About Voyage Tax

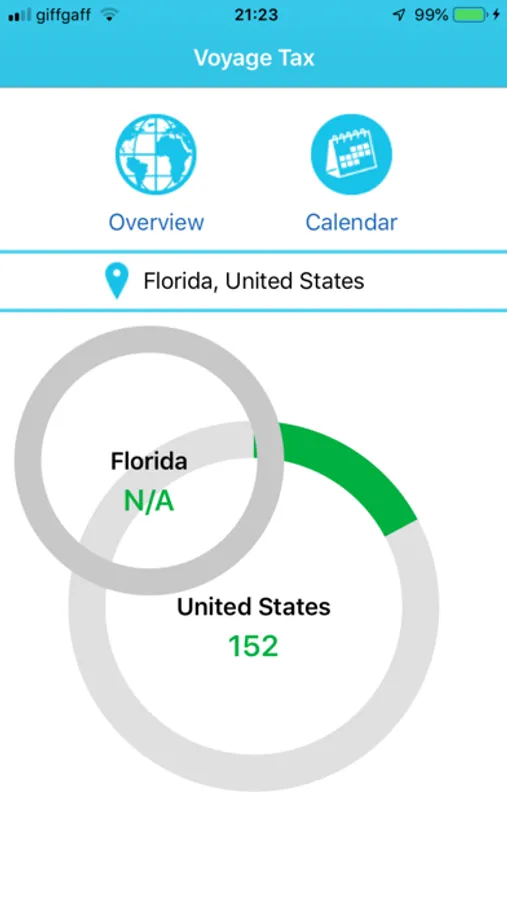

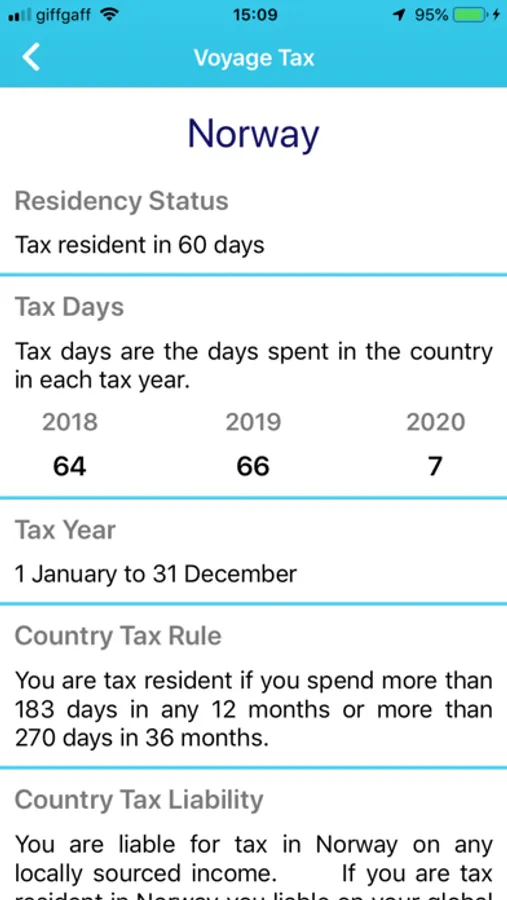

Business travel carries significant tax and immigration risks, especially for frequent or multi-jurisdiction travellers. Even domestic travel can have adverse tax implications when individual states treat travelling employees differently for tax purposes. As well as the direct tax consequences for travellers and employees, business travel may also create business reputation risk if tax or immigration obligations are perceived to be unsatisfied, or even the risk of prosecution for breaches of local employment laws or failure to meet reporting requirements.

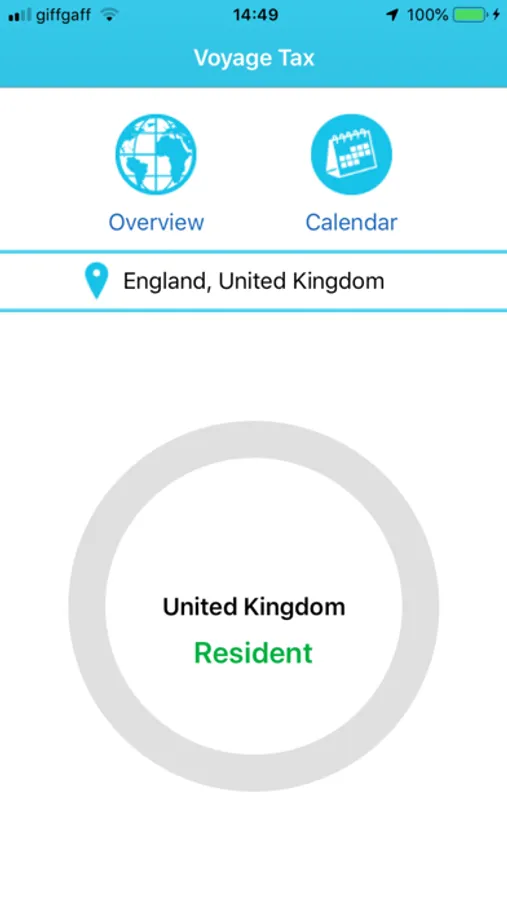

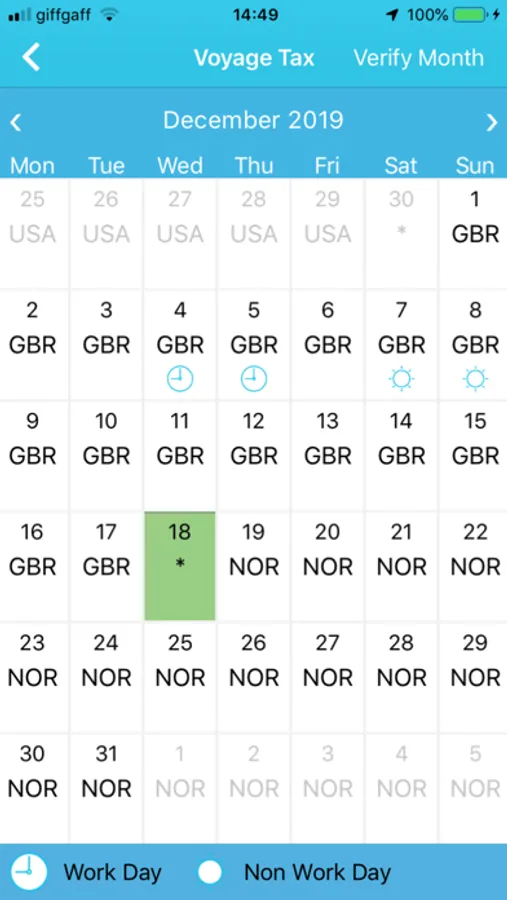

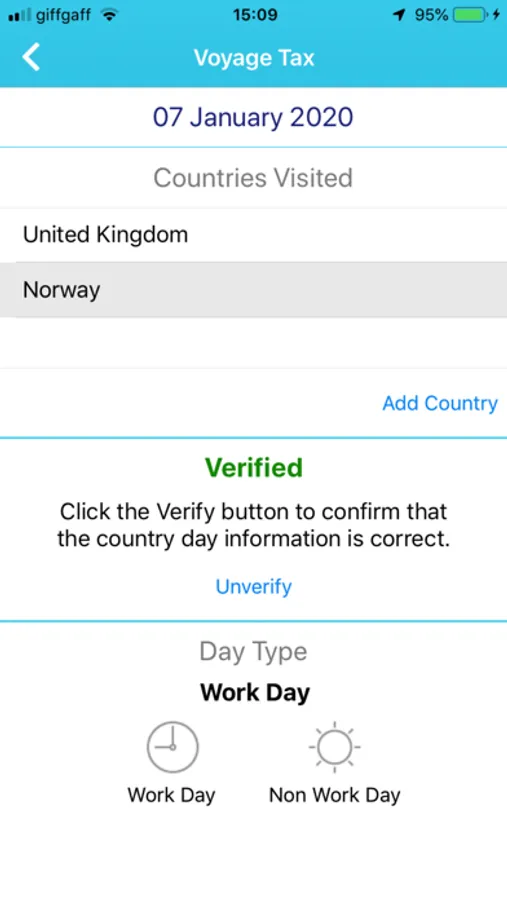

Voyage Tax is able to build up an accurate view of the number of days employees have spent in different jurisdictions by combining travel itinerary, location and expense data. One unique feature of our platform is that we can use any or all all of these sources of data together to establish a comprehensive timeline of traveller movements, and provide a detailed travel audit trail for compliance and reporting purposes.

Voyage Tax can only be used with a Voyage Manager subscription, it does not have a sign up option. Contact Voyage Manager at https://www.voyagemanager.com for more information.

Voyage Tax is able to build up an accurate view of the number of days employees have spent in different jurisdictions by combining travel itinerary, location and expense data. One unique feature of our platform is that we can use any or all all of these sources of data together to establish a comprehensive timeline of traveller movements, and provide a detailed travel audit trail for compliance and reporting purposes.

Voyage Tax can only be used with a Voyage Manager subscription, it does not have a sign up option. Contact Voyage Manager at https://www.voyagemanager.com for more information.