With this app, you can track shift mileage, log expenses, and manage tax records for rideshare driving. Includes features for GPS tracking, receipt photo storage, and business expense calculations.

About iDrive for Uber

Driving ride share for Uber or another company? Use this FREE app to find out how much money you REALLY make from your driving business.

Turn on iDrive as you start every shift. Use the app to create the tax records you need to claim tax deductible expenses.

Using the rate or a Vehicle Log Book approach? Simply turn iDrive on and off as you drive each shift. The app tracks actual Total Shift Mileage—about double partner-reported fare mileage—ready to use at tax time. It's easy.

Itemizing expenses? Add fuel and all business-related expenses—with a picture of each receipt—to create tax records. iDrive uses entered odometer readings to calculate Business Use % of your car, ready to use at tax time. It's simple.

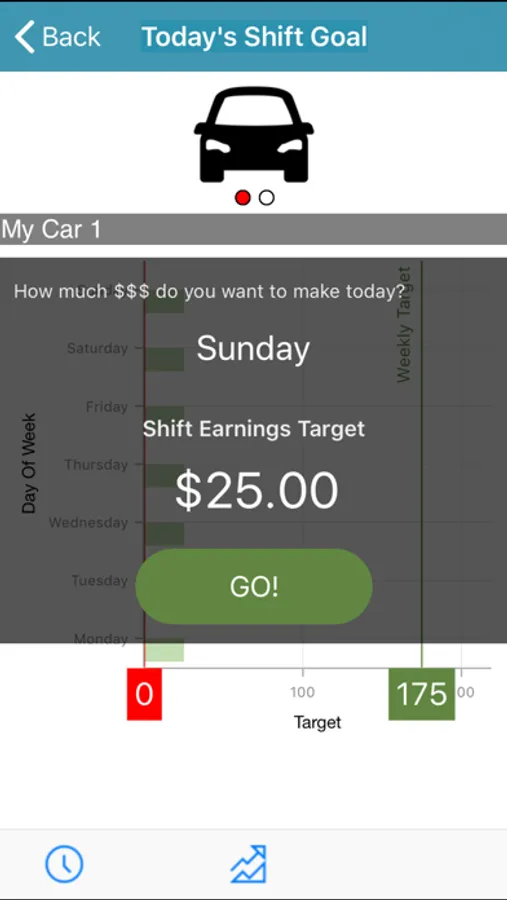

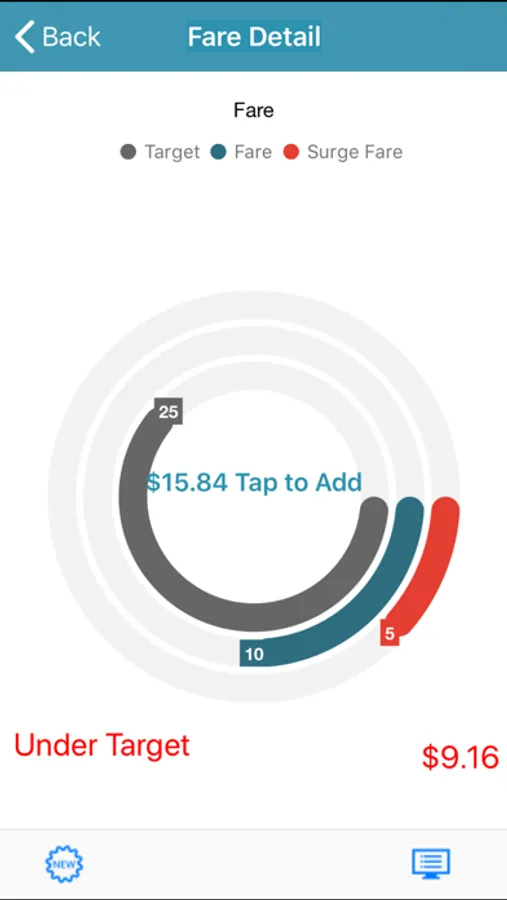

Want to better understand your business and make more money? Actively manage your driving strategy. Add shift targets, fares, and view the results. See any patterns? What can you change? Where, when, and how you drive affect your profit! You're a pro.

Because iDrive is developed by rideshare drivers, this app is more than a tax recordkeeping tool. Additional features include:

EASY INITIAL SETUP

The app needs to work for you. Customize app Settings with your accounting and vehicle details.

• Use Metric or Imperial Units

• App supports multiple currencies

• Use automatic GPS tracking or change to manual odometer entry

• Set tax fiscal year (FY)

- 5 initial settings set local tax rules

- App reports current FY data, change to view prior FYs

- Back up (and restore) entire database by FY

• Define and record information on multiple cars, by each car

• Enter annual/quarterly odometer readings (for Business Use %)

• Car Cost Calculator estimates how much a car may cost to use

DRIVING WITH iDRIVE

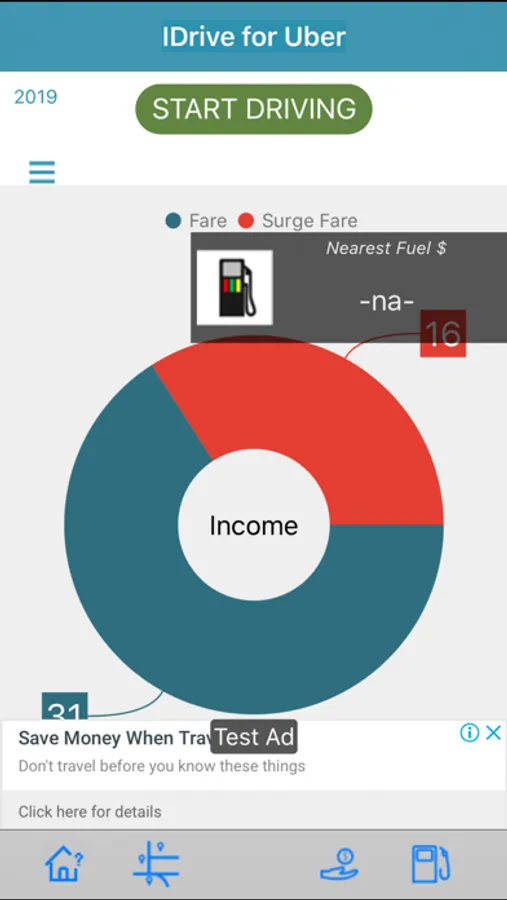

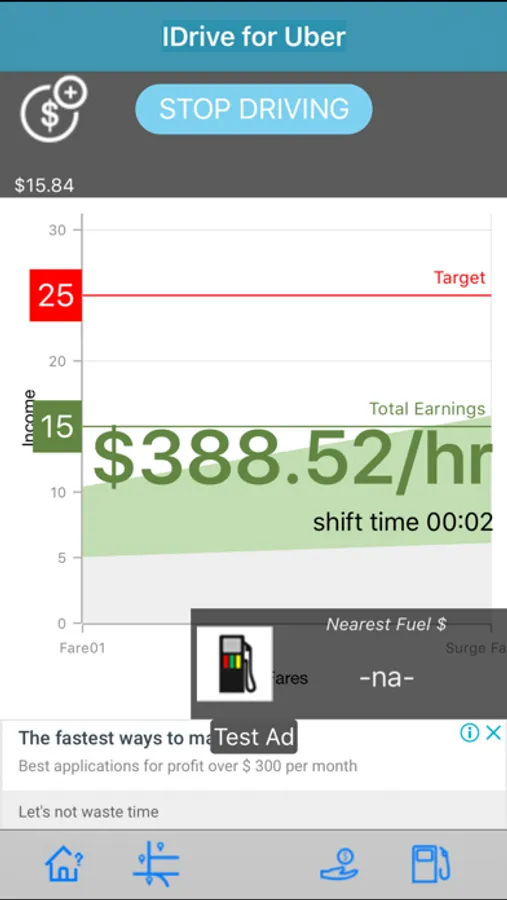

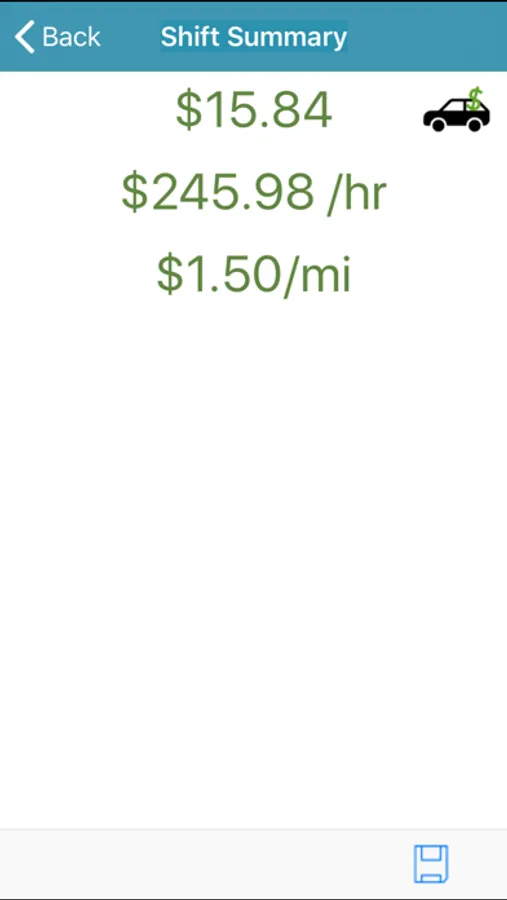

View key shift information while you are driving—driving time, $/hr, driving efficiency. Note interesting end-of-shift information—fare type graph, total shift map.

Use these bonus features when you need them.

Take Me Home!

• Lost in a city or suburb? One tap launches a map to get you back to familiar territory!

Find Best Fuel Price List—check for cheap fuel before you fill up.

• Price List automatically updates as local iDrive users buy fuel

• Nearest (50 mi) and latest (7 days) fuel prices recorded in your area

• Tap item (map or list) for map/directions to that station

Important Locations

• Pre-define information for quick reference to rarely-visited but Important Locations

• See a map of all Important Locations and filter by location type

• Get directions to any Important Location

Quick Messages

• Use pre-sets to call or send text or email messages to loved ones

MANAGING YOUR RECORDS

Routinely save data records off your phone to keep tax records safe.

• Export CSV files and receipt images to your cloud account or email

- Work Logs (contain all shift details, including total shift mileage)

- Expense Log (fuel and business-related purchase details)

- Receipt images from your phone's gallery

Routinely export your database to back up the app

• This Backup file can install your existing records on a new phone

ANALYZE YOUR BUSINESS

If you enter shift time/$ targets and add fare details every time you drive, view these iDrive reports.

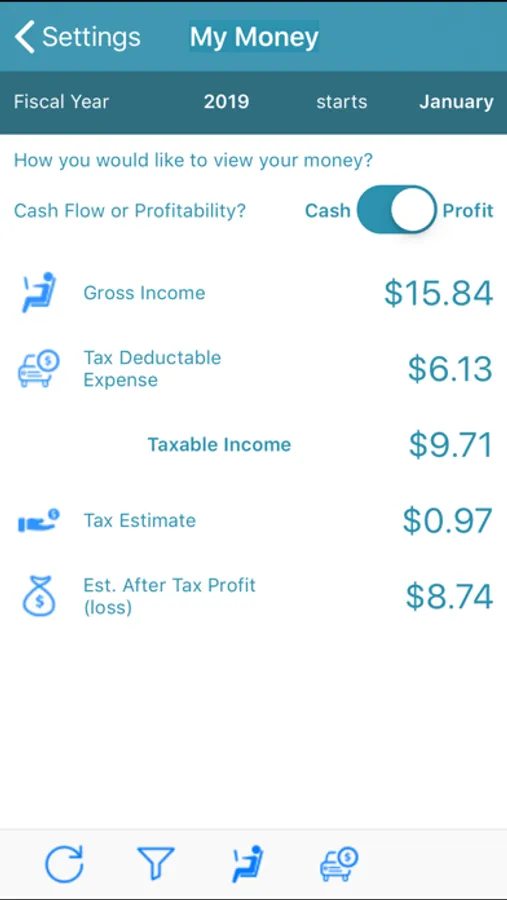

• My Money: entering all income and expense creates Profitability and Cash Flow estimates

• My Hourly Rates: shift start/end times calculate average $/Hr (before and after expenses)

• Productivity by Day of Week: fare totals by the day of the week compare productivity

• Shift Targets: compare actual vs. target income and hours history (app-recorded shift data only)

• Driving Efficiency: compare Paid/Non Paid shift mileage by month (app-recorded shift data only)

Turn on iDrive as you start every shift. Use the app to create the tax records you need to claim tax deductible expenses.

Using the rate or a Vehicle Log Book approach? Simply turn iDrive on and off as you drive each shift. The app tracks actual Total Shift Mileage—about double partner-reported fare mileage—ready to use at tax time. It's easy.

Itemizing expenses? Add fuel and all business-related expenses—with a picture of each receipt—to create tax records. iDrive uses entered odometer readings to calculate Business Use % of your car, ready to use at tax time. It's simple.

Want to better understand your business and make more money? Actively manage your driving strategy. Add shift targets, fares, and view the results. See any patterns? What can you change? Where, when, and how you drive affect your profit! You're a pro.

Because iDrive is developed by rideshare drivers, this app is more than a tax recordkeeping tool. Additional features include:

EASY INITIAL SETUP

The app needs to work for you. Customize app Settings with your accounting and vehicle details.

• Use Metric or Imperial Units

• App supports multiple currencies

• Use automatic GPS tracking or change to manual odometer entry

• Set tax fiscal year (FY)

- 5 initial settings set local tax rules

- App reports current FY data, change to view prior FYs

- Back up (and restore) entire database by FY

• Define and record information on multiple cars, by each car

• Enter annual/quarterly odometer readings (for Business Use %)

• Car Cost Calculator estimates how much a car may cost to use

DRIVING WITH iDRIVE

View key shift information while you are driving—driving time, $/hr, driving efficiency. Note interesting end-of-shift information—fare type graph, total shift map.

Use these bonus features when you need them.

Take Me Home!

• Lost in a city or suburb? One tap launches a map to get you back to familiar territory!

Find Best Fuel Price List—check for cheap fuel before you fill up.

• Price List automatically updates as local iDrive users buy fuel

• Nearest (50 mi) and latest (7 days) fuel prices recorded in your area

• Tap item (map or list) for map/directions to that station

Important Locations

• Pre-define information for quick reference to rarely-visited but Important Locations

• See a map of all Important Locations and filter by location type

• Get directions to any Important Location

Quick Messages

• Use pre-sets to call or send text or email messages to loved ones

MANAGING YOUR RECORDS

Routinely save data records off your phone to keep tax records safe.

• Export CSV files and receipt images to your cloud account or email

- Work Logs (contain all shift details, including total shift mileage)

- Expense Log (fuel and business-related purchase details)

- Receipt images from your phone's gallery

Routinely export your database to back up the app

• This Backup file can install your existing records on a new phone

ANALYZE YOUR BUSINESS

If you enter shift time/$ targets and add fare details every time you drive, view these iDrive reports.

• My Money: entering all income and expense creates Profitability and Cash Flow estimates

• My Hourly Rates: shift start/end times calculate average $/Hr (before and after expenses)

• Productivity by Day of Week: fare totals by the day of the week compare productivity

• Shift Targets: compare actual vs. target income and hours history (app-recorded shift data only)

• Driving Efficiency: compare Paid/Non Paid shift mileage by month (app-recorded shift data only)