With this app, you can automate the process of claiming fuel tax refunds and track fuel purchases automatically. Includes features for finding low-cost fuel, analyzing tax savings, and generating IRS refund forms.

About FuelCred: For Fuel Tax Refunds

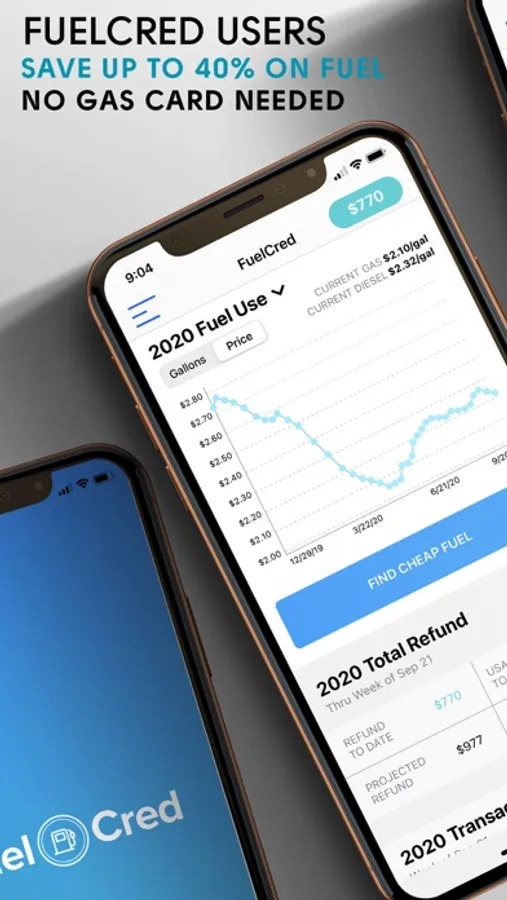

FuelCred saves your business up to 40% on fuel – without annoying ads, gas cards, or gas program subscriptions.

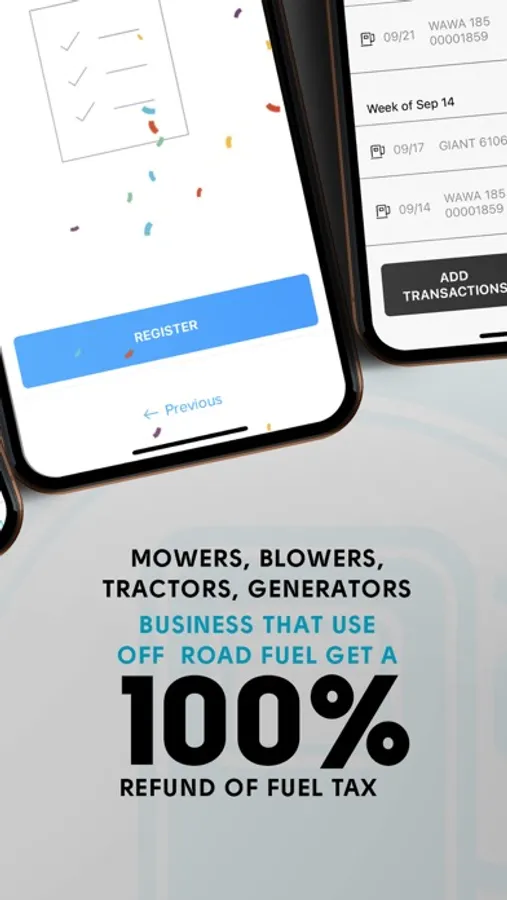

You pay the federal government about 20 cents for every gallon of fuel that you purchase at the pump. But if you use fuel in off-road equipment (e.g. a lawnmower for your landscaping business), this tax is 100% refundable!

FuelCred automates the process of claiming your fuel tax refund, which averages about $600 annually for FuelCred users. All businesses of all sizes qualify, no matter how big or small.

Don’t leave free money on the table. Download the FuelCred app today.

How It Works:

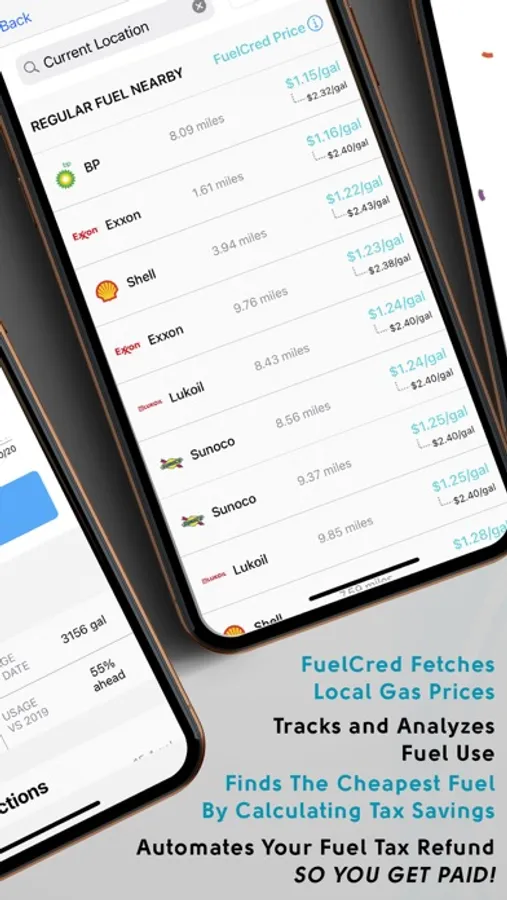

1) Use the “Find Cheap Fuel” feature to locate the cheapest gas/diesel prices in real-time

2) FuelCred determines which gas stations offer the best prices by projecting tax savings based on your historical fuel use

3) FuelCred keeps track of your fuel tax refund and automatically produces the refund form at the end of the year so you can get your refund

Features:

- Automatically identifies and tracks fuel purchases made with your business or personal credit card

- Fetches local gas prices and recommends the best option by analyzing your past fuel transactions

- Tracks current regional gas and diesel prices and fuel price trends

- Compares your fuel use and fuel tax refund to prior years

- Automatically produces the IRS fuel refund form so you can get your refund (both 2019 and 2020)

Disclaimer: Service Station and Fuel Price Data provided by OPIS (Oil Price Information Service)

Terms of Use: https://fuelcred.com/terms-of-service-and-use/

You pay the federal government about 20 cents for every gallon of fuel that you purchase at the pump. But if you use fuel in off-road equipment (e.g. a lawnmower for your landscaping business), this tax is 100% refundable!

FuelCred automates the process of claiming your fuel tax refund, which averages about $600 annually for FuelCred users. All businesses of all sizes qualify, no matter how big or small.

Don’t leave free money on the table. Download the FuelCred app today.

How It Works:

1) Use the “Find Cheap Fuel” feature to locate the cheapest gas/diesel prices in real-time

2) FuelCred determines which gas stations offer the best prices by projecting tax savings based on your historical fuel use

3) FuelCred keeps track of your fuel tax refund and automatically produces the refund form at the end of the year so you can get your refund

Features:

- Automatically identifies and tracks fuel purchases made with your business or personal credit card

- Fetches local gas prices and recommends the best option by analyzing your past fuel transactions

- Tracks current regional gas and diesel prices and fuel price trends

- Compares your fuel use and fuel tax refund to prior years

- Automatically produces the IRS fuel refund form so you can get your refund (both 2019 and 2020)

Disclaimer: Service Station and Fuel Price Data provided by OPIS (Oil Price Information Service)

Terms of Use: https://fuelcred.com/terms-of-service-and-use/