24% per annum)

Processing Fee: ₹236 - ₹600 (12% of Loan Amount - ₹200 - ₹600 + GST @18% - ₹36 - ₹108)

EMI Amount: ₹3,571 - ₹33,980

Loan amount is ₹20,000 - ₹3,00,000. Total loan repayment amount is ₹21,426 - ₹3,33,980.

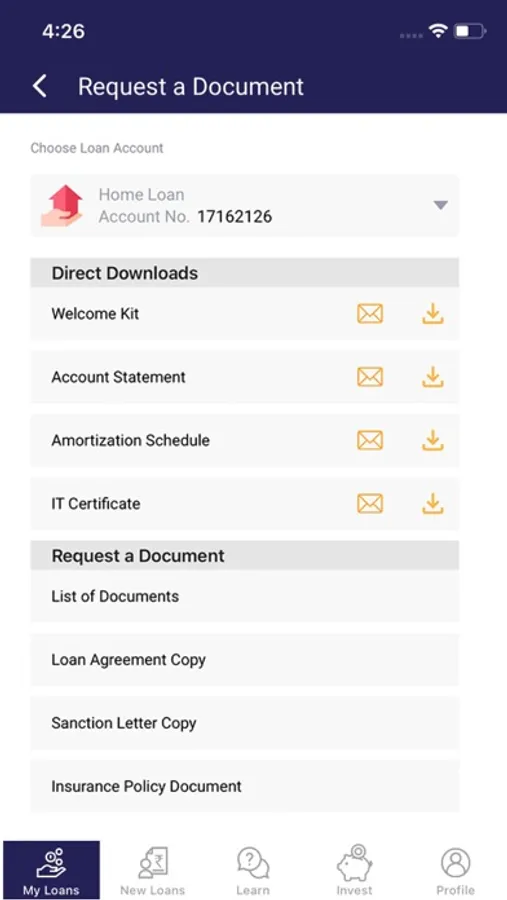

Home Loan:

IIFL Home Loans progressively works towards facilitating affordable home loans to first-time home buyers in the country.

Why choose IIFL Home Loan?

- Quick loan approval in 30 minutes*

- Loan starting from ₹2 lakh*

- Easy balance transfer

*T&C apply.

Secured Business Loan (Loan Against Property):

Setting up a small venture or need working capital to further your

business, our Secured Business Loan/Loan Against Property is the best solution for you.

Why choose IIFL Secured Business Loan?

- Maximum loan assistance

- Flexible repayment

- Jhatpat loan approval

- Lower interest rates

*T&C apply.

Any/all loan product specifications and information that may be stated are subject to change from time to time. IIFL Finance Limited (including its associates & affiliates) ("IIFL") assumes no liability or responsibility for any errors or omissions in the content stated herein, and under no circumstances shall IIFL be liable for any damage, loss, injury, or disappointment suffered by any reader.

Why choose IIFL Finance?

- Trusted and reputed brand name

- Simple paperless application process

- Affordable interest rates

- Caters to multiple requirements

- Flexible repayment options

- Quicker approval and disbursal

- Minimal documentation required

Products offered by IIFL Loans app:

Gold Loan:

IIFL's loan app offers instant loans against the value of your gold with minimal effort. Through this app, you can easily make appointments from the comfort of your own home or you can visit your nearest branch to pledge your gold.

Why choose IIFL Gold Loan?

- Easy application process

- Zero hidden costs

- Low interest rates

- Quick disbursal

- Offers unique and comprehensive gold loans

Business Loan:

Whether you are an entrepreneur or an established businessperson, applying for a business loan has never been this easy. IIFL loans app ensures the entire process is digital, lightning-fast, and with minimum paperwork.

Why choose IIFL Business Loan?

- Loans for businesses of any size

- Entirely digital and paperless process

- No collateral needed

- Offers affordable and attractive interest rates

- MSME business loans can help you invest in vital infrastructure, machinery, plants, operations, advertising, marketing, etc.

Personal Loan:

Wedding, vacation, home renovation, car makeover – you may have multiple items on your bucket list. With minimal documentation, the app can let you avail loans up to 5 lakhs.

Why choose IIFL Personal Loan?

- Attractive and affordable interest rates

- Offers better liquidity

- Achieve your personal financial goals easily

- Application is processed within minutes

- Zero extensive documentation

- Quick approval

Product Features for Personal Loan:

1. Get loans ranging from INR 5,000 to INR 5,00,000.

2. 100% online loan application process - Only a few documents need to be uploaded on the application.

3. Disbursal within 24 hours.

4. Attractive APR ranging from 21% - 30% makes repayment easy.

5. Minimum tenure is 3 months and maximum tenure is 42 months.

6. Processing fee is 2% - 6% (Minimum ₹500 to be charged). An additional convenience fee of ₹500 will be charged.

7. Get a higher loan on successful repayment.

*The annual interest rates and processing fee will vary as per the risk profile of the customers and the selected tenure.

Example:

Loan Amount: ₹20,000 - ₹3,00,000

Tenure: 180 days (6 months) - 10 months (300 days)

Interest Charged: ₹1,426 (24% per annum)

Processing Fee: ₹236 - ₹600 (12% of Loan Amount - ₹200 - ₹600 + GST @18% - ₹36 - ₹108)

EMI Amount: ₹3,571 - ₹33,980

Loan amount is ₹20,000 - ₹3,00,000. Total loan repayment amount is ₹21,426 - ₹3,33,980.

Home Loan:

IIFL Home Loans progressively works towards facilitating affordable home loans to first-time home buyers in the country.

Why choose IIFL Home Loan?

- Quick loan approval in 30 minutes*

- Loan starting from ₹2 lakh*

- Easy balance transfer

*T&C apply.

Secured Business Loan (Loan Against Property):

Setting up a small venture or need working capital to further your

business, our Secured Business Loan/Loan Against Property is the best solution for you.

Why choose IIFL Secured Business Loan?

- Maximum loan assistance

- Flexible repayment

- Jhatpat loan approval

- Lower interest rates

*T&C apply.

Any/all loan product specifications and information that may be stated are subject to change from time to time. IIFL Finance Limited (including its associates & affiliates) ("IIFL") assumes no liability or responsibility for any errors or omissions in the content stated herein, and under no circumstances shall IIFL be liable for any damage, loss, injury, or disappointment suffered by any reader.