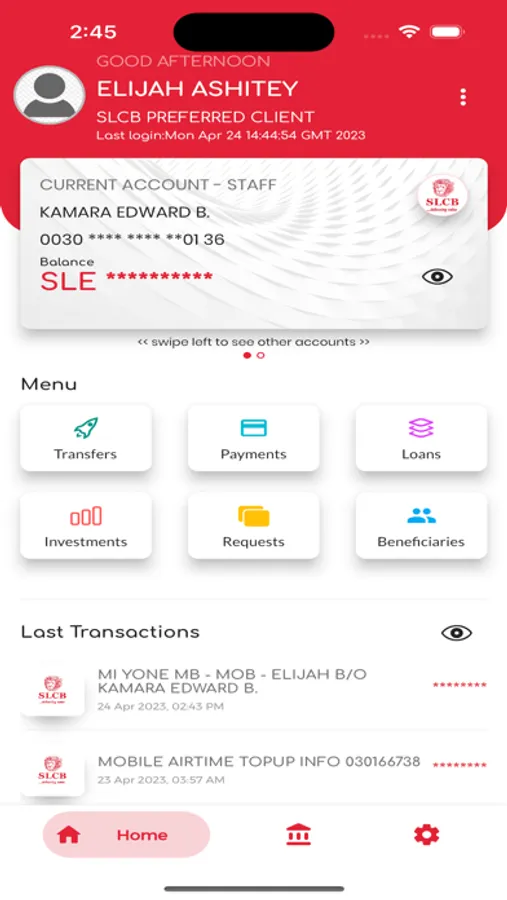

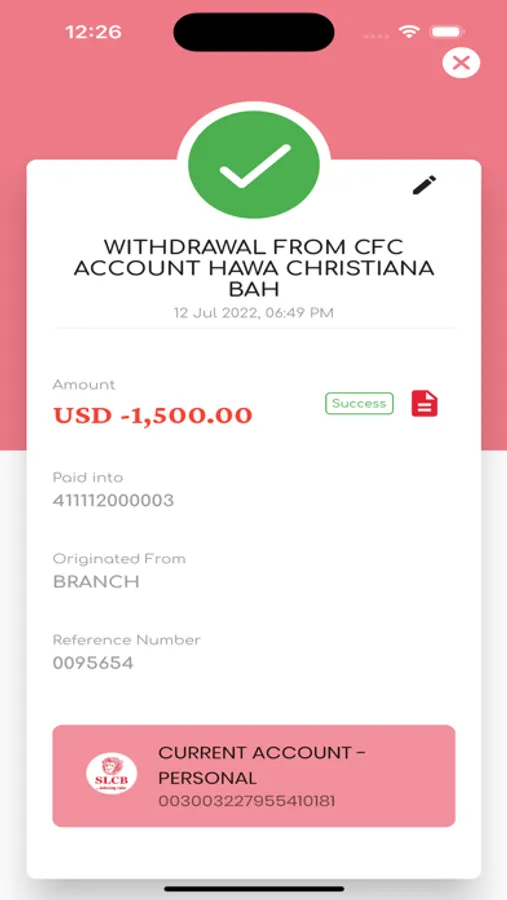

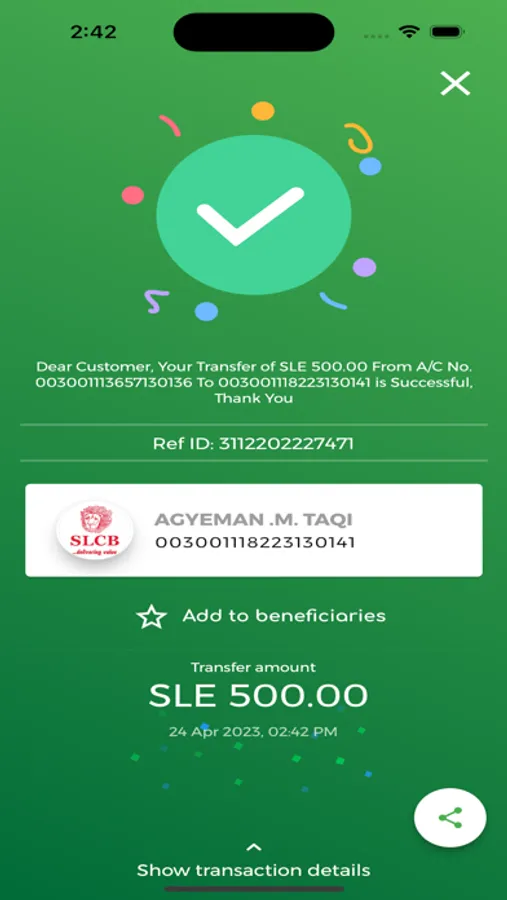

In this app, users can perform various banking transactions such as transferring funds, making QR payments, and requesting bank services. Includes features like beneficiary management, fund transfers within and outside the bank, and service requests such as statement and cheque book requests.

AppRecs review analysis

AppRecs rating 4.6. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★★☆

4.6

AppRecs Rating

Ratings breakdown

5 star

60%

4 star

40%

3 star

0%

2 star

0%

1 star

0%

What to know

✓

High user satisfaction

100% of sampled ratings are 4+ stars (4.6★ average)

About SLCB

About the app

Get the MiYone SLCB Mobile app to make everyday banking easier.

A Mobile Banking App aimed at using cutting-edge technology to bridge the gap between innovation and banking services.

Features of SLCB Mobile Banking App

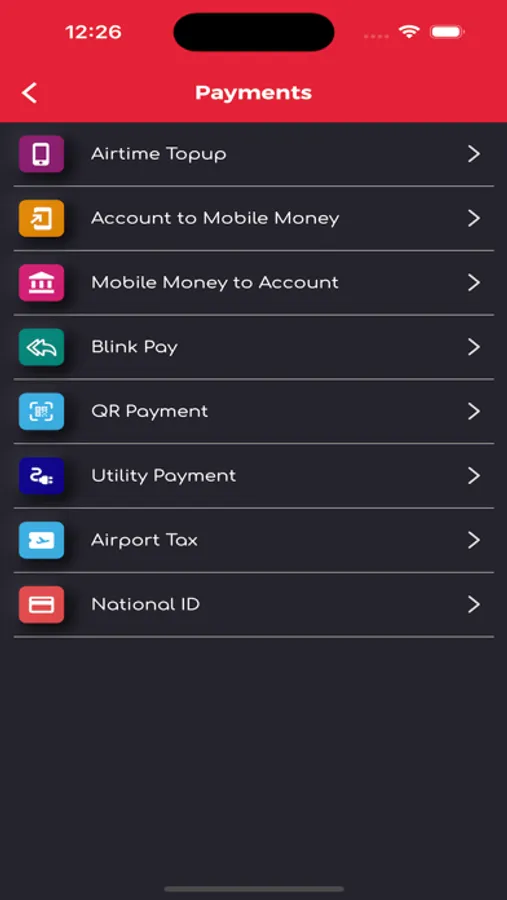

1. QR-QR - A special feature that allows you to do payment at your convenience. QR means Quick Response i.e. it allows customers to do Quick Response payment from a supermarket, shopping centre etc.

2. Transfer Funds

· Own Account: transfers from own account to another account linked.

· Third Party: transfers to third party within same bank i.e. within SLCB

· Other Bank: transfer of funds from your account to other bank e.g. from SLCB to Access Bank etc.

· Salone Link: A special money transfer feature that allows you to transfer or send money from your account to someone (with or without a bank account).

3. Blink Pay: A money transfer that allows you to transfer funds.

· Order: allows you to send money to an individual which will be claimed by the individual into an account.

· Request: allows you to request money from an individual will be claimed by you into an account. For SLCB customers only.

4. Request: allows you to make series of customer request.

· Statement Request: allows you to request for bank statement(Visa or Ordinary)

· Cheque Book Request: allows you to request for cheque book(customers can select preferred pick up branch)

· View Forex Rate: allows you to view various transfer and note rates, buying and selling.

· Stop Cheque: Stop cheque allows you to stop a cheque (either single or range).

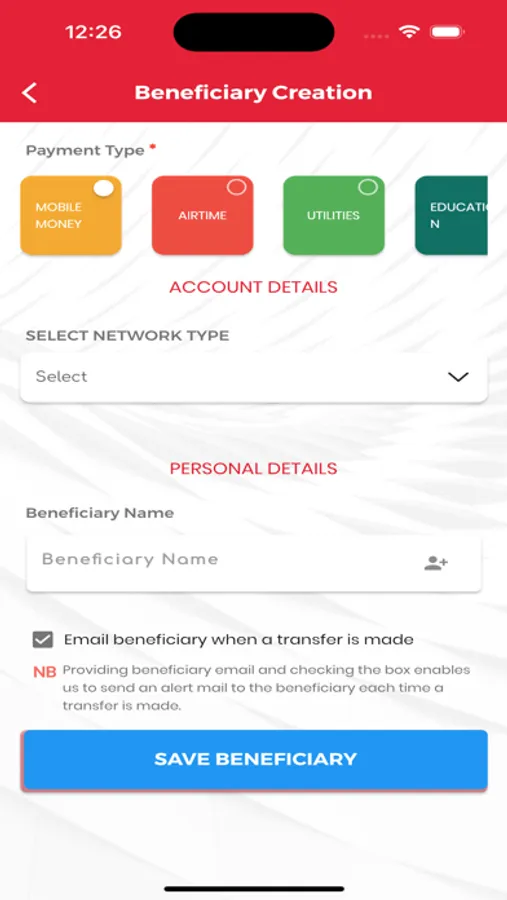

5. Beneficiaries: This is a feature on the application that allows you to add pool of beneficiary either for SLCB or OTHER BANKS

· In SLCB: This is mainly for customers holding account within SLCB.

· Other Banks: For customers in other bank

· View Beneficiary: the view beneficiary will allow you to see a pool of beneficiary created for SLCB and OTHER BANKS

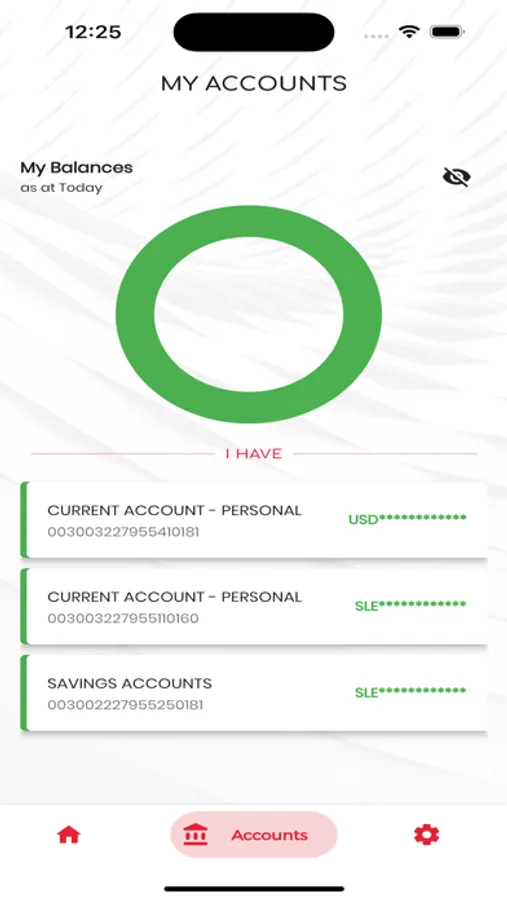

6. Add Account: this feature allows you to add account online

7. Customer Compliant: it allows customers of the bank to make complaints of dissatisfied issues

8. Find Branch: this feature will help our customers to locate our nearest branches country wide with full address and location.

9. Settings

· Change Password: Customers will be able to change password

· Change Nickname: Customers will change their name to a nickname and it would appear on the Mobile App

· Change PIN Code: customer will be able to set a four (4) Digit Pin and will be able reset Pin also

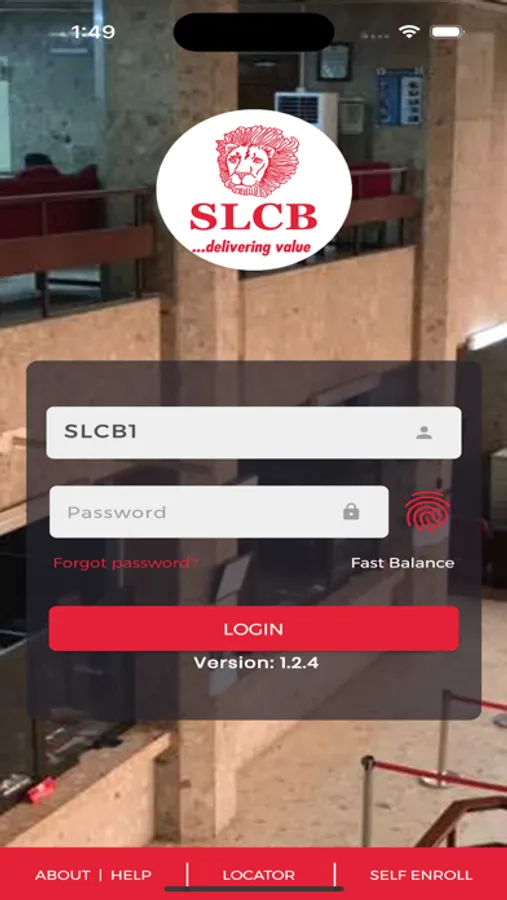

· Fast Balance Activation: you will be able to activate fast balance which will enable you to view your balance without you logging into the Mobile App

· Fast Balance Deactivation: you will be able to deactivate fast balance hence you will not be able to see fast balance on the Mobile App login page.

· Forgot PIN Code: allows you to change Pin code

10. Loan Details-allows you to view loan details.

11. Loan Quotation-allows you to view loan quotation

SLCB....... delivering value.

Get the MiYone SLCB Mobile app to make everyday banking easier.

A Mobile Banking App aimed at using cutting-edge technology to bridge the gap between innovation and banking services.

Features of SLCB Mobile Banking App

1. QR-QR - A special feature that allows you to do payment at your convenience. QR means Quick Response i.e. it allows customers to do Quick Response payment from a supermarket, shopping centre etc.

2. Transfer Funds

· Own Account: transfers from own account to another account linked.

· Third Party: transfers to third party within same bank i.e. within SLCB

· Other Bank: transfer of funds from your account to other bank e.g. from SLCB to Access Bank etc.

· Salone Link: A special money transfer feature that allows you to transfer or send money from your account to someone (with or without a bank account).

3. Blink Pay: A money transfer that allows you to transfer funds.

· Order: allows you to send money to an individual which will be claimed by the individual into an account.

· Request: allows you to request money from an individual will be claimed by you into an account. For SLCB customers only.

4. Request: allows you to make series of customer request.

· Statement Request: allows you to request for bank statement(Visa or Ordinary)

· Cheque Book Request: allows you to request for cheque book(customers can select preferred pick up branch)

· View Forex Rate: allows you to view various transfer and note rates, buying and selling.

· Stop Cheque: Stop cheque allows you to stop a cheque (either single or range).

5. Beneficiaries: This is a feature on the application that allows you to add pool of beneficiary either for SLCB or OTHER BANKS

· In SLCB: This is mainly for customers holding account within SLCB.

· Other Banks: For customers in other bank

· View Beneficiary: the view beneficiary will allow you to see a pool of beneficiary created for SLCB and OTHER BANKS

6. Add Account: this feature allows you to add account online

7. Customer Compliant: it allows customers of the bank to make complaints of dissatisfied issues

8. Find Branch: this feature will help our customers to locate our nearest branches country wide with full address and location.

9. Settings

· Change Password: Customers will be able to change password

· Change Nickname: Customers will change their name to a nickname and it would appear on the Mobile App

· Change PIN Code: customer will be able to set a four (4) Digit Pin and will be able reset Pin also

· Fast Balance Activation: you will be able to activate fast balance which will enable you to view your balance without you logging into the Mobile App

· Fast Balance Deactivation: you will be able to deactivate fast balance hence you will not be able to see fast balance on the Mobile App login page.

· Forgot PIN Code: allows you to change Pin code

10. Loan Details-allows you to view loan details.

11. Loan Quotation-allows you to view loan quotation

SLCB....... delivering value.