Mortgage Loan Calculator is an application that will help you calculate the mortgage loan that best suits your needs.

It has a simple but powerful interface and you will easily obtain the monthly payment that would correspond to the data entered, such as the value of the property for which the mortgage loan is requested, the down payment made, the years of maturity or the interest rate.

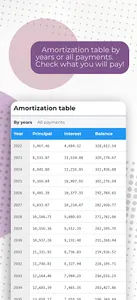

You will be able to check an accurate amortization table in which you will see, month by month or by year: the interest applied, the amortized capital and the resulting balance at that date, as well as the corresponding LTV (Loan To Value).

We also offer charts so you can easily and quickly visualize the progress of the mortgage loan throughout its duration.

Features:

- Easy to enter data: property value, down payment, interest and term in years.

- Instant calculation of the amount due per month

- Amortization tables by years or all payments, showing principal paid, interest, remaining balance and LTV

- Amazing graphs such as detailed payment made over the life of the mortgage, balance at each point in time and total breakdown of interest and principal paid

- Summary report with all calculated data

What is a mortgage?

A mortgage is a loan from a bank or a financial institution that helps the borrower purchase a house. A mortgage is secured by the home itself, so if the borrower defaults on the loan, the bank can sell the home and recoup its losses. Mortgage payments are usually monthly and consist of four components: principal, interest, taxes and insurance.

Before getting a mortgage, the borrower agrees to certain terms and conditions. These specify how long she has to pay the mortgage back, which can span decades, and how much she has to pay each year as well as what she’s required to pay at signing, which is a percentage of the home’s cost called a down payment.

These terms and conditions also specify the rate at which interest accrues, and whether it accrues at a fixed rate, which means the rate stays the same for the entire term of the loan; or at an adjustable rate, where the interest rate can be raised or lowered. Some mortgages are a hybrid of both, like the 7/1 adjustable-rate mortgage (ARM), which accrue interest at a fixed rate for the first seven years of its term, after which the lender may adjust the interest rate.

Borrowers pay back the bank for their mortgage at regular intervals, usually monthly. The payments go toward the total amount of money borrowed, which is called the principal, and the interest, although the latter is tax-deductible. The process of paying off a mortgage is called amortization.

Mortgages are considered secured loans, meaning that they’re backed up by an asset — the house — should the homeowner default. When the borrower defaults, lenders are permitted to take back the house, which is called foreclosure. For this reason, some lenders require borrowers to take out some kind of insurance, such homeowners’ insurance, which covers material damage to the property, or mortgage insurance, which protects the lender in case the borrower defaults.

It has a simple but powerful interface and you will easily obtain the monthly payment that would correspond to the data entered, such as the value of the property for which the mortgage loan is requested, the down payment made, the years of maturity or the interest rate.

You will be able to check an accurate amortization table in which you will see, month by month or by year: the interest applied, the amortized capital and the resulting balance at that date, as well as the corresponding LTV (Loan To Value).

We also offer charts so you can easily and quickly visualize the progress of the mortgage loan throughout its duration.

Features:

- Easy to enter data: property value, down payment, interest and term in years.

- Instant calculation of the amount due per month

- Amortization tables by years or all payments, showing principal paid, interest, remaining balance and LTV

- Amazing graphs such as detailed payment made over the life of the mortgage, balance at each point in time and total breakdown of interest and principal paid

- Summary report with all calculated data

What is a mortgage?

A mortgage is a loan from a bank or a financial institution that helps the borrower purchase a house. A mortgage is secured by the home itself, so if the borrower defaults on the loan, the bank can sell the home and recoup its losses. Mortgage payments are usually monthly and consist of four components: principal, interest, taxes and insurance.

Before getting a mortgage, the borrower agrees to certain terms and conditions. These specify how long she has to pay the mortgage back, which can span decades, and how much she has to pay each year as well as what she’s required to pay at signing, which is a percentage of the home’s cost called a down payment.

These terms and conditions also specify the rate at which interest accrues, and whether it accrues at a fixed rate, which means the rate stays the same for the entire term of the loan; or at an adjustable rate, where the interest rate can be raised or lowered. Some mortgages are a hybrid of both, like the 7/1 adjustable-rate mortgage (ARM), which accrue interest at a fixed rate for the first seven years of its term, after which the lender may adjust the interest rate.

Borrowers pay back the bank for their mortgage at regular intervals, usually monthly. The payments go toward the total amount of money borrowed, which is called the principal, and the interest, although the latter is tax-deductible. The process of paying off a mortgage is called amortization.

Mortgages are considered secured loans, meaning that they’re backed up by an asset — the house — should the homeowner default. When the borrower defaults, lenders are permitted to take back the house, which is called foreclosure. For this reason, some lenders require borrowers to take out some kind of insurance, such homeowners’ insurance, which covers material damage to the property, or mortgage insurance, which protects the lender in case the borrower defaults.

Show More