With this banking app, you can manage your accounts, transfer funds, and pay bills easily. Includes account overview, fund transfers, bill payments, and card controls.

AppRecs review analysis

AppRecs rating 4.4. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.4

AppRecs Rating

Ratings breakdown

5 star

85%

4 star

7%

3 star

2%

2 star

1%

1 star

5%

What to know

✓

High user satisfaction

85% of sampled ratings are 5 stars

⚠

Pricing complaints

Many low ratings mention paywalls or pricing

About myABL

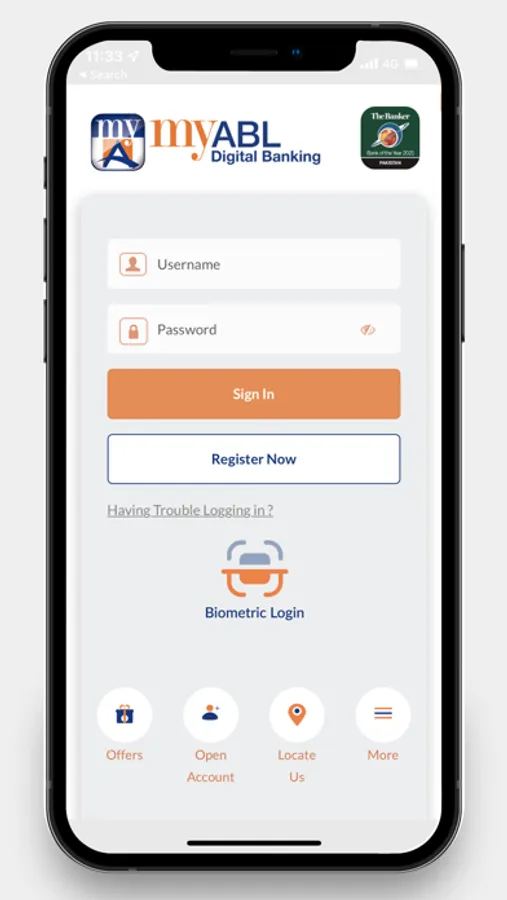

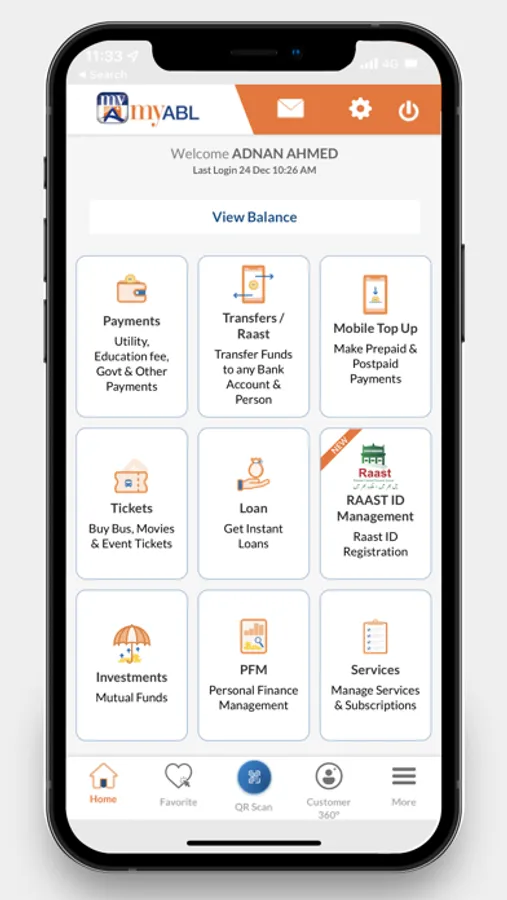

Simplify your Banking with myABL Mobile App

Manage your finances effortlessly with myABL, the ultimate mobile banking solution by Allied Bank. Conveniently, access your accounts, make payments, and transfer funds anytime, anywhere. Trusted by millions across Pakistan, myABL ensures your financial data is protected with advanced encryption technology.

Key Features:

Money Transfer:

• Transfer Funds: Instantly send money to any account, anytime via IBAN, Account Number, CNIC Transfer.

• QR Payments: Make secure Instant payments or transfer funds using QR Code.

• RAAST Transfer: Transfer Funds Through RAAST ID.

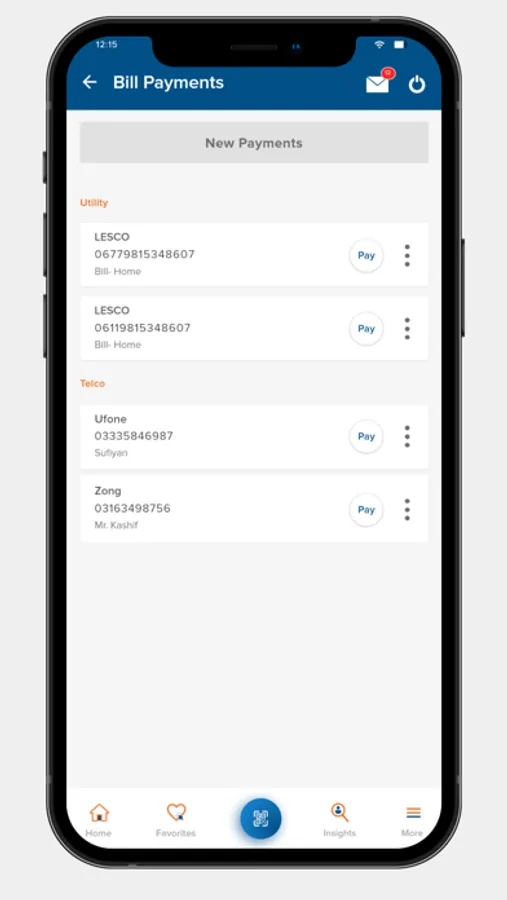

Payments:

• Pay Bills: Pay Utility Bills, Telco, Education Fee, Credit Card Bills, Internet Bills, Govt. Payments, Mobile Top-ups and more in just a few clicks.

• Donations: Transfer your donations quickly through myABL Mobile App.

• Franchise Payments: Conveniently manage and pay your franchise dues with just a few taps.

• Ticketing: Book & Pay for a wide range of tickets for movies, buses, and other events.

Loans:

• PayDay Loan (Advance Salary): Customers whose salary is being processed through Allied Bank can seamlessly obtain advance salary without any markup.

Account Management:

Stay on top of your finances—view balances, download detailed bank statements, and more.

• Profile Management: Update your mailing address and CNIC expiry date.

• Cheque Management: Manage your cheques conveniently—apply for a new chequebook, use Positive Pay, or stop cheque payments.

• RAAST Management: Seamlessly create, link, delink, or delete your RAAST ID directly through the app.

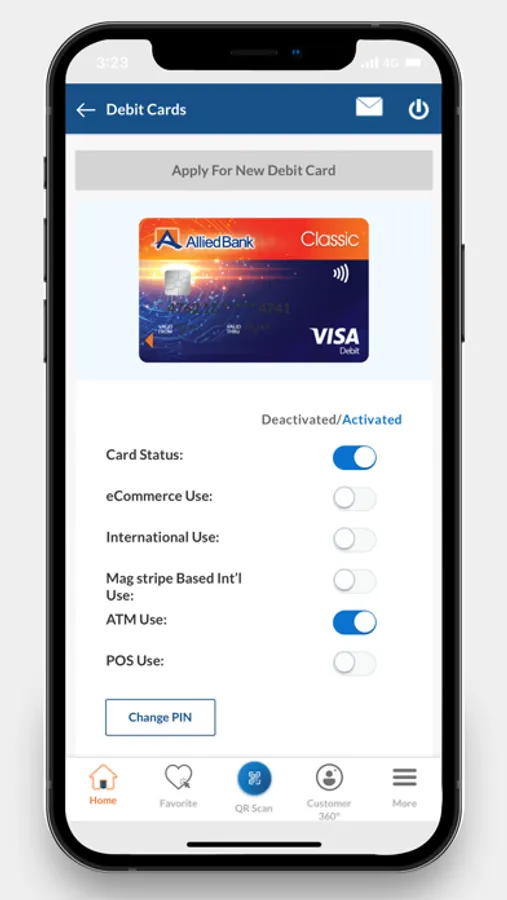

Cards:

Get full control over your cards—instantly activate or deactivate your debit, credit, or virtual cards, track expenses in real-time, and apply for new cards directly.

Investments:

Manage your investments with ABL Asset Management Company.

Earn Rewards with myABL Coins:

Our exclusive loyalty program let’s you earn digital coins for card transactions. Redeem your coins in our marketplace. The more you transact, the more you earn.

Deals & Discounts:

Find the best deals & discounts on your ABL debit & credit cards & QR.

Additional Services:

• Payees & Billers: Easily add and manage payees and billers for quick and hassle-free payments.

• Account Maintenance Certificate: Generate your account maintenance certificate seamlessly, through myABL Mobile app.

• Withholding Tax Certificate: Easily download your withholding tax certificate for tax reporting and compliance, all within the app.

• Dormant Account Activation: Activate your Dormant account from myABL without any need to visit branch.

• Branch & ATM Locator: Locate your nearest ABL branch or ATM.

• Temporary Limit Enhancement: Instantly increase your daily limits of ATM and myABL services with just few clicks.

Statements:

Conveniently view your account statement, transaction history, mini statements at one click.

Robust Security:

Enjoy peace of mind with biometric login, two-factor authentication, and end-to-end encryption to protect your data and transactions. Visit our Security Guide for details on how we keep your data safe.

Complaints & Support:

Easily submit your complaints through the app for quick resolution. Get quick support and updates on your issues, all in one place.

Why Choose myABL?

• 24/7 Access: Manage your finances anytime, anywhere.

• Hassle-Free Banking: Say goodbye to long queues and branch visits.

• Exclusive Features: Enjoy offers and services tailored to your lifestyle needs.

• Convenient Payments: Simplify your lifestyle with instant bill payments and funds transfers.

Download myABL Today!

Join millions of satisfied users who trust myABL for their digital banking needs in Pakistan. Skip the lines and enjoy seamless banking right from your mobile device.

For Assistance:

• 24/7 Helpline: 042-111-225-225

• Email: complaint@abl.com or cm@abl.com

• Corporate Website: www.abl.com

Manage your finances effortlessly with myABL, the ultimate mobile banking solution by Allied Bank. Conveniently, access your accounts, make payments, and transfer funds anytime, anywhere. Trusted by millions across Pakistan, myABL ensures your financial data is protected with advanced encryption technology.

Key Features:

Money Transfer:

• Transfer Funds: Instantly send money to any account, anytime via IBAN, Account Number, CNIC Transfer.

• QR Payments: Make secure Instant payments or transfer funds using QR Code.

• RAAST Transfer: Transfer Funds Through RAAST ID.

Payments:

• Pay Bills: Pay Utility Bills, Telco, Education Fee, Credit Card Bills, Internet Bills, Govt. Payments, Mobile Top-ups and more in just a few clicks.

• Donations: Transfer your donations quickly through myABL Mobile App.

• Franchise Payments: Conveniently manage and pay your franchise dues with just a few taps.

• Ticketing: Book & Pay for a wide range of tickets for movies, buses, and other events.

Loans:

• PayDay Loan (Advance Salary): Customers whose salary is being processed through Allied Bank can seamlessly obtain advance salary without any markup.

Account Management:

Stay on top of your finances—view balances, download detailed bank statements, and more.

• Profile Management: Update your mailing address and CNIC expiry date.

• Cheque Management: Manage your cheques conveniently—apply for a new chequebook, use Positive Pay, or stop cheque payments.

• RAAST Management: Seamlessly create, link, delink, or delete your RAAST ID directly through the app.

Cards:

Get full control over your cards—instantly activate or deactivate your debit, credit, or virtual cards, track expenses in real-time, and apply for new cards directly.

Investments:

Manage your investments with ABL Asset Management Company.

Earn Rewards with myABL Coins:

Our exclusive loyalty program let’s you earn digital coins for card transactions. Redeem your coins in our marketplace. The more you transact, the more you earn.

Deals & Discounts:

Find the best deals & discounts on your ABL debit & credit cards & QR.

Additional Services:

• Payees & Billers: Easily add and manage payees and billers for quick and hassle-free payments.

• Account Maintenance Certificate: Generate your account maintenance certificate seamlessly, through myABL Mobile app.

• Withholding Tax Certificate: Easily download your withholding tax certificate for tax reporting and compliance, all within the app.

• Dormant Account Activation: Activate your Dormant account from myABL without any need to visit branch.

• Branch & ATM Locator: Locate your nearest ABL branch or ATM.

• Temporary Limit Enhancement: Instantly increase your daily limits of ATM and myABL services with just few clicks.

Statements:

Conveniently view your account statement, transaction history, mini statements at one click.

Robust Security:

Enjoy peace of mind with biometric login, two-factor authentication, and end-to-end encryption to protect your data and transactions. Visit our Security Guide for details on how we keep your data safe.

Complaints & Support:

Easily submit your complaints through the app for quick resolution. Get quick support and updates on your issues, all in one place.

Why Choose myABL?

• 24/7 Access: Manage your finances anytime, anywhere.

• Hassle-Free Banking: Say goodbye to long queues and branch visits.

• Exclusive Features: Enjoy offers and services tailored to your lifestyle needs.

• Convenient Payments: Simplify your lifestyle with instant bill payments and funds transfers.

Download myABL Today!

Join millions of satisfied users who trust myABL for their digital banking needs in Pakistan. Skip the lines and enjoy seamless banking right from your mobile device.

For Assistance:

• 24/7 Helpline: 042-111-225-225

• Email: complaint@abl.com or cm@abl.com

• Corporate Website: www.abl.com