About BHIM KVB Upay

Karur Vysya Bank presents KVB Upay – A Unified Payments Interface (UPI) application that lets you transfer funds from any bank account using a Virtual Payment Address (VPA), IFSC & Aadhaar.

What is UPI?

Unified Payments Interface (UPI) is an instant real-time payment system developed by National Payments Corporation of India facilitating inter-bank transactions. The UPI is regulated by the Reserve Bank of India (RBI) and works instantly by transferring funds between two bank accounts on a mobile platform.

If you operate multiple banks account & use multiple apps for your payments? Switch to KVB Upay for managing all your accounts at one place.

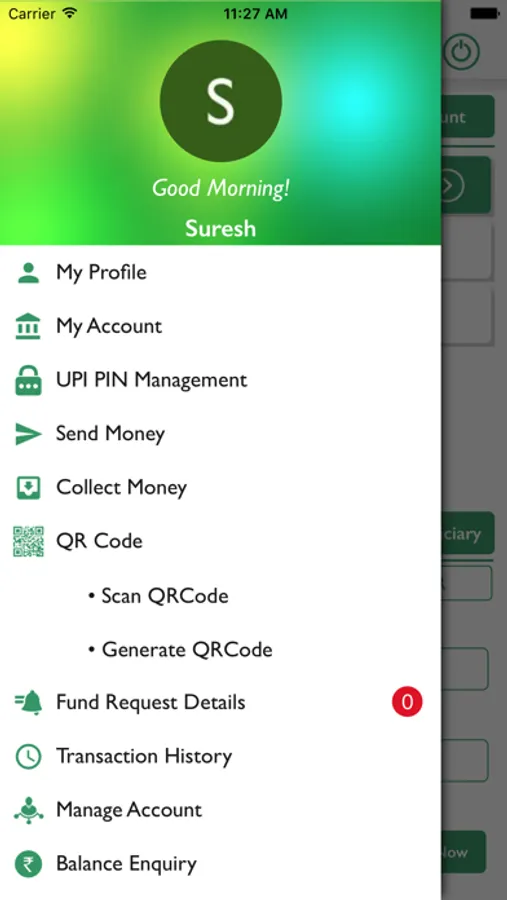

Benefits of using KVB Upay

- No need to remember account number, IFSC for fund transfer

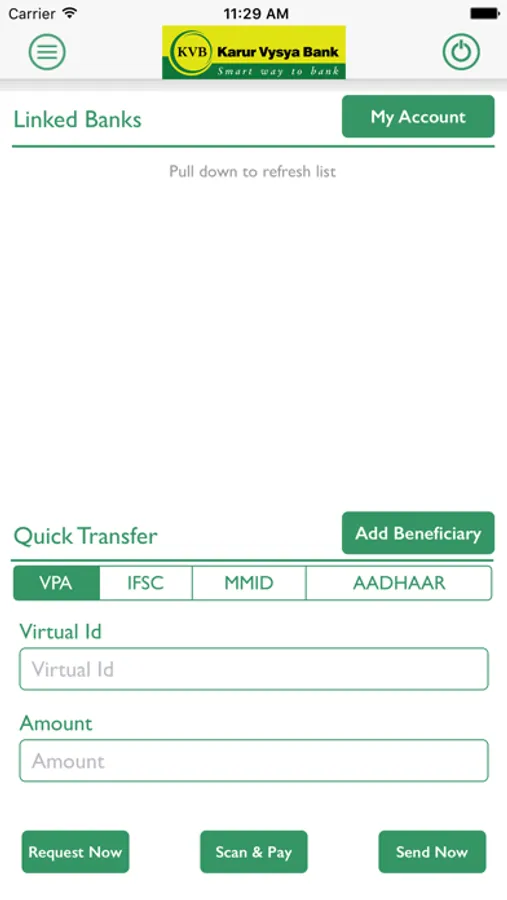

- Send/Collect money using a Virtual Payment Address

- Access all bank accounts linked to your mobile number in one app

- Pay to friends & relatives using their VPA

- Pay to any user using any UPI application.

- Request money from any UPI user

- Scan a QR and pay on the fly.

- Make Payments by QR Scanning

- Check account balance

- Block unwanted VPA as Spam

What are the requirements for using KVB UPay?

You should have following

- A iPhone with internet services

- An operative bank account

- The mobile number being registered with UPI must be linked to the bank account.

- Active debit card relating to this account for creating mPin.

How to register for KVB Upay?

- Download “BHIM KVBUPay” from iOS App Store

- Click on “Proceed” to verify your mobile number.

- An SMS will be sent from your mobile for verification.

- After your mobile number is verified, the Profile Registration screen is displayed. Fill in the required details.

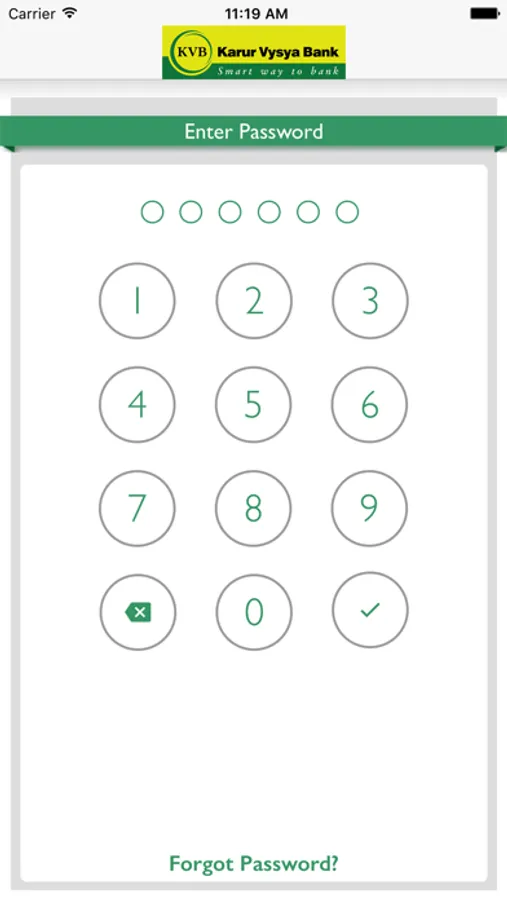

- Create six digits numeric application password for logging in to application and confirm the same.

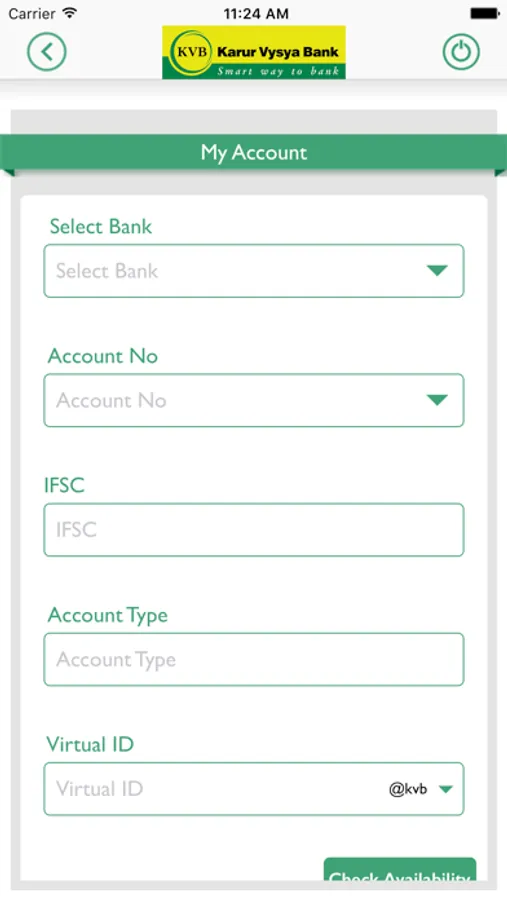

- Once successfully registered, login to the app and create VPA for the bank account linked.

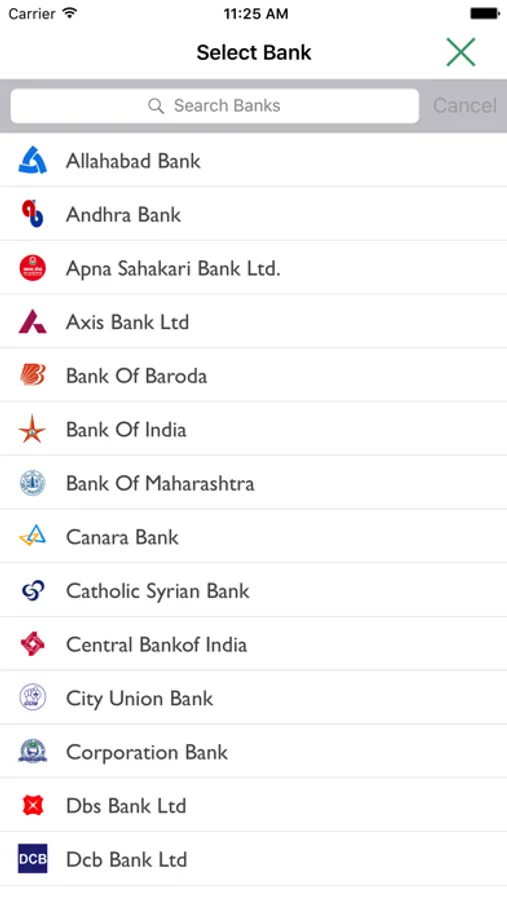

- Select the Bank & create VPA for the bank.

- Set mPin for the selected bank using debit card

Support 24 X 7:

Email id: customersupport@kvbmail.com

Toll Free Number: 18602001916

Supported Banks: Visit our website https://www.npci.org.in/bhim-live-members to find out if your bank is live on BHIM

Permissions for App and reasons

SMS - As per NPCI guidelines, we will be sending a background SMS to verify the customer and mobile number linked to it.

Location – As per NPCI guidelines, we will capture location details

Storage – We need this permission to store the scanned QR Code.

Calls – We need this permission to detect SIM present or not

Go ahead and download BHIM KVBUPay application to experience the unique way of making payments using a Virtual Payment Address (VPA).

What is UPI?

Unified Payments Interface (UPI) is an instant real-time payment system developed by National Payments Corporation of India facilitating inter-bank transactions. The UPI is regulated by the Reserve Bank of India (RBI) and works instantly by transferring funds between two bank accounts on a mobile platform.

If you operate multiple banks account & use multiple apps for your payments? Switch to KVB Upay for managing all your accounts at one place.

Benefits of using KVB Upay

- No need to remember account number, IFSC for fund transfer

- Send/Collect money using a Virtual Payment Address

- Access all bank accounts linked to your mobile number in one app

- Pay to friends & relatives using their VPA

- Pay to any user using any UPI application.

- Request money from any UPI user

- Scan a QR and pay on the fly.

- Make Payments by QR Scanning

- Check account balance

- Block unwanted VPA as Spam

What are the requirements for using KVB UPay?

You should have following

- A iPhone with internet services

- An operative bank account

- The mobile number being registered with UPI must be linked to the bank account.

- Active debit card relating to this account for creating mPin.

How to register for KVB Upay?

- Download “BHIM KVBUPay” from iOS App Store

- Click on “Proceed” to verify your mobile number.

- An SMS will be sent from your mobile for verification.

- After your mobile number is verified, the Profile Registration screen is displayed. Fill in the required details.

- Create six digits numeric application password for logging in to application and confirm the same.

- Once successfully registered, login to the app and create VPA for the bank account linked.

- Select the Bank & create VPA for the bank.

- Set mPin for the selected bank using debit card

Support 24 X 7:

Email id: customersupport@kvbmail.com

Toll Free Number: 18602001916

Supported Banks: Visit our website https://www.npci.org.in/bhim-live-members to find out if your bank is live on BHIM

Permissions for App and reasons

SMS - As per NPCI guidelines, we will be sending a background SMS to verify the customer and mobile number linked to it.

Location – As per NPCI guidelines, we will capture location details

Storage – We need this permission to store the scanned QR Code.

Calls – We need this permission to detect SIM present or not

Go ahead and download BHIM KVBUPay application to experience the unique way of making payments using a Virtual Payment Address (VPA).