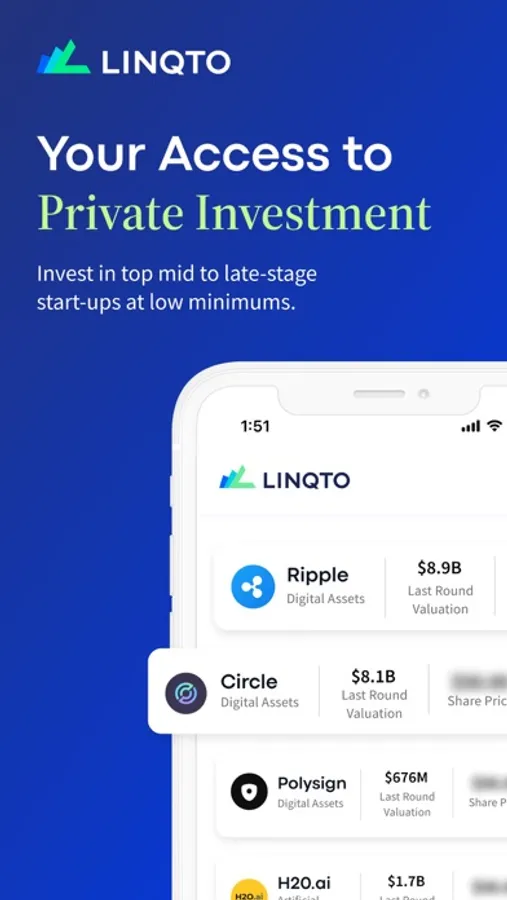

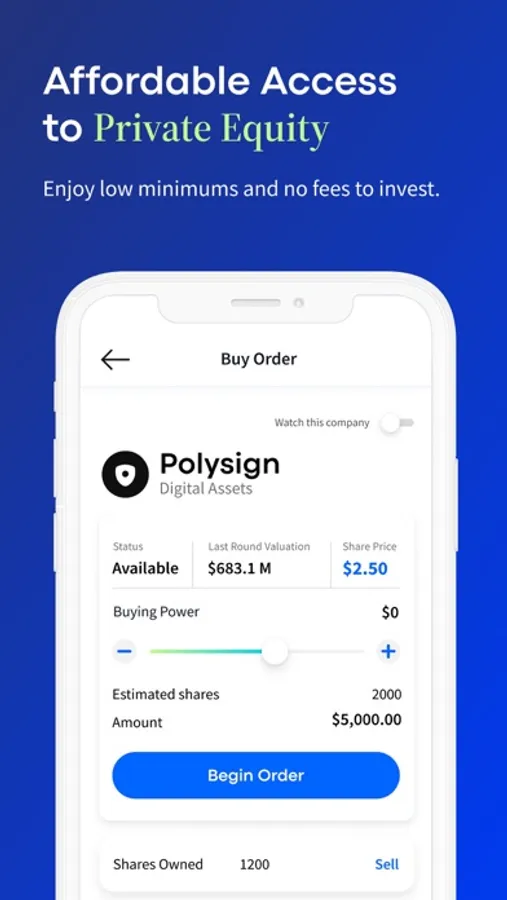

With this investment platform, you can evaluate private company opportunities and track investments. Includes access to unicorn investments, portfolio management tools.

AppRecs review analysis

AppRecs rating 3.3. Trustworthiness 85 out of 100. Review manipulation risk 21 out of 100. Based on a review sample analyzed.

★★★☆☆

3.3

AppRecs Rating

Ratings breakdown

5 star

51%

4 star

12%

3 star

4%

2 star

3%

1 star

29%

What to know

✓

Low review manipulation risk

21% review manipulation risk

✓

Credible reviews

85% trustworthiness score from analyzed reviews

⚠

High negative review ratio

33% of sampled ratings are 1–2 stars

About Linqto

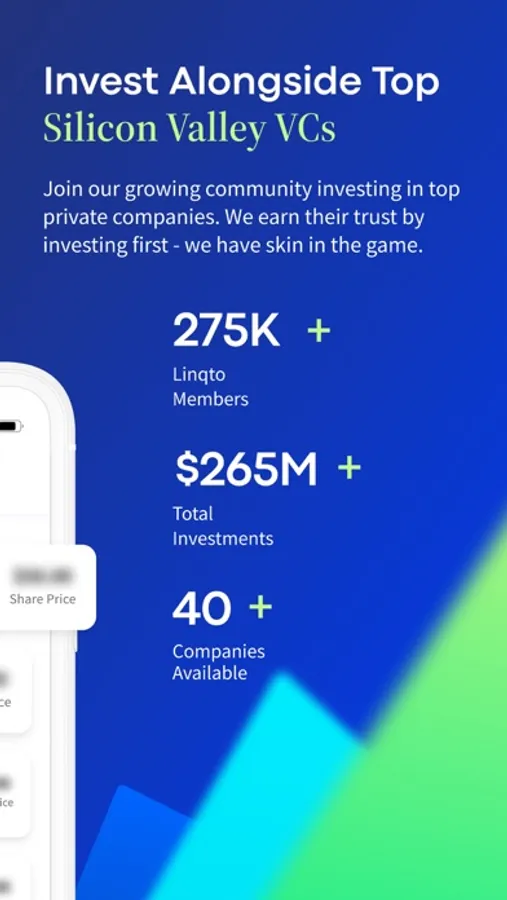

Linqto is a leading global financial technology investment platform allowing accredited investors to identify, evaluate, and access investments in the world's leading unicorns and private companies. Linqto has facilitated over US $464 million total investments in 125+ innovative mid-to-late-stage private companies and a diverse range of sectors, including fintech, artificial intelligence, aerospace, health tech, sustainable materials, and digital assets. Linqto is a global leader in democratizing access to private market investments. (Data as of 3/10/25)

IMPORTANT LEGAL NOTICE AND DISCLOSURES:

This information is proprietary property of Linqto, Inc and/or its affiliates (collectively, "Linqto") and any use, interference with, disclosure or copying of this material is unauthorized and strictly prohibited. This information is provided for informational purposes only and is subject to change without notice.

An investment on the Linqto platform is an investment in shares of a series of Linqto Liquidshares, LLC (the “Fund”), a Delaware limited liability company, which will invest in a private company either by directly purchasing shares of the private company or indirectly through an investment in a third-party special purpose vehicle that holds shares of the private company. Investors in the Fund will not directly own or hold shares of the private company but will own shares of the Fund. The securities being offered have not been registered under the Securities Act of 1933 (the “33 Act”) or any state securities laws and are being offered and sold in accordance with exemptions provided by Regulation D promulgated under the 33 Act. Linqto makes no guarantee that any private company available on its platform will experience an IPO or any other liquidity event.

The information contained herein does not constitute any form of representation or undertaking and nothing herein should in any way be deemed to alter the legal rights and obligations contained in the agreements between Linqto and its clients. Nothing herein is intended to constitute investment, legal, tax, accounting, insurance, or other professional advice. Linqto does not make any recommendations regarding the merit of any company, security or other financial product or investment strategy, or any recommendation regarding the purchase or sale of any company, security, financial product or investment, nor endorse or sponsor any company identified in this presentation.

Investing in securities in private companies is speculative and involves a high degree of risk. Investors must be prepared to withstand a total loss of their investment. Before investing in the Fund, investors are encouraged to complete their own independent due diligence of the Fund and the private company, which includes, but it not limited to, reviewing all offering documents, including the private placement memorandum, subscription agreement, the Fund’s operating agreement, and any other relevant materials provided by Linqto.

IMPORTANT LEGAL NOTICE AND DISCLOSURES:

This information is proprietary property of Linqto, Inc and/or its affiliates (collectively, "Linqto") and any use, interference with, disclosure or copying of this material is unauthorized and strictly prohibited. This information is provided for informational purposes only and is subject to change without notice.

An investment on the Linqto platform is an investment in shares of a series of Linqto Liquidshares, LLC (the “Fund”), a Delaware limited liability company, which will invest in a private company either by directly purchasing shares of the private company or indirectly through an investment in a third-party special purpose vehicle that holds shares of the private company. Investors in the Fund will not directly own or hold shares of the private company but will own shares of the Fund. The securities being offered have not been registered under the Securities Act of 1933 (the “33 Act”) or any state securities laws and are being offered and sold in accordance with exemptions provided by Regulation D promulgated under the 33 Act. Linqto makes no guarantee that any private company available on its platform will experience an IPO or any other liquidity event.

The information contained herein does not constitute any form of representation or undertaking and nothing herein should in any way be deemed to alter the legal rights and obligations contained in the agreements between Linqto and its clients. Nothing herein is intended to constitute investment, legal, tax, accounting, insurance, or other professional advice. Linqto does not make any recommendations regarding the merit of any company, security or other financial product or investment strategy, or any recommendation regarding the purchase or sale of any company, security, financial product or investment, nor endorse or sponsor any company identified in this presentation.

Investing in securities in private companies is speculative and involves a high degree of risk. Investors must be prepared to withstand a total loss of their investment. Before investing in the Fund, investors are encouraged to complete their own independent due diligence of the Fund and the private company, which includes, but it not limited to, reviewing all offering documents, including the private placement memorandum, subscription agreement, the Fund’s operating agreement, and any other relevant materials provided by Linqto.