Getting access to working capital is historically a daunting task for many small business owners. Lendio is a leader in the online lending space for businesses through our marketplace to help them find the best offer for their business. With its mobile app, Lendio helps small business owners to better prepare their businesses for capital and manage their loan payments.

Seamlessly connect your bank accounts to manage cash flow insights and view a centralized dashboard for your business. Access capital, view forecasting/projections, accept payments, open a business bank account and get guidance to maximize your tax write-offs and savings opportunities.

Get more out of your Lendio account:

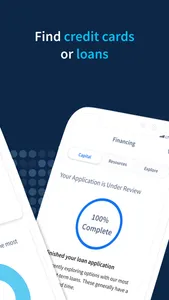

• View loan offers, monitor cash flow and connect with your personalized loan expert.

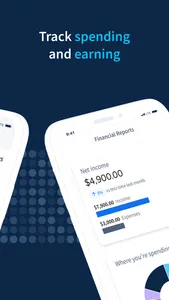

• Manage your cash flow with a centralized dashboard, no more data entry or managing complicated spreadsheets.

• Take action with financial insights to track upcoming revenue, expenses or changes in spending habits.

• Explore loan offers, credit cards, and other business funding options.

Business banking made easy:

• The Lendio Business bank account has no minimum balance requirement and no annual fees.

• Easily separate personal and business expenses and get insights based on spending habits.

• View your income, expenses, and profit all in one place.

• Auto-categorize expenses to simplify reporting and taxes.

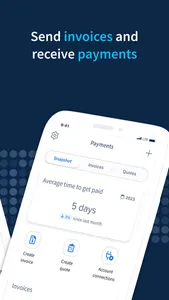

Professional invoicing:

• Create & send professional invoices to get paid on time.

• Accept credit card payments with text-to-pay, and send gentle reminders for late payments.

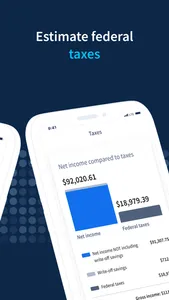

Be prepared at tax time:

• Your data is organized and categorized, with all your account balances in one place.

• Makes annual and quarterly taxes easier.

Your account information automatically syncs across the web and your phone so it’s always up to date and at your fingertips.

Have questions? Get answers from our friendly U.S. based support team at mobileapp@lendio.com

____________________________

Lendio is a financial technology company and is not a bank. Banking services provided by Thread, Member FDIC. The Lendio Visa® Debit Card is issued by Thread pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

Seamlessly connect your bank accounts to manage cash flow insights and view a centralized dashboard for your business. Access capital, view forecasting/projections, accept payments, open a business bank account and get guidance to maximize your tax write-offs and savings opportunities.

Get more out of your Lendio account:

• View loan offers, monitor cash flow and connect with your personalized loan expert.

• Manage your cash flow with a centralized dashboard, no more data entry or managing complicated spreadsheets.

• Take action with financial insights to track upcoming revenue, expenses or changes in spending habits.

• Explore loan offers, credit cards, and other business funding options.

Business banking made easy:

• The Lendio Business bank account has no minimum balance requirement and no annual fees.

• Easily separate personal and business expenses and get insights based on spending habits.

• View your income, expenses, and profit all in one place.

• Auto-categorize expenses to simplify reporting and taxes.

Professional invoicing:

• Create & send professional invoices to get paid on time.

• Accept credit card payments with text-to-pay, and send gentle reminders for late payments.

Be prepared at tax time:

• Your data is organized and categorized, with all your account balances in one place.

• Makes annual and quarterly taxes easier.

Your account information automatically syncs across the web and your phone so it’s always up to date and at your fingertips.

Have questions? Get answers from our friendly U.S. based support team at mobileapp@lendio.com

____________________________

Lendio is a financial technology company and is not a bank. Banking services provided by Thread, Member FDIC. The Lendio Visa® Debit Card is issued by Thread pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

Show More