APM Mobile Edge

American Pacific Mortgage Corporation

3.8 ★

store rating

Free

Use this mortgage app to track your loan process and access real-time updates. Includes secure document transfer, mortgage calculators, and educational resources.

AppRecs review analysis

AppRecs rating 3.8. Trustworthiness 75 out of 100. Review manipulation risk 24 out of 100. Based on a review sample analyzed.

★★★☆☆

3.8

AppRecs Rating

Ratings breakdown

5 star

56%

4 star

10%

3 star

9%

2 star

9%

1 star

16%

What to know

✓

Low review manipulation risk

24% review manipulation risk

✓

Credible reviews

75% trustworthiness score from analyzed reviews

✓

Good user ratings

66% positive sampled reviews

About APM Mobile Edge

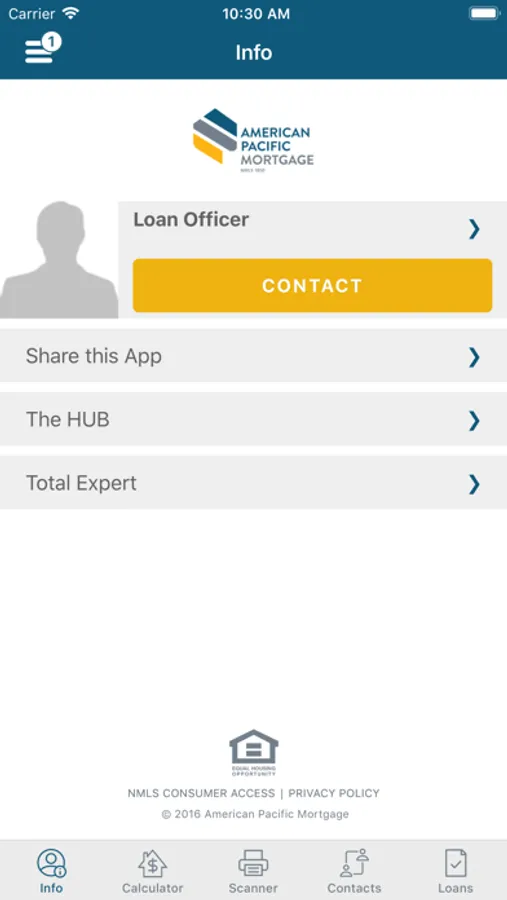

The APM Mobile Edge Application was designed to guide the borrower through the loan process and provide real time updates and communication to all parties involved, ensuring more efficient transactions and on time closings. Whether you are ready to purchase a home, or refinance your current mortgage, the Loan Advisors will help you choose the best loan to match your financial circumstances.

Key Features:

- Live, real-time updates to let involved parties know where they stand and when to take action

- Milestone communication as loan is processed

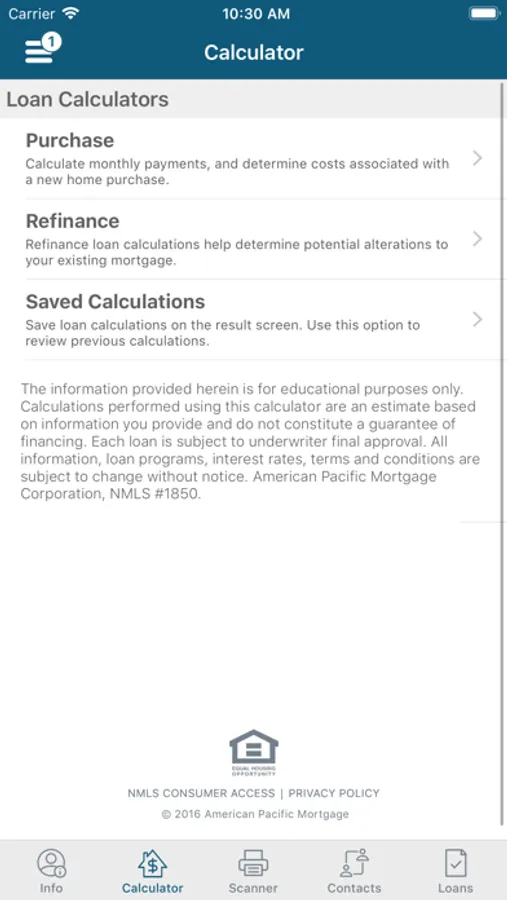

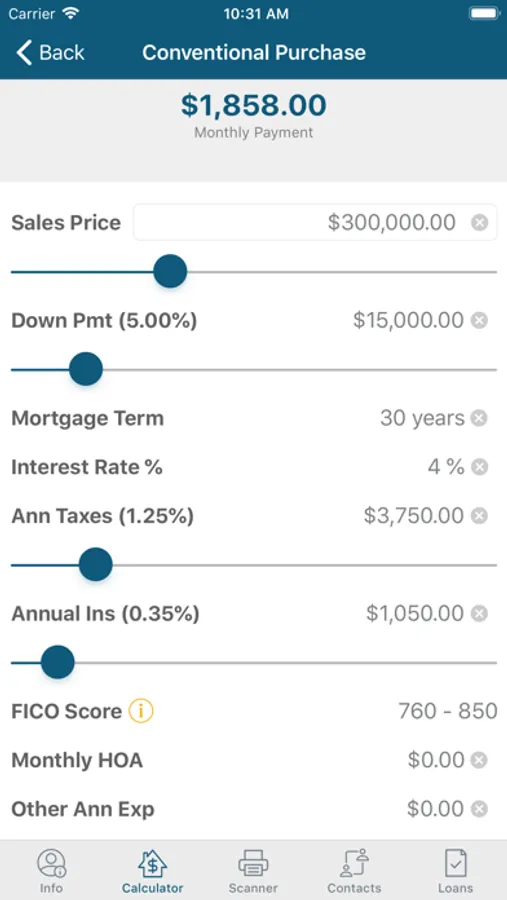

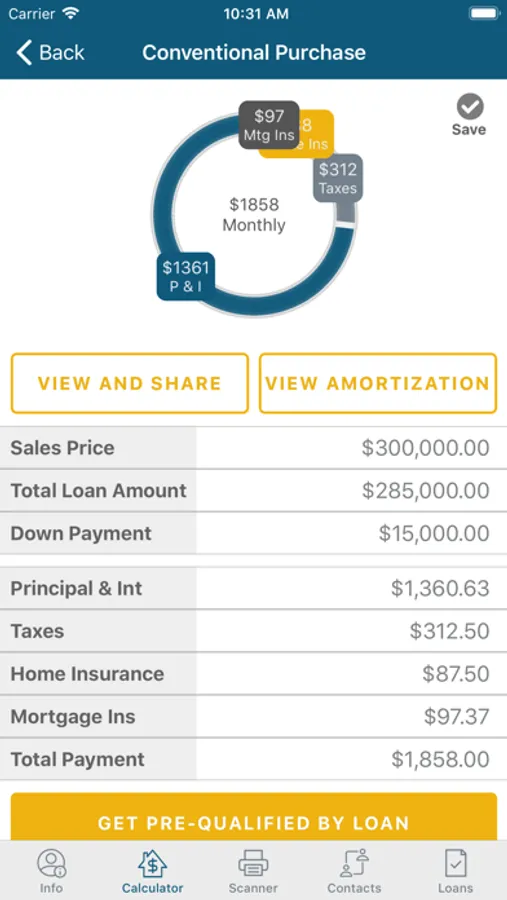

- State-of the art mortgage calculators to provide various loan options and help the borrower better evaluate monthly payments and budget

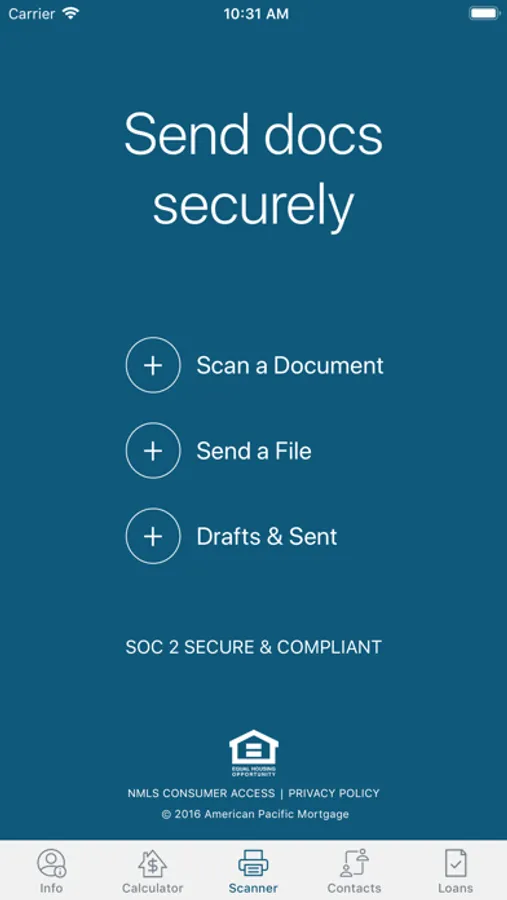

- Secure document transfer to ensure more efficient transactions and document gathering

- Loan Officers can collect, scan and preview documents and communicate directly with borrower through the application

- Loan Officers can view appraisals and credit reports through the application as well as order credit.

- Education feature to inform borrower by educating them on unique Mortgage

- Industry terminology and helping them feel more confident with the loan process.

- Includes a glossary of mortgage related terms, a news feed, and articles about specific loan topics.

Key Features:

- Live, real-time updates to let involved parties know where they stand and when to take action

- Milestone communication as loan is processed

- State-of the art mortgage calculators to provide various loan options and help the borrower better evaluate monthly payments and budget

- Secure document transfer to ensure more efficient transactions and document gathering

- Loan Officers can collect, scan and preview documents and communicate directly with borrower through the application

- Loan Officers can view appraisals and credit reports through the application as well as order credit.

- Education feature to inform borrower by educating them on unique Mortgage

- Industry terminology and helping them feel more confident with the loan process.

- Includes a glossary of mortgage related terms, a news feed, and articles about specific loan topics.