AppRecs review analysis

AppRecs rating 3.9. Trustworthiness 0 out of 100. Review manipulation risk 0 out of 100. Based on a review sample analyzed.

★★★☆☆

3.9

AppRecs Rating

Ratings breakdown

5 star

44%

4 star

11%

3 star

33%

2 star

11%

1 star

0%

About Mintos

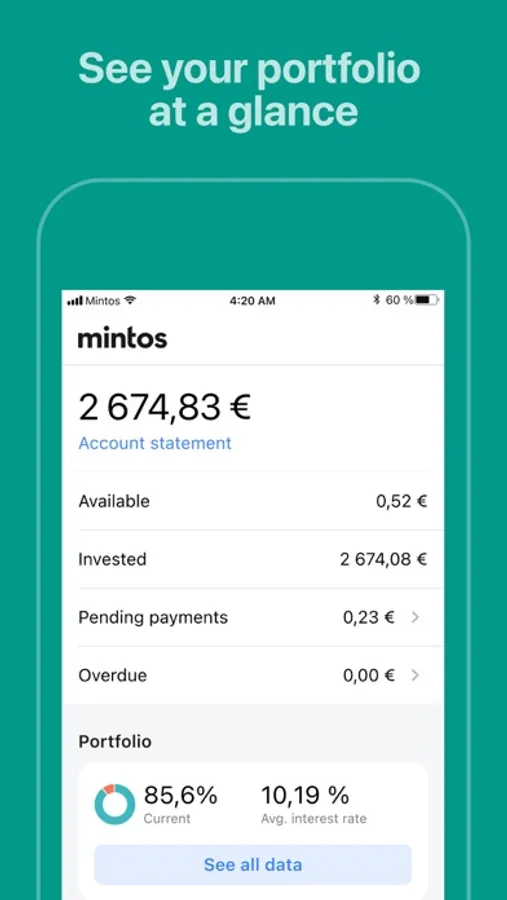

Create your wealth with Mintos, one of Europe’s leading investment platforms trusted by 600,000+ investors. With Mintos, you can build and diversify your portfolio across loans, bonds, real estate, ETFs, and money market funds - all assets in one place.

Whether you’re starting out or growing a larger portfolio, Mintos gives you the opportunity to earn regular returns, manage risk, and build long-term wealth.

Invest like nowhere else

Mintos offers a unique mix of asset classes from loans, bonds, real estate, ETFs to money market funds.

All in one place to diversify your investment portfolio to meet your personal ambition.

Accessible investing

Start from just €50.

Low cost investing with transparent fees. Many asset classes are available for free.

Licensed and regulated

With a MiFID II license, we’re a regulated investment firm.

Managing €700M+ in assets and operating across Europe.

Invest your way

From beginner to experienced investor, Mintos empowers you to reach your financial goals.

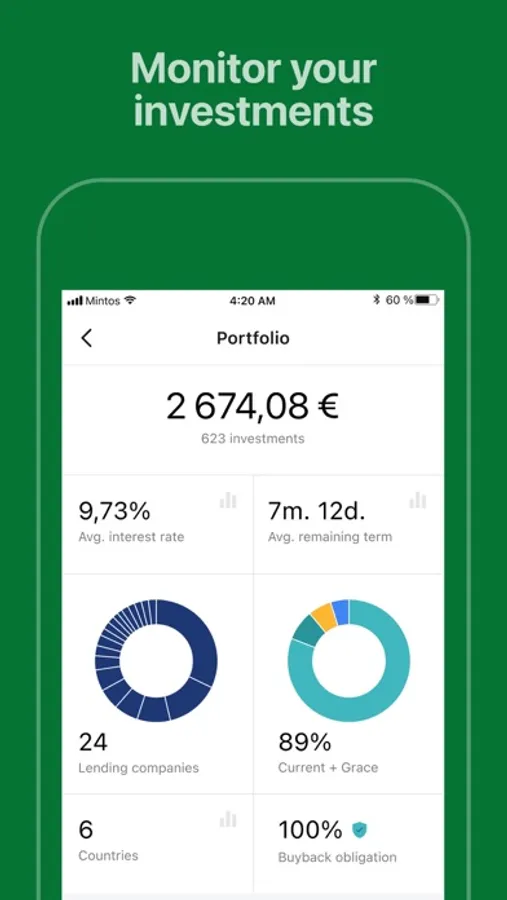

Manage risk across different asset classes and regions, a foundation to a healthy portfolio with good returns.

Starting from daily returns on loans to predictable returns on bonds, real estate and other assets.

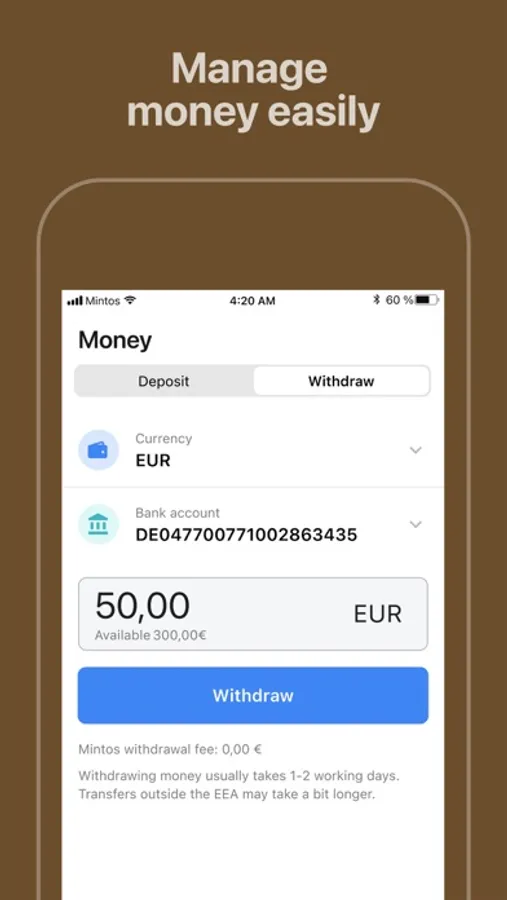

Our secondary market gives you access to cash when you need it. Life happens, we know it.

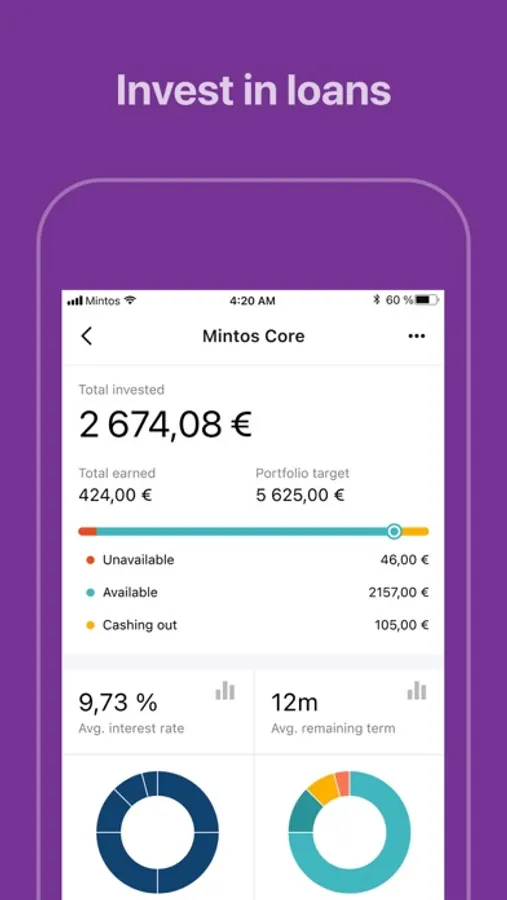

Access our proprietary technology in loans portfolio management and let us do the work for you.

Disclaimer:

The value of your investment can go up as well as down. You could lose some or all of the invested money. Mintos is a member of the national investor compensation scheme established under EU Directive 97/9/EC. The scheme provides compensation if Mintos fails to return financial instruments or cash to investors. The compensation is limited to the outstanding liabilities, up to €20 000. The scheme doesn’t compensate for losses due to changes in the price or liquidity of financial instruments.

Whether you’re starting out or growing a larger portfolio, Mintos gives you the opportunity to earn regular returns, manage risk, and build long-term wealth.

Invest like nowhere else

Mintos offers a unique mix of asset classes from loans, bonds, real estate, ETFs to money market funds.

All in one place to diversify your investment portfolio to meet your personal ambition.

Accessible investing

Start from just €50.

Low cost investing with transparent fees. Many asset classes are available for free.

Licensed and regulated

With a MiFID II license, we’re a regulated investment firm.

Managing €700M+ in assets and operating across Europe.

Invest your way

From beginner to experienced investor, Mintos empowers you to reach your financial goals.

Manage risk across different asset classes and regions, a foundation to a healthy portfolio with good returns.

Starting from daily returns on loans to predictable returns on bonds, real estate and other assets.

Our secondary market gives you access to cash when you need it. Life happens, we know it.

Access our proprietary technology in loans portfolio management and let us do the work for you.

Disclaimer:

The value of your investment can go up as well as down. You could lose some or all of the invested money. Mintos is a member of the national investor compensation scheme established under EU Directive 97/9/EC. The scheme provides compensation if Mintos fails to return financial instruments or cash to investors. The compensation is limited to the outstanding liabilities, up to €20 000. The scheme doesn’t compensate for losses due to changes in the price or liquidity of financial instruments.